Arkansas Bill of Sale Form

Arkansas bill of sale is a legal document that documents a private transaction between a buyer and a seller involving various items. It normally contains all of the relevant information regarding the parties, as well as their signatures. Later on, the bill of sale document can be used as proof of ownership transfer during automobile or boat registration and titling.

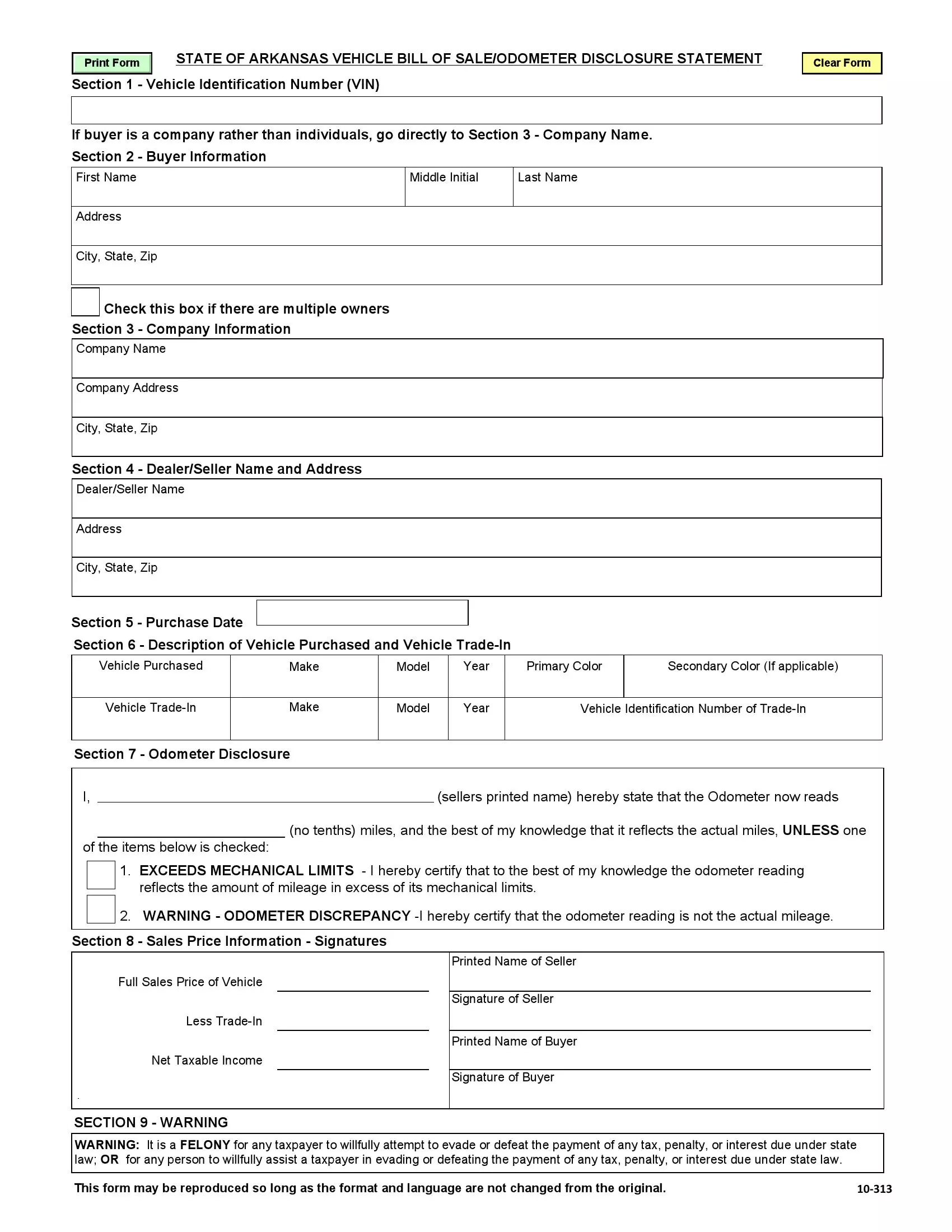

Here, you will find different customized templates to use as an Arkansas bill of sale. You can add the needed fields to the customized bill of sale form and download already existing forms for your use. There is an official bill of sale form provided by the Arkansas DFA, Form 10-313, that you can use for vehicle transactions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Arkansas Vehicle Bill of Sale Form |

| Other Names | Arkansas Car Bill of Sale, Arkansas Automobile Bill of Sale |

| DMV | Arkansas Department of Finance and Administration |

| Vehicle Registration Fee | $17-30 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 17 |

Arkansas Bill of Sale Forms by Type

There are five main types of Arkansas bill of sale documents based on the property type involved: vehicle, trailer, boat, firearm, and general. Choose the one you need according to your case.

Use an Arkansas vehicle bill of sale to buy or sell a private motor vehicle. Once the document is signed, it is considered legal proof of transaction. The newcomers to Arkansas and those who bought a new vehicle will have 30 days to register it.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

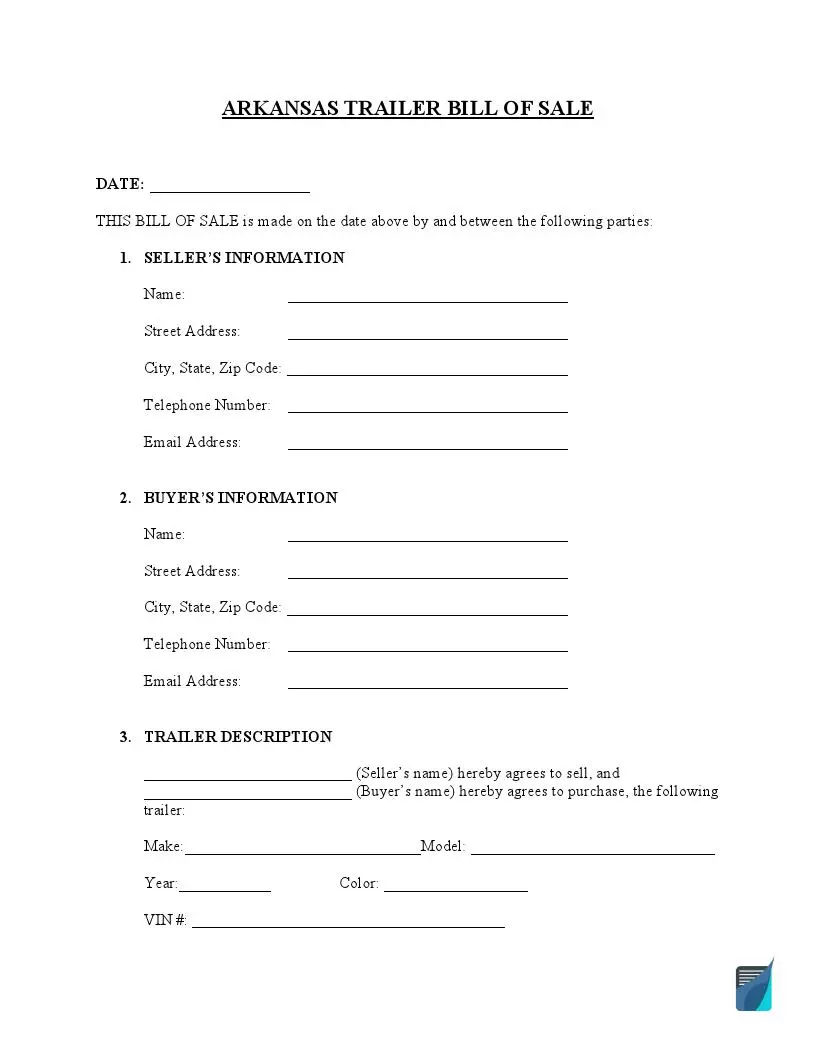

An Arkansas trailer bill of sale can be used while transferring the ownership of a trailer to a new owner. This type of Arkansas bill of sale form applies to all trailer types, including dry van trailers, flatbed trailers, and refrigerated trailers.

| Alternative Name | Trailer Sale Agreement |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

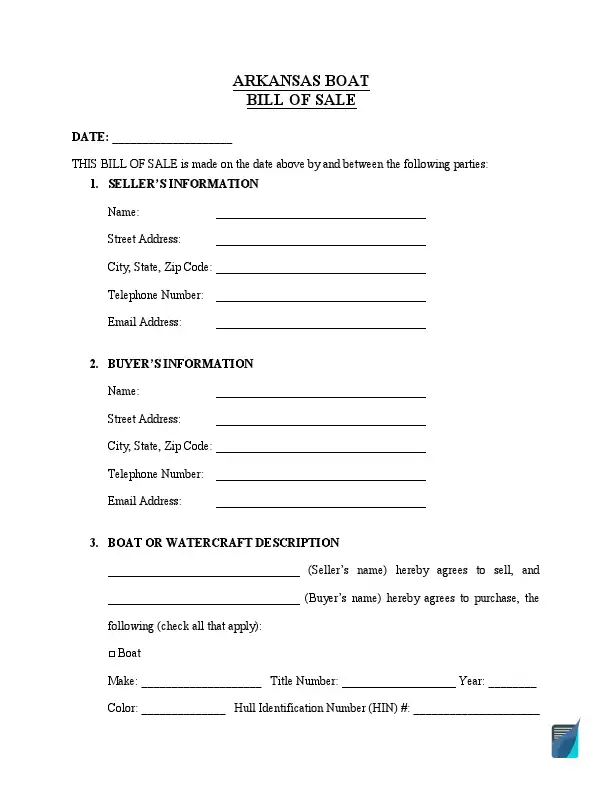

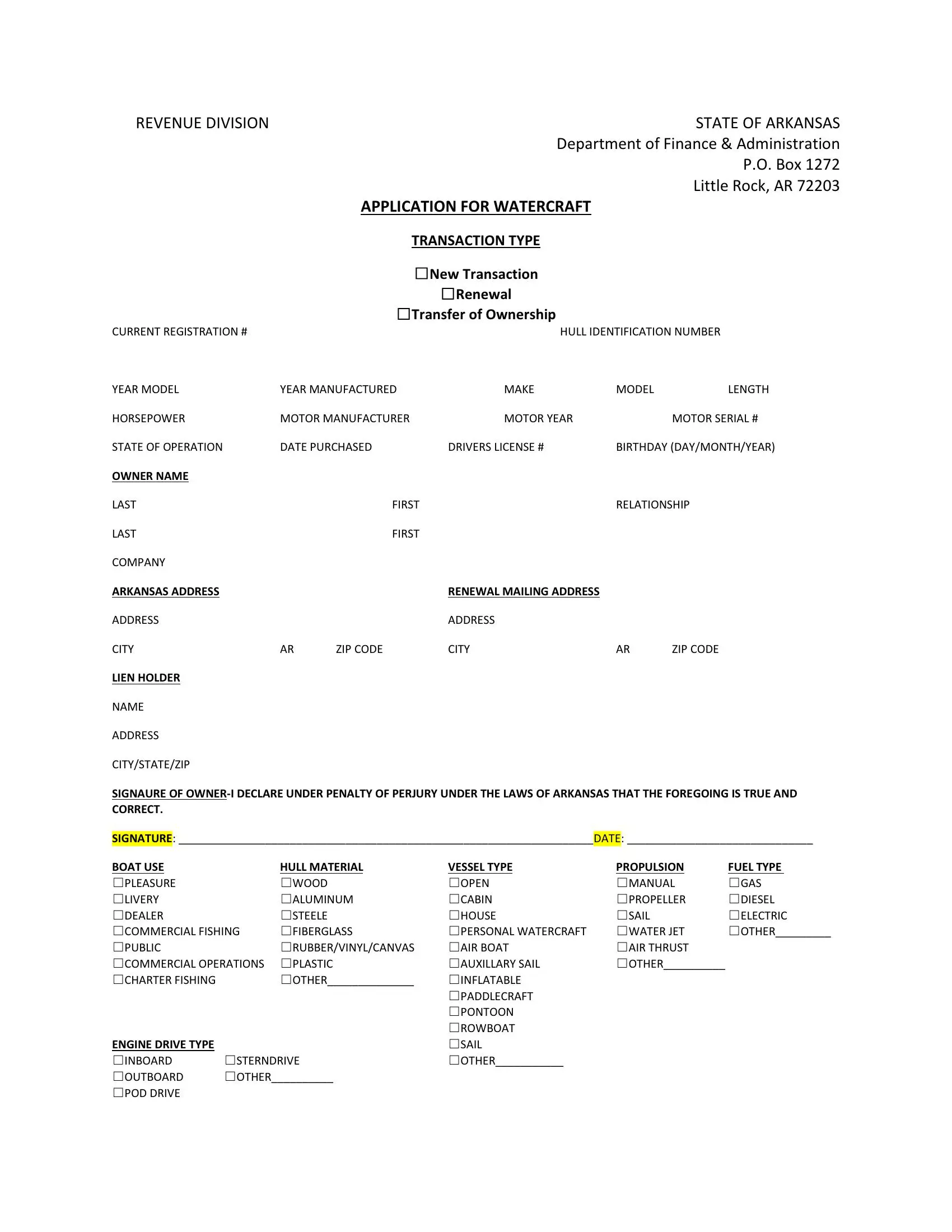

For the recording of a vessel transaction, fill out an Arkansas vessel bill of sale. The paperwork should be provided to the Arkansas DFA to prove ownership after filling out all of the fields and signing the document by both the buyer and seller.

| Alternative Name | Watercraft Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

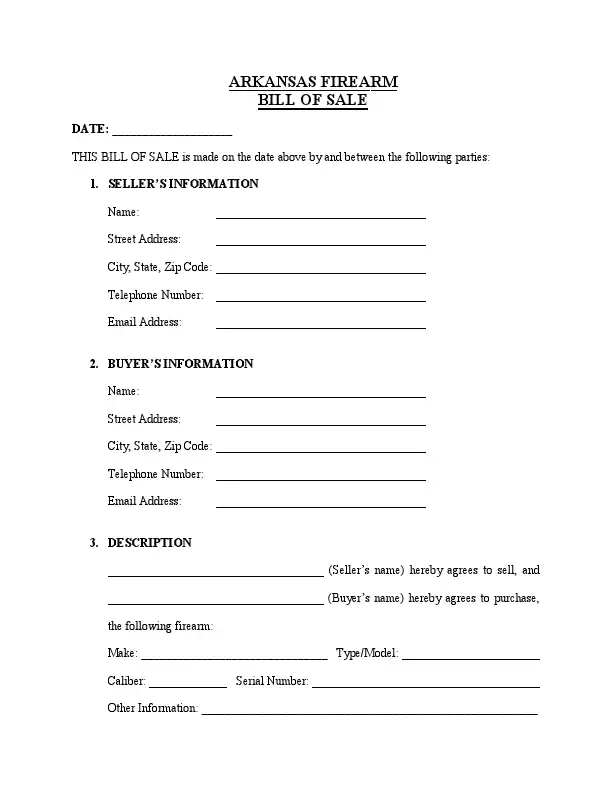

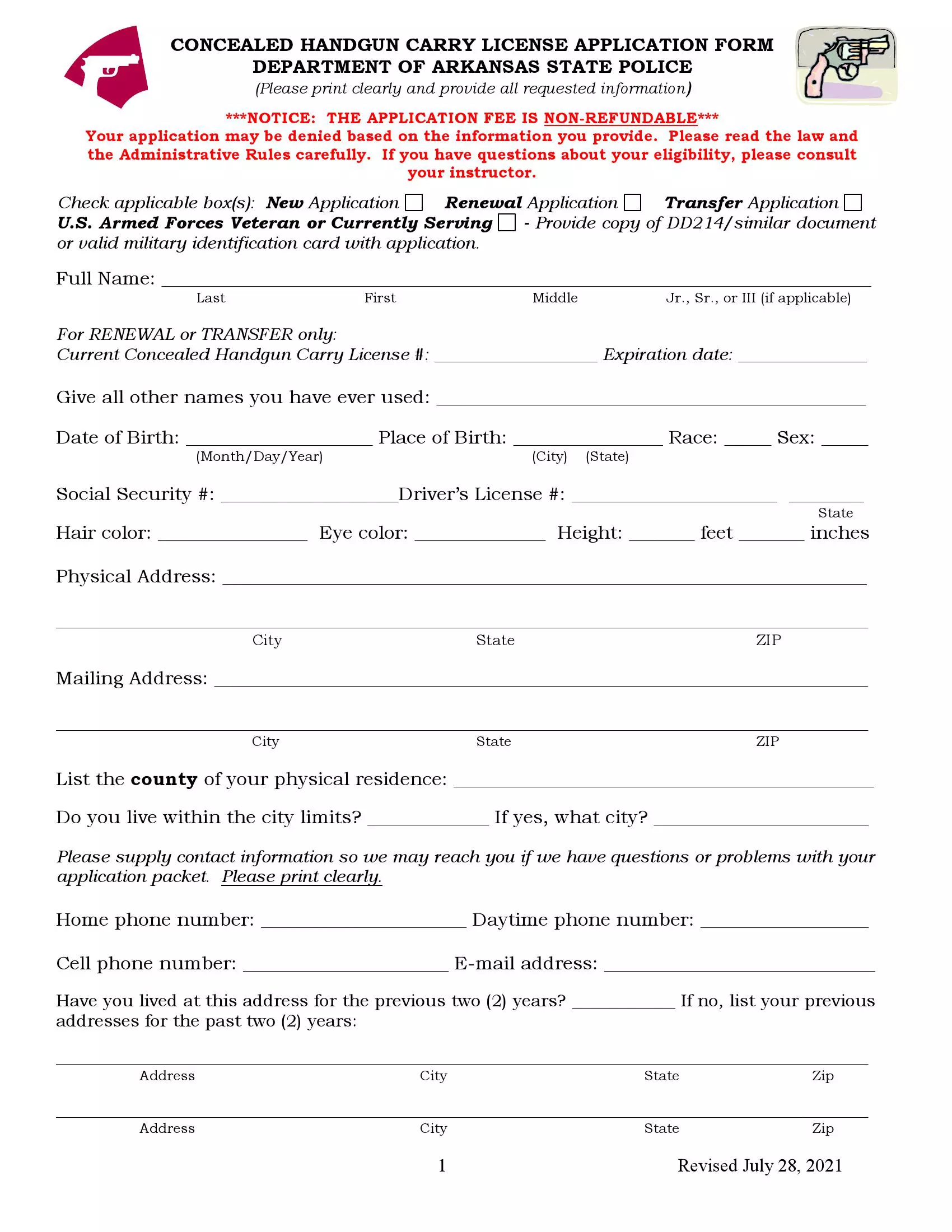

To transfer a new or used gun between two parties and have legal proof, use a firearm bill of sale.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

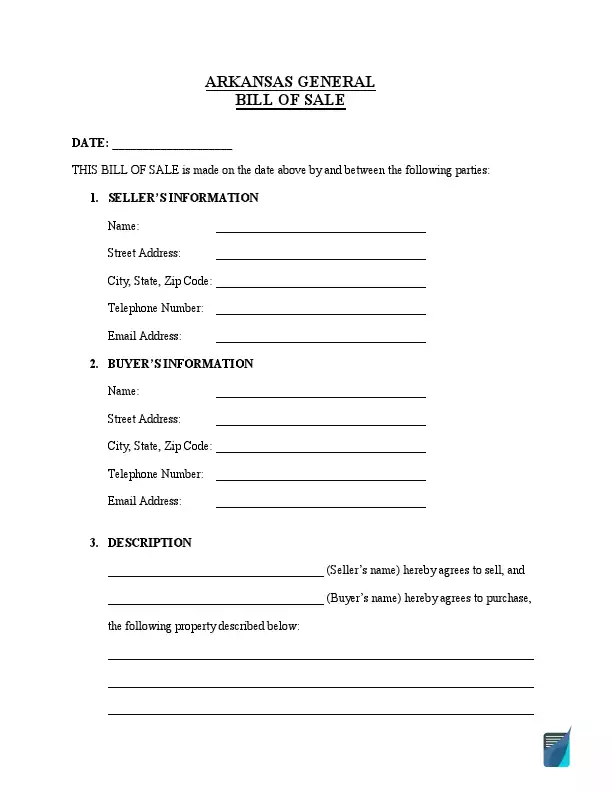

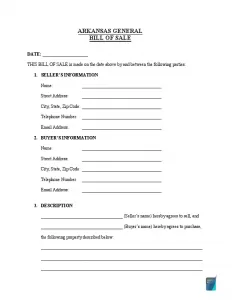

Use this general bill of sale for any type of private purchase in the Arkansas state involving any property.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write an AR Vehicle Bill of Sale

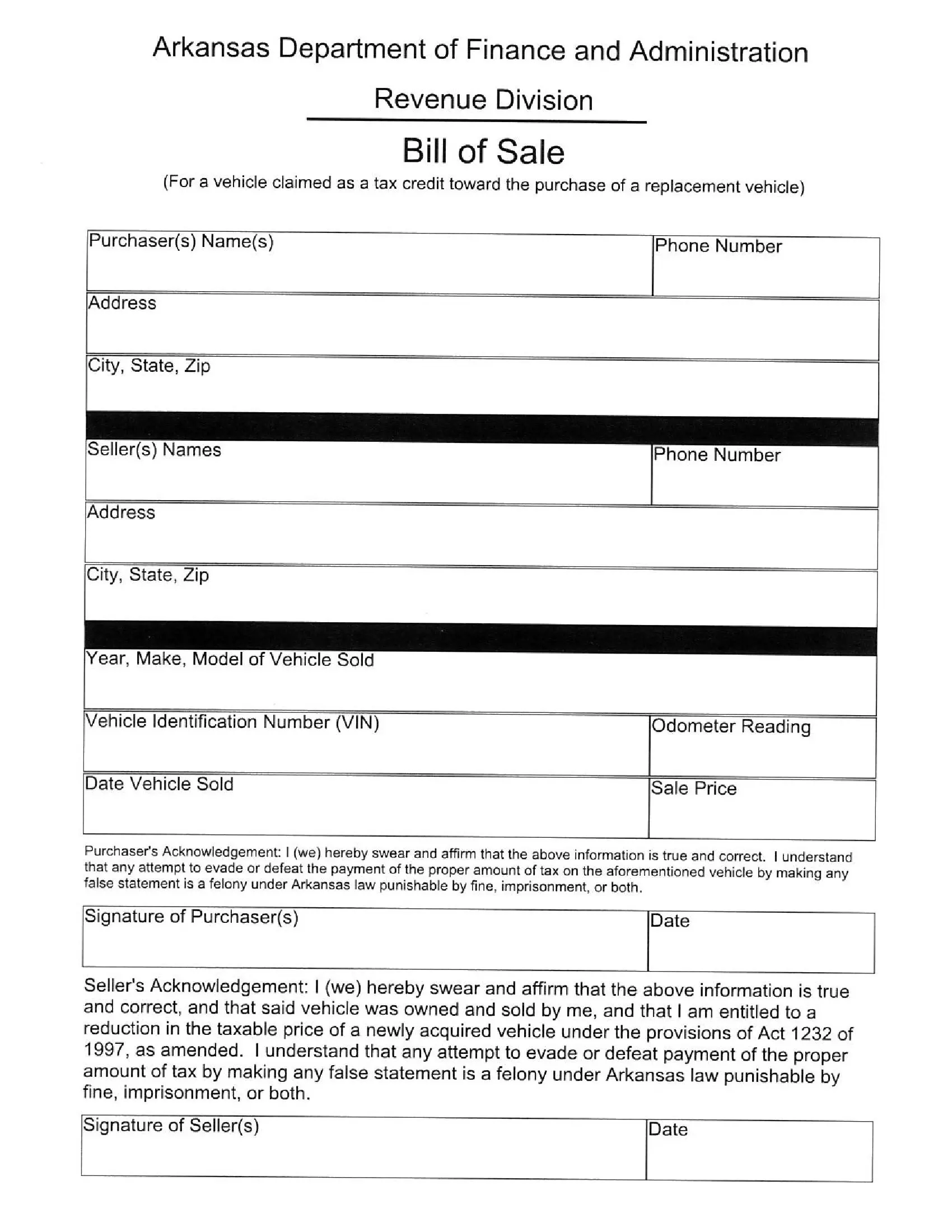

To conduct a safe vehicle transaction for both a seller and buyer, it is essential to have a document confirming vehicle ownership transfer. In Arkansas, you can freely use the official Arkansas bill of sale provided by the local DMV. Here is how to correctly complete this template.

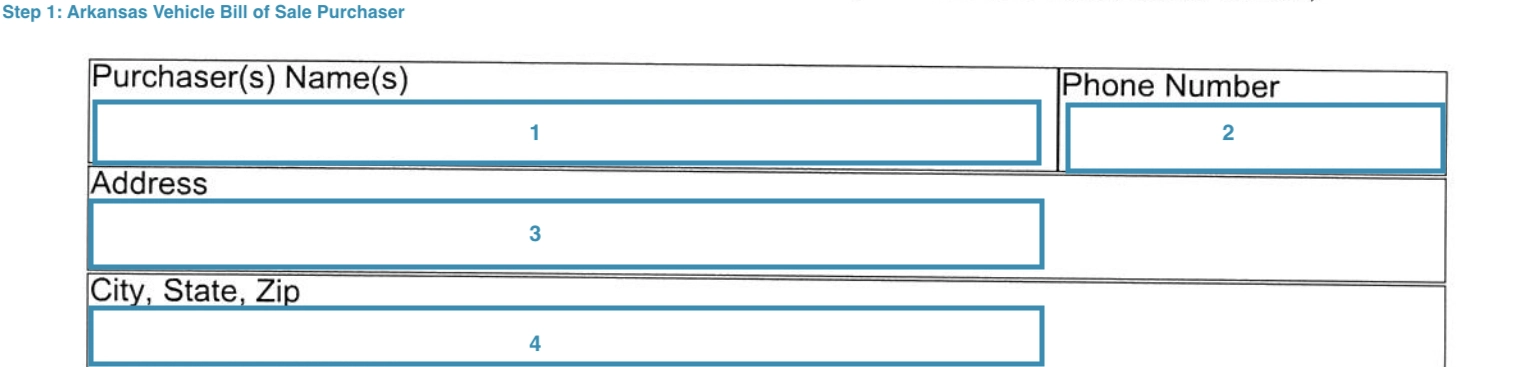

Step 1: Indicate the purchaser’s information

In the first section, you need to type the purchaser’s details, including:

- Full legal name

- Home address

- City of residence

- State of residence

- Zip code

- Telephone number

- Email address

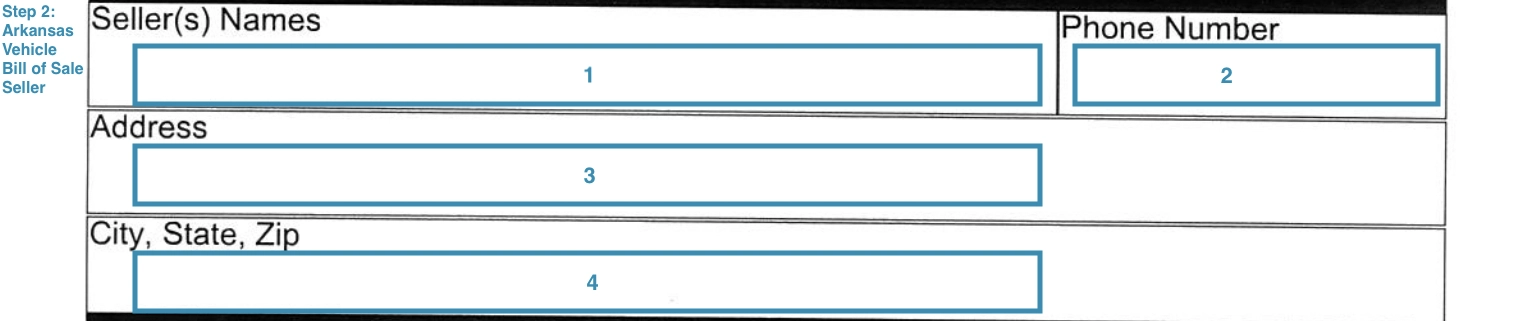

Step 2: Provide the seller’s contact details

Indicate the other party by writing the same information about them, including:

- Full legal name

- Home address

- City of residence

- State of residence

- Zip code

- Telephone number

- Email address

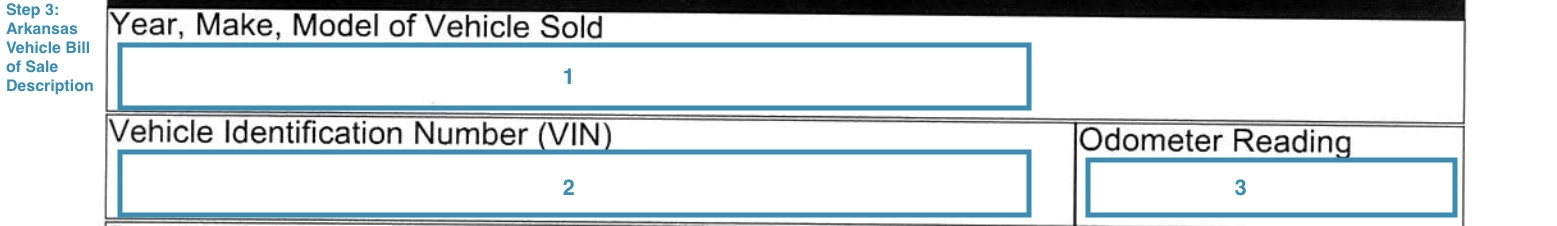

Step 3: Describe the vehicle you sell

By clarifying the details regarding the vehicle being sold, the parties ensure that a seller is released from any future accusations. The purchaser is protected from possible issues while registering the vehicle. Thus, the Arkansas bill of sale must have the following details:

- Year of manufacture

- Make and model of the vehicle

- Identification Number

- Distance traveled (odometer reading)

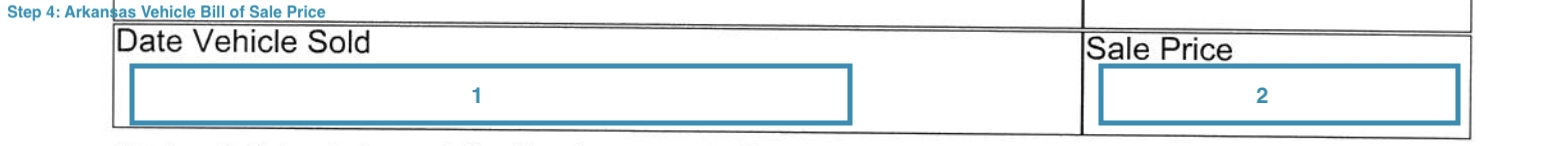

Step 4: Indicate the date and price of the vehicle

The following step is to specify the date of the transaction and the way in which you’ll be given money for the vehicle.

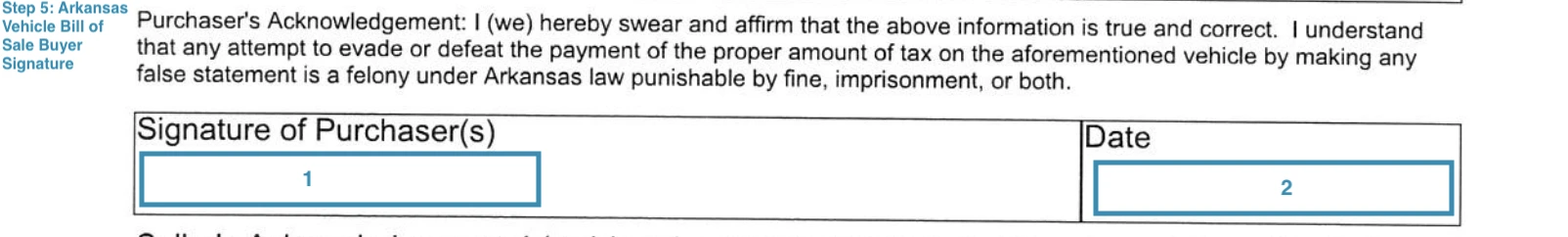

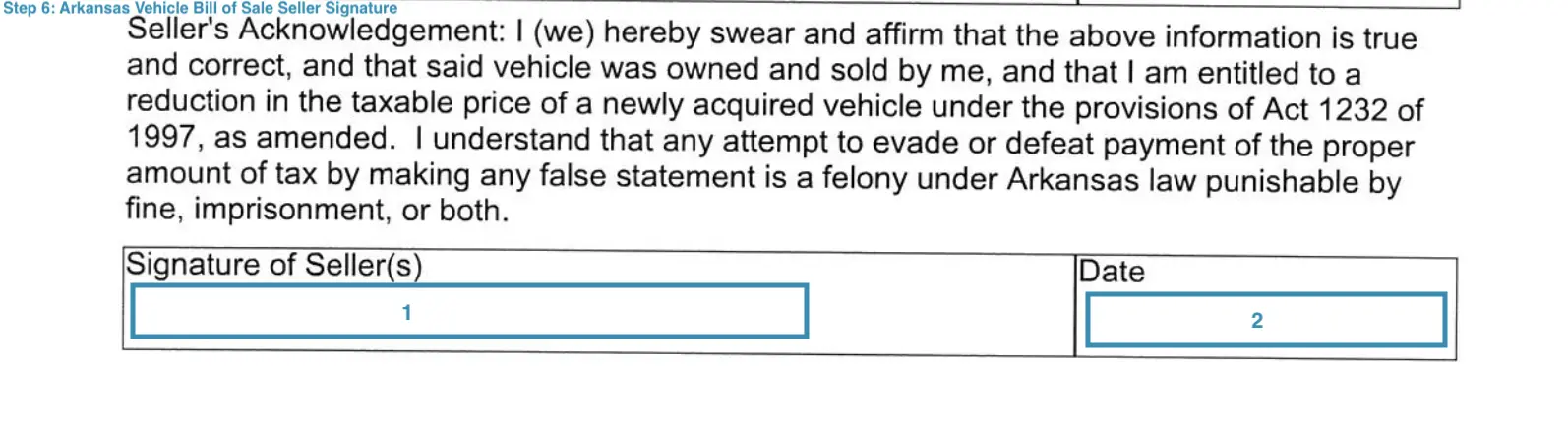

Step 5: Provide the buyer’s signature

After checking all the information, the buyer signs the bill of sale as a confirmation of the purchase.

Step 6: Place the seller’s signature

Lastly, the seller affirms that the information provided in the Arkansas bill of sale is correct by signing the form.

If the parties desire, they can ask the official representative or notary public to notarize the bill of sale form, although it is not mandatory in Arkansas.

Registering a Motor Vehicle in Arkansas

Take note that registration should commence no later than 15 days after the actual transfer date. If you want to register your car out of the state or for the first time, your newly acquired vehicle will undergo a Vehicle Identification Inspection. It is a mandatory procedure that confirms the validity of the car – registration details, origin, and motor vehicle parts.

Then, proceed to the local Department Revenue Office at your county to get registration documents, which are classified according to the nature of the purchase. Did you buy it from a private individual, car dealer, or on lease?

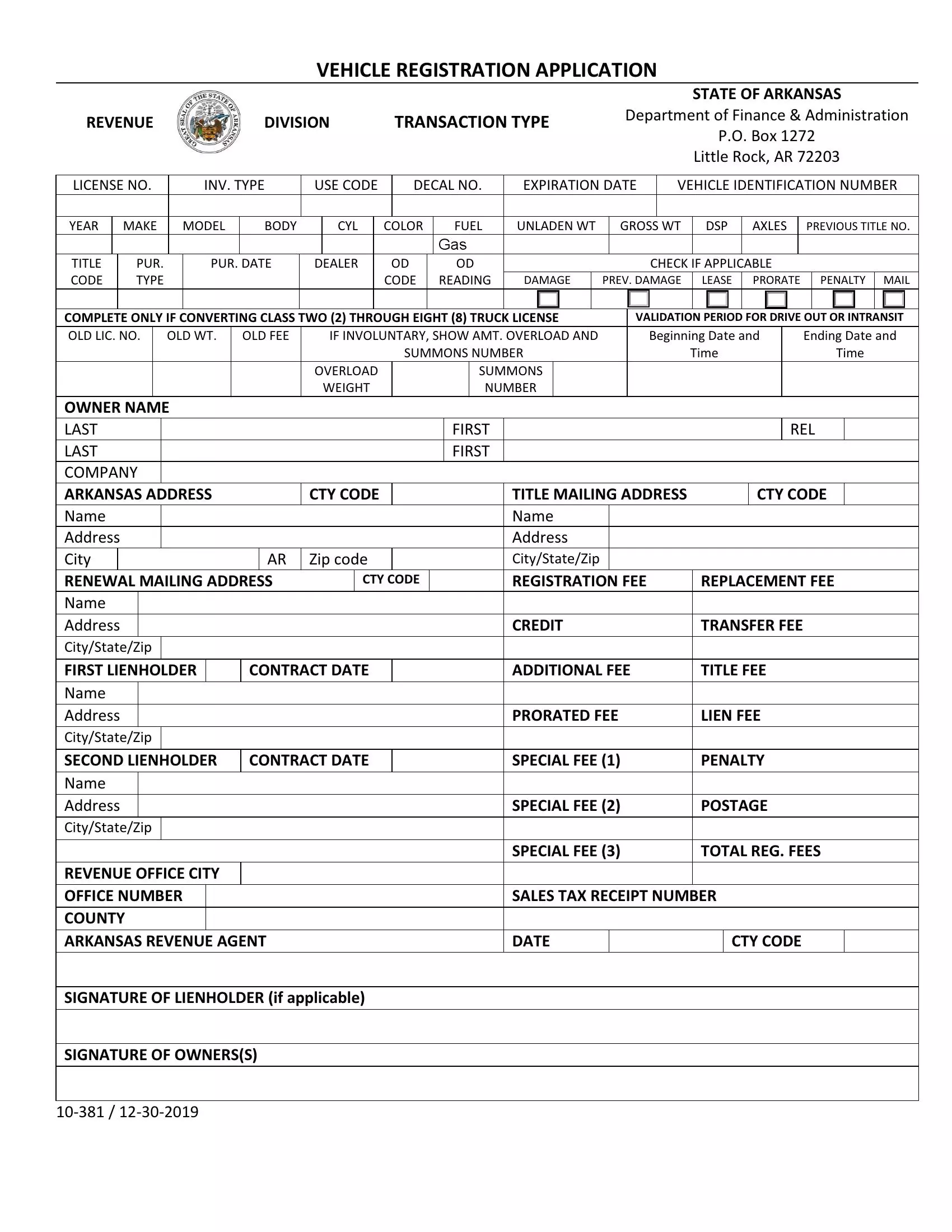

If you bought the vehicle from a private party, you must fill a Vehicle Registration Application (Form 1-381). It is a compulsory document for processing the title and vehicle registration. On the other hand, the Manufacturer’s Certificate of Origin (MCO) is required if you bought from a car dealer. And if you are leasing the vehicle, you must submit the lease agreement copy, signed by both parties.

As for the manufacturing year, a vehicle that is below ten years old requires you to fill in an Odometer Disclosure Statement Form (Form 10-313), or you can write the reading on the back of the title.

After buying the car, you must take it for assessment at the county office. The county assessor will then issue you with a document that proves the assessment took place at a particular date within the same year of the sale. You have to submit the assessment documentation at the registration office.

You must also purchase Arkansas insurance from a legit insurance company operating in the state. Another essential document is a tax compliance certificate that proves you have been paying your personal property taxes on time, without evading. Don’t forget to produce the current Arkansas registration certificate, which is also mandatory in processing the new title of ownership.

It is imperative to note that the purchaser will pay all the registration fees for the newly acquired vehicle after completing the vehicle bill of sale template successfully.

In a nutshell, the documents below are necessary for a successful registration:

- Arkansas vehicle bill of sale form

- Copy of insurance

- Vehicle Registration Certificate, Manufacturer’s Certificate of Origin, or Lease Agreement Copy

- Registration certificate

- Odometer disclosure statement

- Proof of assessment

- VIN Inspection results

- Recent personal property taxes compliance certificate

After personally presenting all of the documents at the revenue office, the registration process will be considered complete and you will get the new title and license plates.

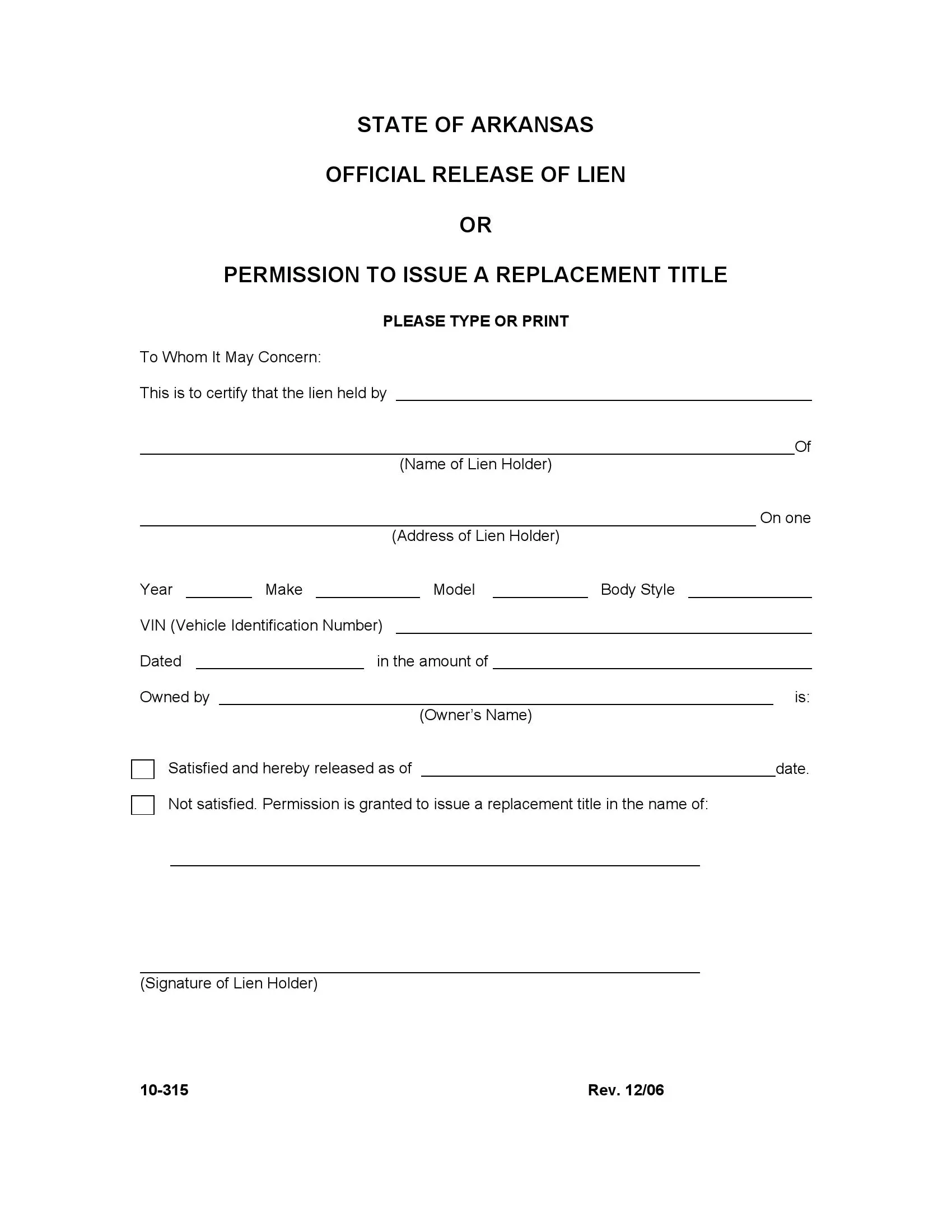

Relevant Official Forms

The vehicle registration application is an official form accepted in the state of Arkansas.

When selling or buying a vehicle, use the bill of sale form to secure the deal. The form can be later used as proof of ownership.

The odometer disclosure statement is a document any vehicle seller must fill out. In Arkansas, it’s merged with the Bill of Sale form.

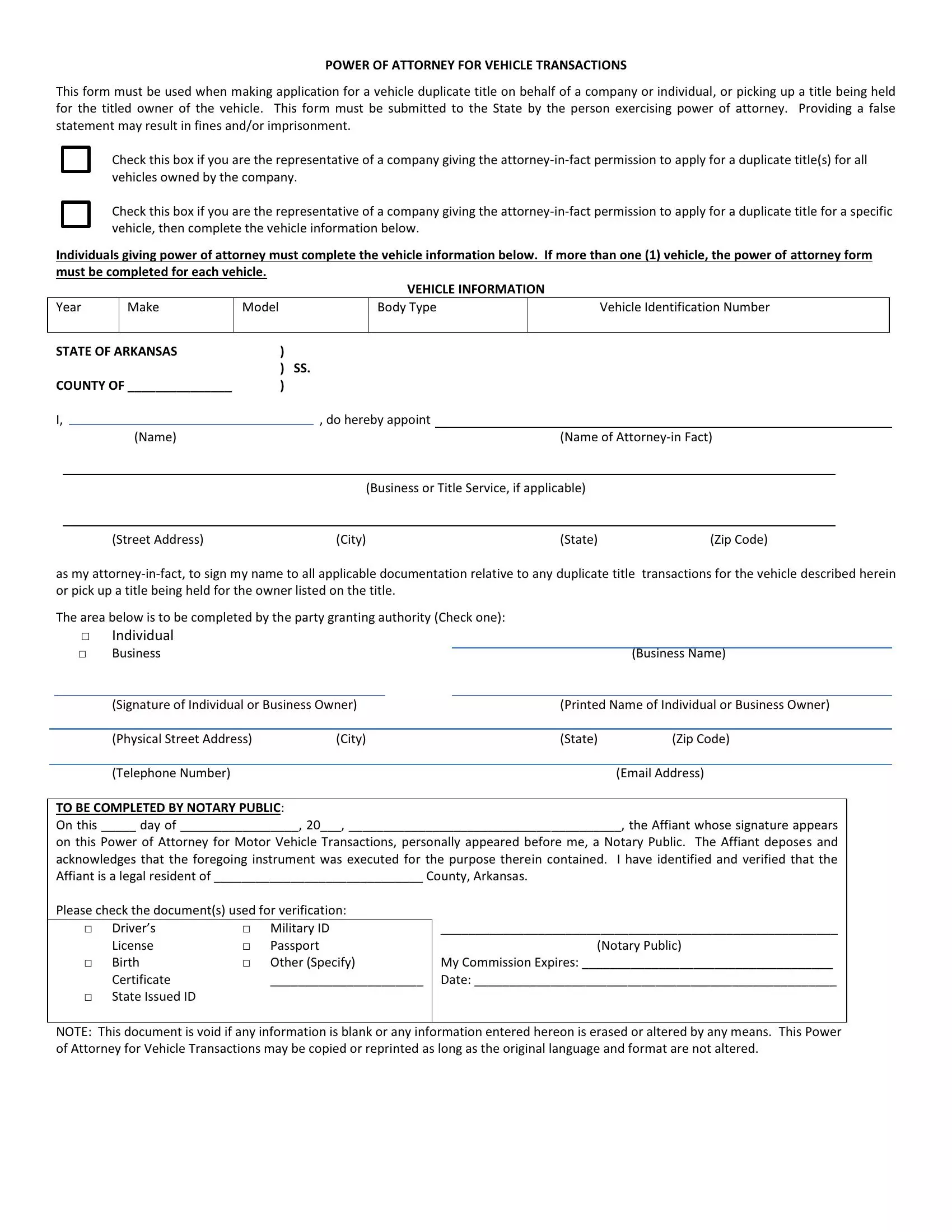

Having a power of attorney form allows a trusted person to conduct any vehicle-related operations on behalf of the title owner.

Application for watercraft is used to register and title your vessel.

Application for a concealed gun carry license or its renewal. For Arkansas residents only.

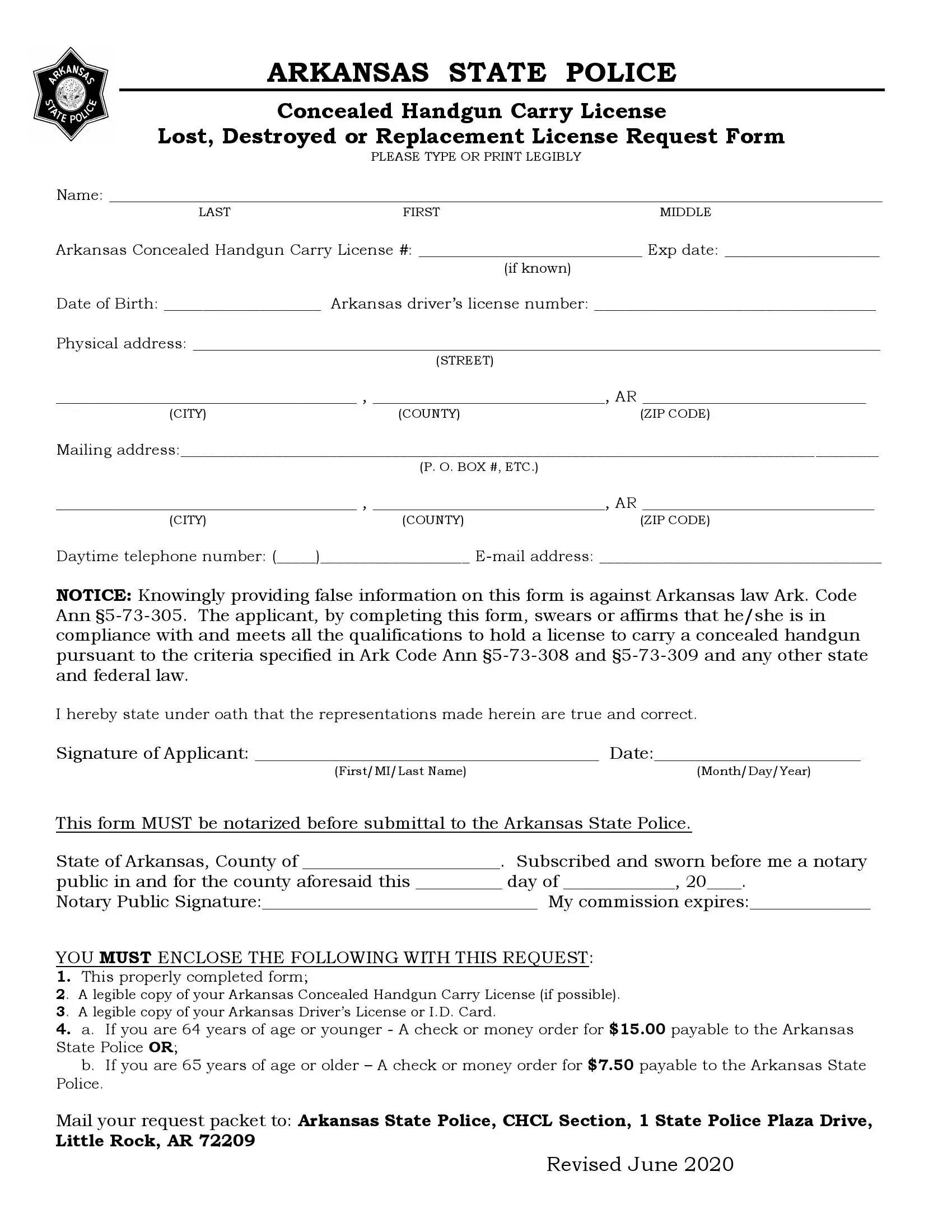

Request for a new gun license in case the previous one was lost or destroyed.

Short Arkansas Bill of Sale Video Guide

Other Bill of Sale Forms by State