Arkansas Last Will and Testament Form

An Arkansas last will is a legally binding document that expresses the testator’s final wishes in the form prescribed by the state law and determines the legal distribution of the will creator’s property subsequently after their demise.

In case you’re interested in a valid Arkansas last will and testament form, you will find a suitable PDF template on this site, as well as recommendations on last will creation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Arkansas Last Will Laws and Requirements

| Requirements | State laws | Statutes | Title 28 – Wills, Estates, and Fiduciary Relationships; Chapter 25 – Execution and Revocation |

| Definitions | 28-1-102. Definitions | |

| Signing requirement | Two witnesses | 28-25-103. Execution generally |

| Age of testator | 18 and older | 28-25-101. Who may make wills. |

| Age of witnesses | 28-25-102. Witnesses. | |

| Self-proving wills | Allowed | 28-25-106. Affidavit of attesting witness. |

| Handwritten wills | Recognized if meeting certain conditions | 28-25-104. Holographic wills generally. |

| Oral wills | Not recognized | 28-25-103. Execution generally |

| Holographic wills | Recognized if meeting certain conditions | 28-25-104. Holographic wills generally. |

| Depositing a will | Possible with the Circuit court of an Arkansas county A fee is $2 |

28-25-108. Deposit of will with court in testator’s lifetime |

How to Create an Arkansas Last Will

1. Think about your possibilities. Make a decision whether you would like to hire lawyers or make your last will on your own (either handwriting it all or working with a free last will and testament form).

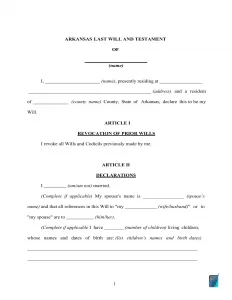

2. Specify your information. Fill in your full name and address (the city, county, and state of residence) to establish the testator of the will. Review the information you wrote along with the rest of the section, which includes “Expenses and Taxes.”

3. Establish the executor. In this section, you establish who’s going to carry out your will by entering their full legal name, along with their city, county, and state of residence. Almost all states have special rules concerning out-of-state representatives and executors, which often results in additional hassle and red tape. That’s why it is advised to appoint a person who resides in the same state as you. As an assurance, it’s possible to choose an alternative executor of the will. That way, you’ll be certain that even if the initially appointed executor is not able to carry out their obligations, there is a second trusted person you can count on.

4. Indicate the guardian (optional). In case you have underage or dependent children and don’t wish the court to select a guardian for them when you are no longer here, it is possible to specify a friend or acquaintance as a guardian for your children.

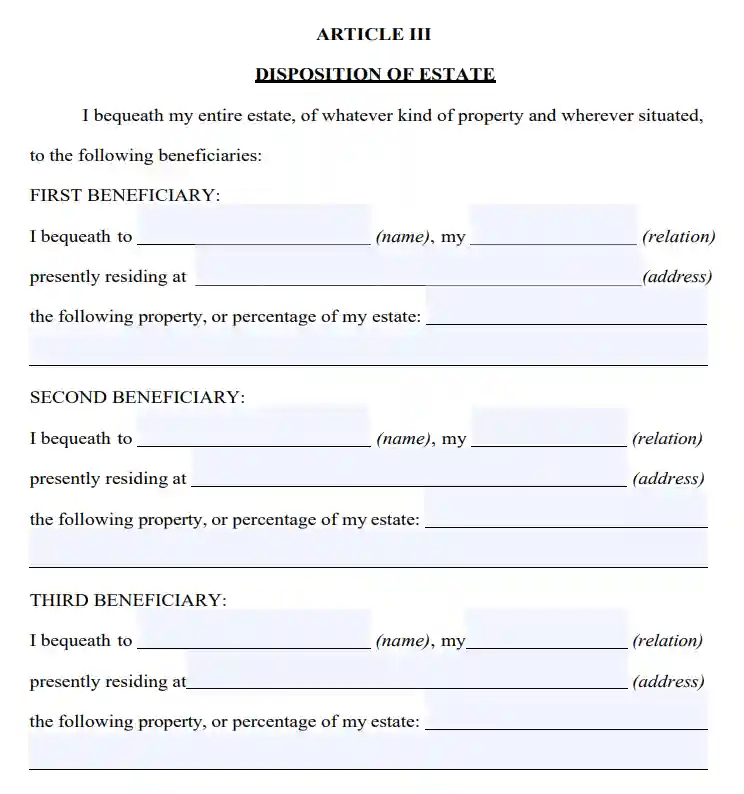

5. Indicate your beneficiaries. At this point, indicate those to whom you’d like to leave your property, that is, your beneficiaries. Fill out their full names, places of residence, and your relationship to them (spouse, child, friend).

6. Designate property. Write down your possessions and describe the way you wish to distribute them among your beneficiaries in case you have something planned besides splitting the property evenly. Assets may include money for outstanding debts, real estate, stocks, company ownership, cash, and any material things of financial value you own. Please notice that there are things that cannot be distributed in the will, for instance, joint and living will assets and life insurance.

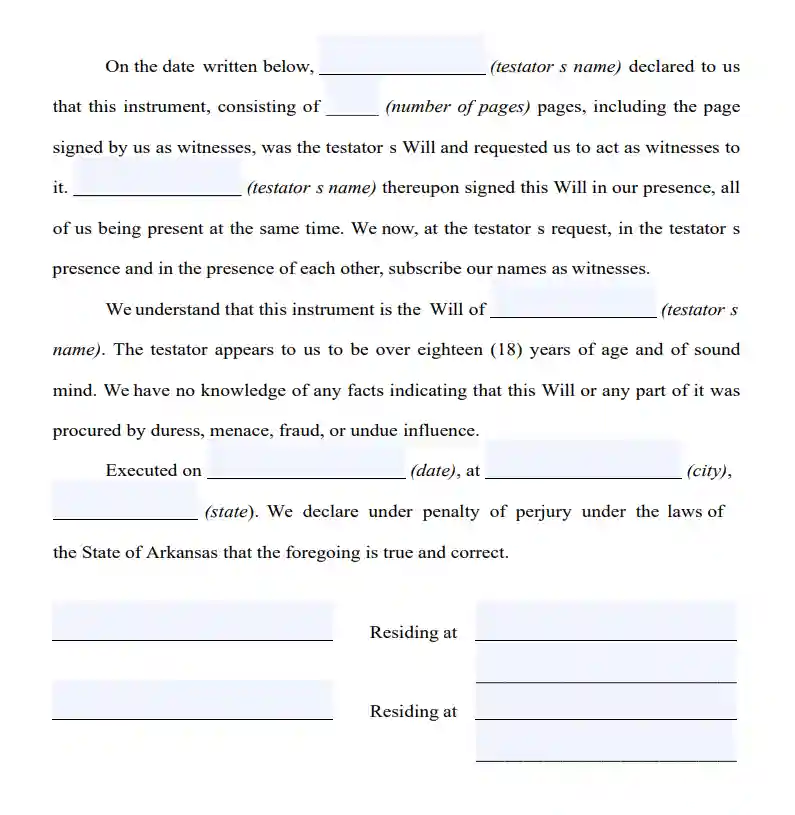

7. Ask witnesses to finalize the document. As per Arkansas legislation, for any last will and testament to be considered legitimate, it must be signed by two witnesses. It is possible to name another person as a witness only if they’re older than 18 years and are disinterested in your heritage. Consider picking witnesses who are younger than you to ensure they will likely be present if the will is contested in the court or some other problem arises.

At this point, you (as well as your two witnesses) have to sign the will after filling out your full legal addresses and names. Don’t neglect to check each paragraph carefully before concluding the matter.

Create an Arkansas Last Will and Testament

Frequently Asked Questions

Is an Arkansas will form valid without notarization?

Arkansas statute affirms that a will is valid without notarization. Even so, you can make your last will self-proving by attaching an affidavit to it, and then you will have to head to a notary if you wish to make it happen. Making your last will self-proving is actually a great choice because it speeds up the probate and grants you another level of certainty in case the will’s validity is challenged.

Can you leave out your children or spouse from a last will and testament?

In Arkansas, there’s not such a concept as community or marital property. This means that all the assets gathered or increased during the marriage are not required to be evenly devolved to both spouses. You can leave your spouse out of the will, but Arkansas law implies that your spouse is entitled to a certain minimum amount of your property.

Regarding other members of the family, it is possible to lawfully disinherit anyone else. Your children no younger than 18 or any other members of the family can be legally disinherited absolutely in your last will. To do that, include particular paragraphs to the last will.

Is it possible to change my last will without my assent?

Only the testator can change his or her will. There is only one situation when a 3rd party is permitted to get involved. If you’re physically unable to sign your last will and testament, another person is permitted to do it instead of you yet only in your presence.

Can a signed, typewritten will be revised in Arkansas?

In line with Arkansas law, you can adjust or revoke your will if you are not obligated by a legal contract not to do it.

It’ll also be a wise decision to revise your last will in the following situations:

- Birth or adoption of a child

- Marriage or divorce

- Selling or purchasing real estate

- Great changes in your financial position

What does one have to do in case they aren't physically able to sign his or her last will?

Arkansas Estate Code makes it possible for another person to sign your last will and testament just per your directive and with you present. Verbal communication, a positive answer to a query, or body gestures are the methods that can be used to communicate that you’d like a specific person to sign your last will.

| Related documents | Times when you may want to create one |

| Codicil | You need to slightly change your last will without writing a new one. |

| Self-proving affidavit | You wish the probate to be quicker when it’s necessary. |

| Living will | You want to declare your wishes about the end-of-life health care and life-prolonging procedures. |

| Living trust | You would like to look at an alternative to a will. |

Last Will and Testament Forms for Other States