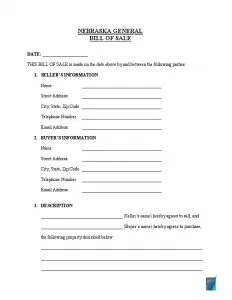

Nebraska Bill of Sale Form

Nebraska bill of sale is a crucial document that provides you with a secure way to transfer ownership of a high-value property such as a car, watercraft, or gun. Make sure to fill out the bill of sale according to your state requirements to avoid any potential legal claims if the sale goes wrong.

The Nebraska Department of Motor Vehicles (DMV) provides Nebraska residents with an official vehicle bill of sale template they can use when they plan to sell or buy a motor vehicle. The bill of sale form will come in handy during the registration process. Apart from the motor vehicle bill of sale, the buyer must get the vehicle’s title with signatures on the back and an odometer disclosure statement to verify the mileage at the time of purchase.

Below, you can access a downloadable and editable template of a bill of sale valid in Nebraska that will cover most private property purchase deals. Using lawyer-approved and official forms will shield you from any legal risks in the future. You can also use a printable vehicle bill of sale form provided by the Nebraska DMV.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Nebraska Motor Vehicle Bill of Sale Form |

| Other Names | Nebraska Car Bill of Sale, Nebraska Automobile Bill of Sale |

| DMV | Nebraska Department of Motor Vehicles |

| Vehicle Registration Fee | $15 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 26 |

Nebraska Bill of Sale Forms by Type

Nebraska bills of sale can help sellers and buyers complete any sale type. The document has a place for specific vehicle details and both parties’ personal information. Bills of sale can vary for each item you’re about to purchase or sell, so it’s vital to check twice whether the selected document template is appropriate for your case.

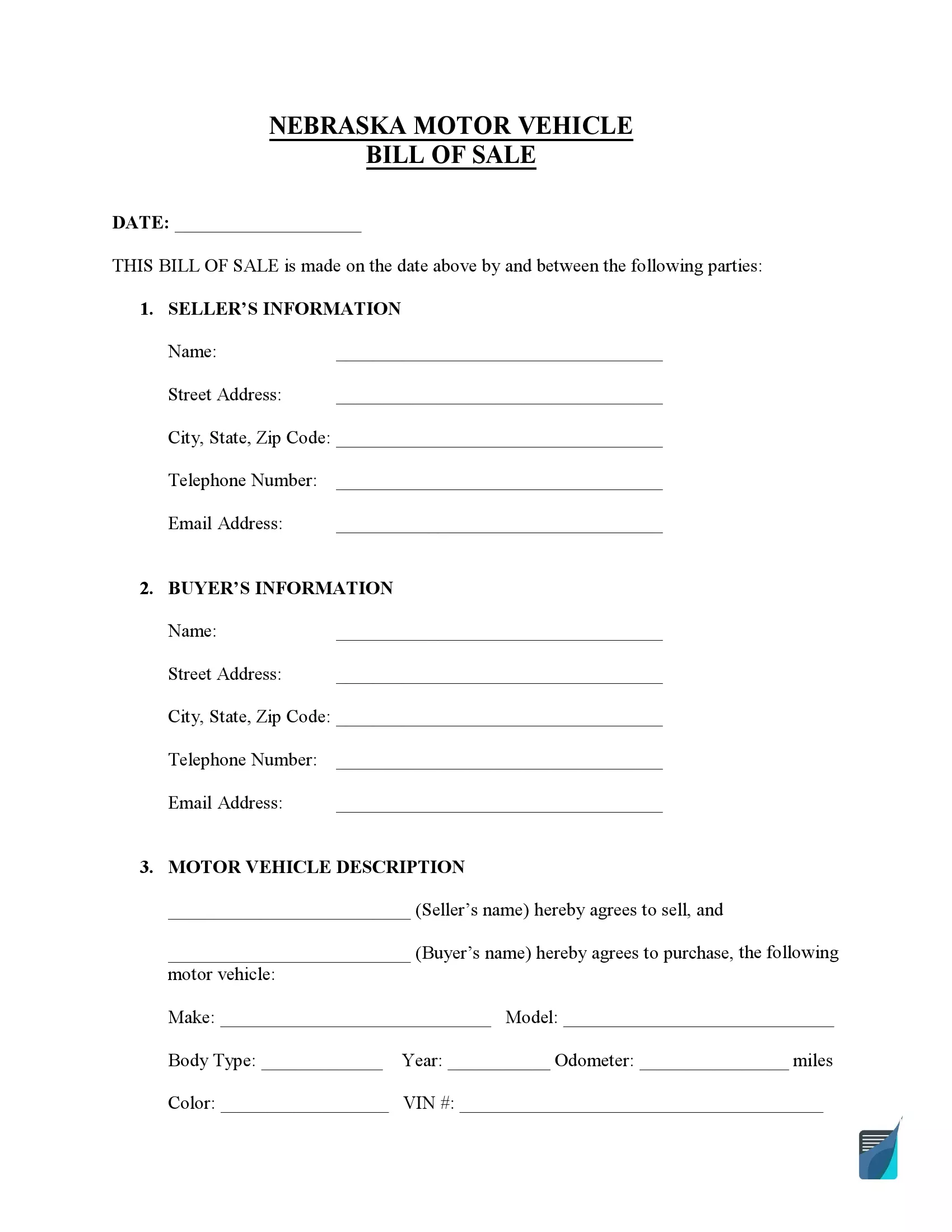

Nebraska motor vehicle bill of sale form is a document required at the time of motor vehicle transfer. According to the Nebraska laws, you must register your vehicle within 30 days after relocation or purchase. Nebraska demands a 5.5% state sales tax rate and additional title, registration, and plate fees.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Required |

| Download | PDF Template |

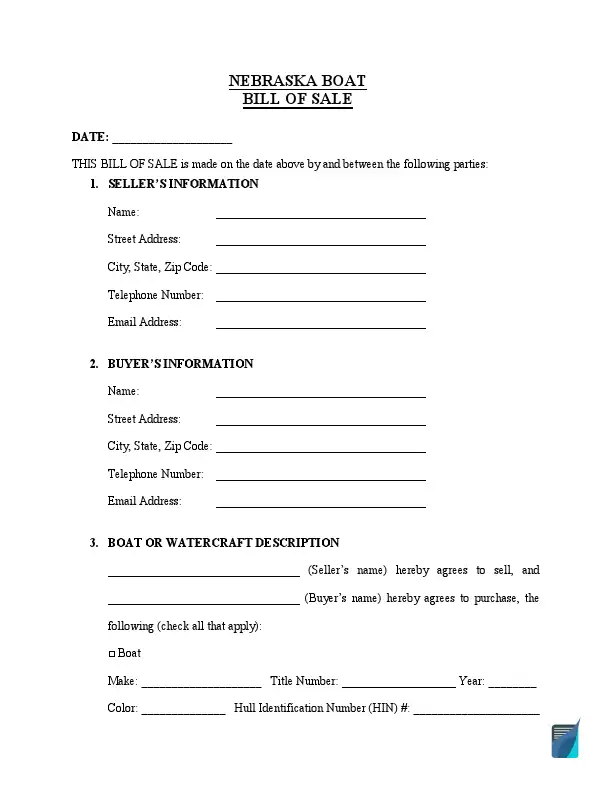

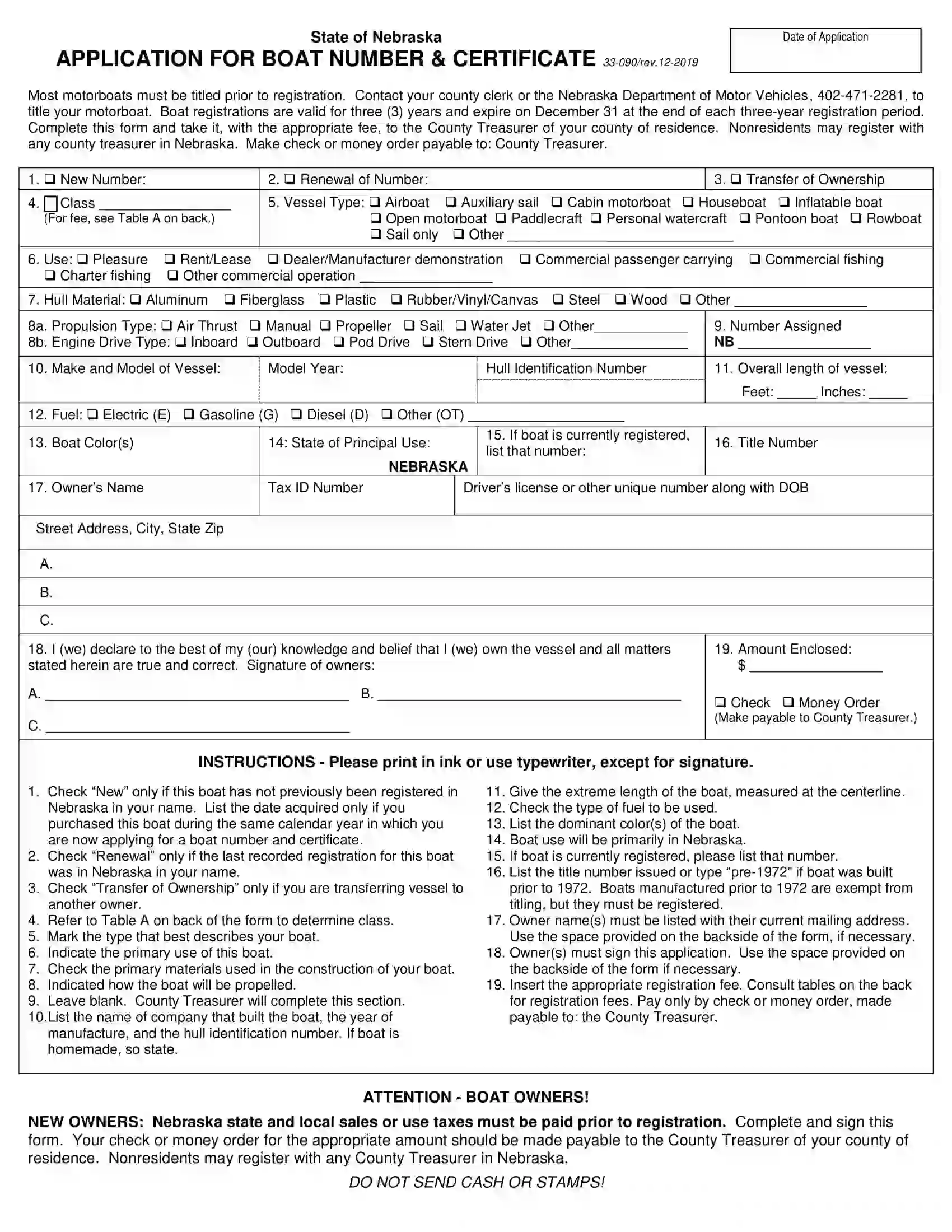

Fill out a boat bill of sale to secure the watercraft ownership transfer, which is specifically crucial when you buy from private sellers. After purchasing a boat from a private seller, you have 15 days to notify Game and Parks about the boat’s new owner and 30 days after entering the Nebraska waters to register the boat in the new owner’s name.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Required |

| Download | PDF Template |

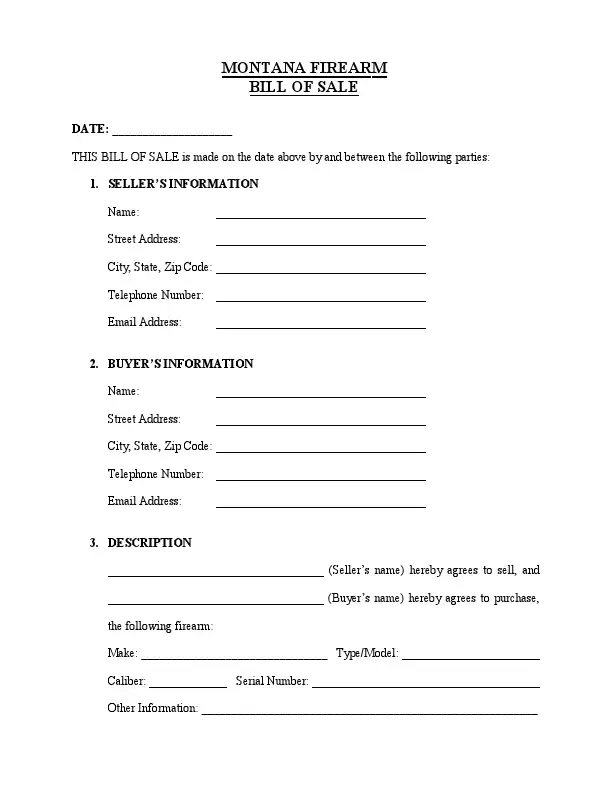

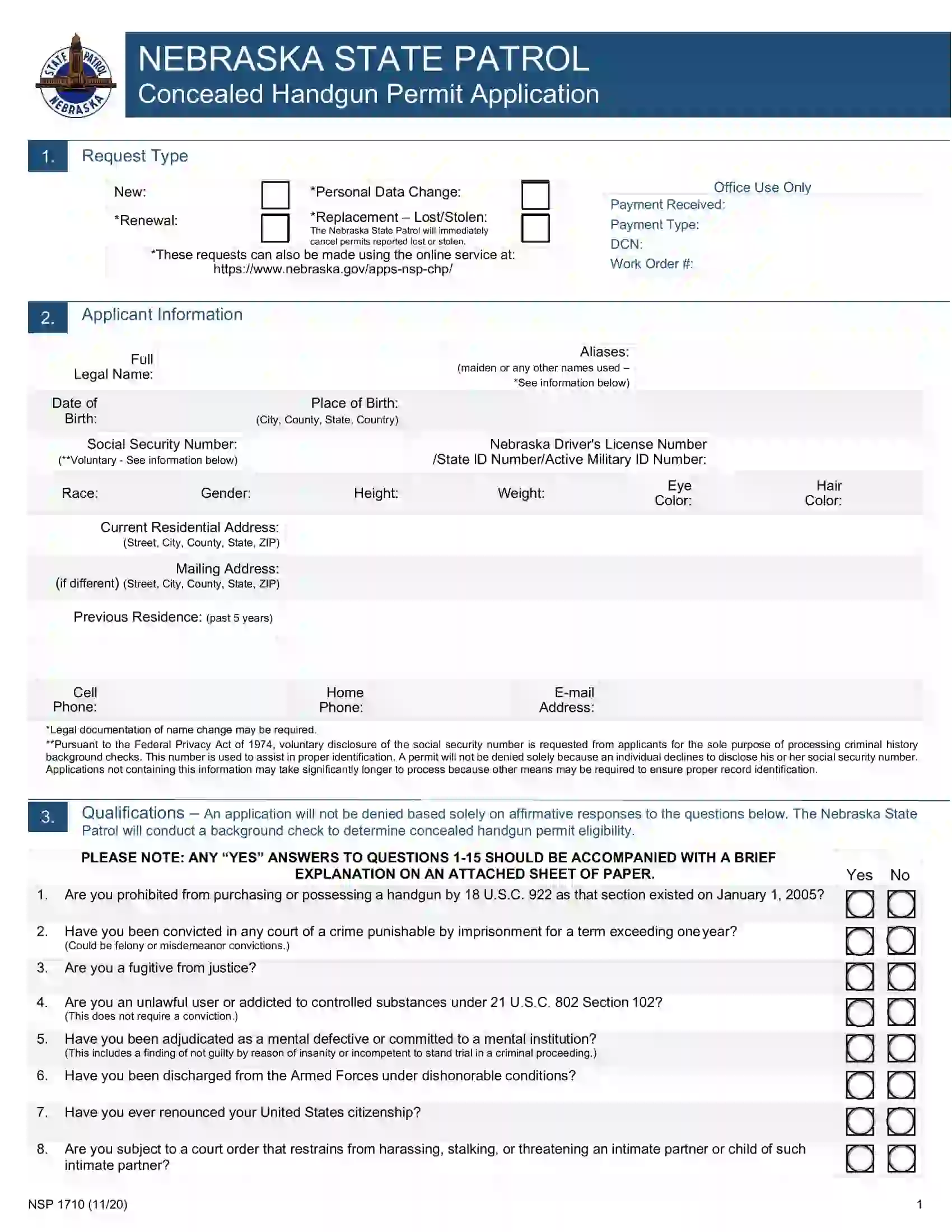

Use a firearm bill of sale during the gun purchase in Nebraska to record the ownership transfer. The purchaser must obtain a concealed handgun permit or handgun certificate to seal the deal. Although Nebraska allows open-carry of the gun, you have to check your local regulations because some counties, like Omaha, require a person to register their handgun.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

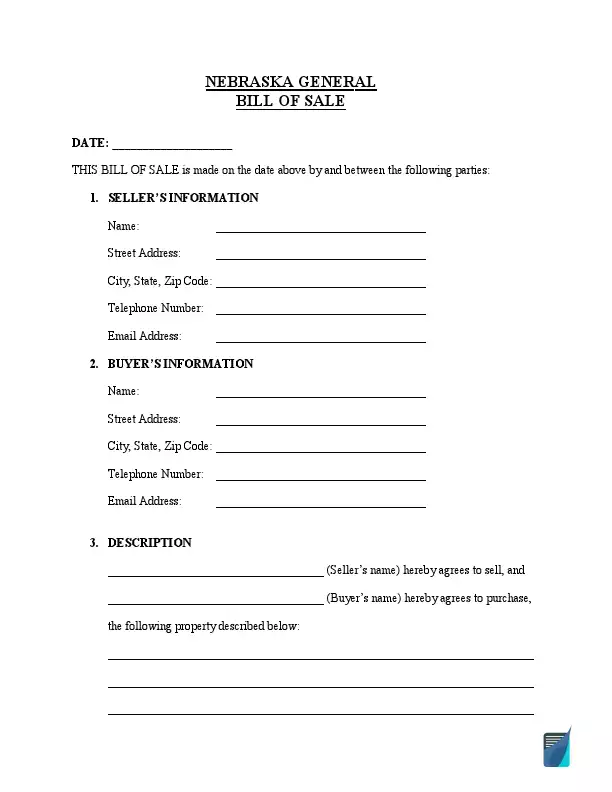

Use a general bill of sale form to seal most purchase deals, including selling vehicle accessories, tools, and equipment. This form can serve as additional layer of security for both the buyer and seller.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a NE Vehicle Bill of Sale

Nebraska form for a motor vehicle is an official document required by the Nebraska DMV to register the vehicle, title, or ownership transfer. This form is usually needed when the motor vehicle is sold to document the transaction between the transferor and the transferee. This document must contain all the necessary vehicle information, like the make, model, identification number, and odometer reading. Here are simple instructions on how to correctly complete the form.

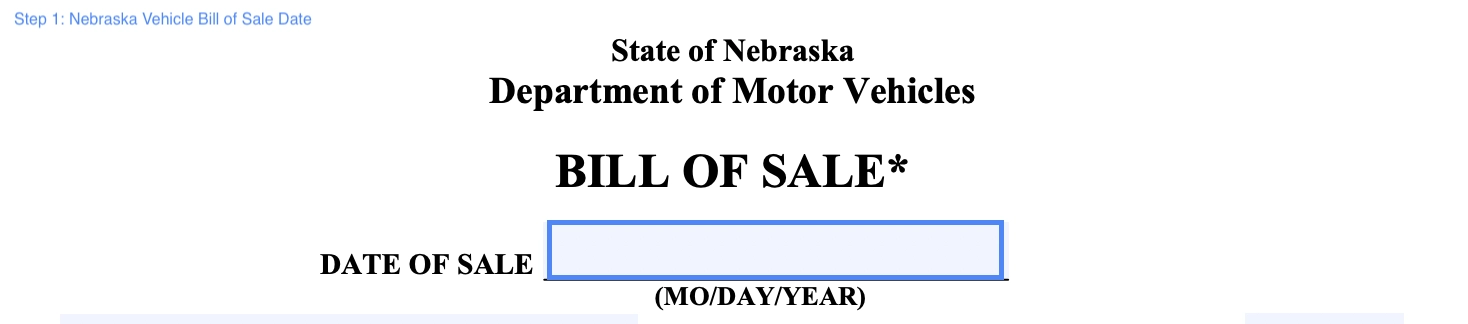

Step 1. Indicate the date of sale

First, you need to state the actual date when the motor vehicle was sold.

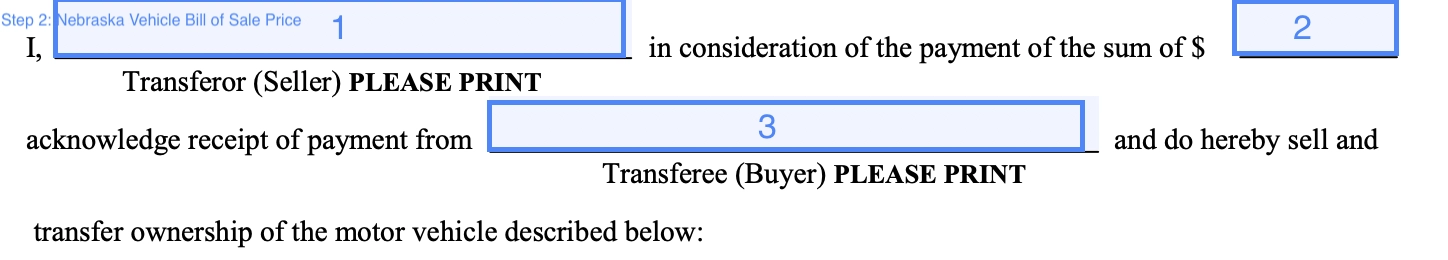

Step 2. Specify the selling price

This section is filled out by the seller, who needs to indicate the total amount of money the motor vehicle costs and write the name of the transferor (the person who is selling the vehicle) and transferee (the person who purchases the vehicle and obtains the ownership rights).

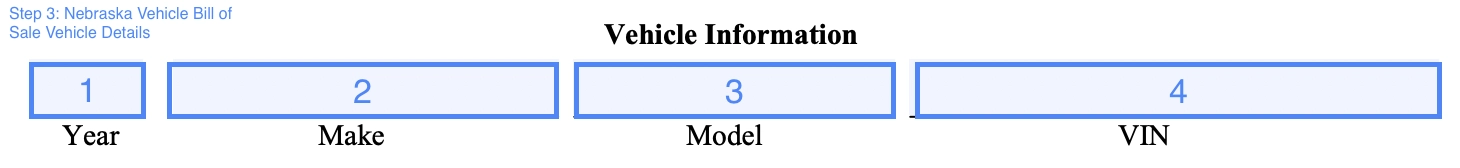

Step 3. Describe the vehicle sold

In this section, the seller must provide valid information regarding the motor vehicle, such as:

- Year

- Make

- Model

- VIN

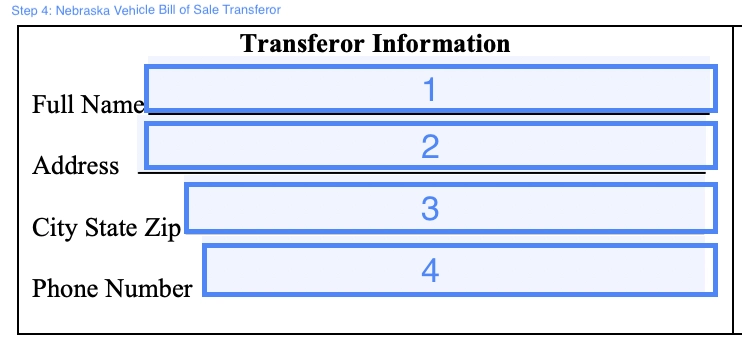

Step 4. Provide the transferor information

Clarify the contact details of the vehicle seller, providing their full name, address (street, city, state, and zip code), and phone number.

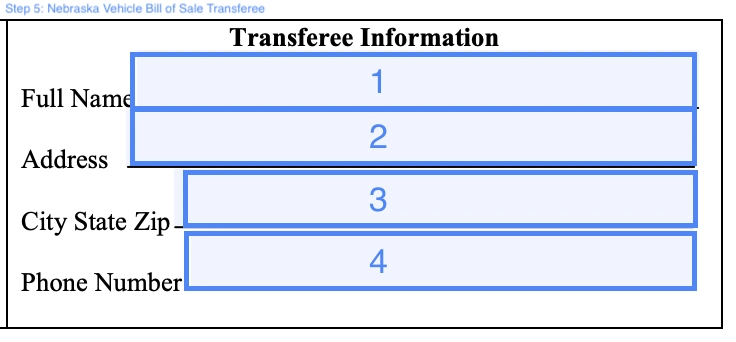

Step 5. Give the transferee information

Here, you must provide the contact information of the person who purchases the motor vehicle. Similar to the seller, the buyer must write down their full name, physical address (street number, city, state, and zip code), and phone number.

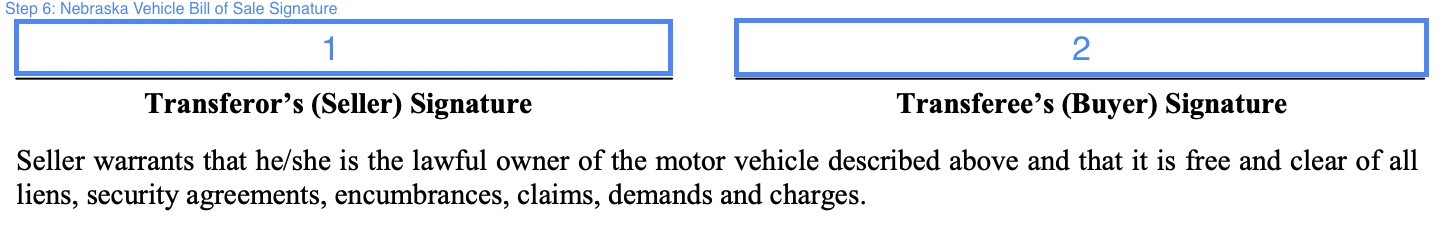

Step 6. Provide the parties’ signatures

After that, the seller and buyer must sign the document to confirm that they agree on and are aware of the information provided.

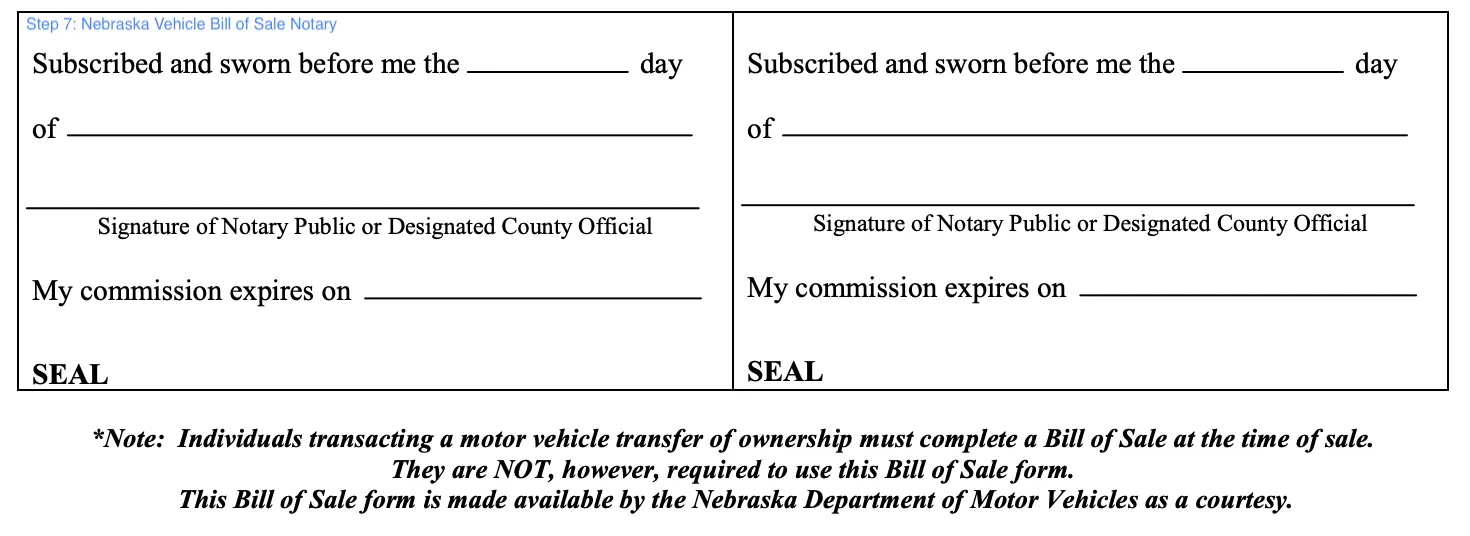

Step 7. Notarize the bill of sale

The last step is to get the signature of a notary public or designated county official to verify the document and make it legally binding.

Form Preview

|

|

|

|

State of Nebraska |

||||

|

Department of Motor Vehicles |

|||||||

|

|

|

|

BILL OF SALE* |

||||

|

DATE OF SALE |

|

|

|

|

|

||

|

|

|

|

|

(MO/DAY/YEAR) |

|

||

I, |

|

in consideration of the payment of the sum of $ |

||||||

|

Transferor (Seller) PLEASE PRINT |

|

|

|

|

|

||

acknowledge receipt of payment from |

|

|

|

and do hereby sell and |

||||

|

|

|

|

Transferee (Buyer) PLEASE PRINT |

|

|||

transfer ownership of the motor vehicle described below:

Vehicle Information

Year |

Make |

Model |

VIN |

Transferor Information

Full Name

Address

City State Zip

Phone Number

Transferee Information

Full Name

Address

City State Zip

Phone Number

Transferor’s (Seller) Signature |

|

Transferee’s (Buyer) Signature |

Seller warrants that he/she is the lawful owner of the motor vehicle described above and that it is free and clear of all liens, security agreements, encumbrances, claims, demands and charges.

|

Subscribed and sworn before me the |

|

day |

|

Subscribed and sworn before me the |

|

day |

||||||||

|

of |

|

|

|

|

|

|

|

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Signature of Notary Public or Designated County Official |

|

|

Signature of Notary Public or Designated County Official |

||||||||||

|

My commission expires on |

|

|

|

|

|

|

My commission expires on |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

SEAL |

|

|

|

|

|

SEAL |

|

|

|

|

||||

*Note: Individuals transacting a motor vehicle transfer of ownership must complete a Bill of Sale at the time of sale.

They are NOT, however, required to use this Bill of Sale form.

This Bill of Sale form is made available by the Nebraska Department of Motor Vehicles as a courtesy.

Revised 1/2014

301 Centennial Mall South ● PO Box 94789 ● Lincoln, NE

Registering a Vehicle in Nebraska

All residents who have recently bought a vehicle or are relocating to the state must register their vehicle. Before moving in, new residents must have their cars examined by the sheriff’s department in the area. Your vehicle’s title, evidence of insurance, and a receipt for the payment of sales taxes must all be submitted for registration.

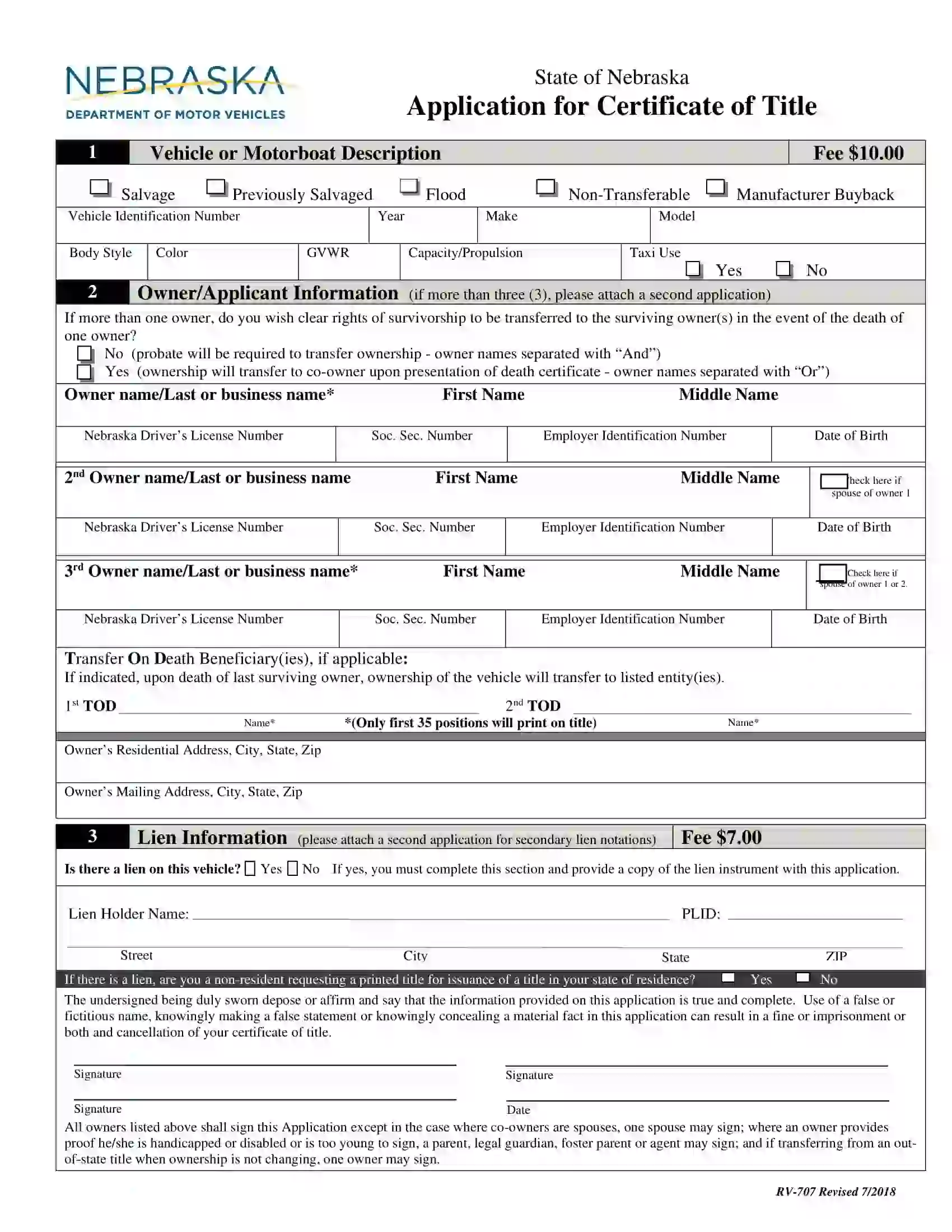

To register a motor vehicle in Nebraska, buyers must gather and present documentation to the Nebraska DMV/County Treasurer’s Office in person. Besides that, buyers must come prepared to pay all fees and taxes, which are determined by the vehicle’s estimated value. Included in the forms and documents needed needed at the time of the presentation are:

- Motor vehicle bill of sale template signed and notarized

- Application form for certificate of title

- Odometer Disclosure Statement

- Proof of payment of taxes (if not, buyers must be prepared to pay taxes on purchase price)

- Sheriff’s inspection

- Title with a vehicle identification number (VIN) and signatures of both parties on the back

- Driver’s license and proof of liability coverage

- Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales

Regarding fees, buyers must be prepared to pay all at the time of registration. They include a $10 title fee and a $15 registration fee. Taxes are based on the Manufacturer’s Suggested Retail Price (MSRP) at the time of purchase and are taxed based on Nebraska’s base tax system. It holds on all vehicles that are less than 14 years of age. All cars 14 years old and above are taxed based on the purchase price. Taxes are as low as $25.00 and can span up to $1,000 for motor vehicles valued at $100,000. Any motor vehicle that operates using a type of fuel not included in Nebraska’s motor fuel laws is subject to an alternative fuel fee of $75. The latter must be paid each time registration is renewed.

Within 30 days of delivery, all cars must be registered with the County Treasurer in person or by correspondence. The date the car was bought determines the registration’s expiration date. Residents of Nebraska who own two or more cars may opt to register them annually with a month of expiration.

Relevant Official Forms

Application for Certificate of Title (Form RV-707) is used to ensure successful vehicle or boat registration.

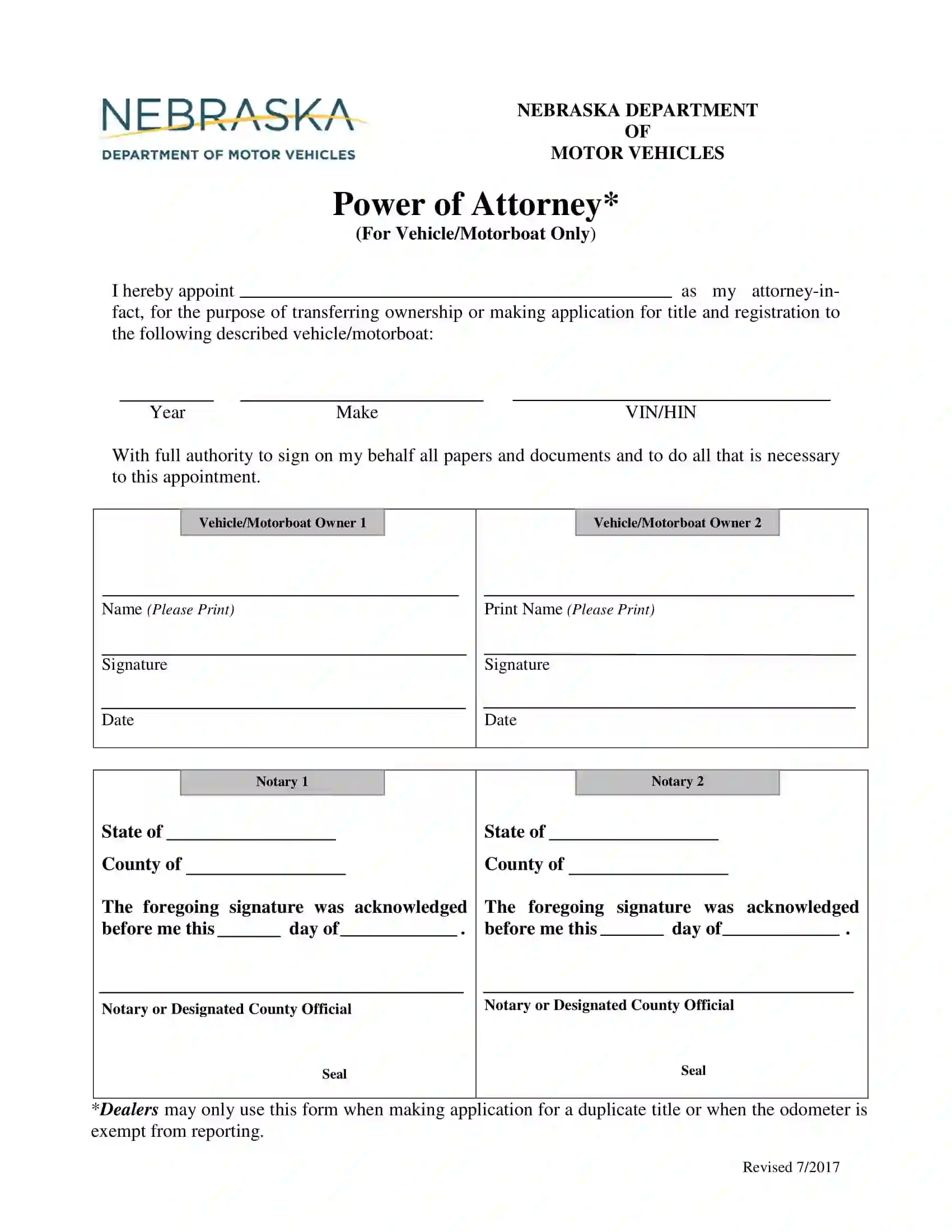

A motor vehicle power of attorney helps a person temporarily hand over legal rights and the right of signature to another person.

Form 33-090 or Application for Boat Number and Certificate is the form required for boat registration and titling in Nebraska.

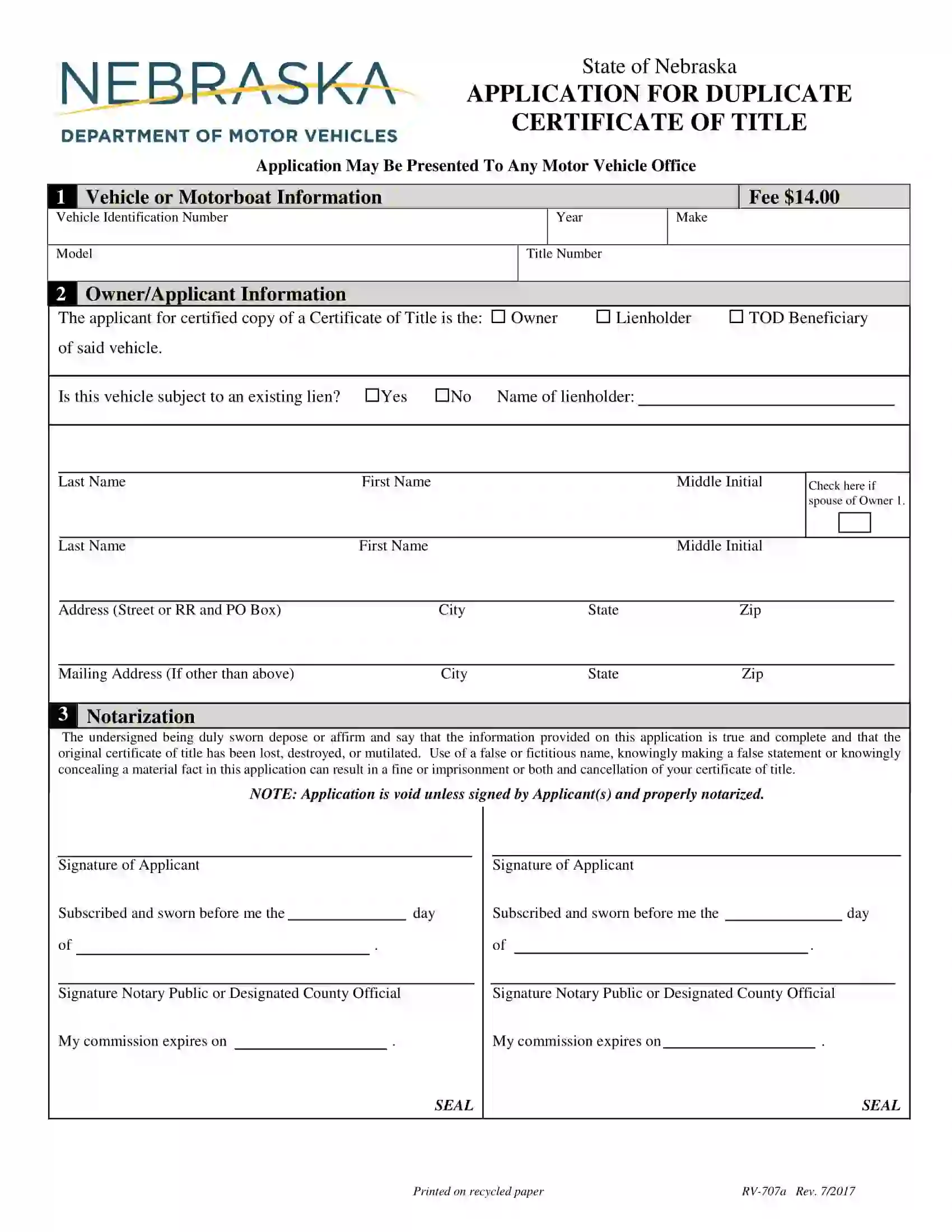

Fill out an Application for Duplicate Certificate of Title (Form RV-707a) if you’ve lost or damaged your original title certificate.

Form NSP 1710 or Concealed Handgun Permit Application is used to apply for a firearm permit in Nebraska.

Short Nebraska Bill of Sale Video Guide

Other Nebraska Forms