Ohio Bill of Sale Form

Ohio bill of sale s a common form to close a deal between a vendor and buyer. Although bills of sale are non-compulsory during private transactions, they are recognized as compelling proof of ownership change and provide additional legal protection.

You are recommended to fill out a bill of sale form correctly, as it will help ease any legal concerns regarding the transaction. If you need your own bill of sale form, you can get a printable version below, along with other official forms applicable in Ohio.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Ohio Vehicle Bill of Sale Form |

| Other Names | Ohio Car Bill of Sale, Ohio Automobile Bill of Sale |

| DMV | Ohio Bureau of Motor Vehicles |

| Vehicle Registration Fee | $34.50 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

Ohio Bill of Sale Forms by Type

All bills of sale come in various forms; each is used for a specific type of sale. It’s essential to use a template appropriate for your purchase or sale.

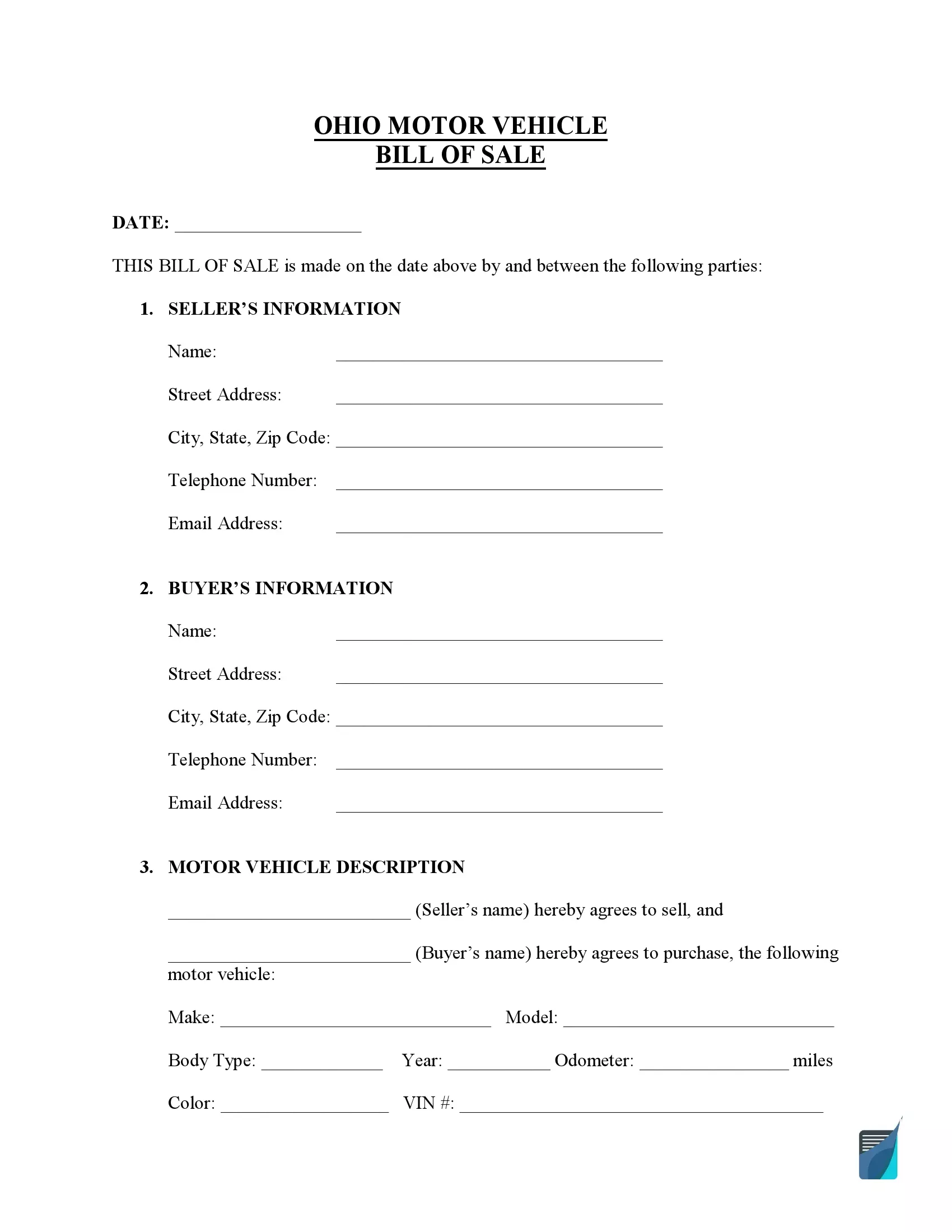

Ohio motor vehicle bill of sale is widely used for making a legally compliant deal. The form must contain information about the vehicle and its condition before the settlement. Once you purchase the motor vehicle in Ohio or transfer it out of state, you must register it within 30 days.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

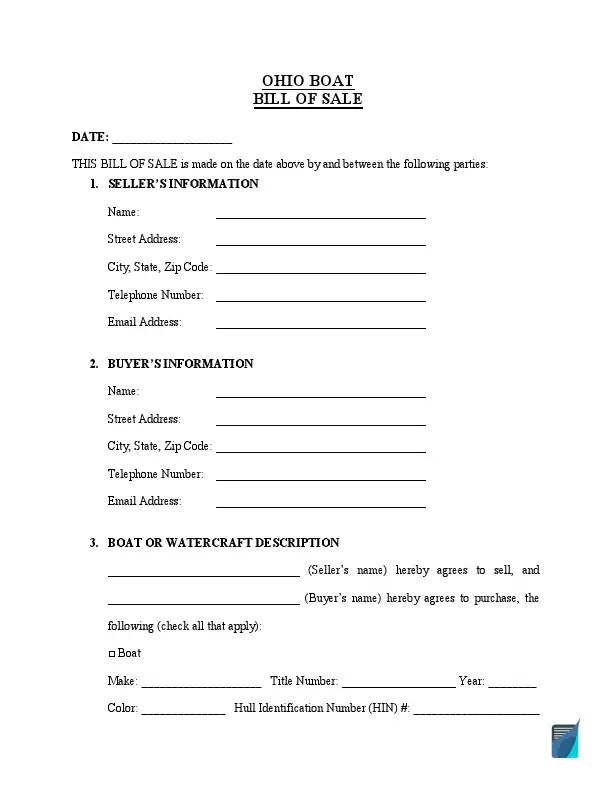

If you plan to buy or sell a vessel in Ohio, signing a proper boat bill of sale form will help you secure the transaction lawfully. If you recently purchased a vessel in Ohio, you must officially change the ownership at the Watercraft Office. Usually, the vessel registration is active for three years until March 1 in Ohio. The must-to-record vessel types are motorized boats and recreational vessels. The boat registration tax varies by the vessel’s length.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

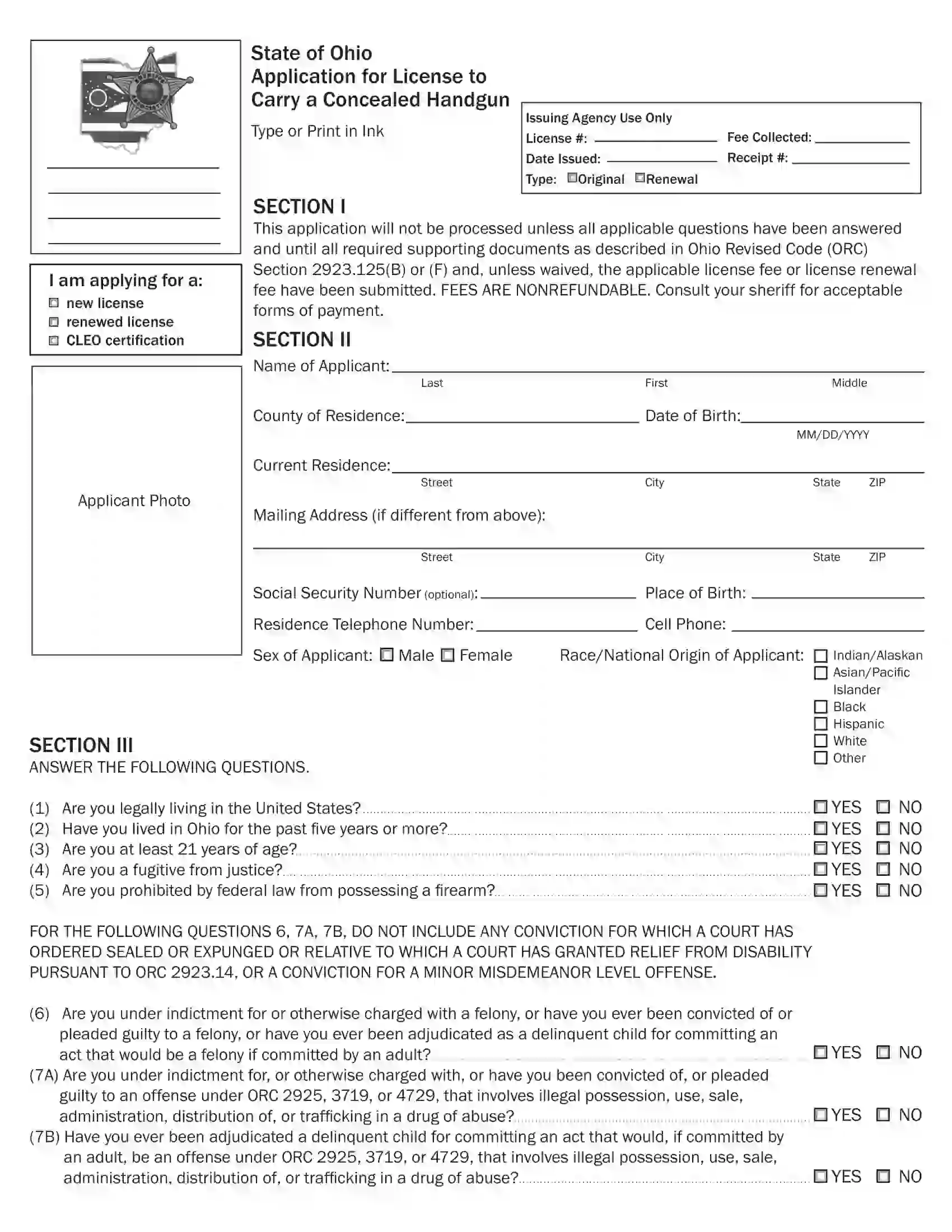

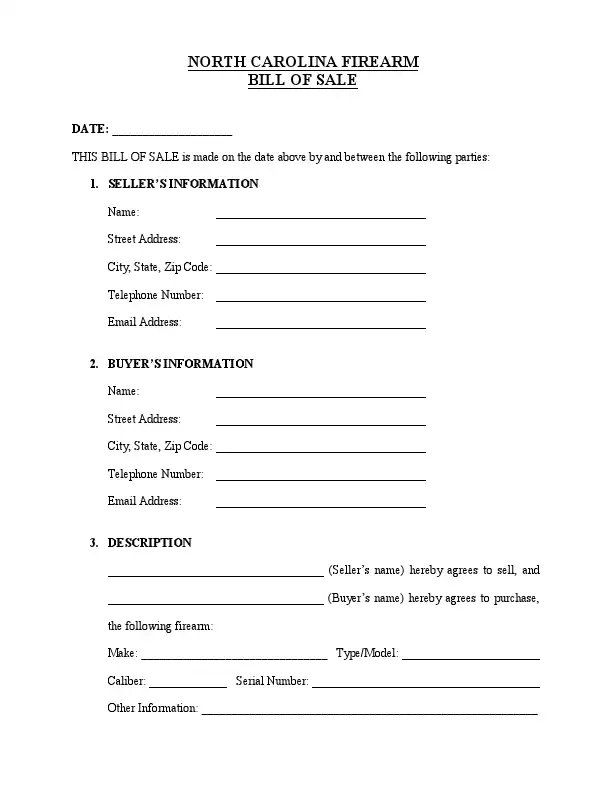

Ohio firearm bill of sale is a helpful form that enables monitoring firearm transfer from one owner to another. Ohio doesn’t require a background check for selling firearms within the state. Ohio doesn’t require a criminal record check or license to sell a firearm. Moreover, no laws impede and constrain the resident’s right to carry a handgun openly.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

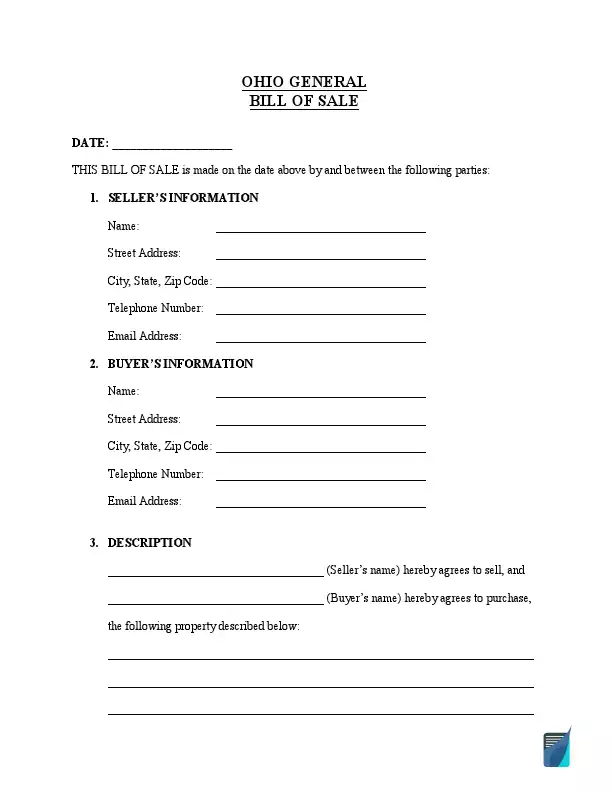

If there is no specialized form for the type of equipment you want to sell in Ohio, you may want to use a general bill of sale.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

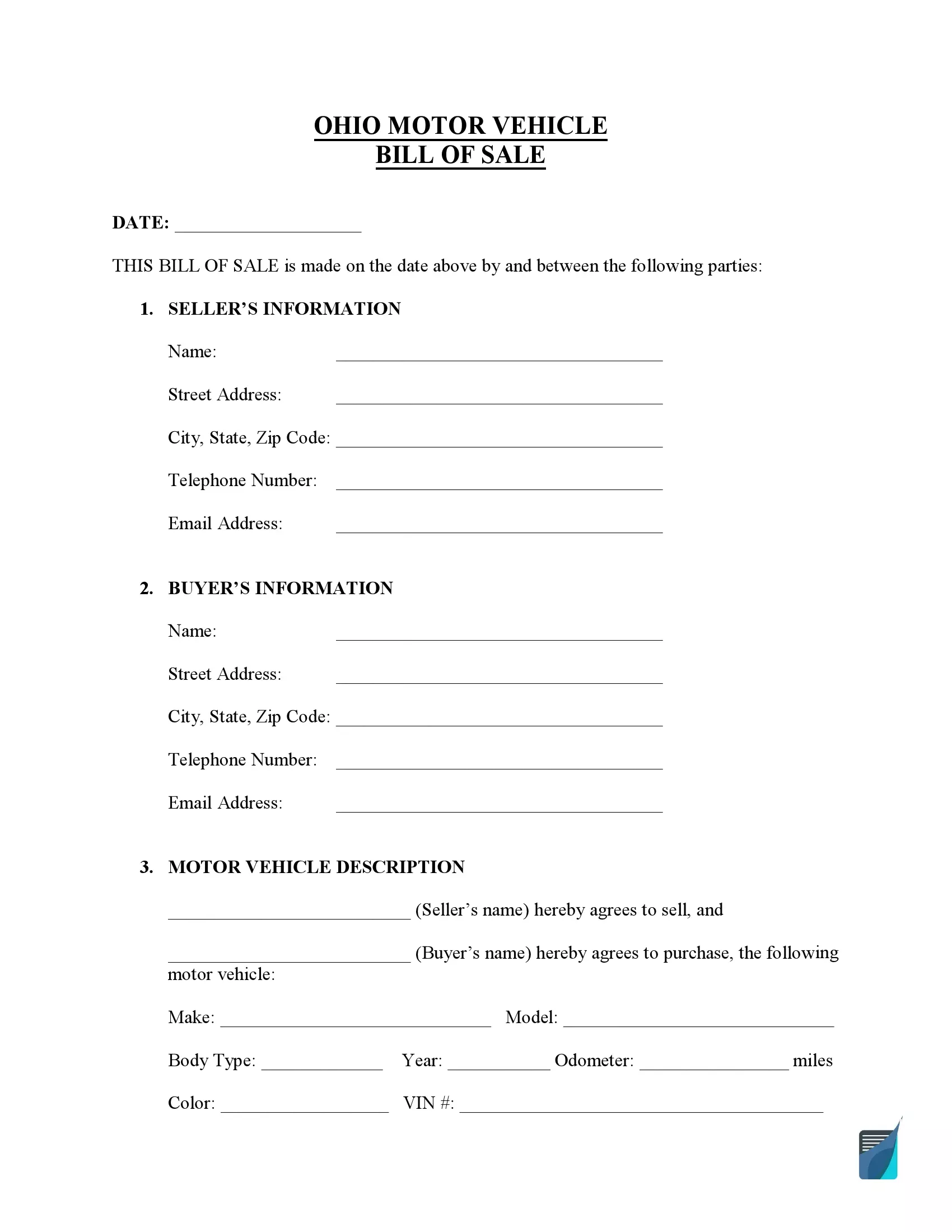

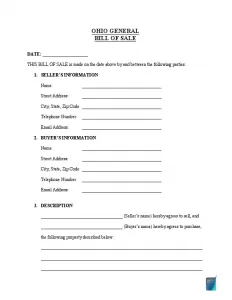

How to Write an OH Vehicle Bill of Sale

Ohio residents need to complete a motor vehicle bill of sale to register their purchased motor vehicle. Here, you’ll find the guidelines developed by drawing upon the template developed by our team.

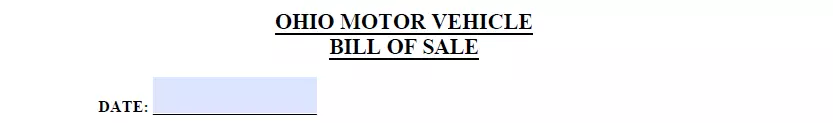

Step 1: Specify when the document is created

The first step you need to take is to specify the transaction date.

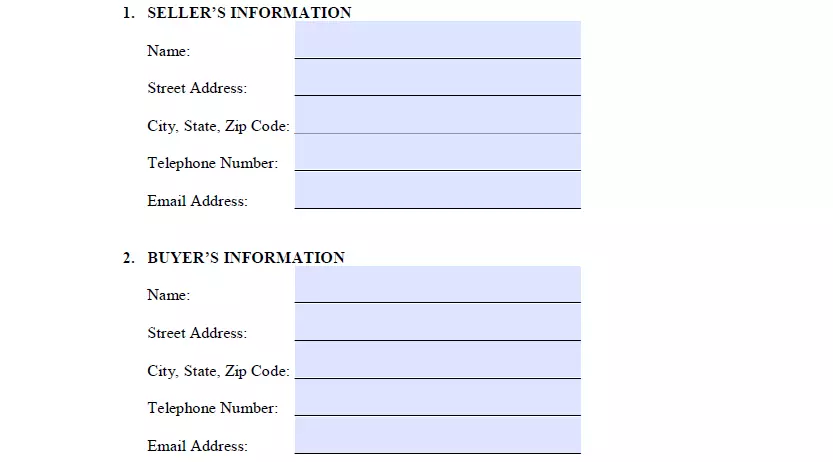

Step 2: Type in the parties’ information

After specifying the date, you are required to fill out all the details related to the purchaser and seller, including:

- Full name

- Address (street, city of residence, state of residence, postal code)

- Contact information (phone number and email address)

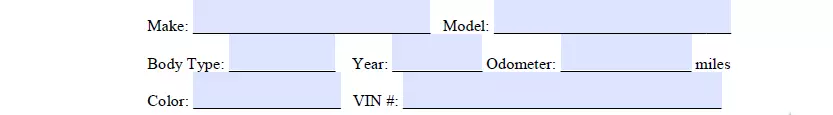

Step 3: Describe the vehicle being sold

In this part, you are expected to enter the detailed information about the motor vehicle that you are trying to sell, such as:

- Make (manufacturer)

- Vehicle’s model

- Vehicle’s body style

- Year

- Miles (odometer reading)

- Automobile’s color

- Identification number

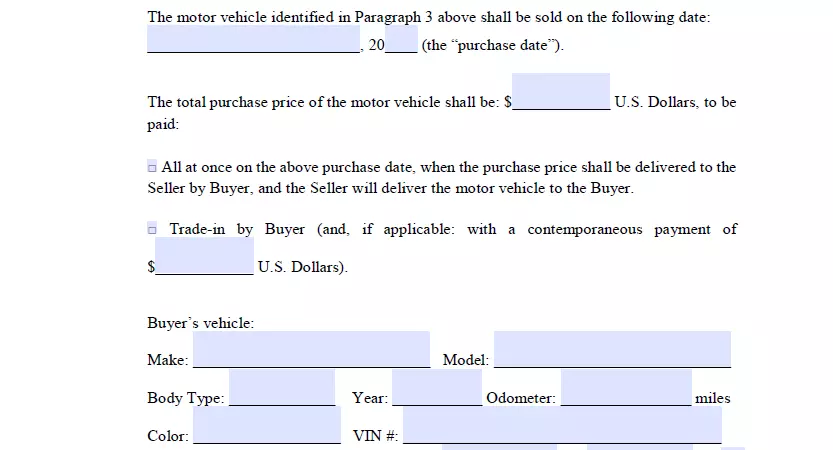

Step 4: Specify the price and payment method

As the seller, you will need to indicate how you’ll get money for the deal. This step requires providing the date of the purchase and the sum decided upon by all parties of the deal. You will have to indicate the selling method the buyer will use to pay the total purchase price:

- One-time payment. The individual pays the entire amount in a single payment and gets the car transported to them on the same day.

- Trade-in. This option allows the buyer to trade their car (usually with a supplement) for the seller’s vehicle. In this case, the bill of sale must also have the purchaser’s vehicle specifics.

- Installment payment. Using this method, you need to indicate the dates when the purchaser has to deliver the first and the final payments, along with their amounts.

Then, indicate how the purchaser is going to pay. You can select among the following options

- Cash

- Check

- Cashier’s cheque

- Money order

The final thing here is to choose whether all applicable taxes are included in the purchase price.

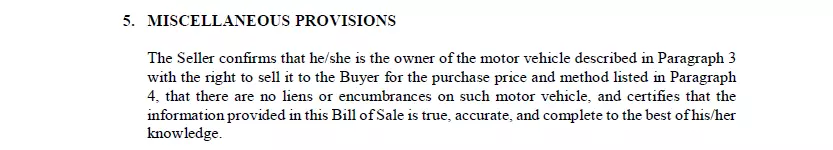

Step 5: Check the miscellaneous terms

You need to go through the standard provisions and ensure both sides understand them. The “as-is” part indicates that the vehicle owner provides no warranty and is not liable for repairs after the transfer.

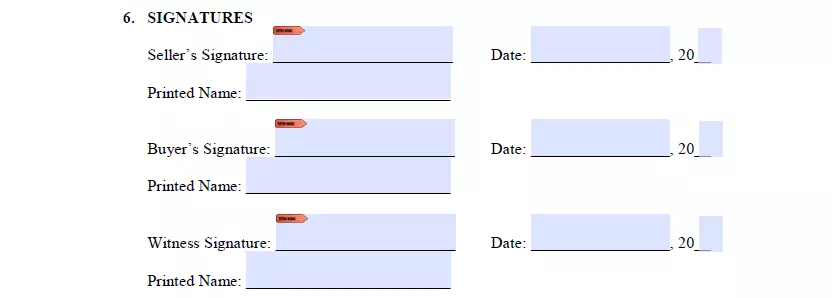

Step 6: Sign the document

The buyer’s signature is usually not necessary. Nonetheless, it’s recommended to get the bill of sale signed by all sides. As an additional precaution, you may have one or two people witness the process and sign the bill of sale.

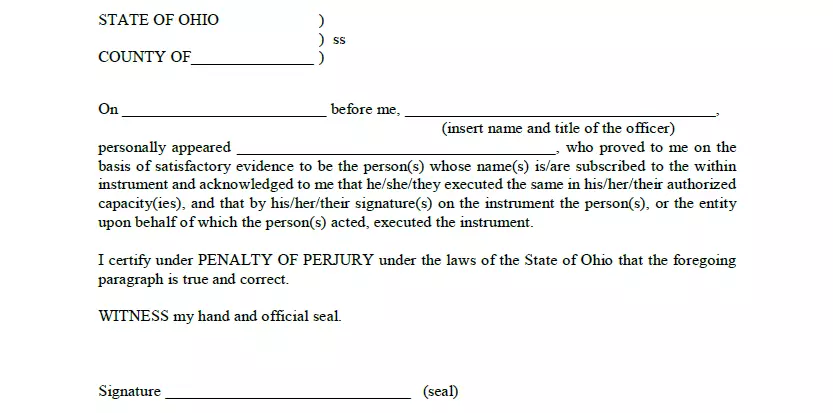

Step 7: Notarize the form

A notary public signature is usually not required, but it is a decent approach to create one more layer of legal safety to your agreement.

The original document copy should be given to the buyer since they’ll require it to get a title to their newly bought motor vehicle. As a seller, you could either get a copy and keep it or have a pair of identical forms signed and filled out by both sides.

Registering a Vehicle in Ohio

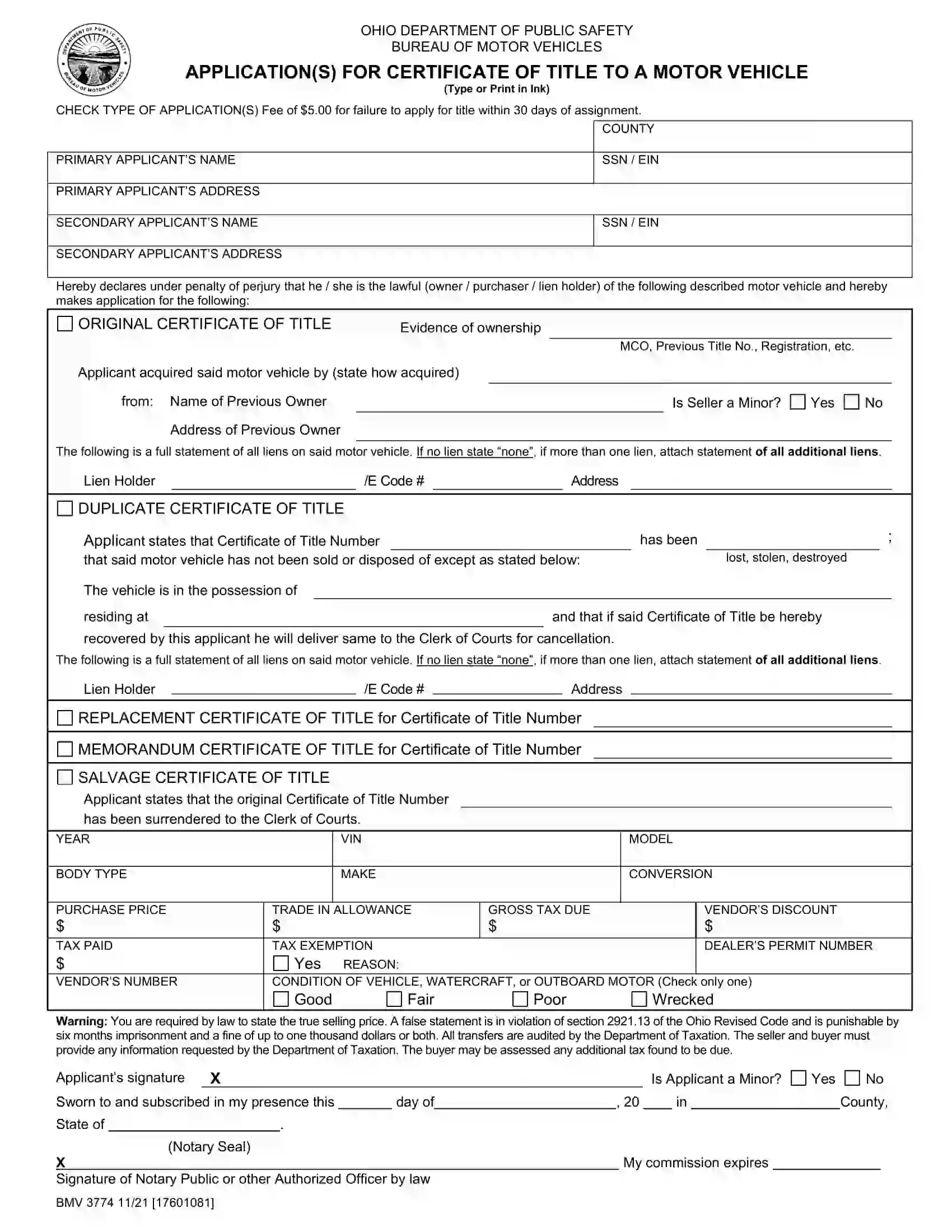

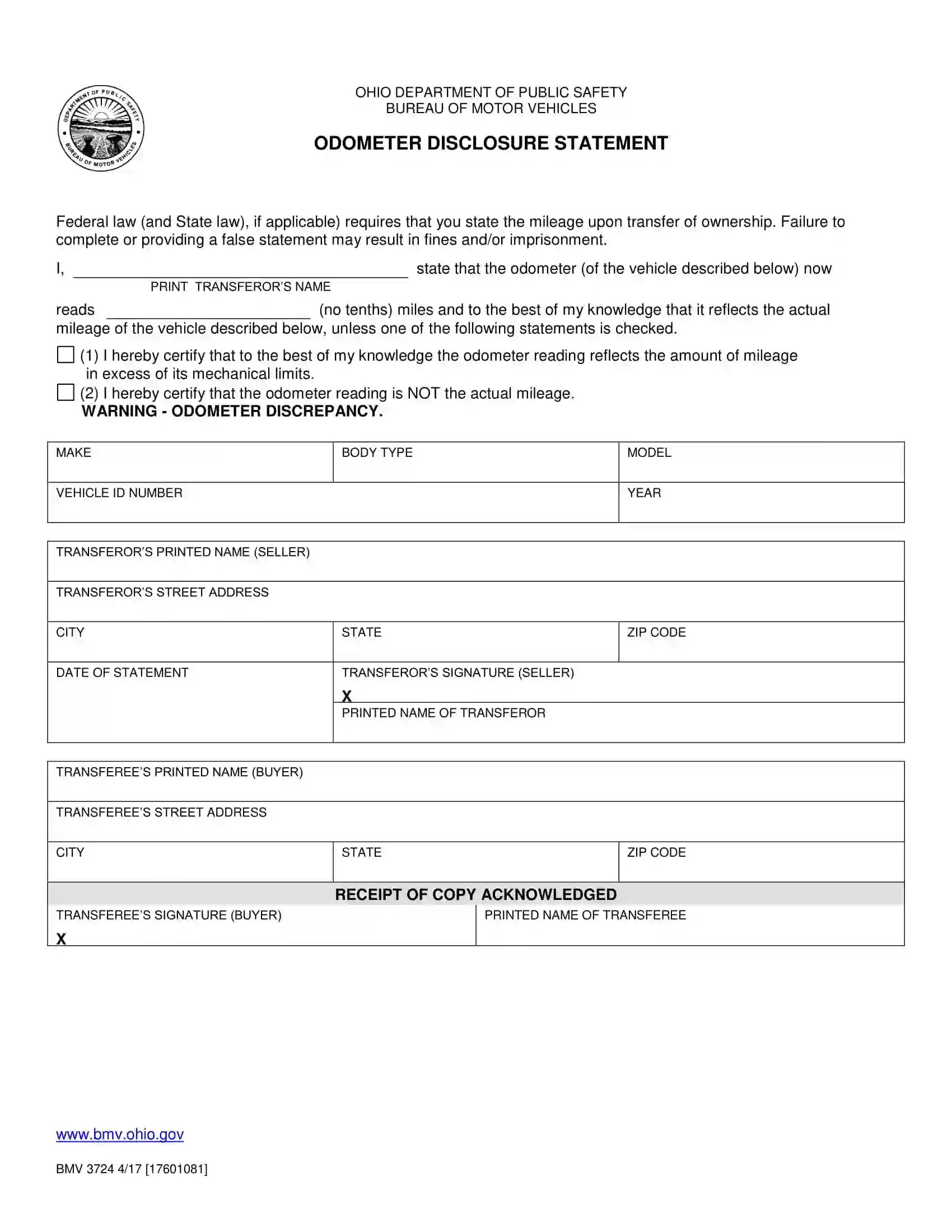

The registration process takes place after the purchase of a motor vehicle. When a vehicle is transferred from one person to another in Ohio, the new owner must provide an odometer disclosure statement (Form BMV-3724) and a motor vehicle bill of sale for the vehicle’s official registration. The registration procedure may be completed in any local BMV Office in Ohio, where the owner should appear in person to provide the following vehicle registration forms:

- Notarized motor vehicle bill of sale and certificate of title

- Driver’s license or SSC of an Ohio resident

- VIN inspection statement (for the new Ohio residents coming to the state with their vehicles registered in another state)

- Valid auto insurance

- Odometer disclosure statement

- Emissions and safety inspection statements (county-specific)

- Registration Information and Authorization to Register for those who acquire leased vehicles

The bill of sale is not mandatory in Ohio. Still, it is recommended to complete this document for the sake of the seller’s and buyer’s security, as this notarized document contains all of the crucial transaction-related information. Besides that, the seller should fill in the “assignment of ownership” section of the title form to include the purchase price, date of ownership transfer, the vehicle’s current mileage, and the buyer’s data.

The vehicle’s buyer should pay all taxes for the vehicle’s purchase and registration fees within 30 days after the private transaction. Owners may opt to receive 45-day temporary tags, which can be issued only before the title change. Only permanent Ohio plates can be obtained for the vehicle once the Ohio title is given to the new owner by the BMV Office.

The sales tax is imposed on vehicle transactions with private sellers and official dealers. The amount of sales tax and title fees to be paid is determined depending on the declared value of the vehicle (indicated in the bill of sale).

Registration is personally undertaken in the local deputy registrar license agency and cannot be completed by mail.

Relevant Official Forms

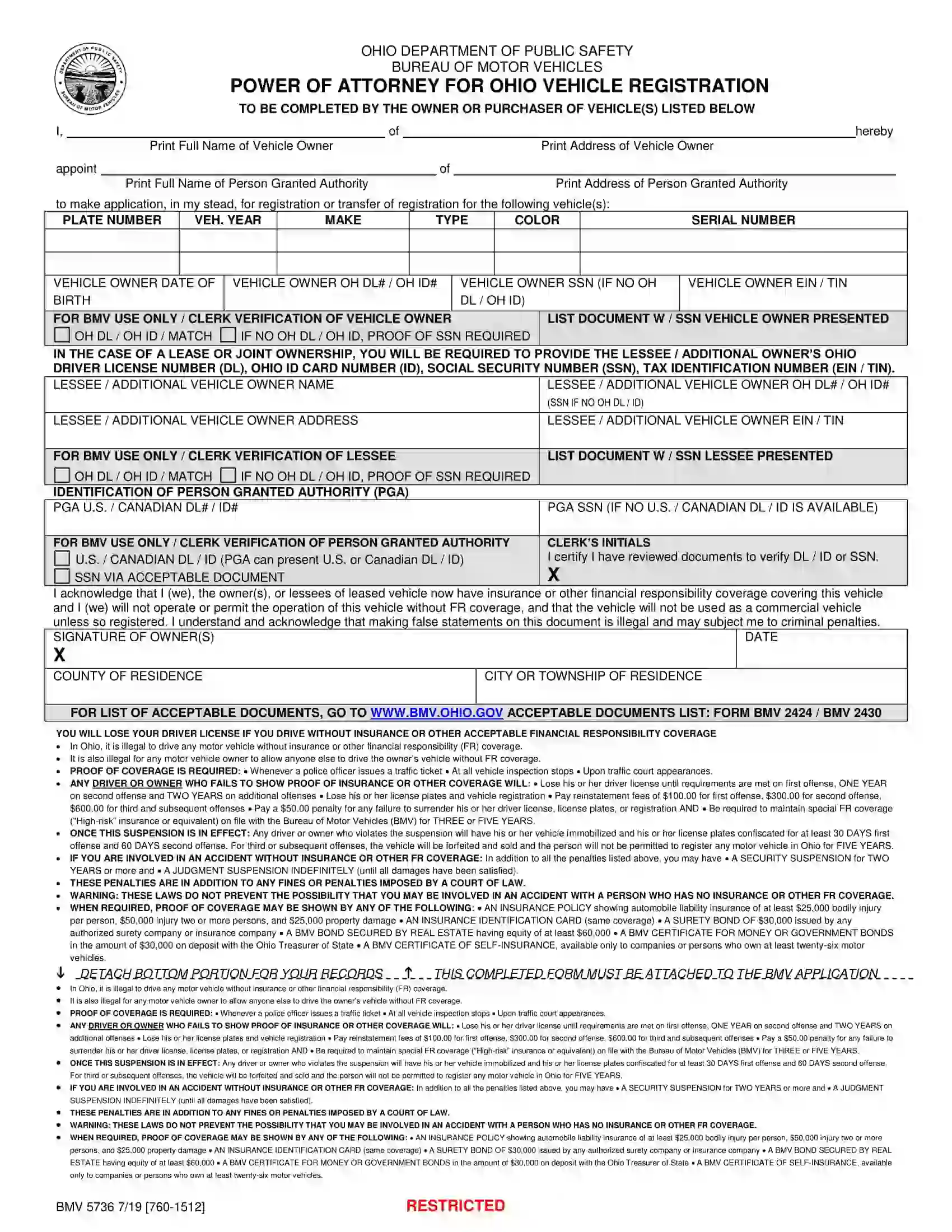

Fill out a motor vehicle power of attorney to give a trusted person the right to handle vehicle registration for you.

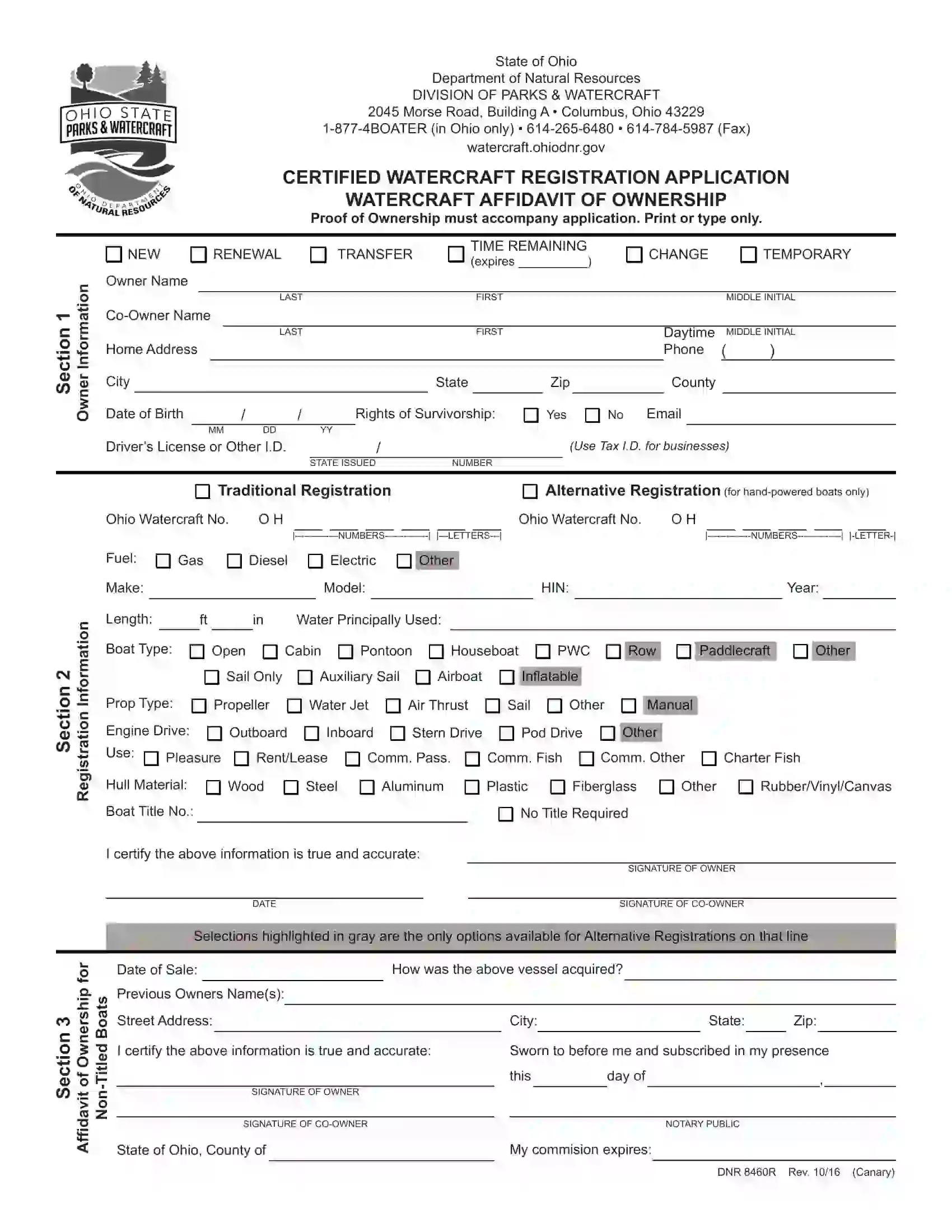

Certified Watercraft Registration Application and Affidavit of Ownership (Form DNR 8460R) is an authorized form required for registering a watercraft in Ohio.

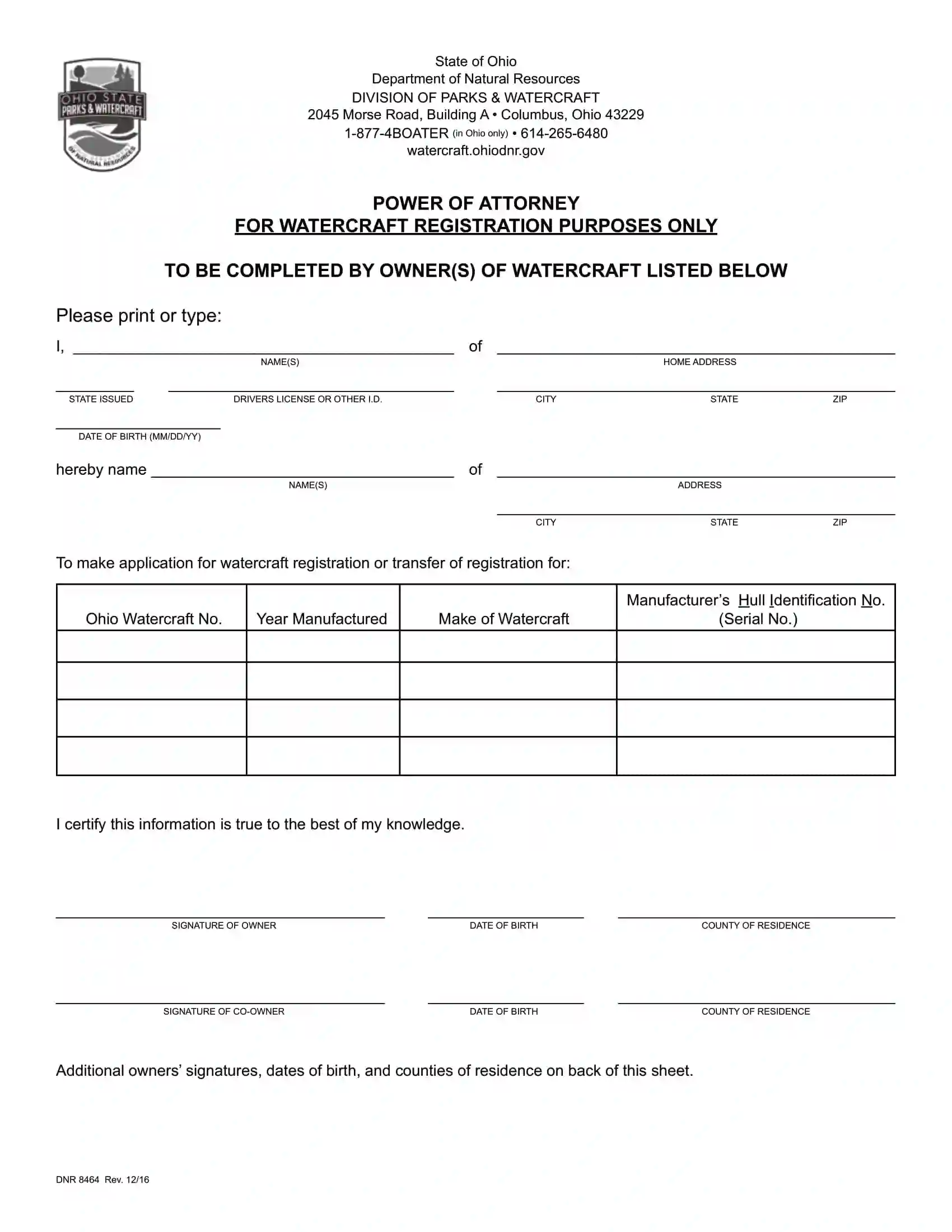

A power of attorney form for watercraft is needed when the vessel registration process or title transfer is conducted by a person of trust.

Short Ohio Bill of Sale Video Guide

Other Bill of Sale Forms by State