Oklahoma Bill of Sale Form

Oklahoma bill of sale is a form used in the state to document a purchase between two private parties. It usually includes the names and addresses of the seller and the buyer, along with descriptive information regarding the item transferred.

Further below, we’ve specified all the information you might require to use this document and where to get a correct bill of sale template, depending on what you are selling or buying.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Oklahoma Vehicle Bill of Sale Form |

| Other Names | Oklahoma Car Bill of Sale, Oklahoma Automobile Bill of Sale |

| DMV | Oklahoma Department of Public Safety |

| Vehicle Registration Fee | $26-96 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 59 |

Oklahoma Bill of Sale Forms by Type

There is a variety of bills of sale, and each is needed for different situations and particular types of property. In most cases, this form is used for various vehicles, firearms, and watercraft. You can also notarize your bill of sale for more legal protection, but it is usually completely optional.

Use an Oklahoma vehicle bill of sale form for automotive transactions. It is an important document that acts as a receipt required by the DPS during the used vehicle titling and registration. You’ll have 30 days from the minute of the sale or the time you moved to Oklahoma to obtain vehicle registration.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

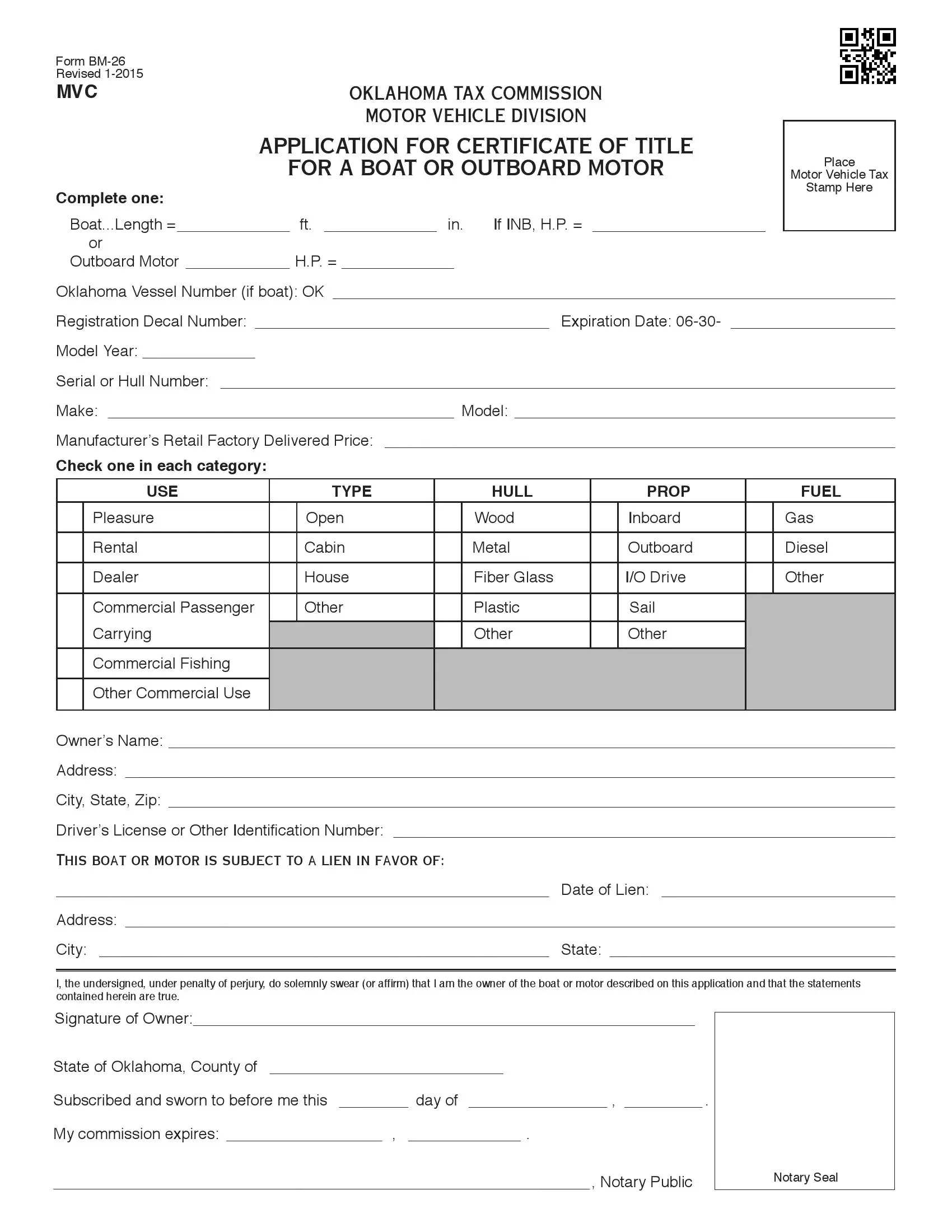

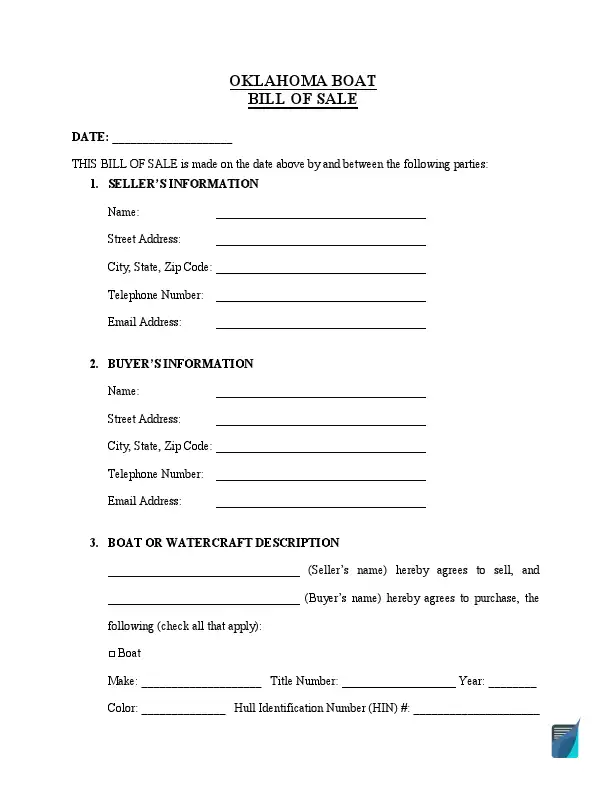

For watercraft, you should use an Oklahoma boat bill of sale with custom fields suitable for vessel transactions. Our custom template allows you to include information about up to two outboard motors and a boat trailer. You have the option of registering your vessel for one year or three years. Practically all boats with an outboard motor of more than 10 HP ought to be registered.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

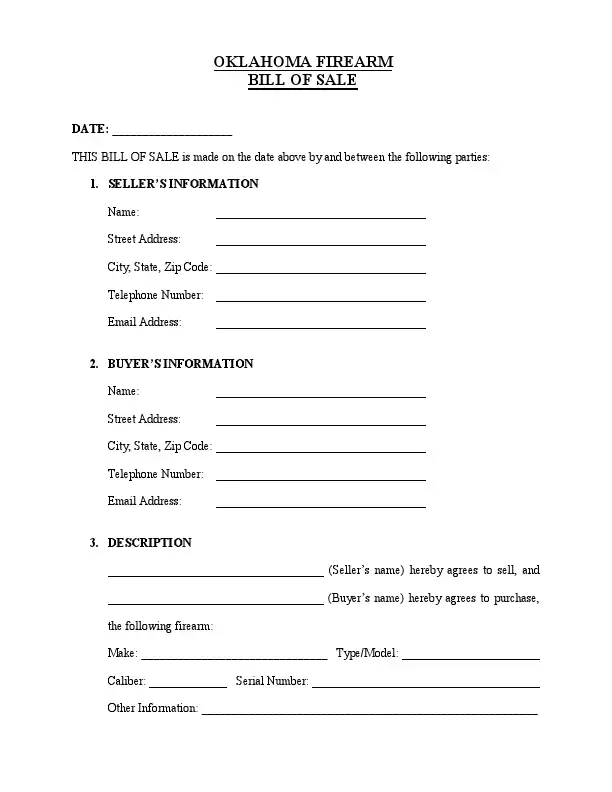

Oklahoma firearm bill of sale is a form that can be used to prove that someone sold or bought a gun. Oklahoma doesn’t have a specialized law that demands guns registration. However, there are people prohibited from buying firearms.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

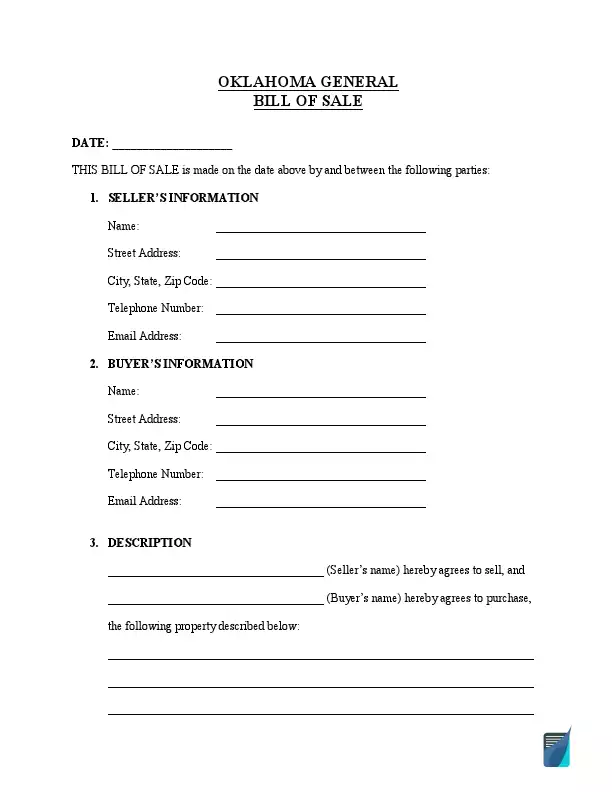

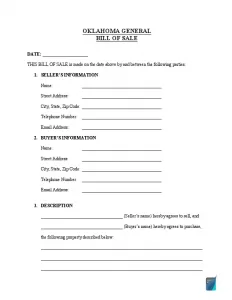

You can use a general bill of sale template if you are transferring miscellaneous items that do not require a specific bill of sale. This general template has all the important sections; you only have to enter the item description in one single text area.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

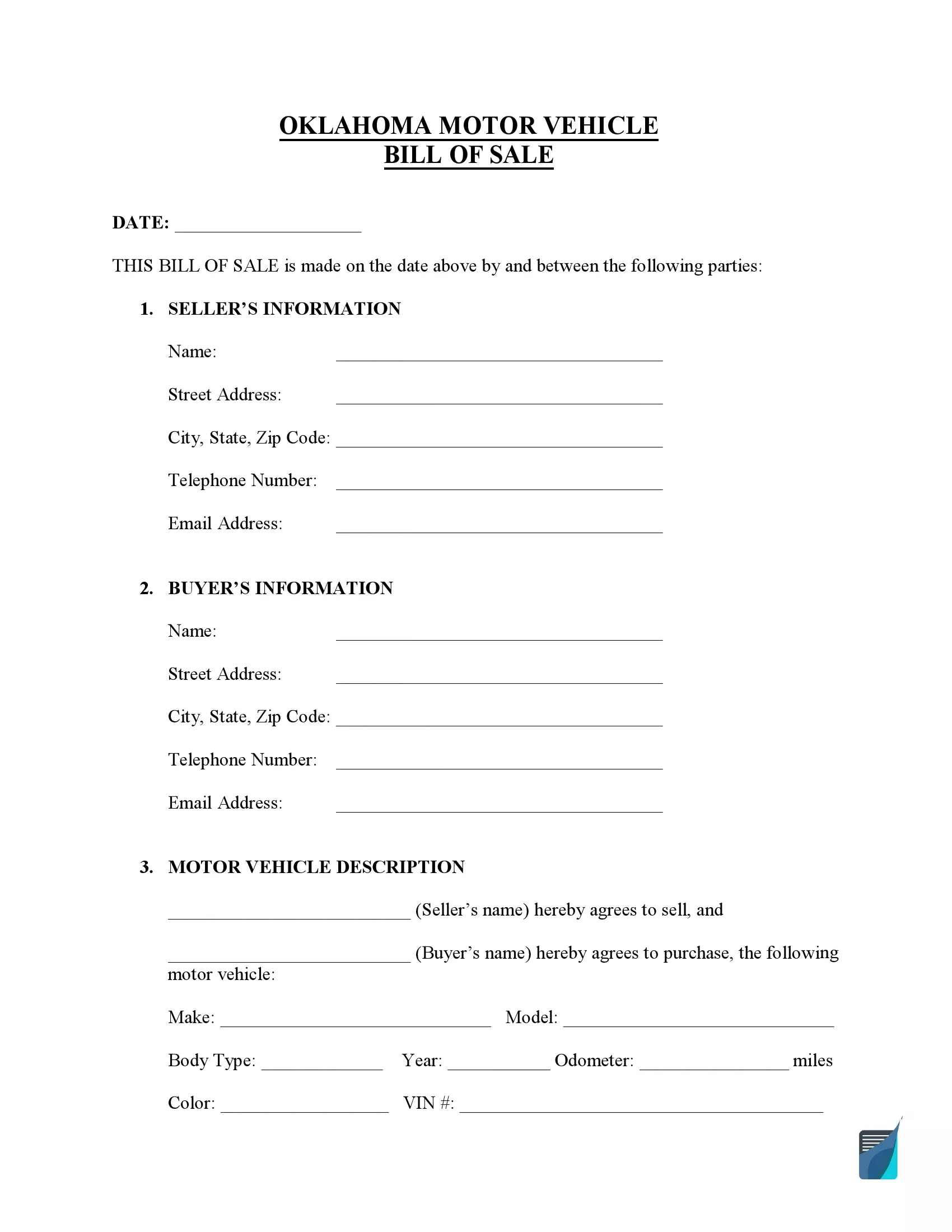

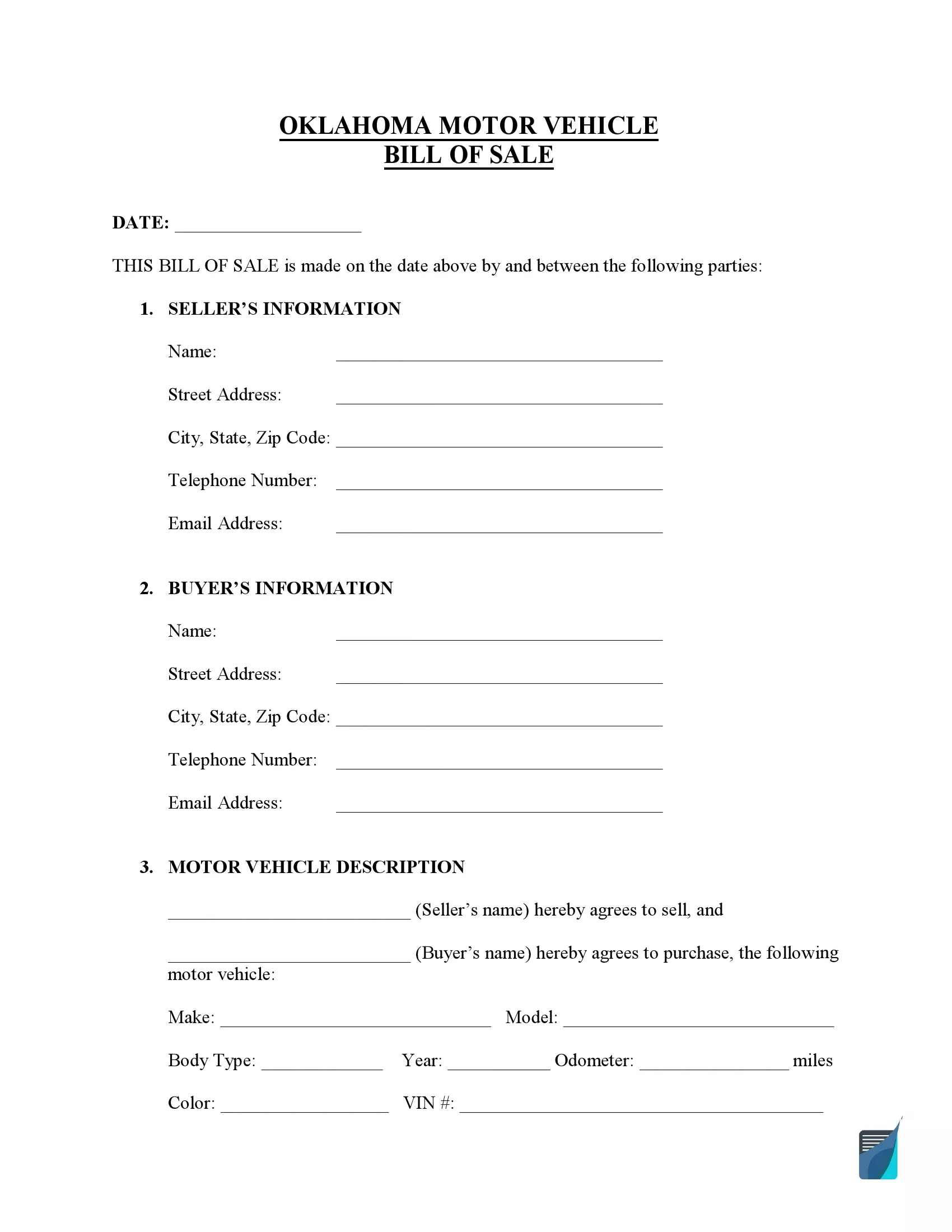

How to Write an OK Vehicle Bill of Sale

Oklahoma vehicle bill of sale is a document required for the parties of a private vehicle transaction to validate the deal. The document should be signed by both parties and attached to the registration package to calculate sales tax and the provision of additional legal guarantees.

The following recommendations are written around the free Oklahoma bill of sale form created by our team. However, you can opt for the official form if the local authorities provide it.

Step 1: Indicate the document’s creation date:

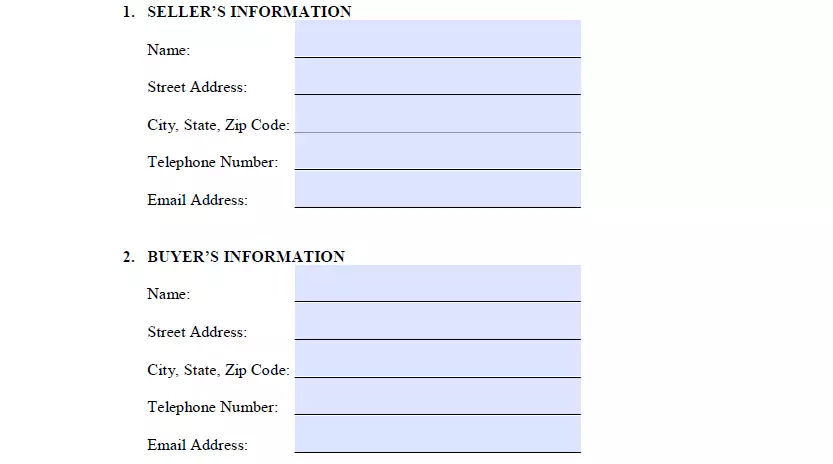

Step 2: Type in the purchaser’s and seller’s particulars:

- Full name

- Home address

- City

- State of residence

- Area code

- Phone number

- Email

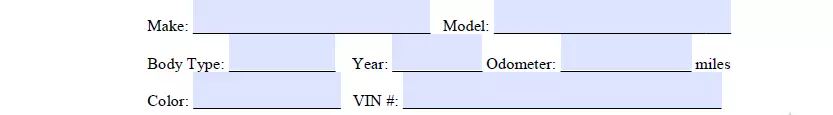

Step 3: Fill in the descriptive particulars of the vehicle:

- Make (manufacturer)

- Vehicle’s model

- Body type

- Year of manufacture

- Miles (odometer reading)

- Car’s color

- Vehicle Identification Number (VIN)

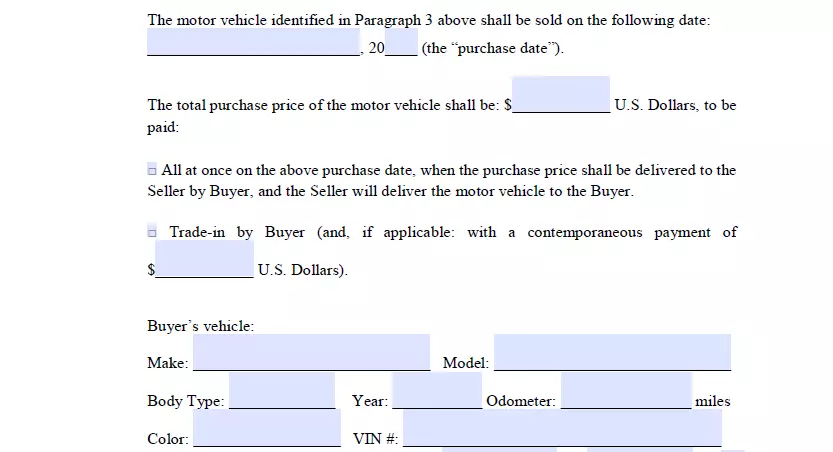

Step 4: Indicate the purchase price and payment method

Type in the transaction date and state the entire price that has to be paid for the motor vehicle. You also need to indicate the sale method the buyer will use:

- Providing the whole amount as a single transaction. The purchaser has the motor vehicle delivered to them and pays off the entire amount within the same day.

- Trade-in. When this particular option is chosen, the selling party trades their motor vehicle for the motor vehicle presented by the purchaser. If the buyer’s vehicle is lower in value, they’ll have to even that out with an additional payment. You also need to describe the buyer’s car.

- Installments. With this particular method, you must indicate the dates when the purchaser must deliver the initial and the final payments, together with their sums.

The next step is considering the type of payment:

- Cash

- Cheque

- Cashier’s cheque

- Money order

Finally, check whether the purchase amount includes all applicable taxes.

Step 5: Read the miscellaneous terms

The miscellaneous terms generally say that the purchaser obtains the property in “as-is” condition and is liable for it after the transaction is completed.

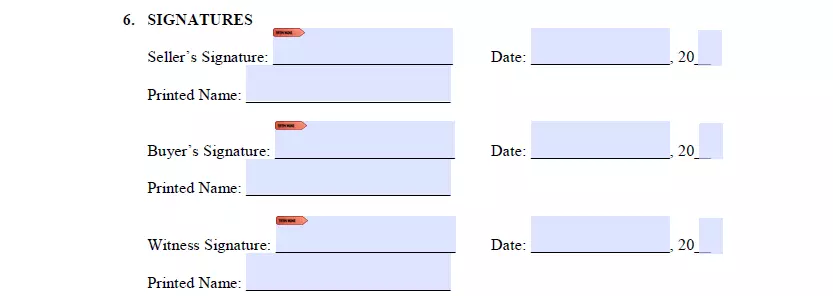

Step 6: Place your signature(s) in the appropriate areas

The buyer’s signature is generally not mandatory. Nonetheless, you’re more protected against legal problems if both sides sign the document. You may have one or two individuals attest to the process and sign the form as an additional precaution.

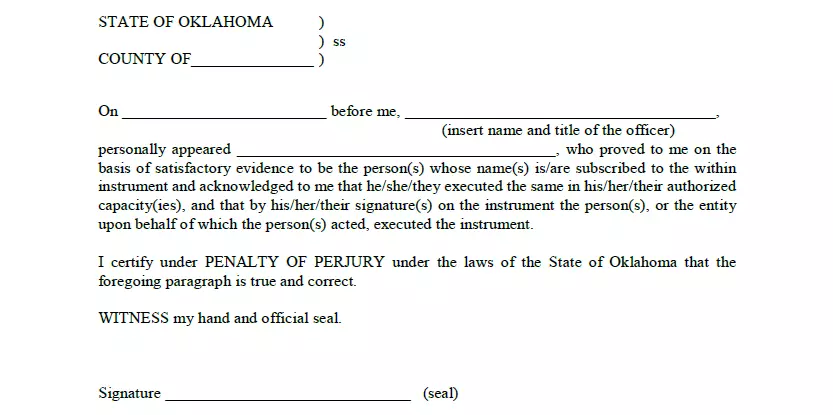

Step 7: Use the help of a notary public

Notarization is generally not required, but it’s an effective way to create another level of protection for your deal.

The buyer needs to get the original bill of sale because it’s commonly required during the title change. You could either get a copy and keep it or have two identical forms signed and filled out by both sides as a seller.

Registering a Vehicle in Oklahoma

The law of Oklahoma requires that all vehicles with a capacity exceeding ten horsepower are registered annually and titled (except for those officially in salvage or junked status). The rule applies to all motor vehicles, including those not in use. You must obtain vehicle registration in a local Oklahoma Motor License Agency of the Oklahoma Tax Commission.

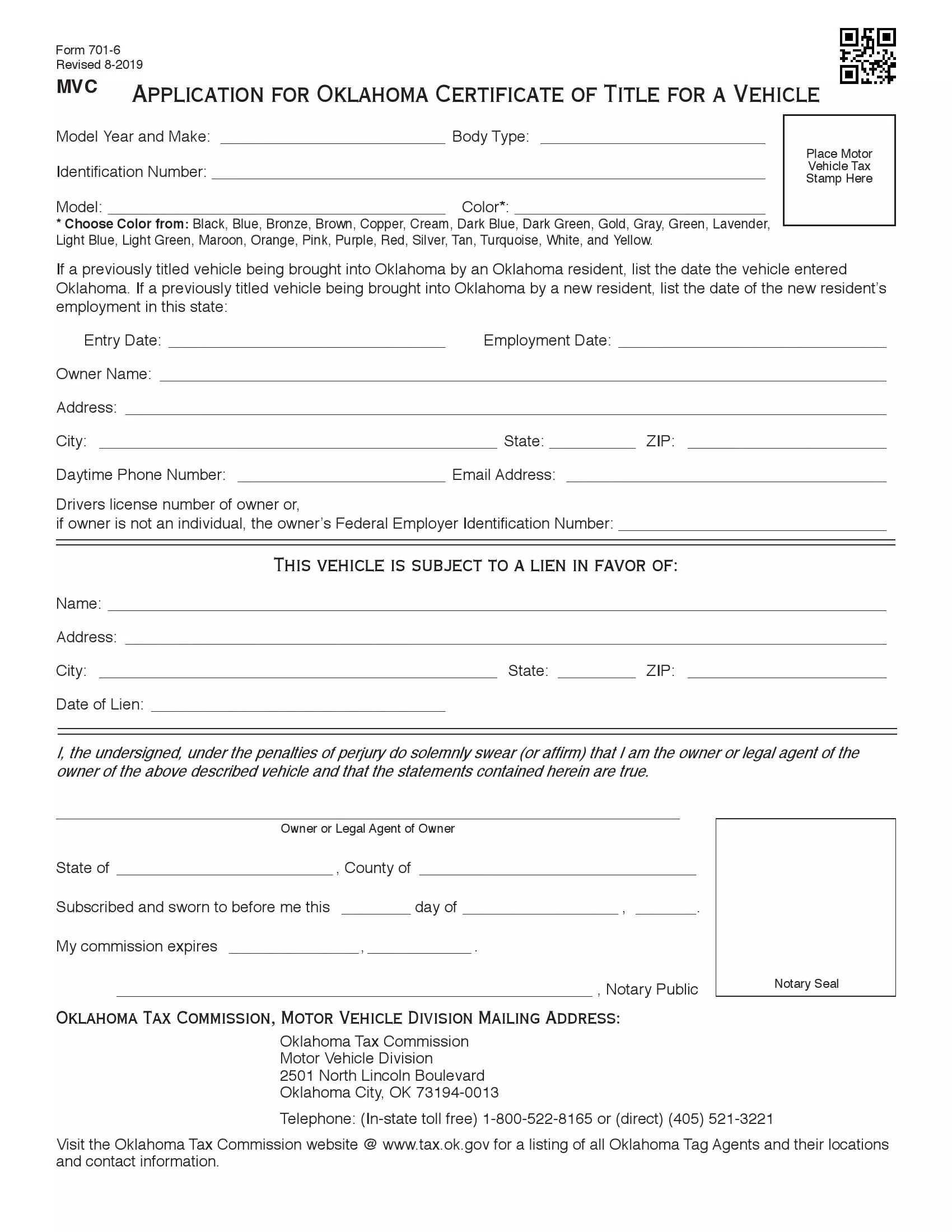

The list of documents required for the registration of your newly acquired vehicle includes:

- A filled and notarized vehicle bill of sale

- Active driver’s license

- The manufacturer’s certificate of origin (MCO) for new vehicles and a current title transferred by the old owner for used vehicles

- Active Oklahoma car insurance statement

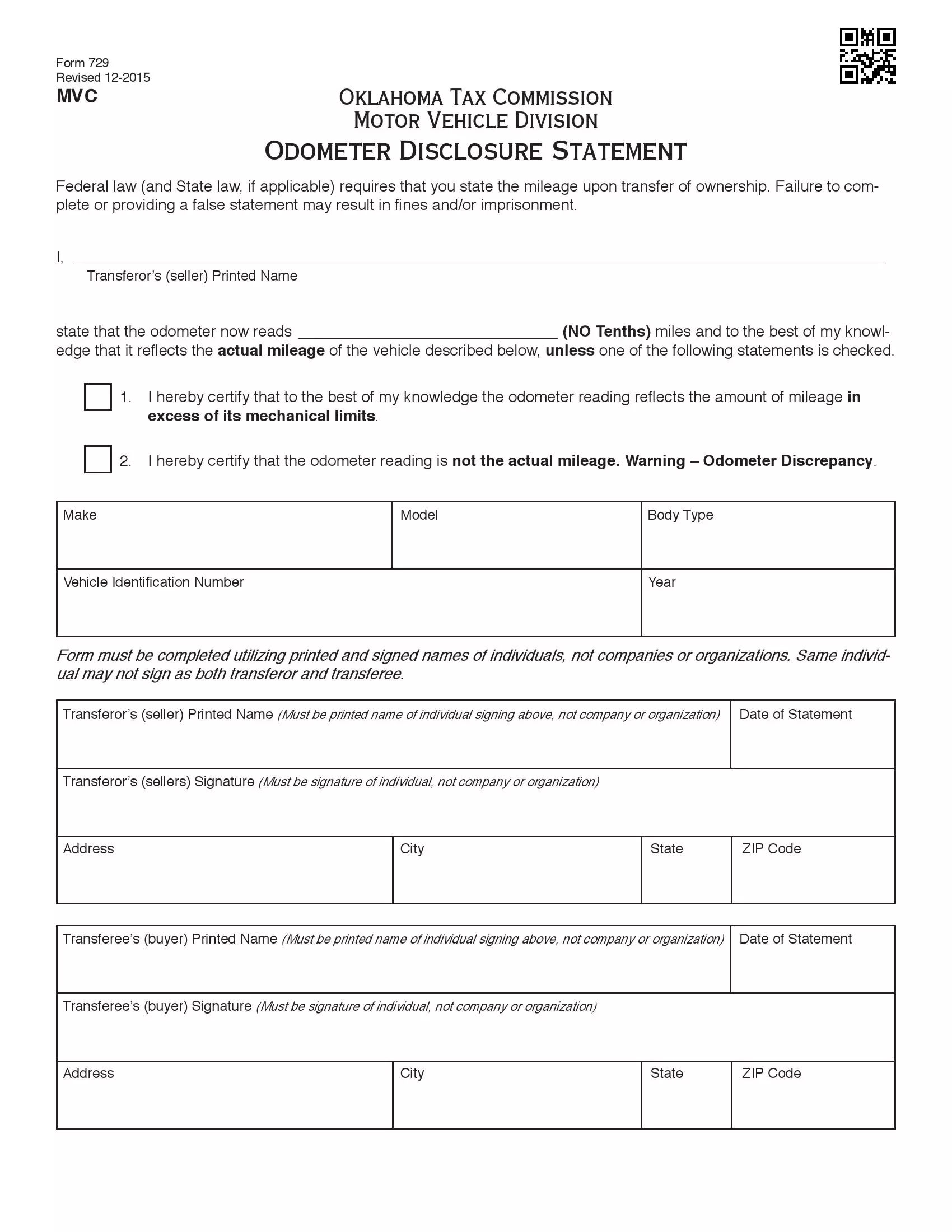

- An odometer disclosure statement (for vehicles less than nine years old)

- VIN inspection statement (for vehicles bought outside Oklahoma)

- Application for Oklahoma Certificate of Title for a Vehicle (Form 701-6)

A newly acquired vehicle can’t be registered without an Oklahoma title or any evidence of that title’s existence. If you register a leased vehicle, a copy of the lease statement should also be attached.

If the buyer is not an individual but an organization, then submitting the Federal Employer Identification Number is mandatory.

The new owner should also pay all taxes and fees before the registration. A standard title fee equals $11 in Oklahoma, while a junk title is calculated at $4 and a certificate of ownership – at $4 as well. Registration of a vehicle for the 1st-4th years of operation costs $96, for the 5th-8th years – $86, for the 9th-12th – $66, and the 13th-16th – $46. Those who have owned a vehicle for more than 17 years pay $26 per year. The sales tax for acquiring a used vehicle is calculated at 1.25% of the purchase price after July 2017. The sales tax does not include the excise tax that the new owner should pay for the transfer of vehicle ownership.

Relevant Official Forms

Odometer Disclosure Statement should be attached to a bill of sale (required by Federal law).

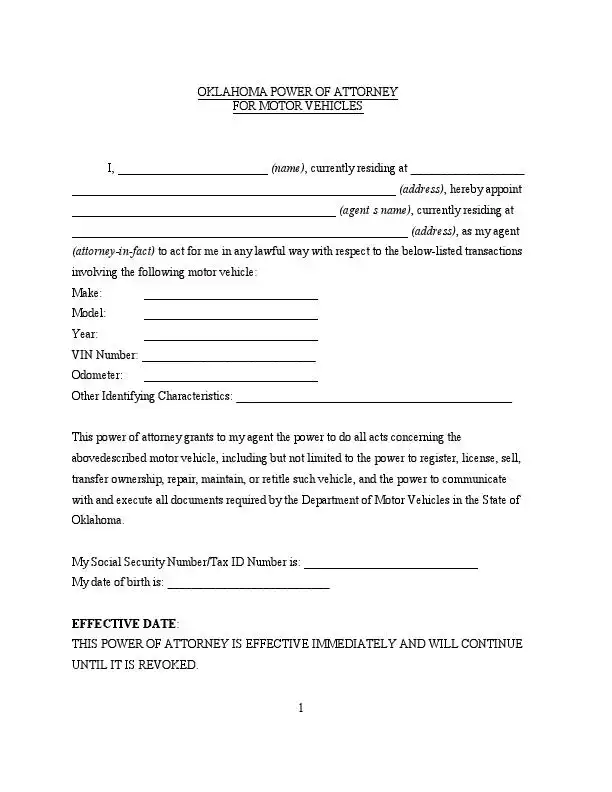

A limited power of attorney form that allows you to appoint a person to act on your behalf in vehicle-related matters.

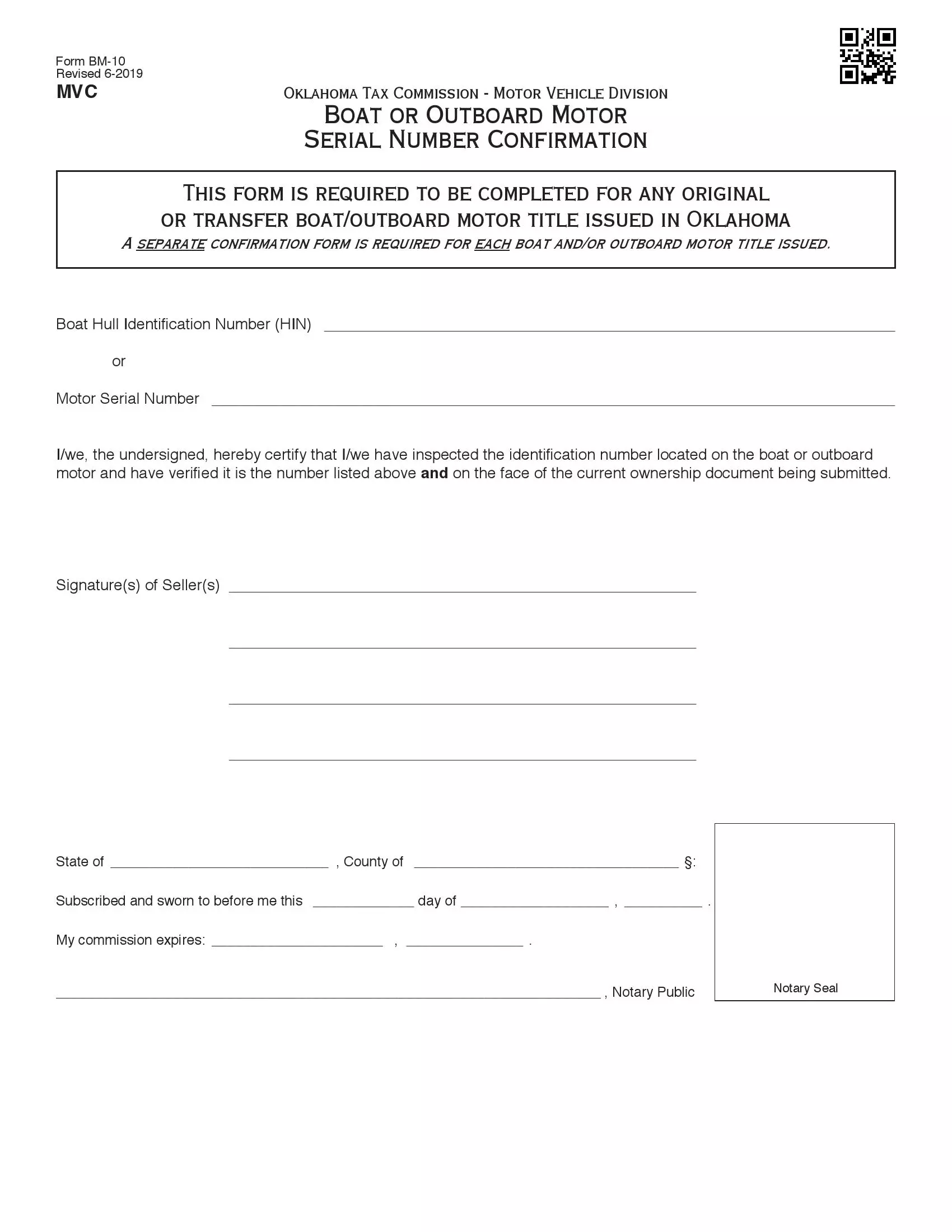

Boat or Outboard Motor Serial Number Confirmation is used before applying for title.

Short Oklahoma Bill of Sale Video Guide

Other Bill of Sale Forms by State