Vermont Bill of Sale Form

Vermont bill of sale is an essential legal document to keep records of transactions between a private seller and buyer. The document functions as proof that there won’t be any legal issues from the sale.

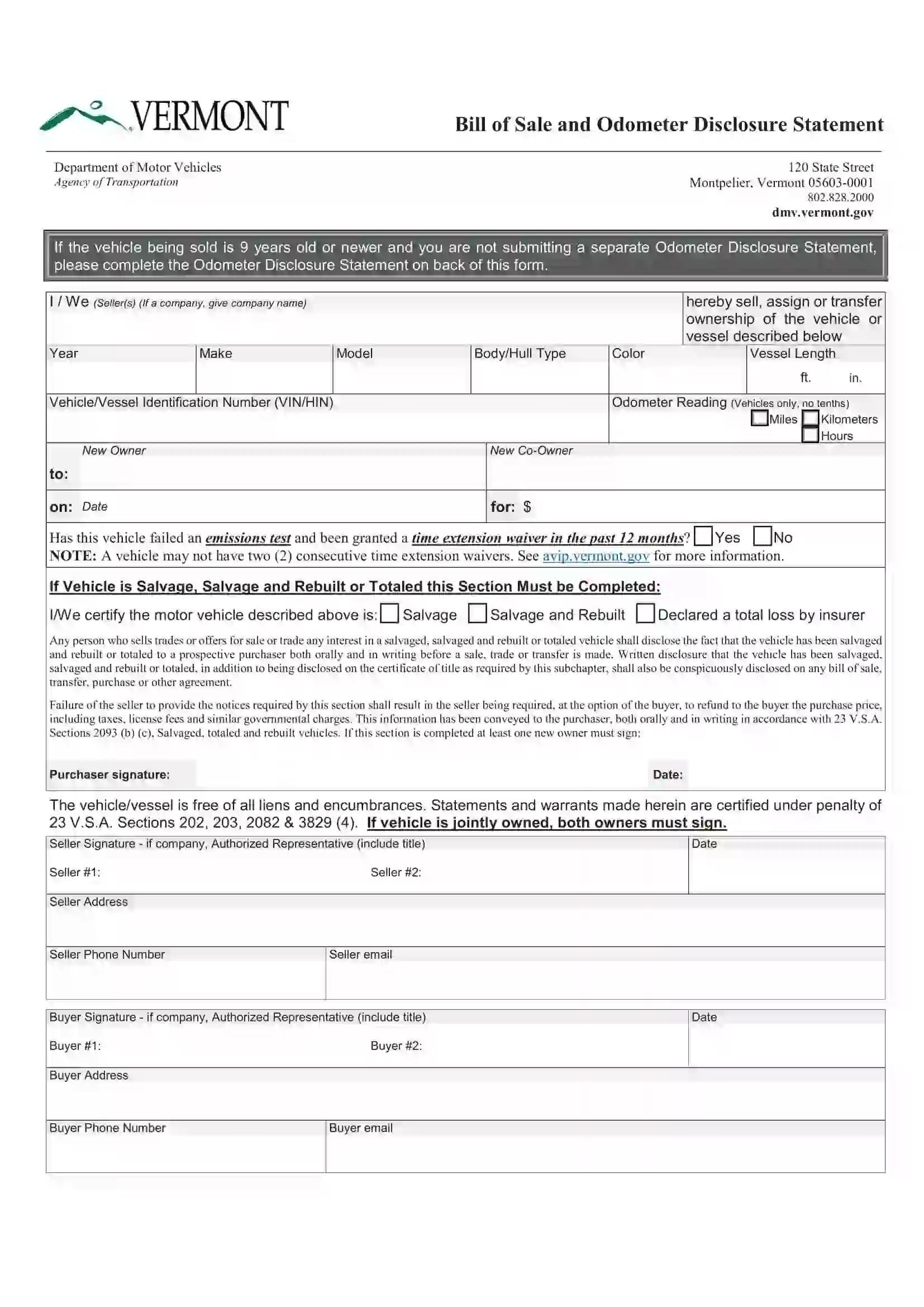

Along with our customizable bill of sale forms, you can use Vermont’s official bill of sale to sell or purchase a vehicle or boat – Form VT-005. This document also contains an odometer disclosure statement to submit with your vehicle bill of sale.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Vermont Motor Vehicle Bill of Sale Form |

| Other Names | Vermont Car Bill of Sale, Vermont Automobile Bill of Sale |

| DMV | Vermont Department of Motor Vehicles |

| Vehicle Registration Fee | $76 (electric car – $74) for 1 year |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 62 |

Vermont Bill of Sale Forms by Type

There exist different Vermont bill of sale forms, and each of them is used for specific circumstances and transactions. Depending on the transaction carried out, you will need to prepare the correct bill of sale, applicable in Vermont.

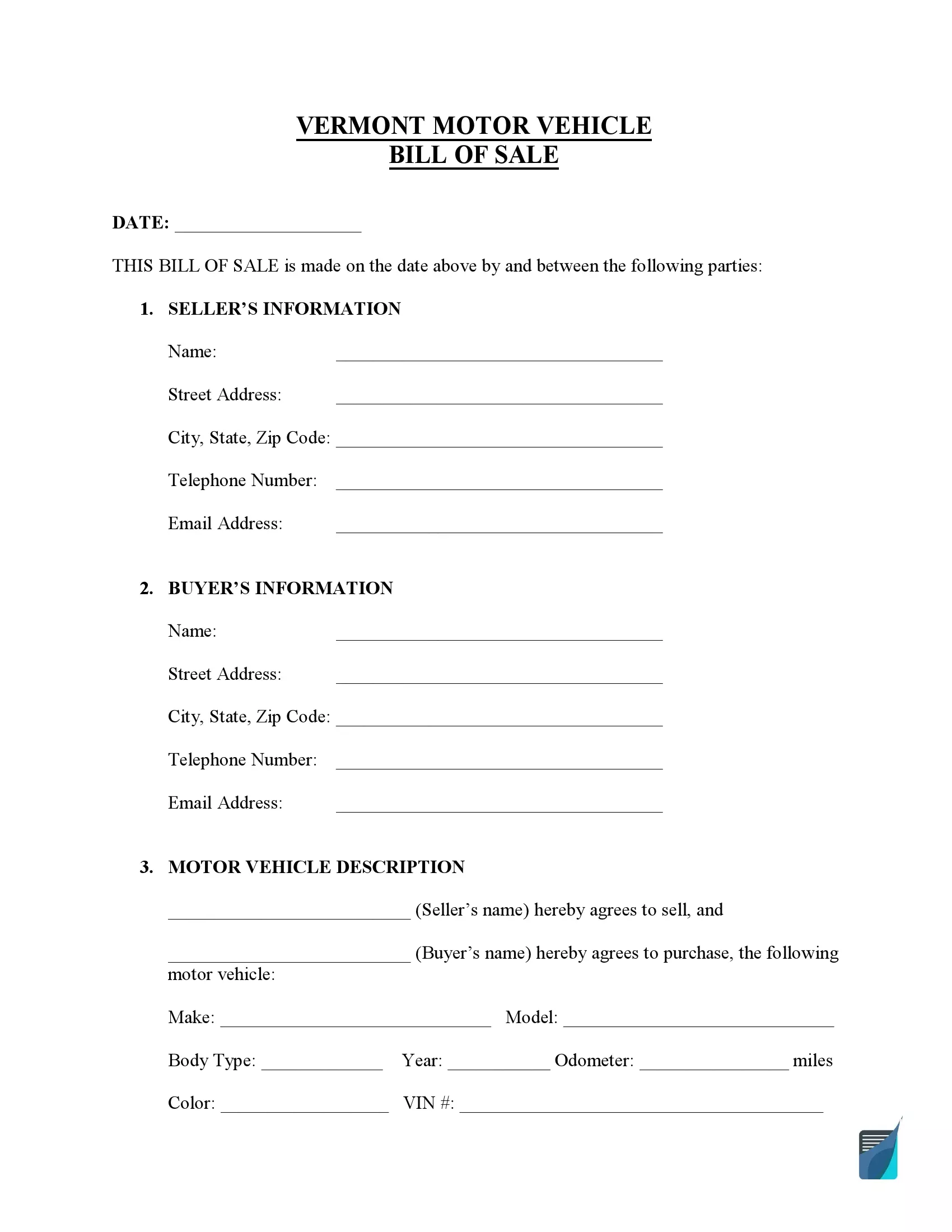

Vermont bill of sale for a motor vehicle allows the buyer to purchase the item without any unrevealed defect and protects the seller from any liability for future accidents. Vehicles must be recorded within 60 days from the moment you relocate to Vermont.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

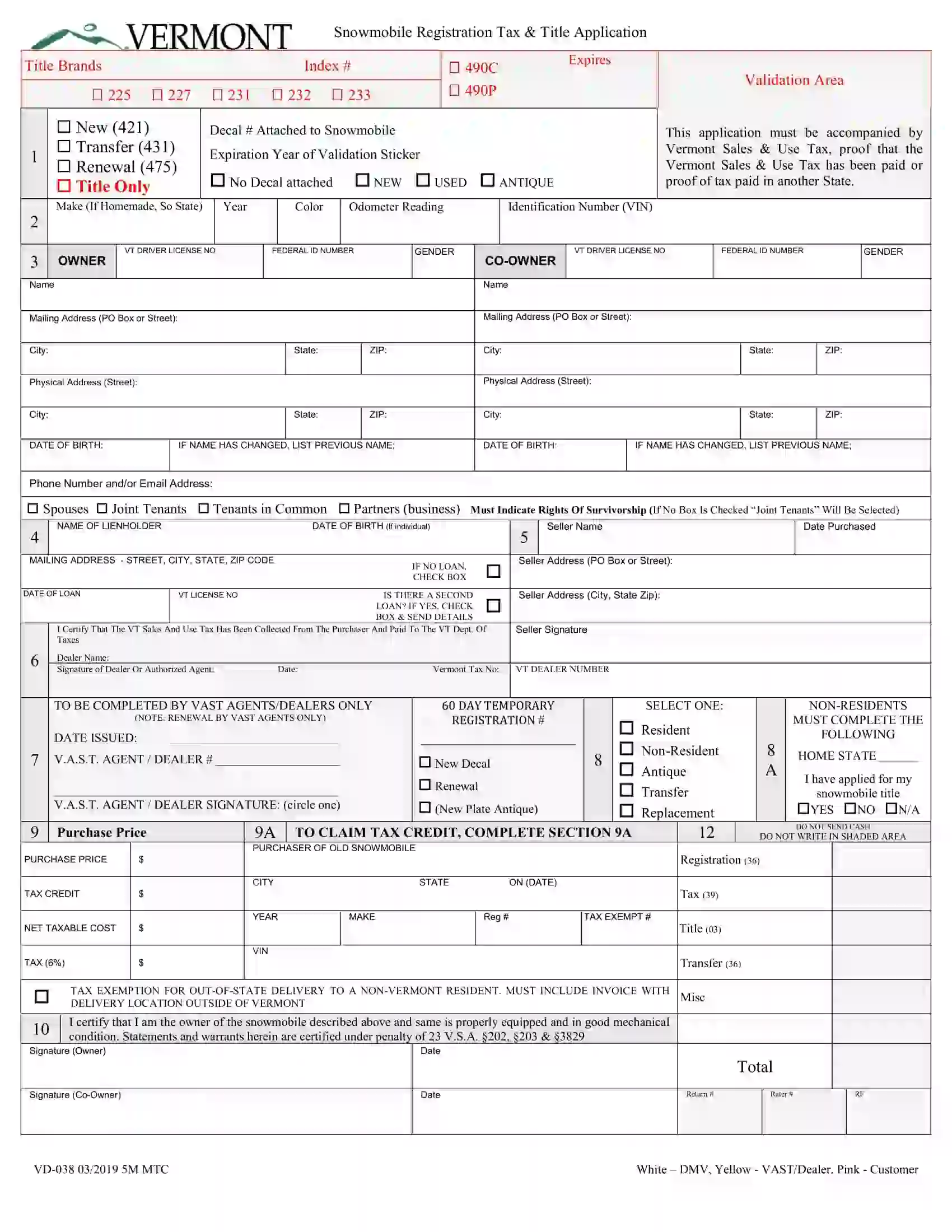

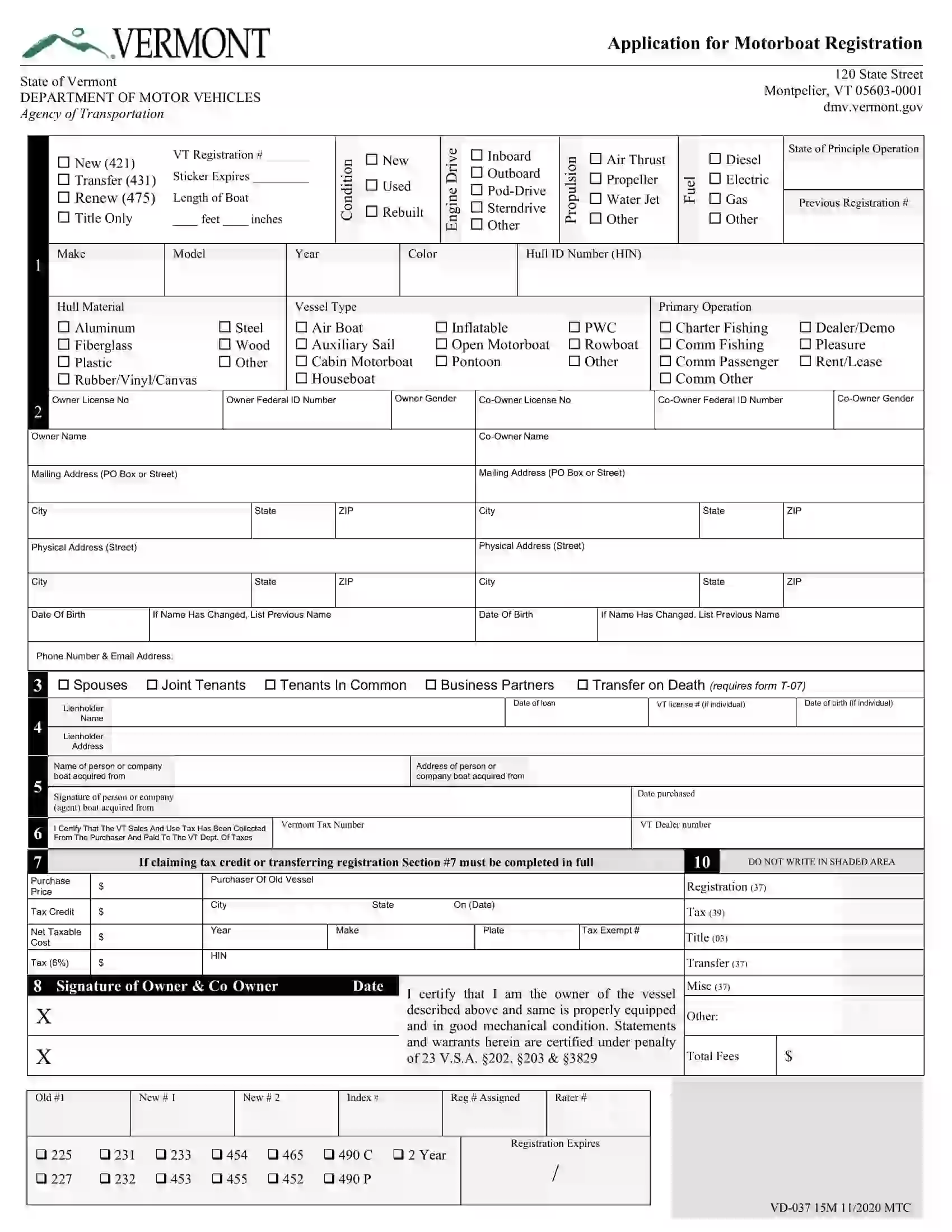

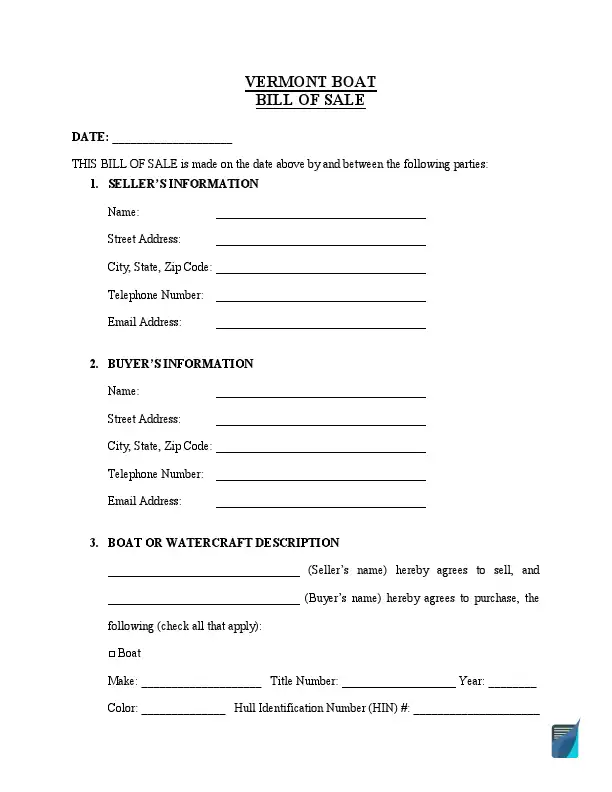

Vermont bill of sale for a vessel records the sale and purchase of a boat and provides both parties with the transaction details. Both the buyer and seller must sign a Vermont boat bill of sale. The validity of boat registrations in Vermont continues for about two years, depending on your application. Practically all motorboats, regardless of size or type, need to be registered.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

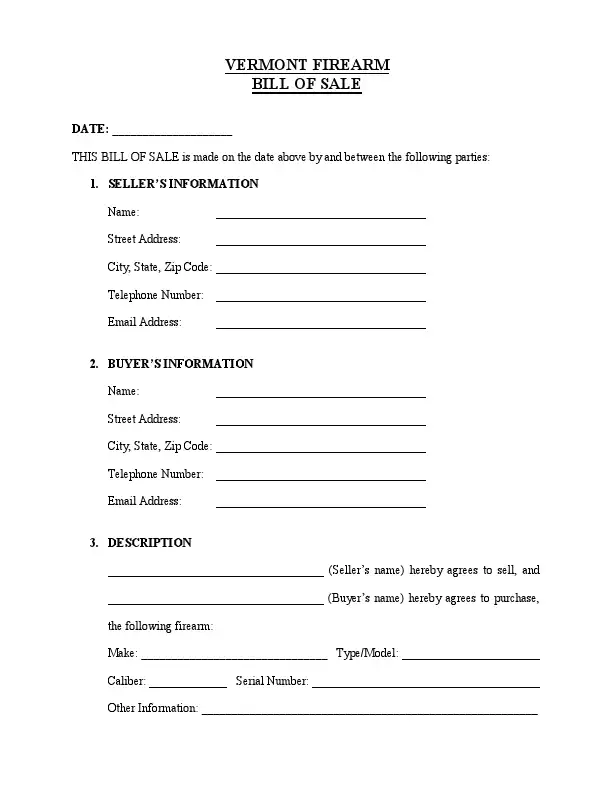

Using a Vermont firearm bill of sale, you can transfer the ownership of a gun. No criminal history check is demanded before selling a gun in Vermont. In Vermont, there isn’t a firearms state registry. Consequently, you don’t need to register the proprietary rights change or those firearms you’re taking with you to the state. According to Vermont law, open-carry of handguns is nowadays allowed for the state residents.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

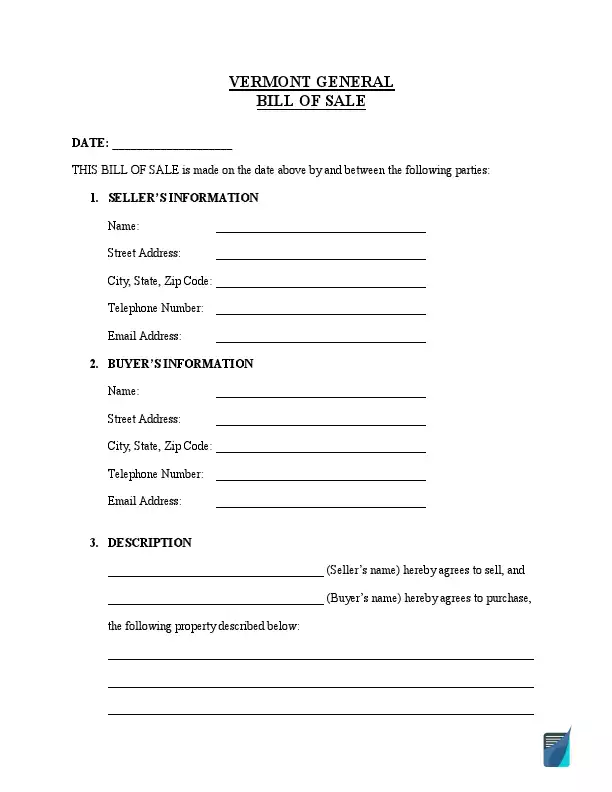

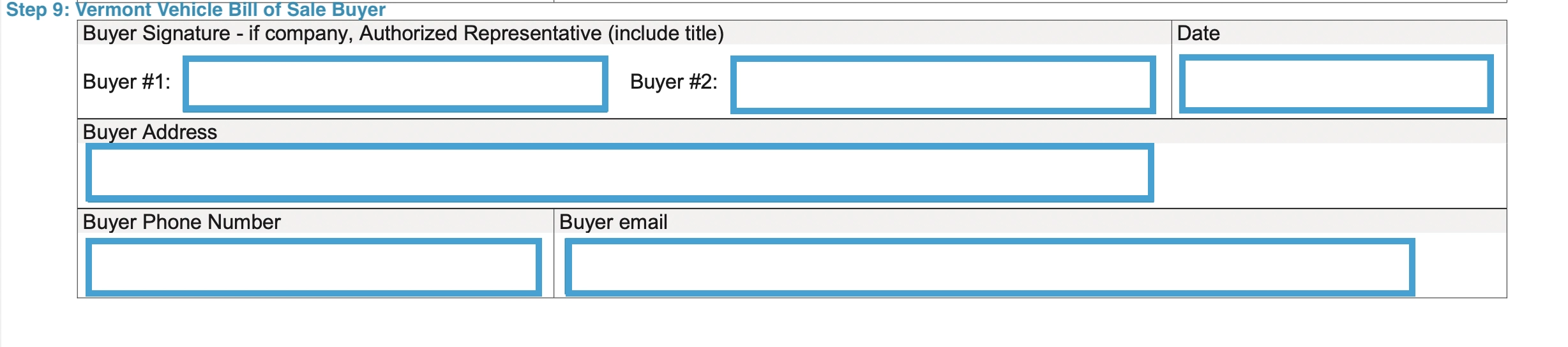

You can choose a Vermont general bill of sale if the transaction does not require a more specific bill of sale form when selling such personal property as livestock equipment, computer, or house appliance. As a rule, both the buyer and seller must sign the document.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a VT Vehicle Bill of Sale

The official Vermont bill of sale form is referred to as Form VT-005, allowing you to complete a private sale of a motor vehicle in Vermont. In this state, completing the bill of sale template is necessary to transfer ownership of a vehicle. You can use the same template for watercraft sales. All you need to do is to enter the details specific to the vehicle. Here is a short explanatory tutorial to help you complete this template within minutes.

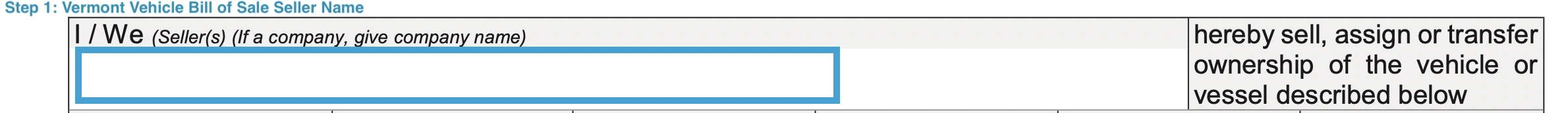

Step 1.

This document is written from the seller’s name. First, indicate the seller.

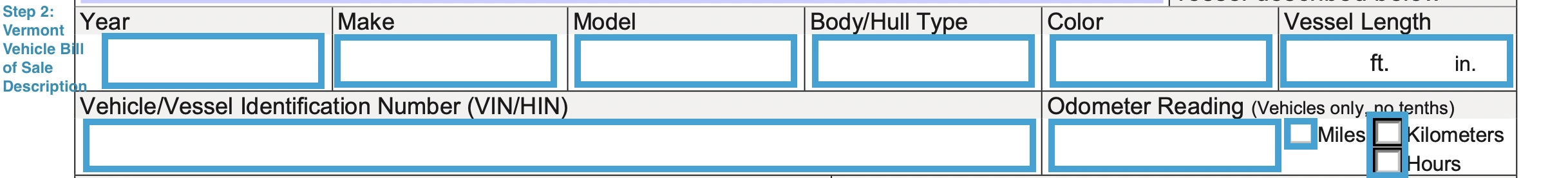

Step 2.

Then, enter official details regarding your vehicle, such as:

- Year

- Make

- Model

- Body type

- Color

- Vehicle Identification Number

Also, provide the odometer reading for vehicles in miles, kilometers, or hours. If the vehicle is older than nine years or newer, there is no need to attach a separate odometer disclosure statement.

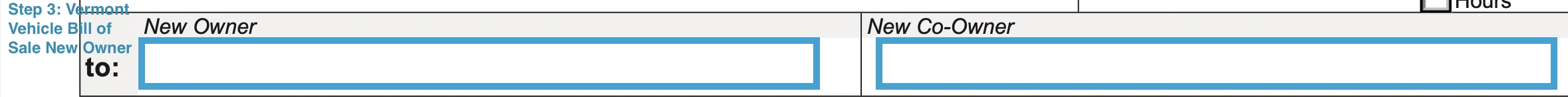

Step 3.

Write down the name of the purchaser. If the new owner is not alone, write the name of a new co-owner as well.

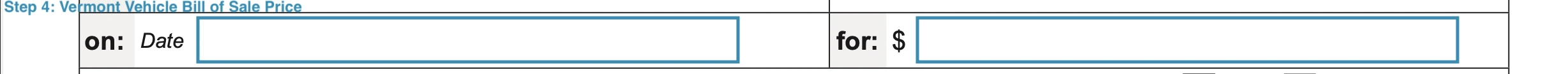

Step 4.

Clarify the date when the transaction occurs and the amount of money required for purchase.

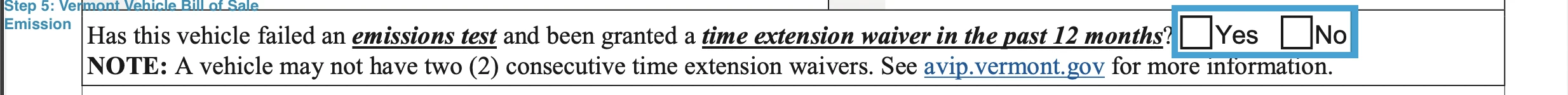

Step 5.

Indicate if the vehicle has a time extension waiver due to a failed emissions test.

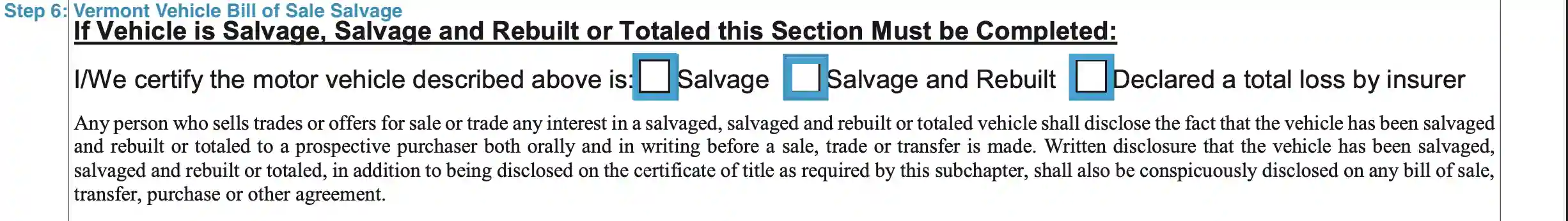

Step 6.

Specify the vehicle’s state – you need to tell if it is rebuilt or salvaged.

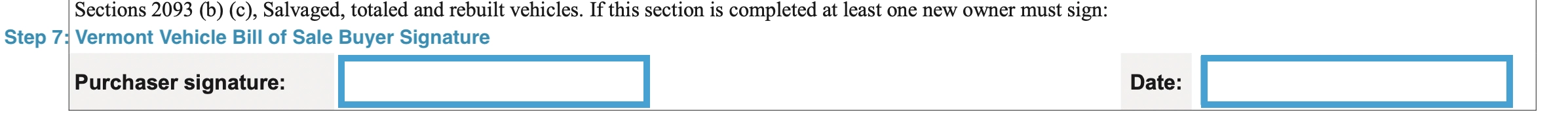

Step 7.

Purchasers must sign the document to confirm that they are aware of the information stated above. Don’t forget to indicate the date of the purchase.

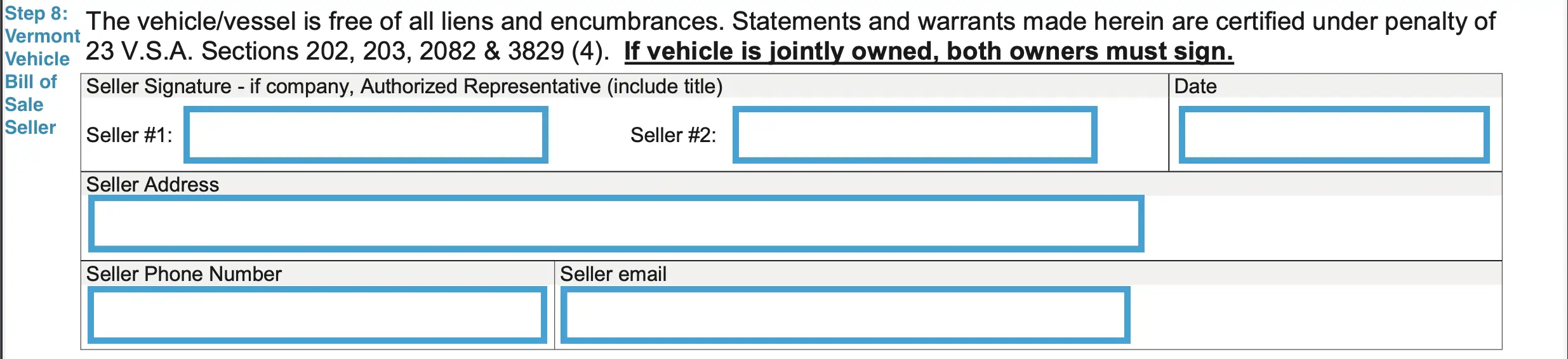

Step 8.

Next, the seller or sellers type in their personal information, such as:

- Printed name

- Address (Street, City, State, and Zip Code)

- Phone number

- Email address

Step 9.

This section must contain the following purchaser’s details:

- Printed name of the buyer (or buyers)

- Date of document completion

- Address (Street, City, State, and Zip Code)

- Phone number

- Email address

Registering a Vehicle in Vermont

According to Vermont laws, new motor vehicle owners have no right to operate that item on the state’s roads until they complete registration. If the owner doesn’t have some necessary documents and needs more time to complete the registration process, a temporary registration document is provided as evidence of the transfer of ownership title.

To complete or obtain temporary registration, you should attend the local division of VT DMV. There, you should provide the following documents for review:

- Completed form TA-VT-005, which is an Odometer Disclosure Statement

- A completed and signed car bill of sale with seller/buyer details, the VIN of your motor vehicle, and other relevant details

- Your driver’s license and state ID for personal identification

- A Manufacturer’s Certificate of Origin (MCO) for brand-new vehicles and a title signed over to the new owner by the old one for used vehicles

- Active auto insurance

- Receipt for paid registration fees and taxes

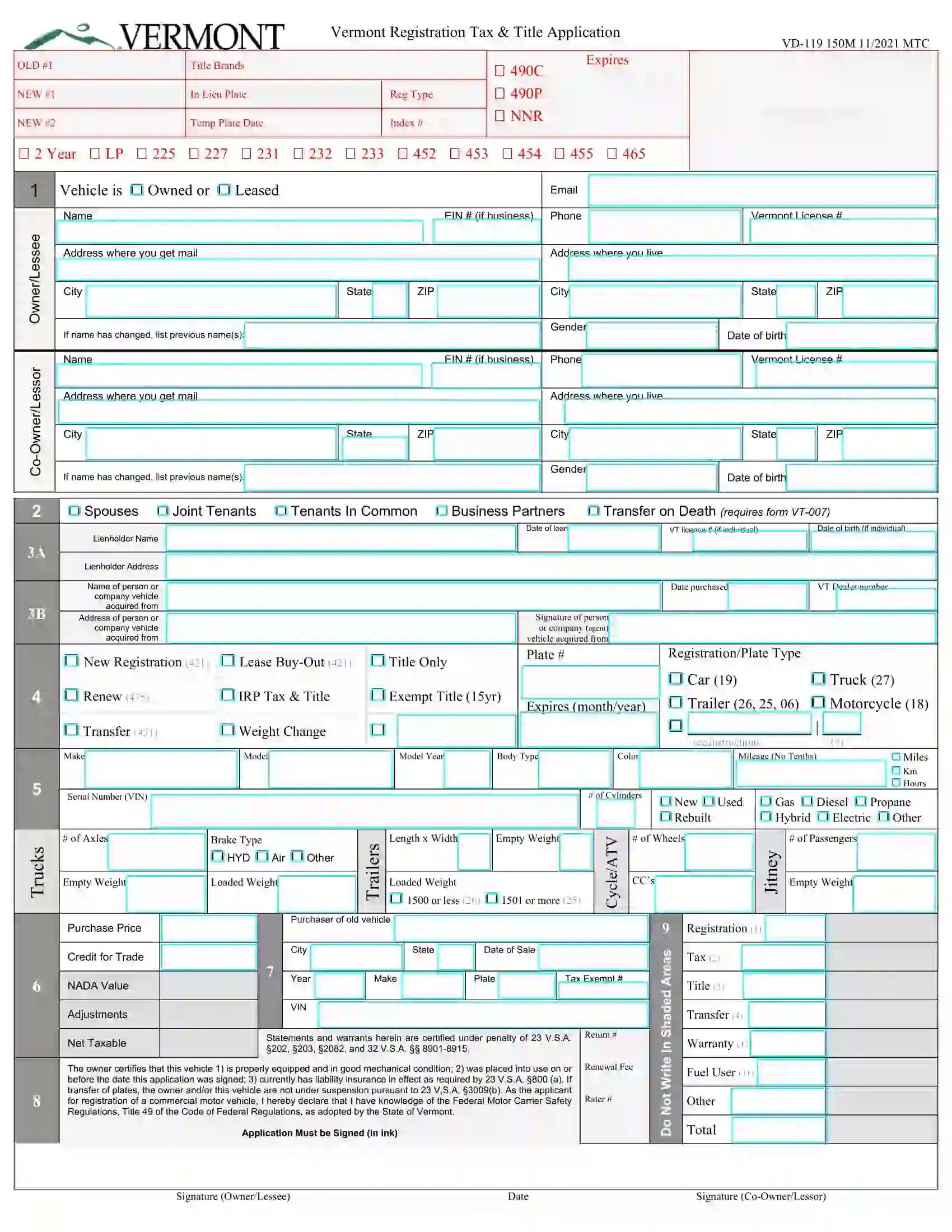

Those who need clarification on the amount of tax or agency to which the tax for motor vehicle acquisition should be paid may consult the Vehicle Taxation policy of the Department of Motor Vehicles of Vermont Agency of Transportation. Currently, the purchase and use tax for autos (including cars and trucks) is set at 6%. This category also covers motorcycles, trailers, and trucks weighing less than 10,099 lbs (for those exceeding this weight, the maximum tax rate is set at $2,075 regardless of weight). This percentage is calculated from the net taxable cost of the motor vehicle you’re acquiring (which should also be stipulated in the bill of sale). Another alternative to determine the tax rate is the National Automobile Dealers Association’s (NADA) clean trade-in value of the item. The taxable sum is the greater of the two.

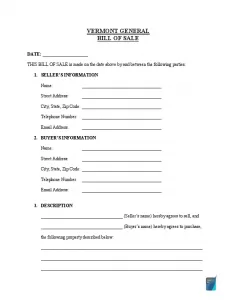

Buyers of motor vehicles in Vermont should also remember that VIN verification may be necessary in case the title was previously registered in another U.S. state or is branded “salvage.”

It’s not mandatory to register the motor vehicle in person. New owners can mail all the documents to the local DMV, including the printed NADA estimation of the vehicle’s value, form VD-119 (registration, tax, and title application form of the state of Vermont), and a receipt of relevant tax and title fee payment.

Relevant Official Forms

Form VT-010 verifies the vehicle identification number (VIN) or hull identification number (HIN).

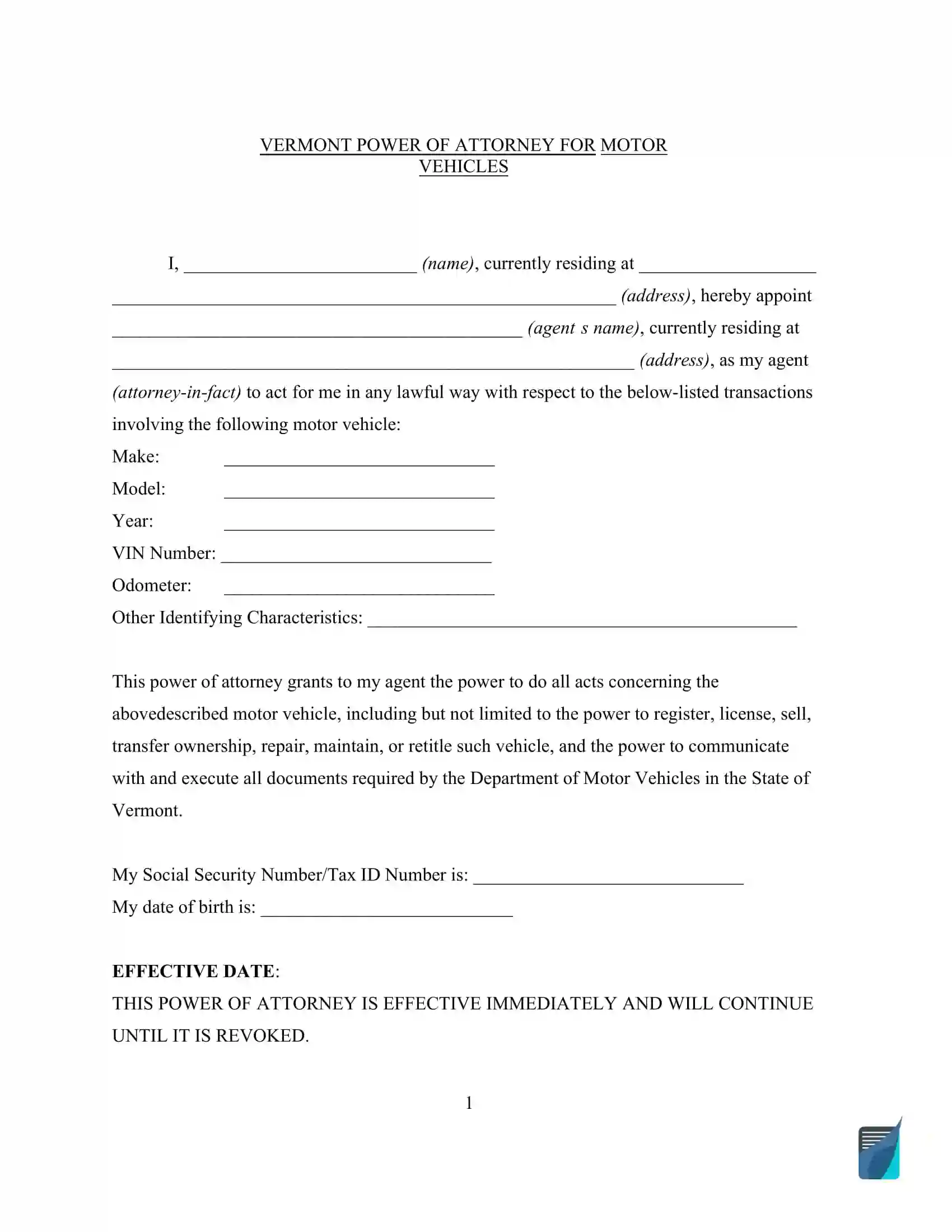

This form helps a person designate a representative to manage the matters regarding the vehicle.

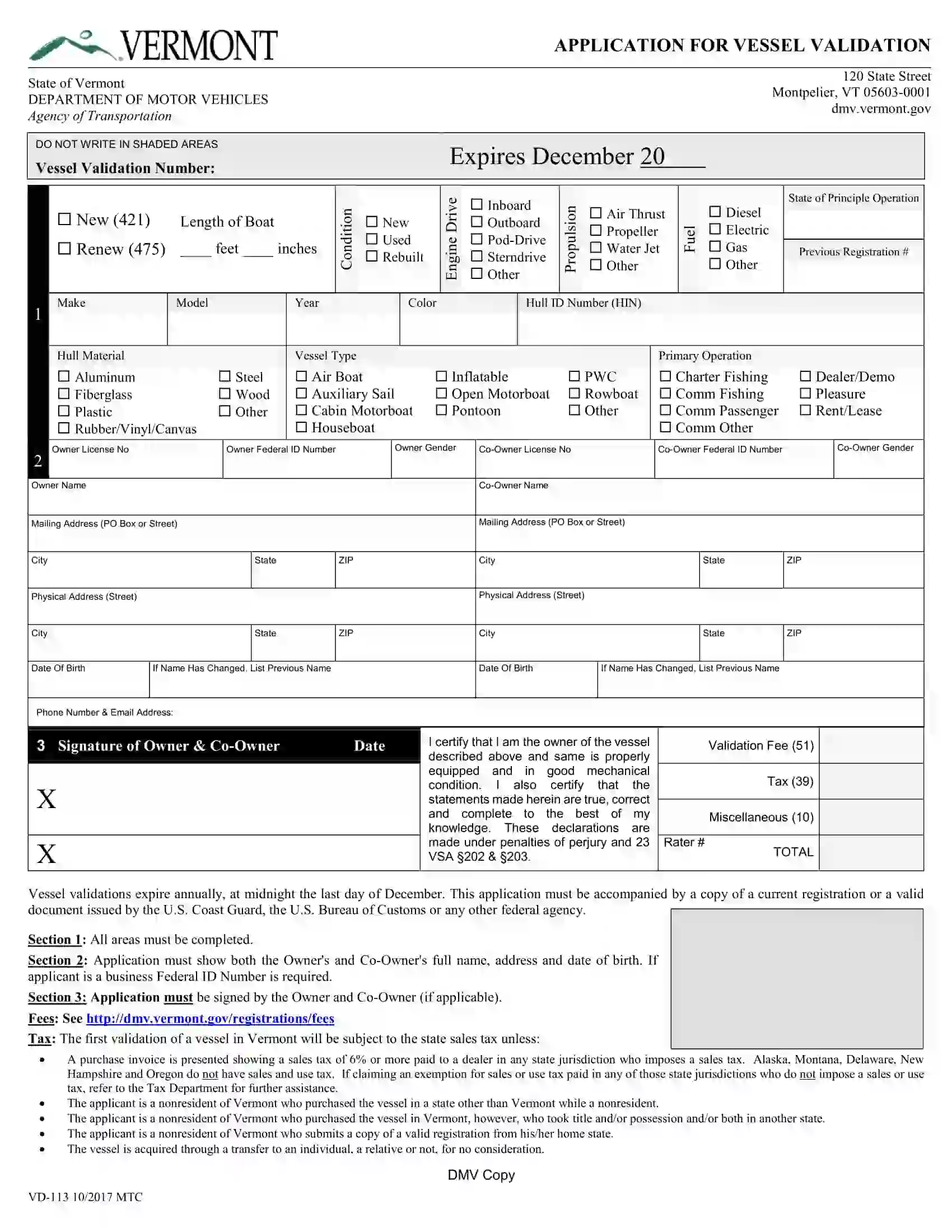

Form VD-113, known as Application for Vessel Validation, is used if the vessel has been registered in another state.

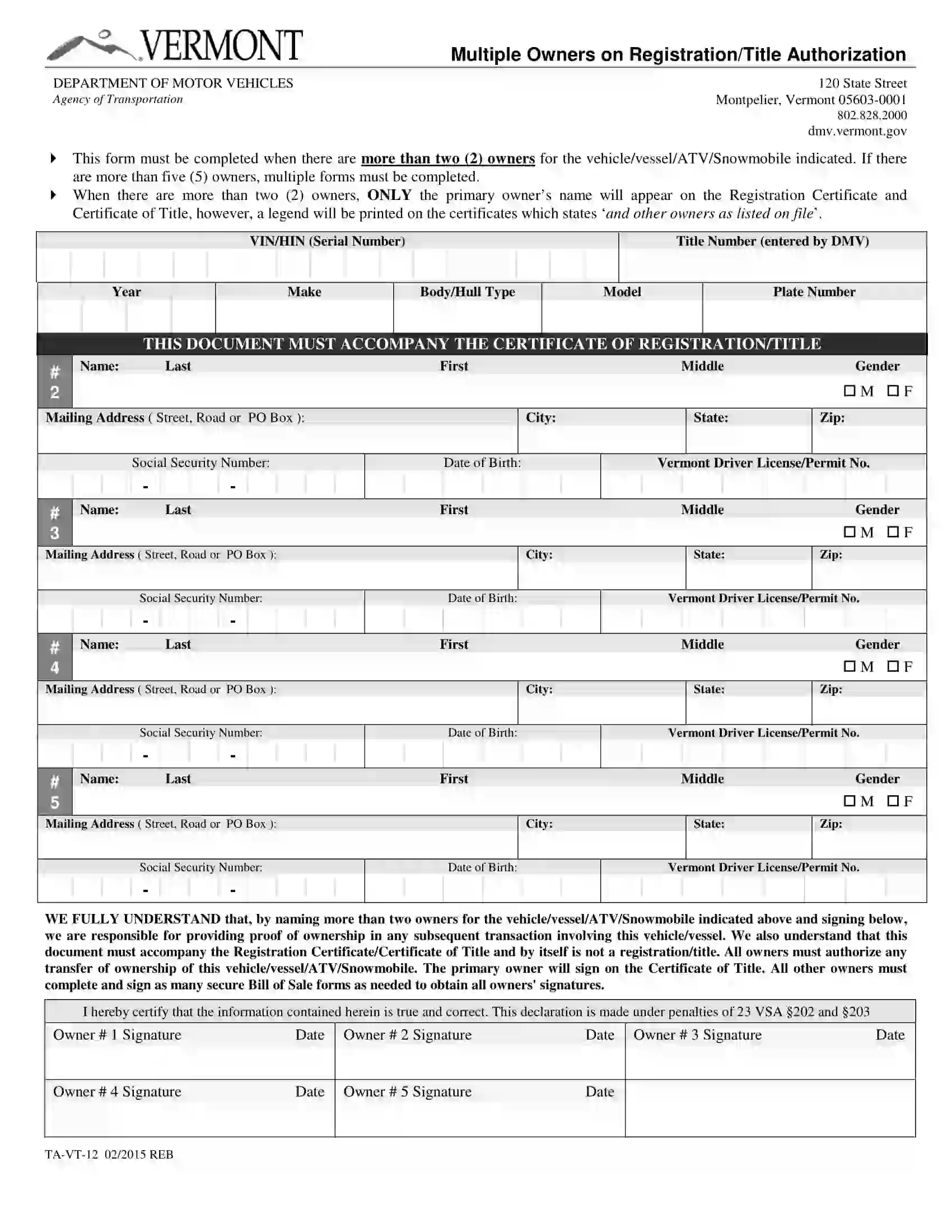

Form VT-012 (Multiple Owners on Registration/Title Authorization) is designed to indicate more than two persons as registered and/or titled owners of the vessel.

Short Vermont Bill of Sale Video Guide

Other Bill of Sale Forms by State