Wisconsin Bill of Sale Form

Wisconsin bill of sale is a transaction receipt between a seller and buyer of specific personal property, asset, or animal. It is optional to prepare the document during personal property transfers. Still, individuals can complete the Wisconsin bill of sale to have additional protection for the deal.

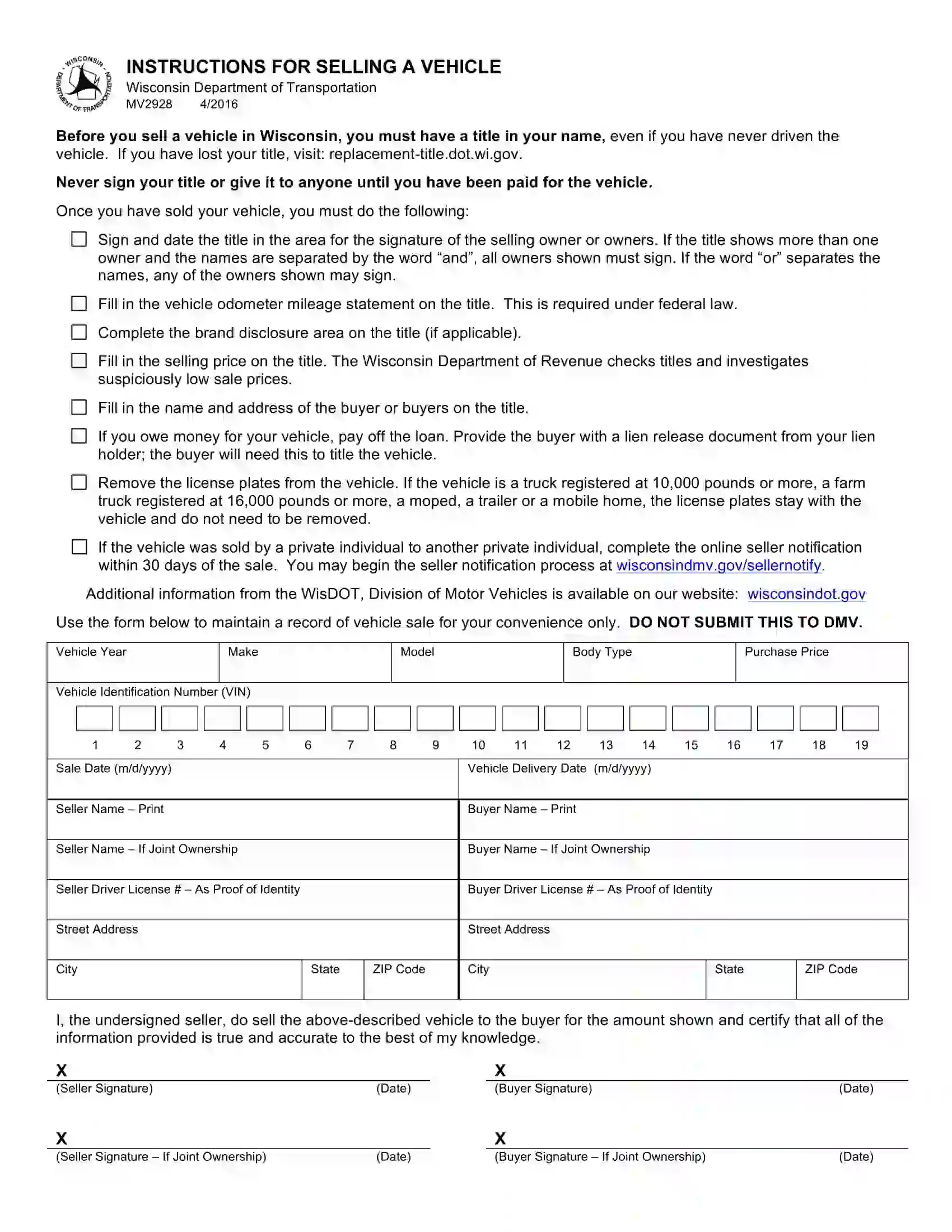

If you need a Wisconsin bill of sale to conduct a private sale, check the forms below and choose a suitable template. You can also use Wisconsin official bill of sale forms to sell or buy a vehicle (Form MV2928) or boat (Bill of Sale). You will find more official forms below.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Wisconsin Vehicle Bill of Sale Form |

| Other Names | Wisconsin Car Bill of Sale, Wisconsin Automobile Bill of Sale |

| DMV | Wisconsin Department of Motor Vehicles |

| Vehicle Registration Fee | $85 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 26 |

Wisconsin Bill of Sale Forms by Type

There are several Wisconsin bill of sale forms, each used for different occasions and types of transactions (read our complete guide to the types of bills of sale). Depending on the transaction type, you must sign the appropriate bill of sale form and register it with the state.

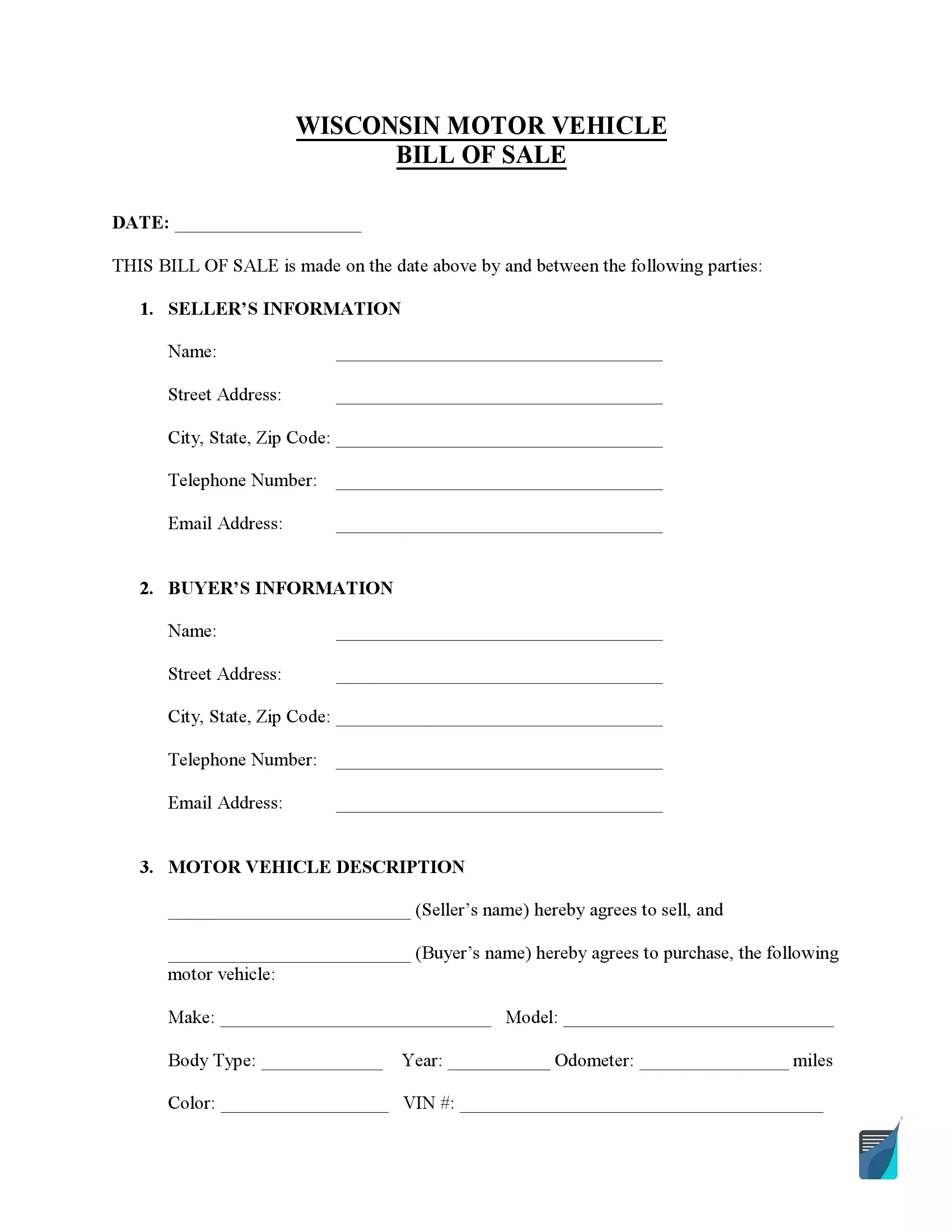

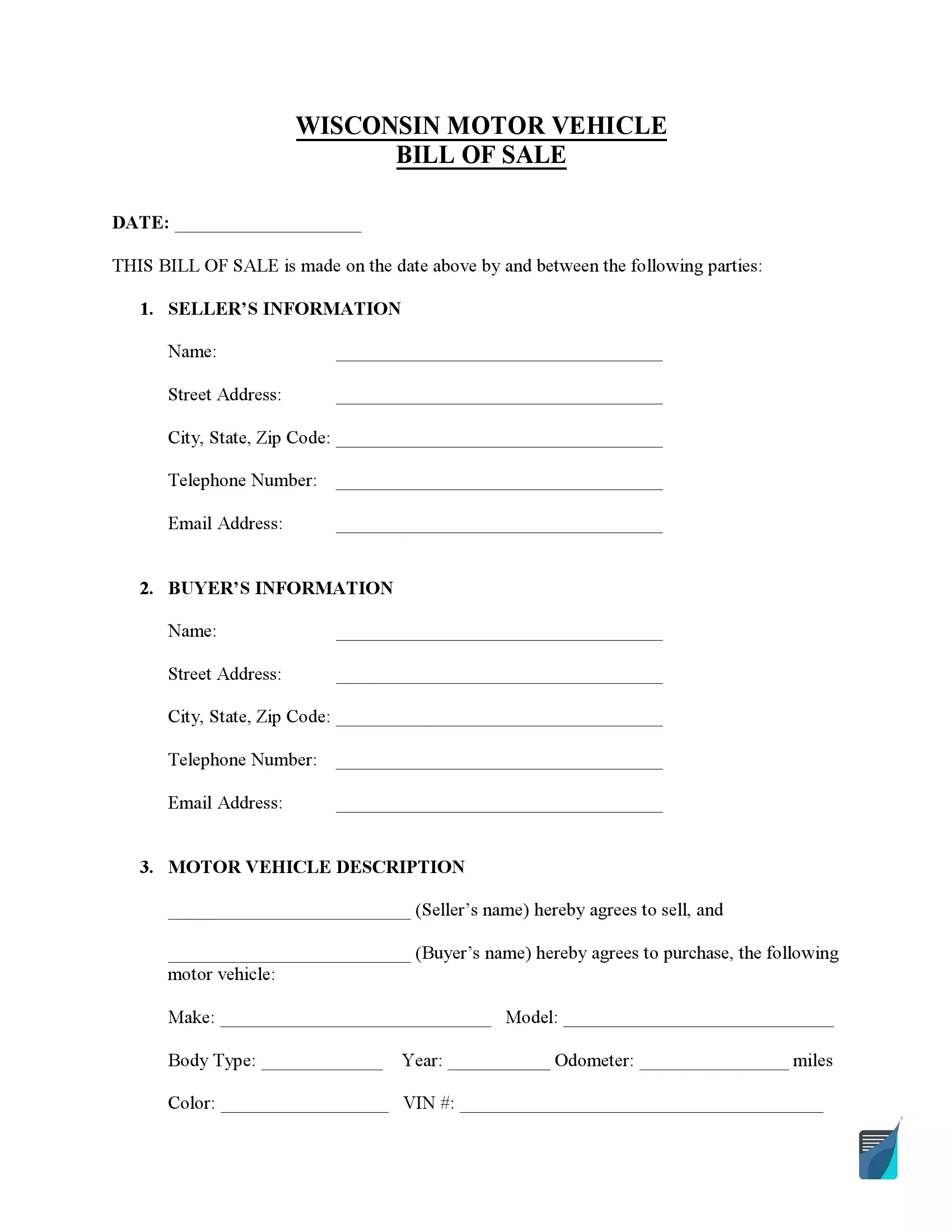

Wisconsin bill of sale for a motor vehicle verifies the transfer of the ownership of a vehicle. You may also need to inspect the vehicle before concluding the transaction. You need to register the vehicle within 30 days from the transaction or the time of moving to Wisconsin. The basic fee for vehicle registration in Wisconsin is $85, although your region can impose additional taxes or fees.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

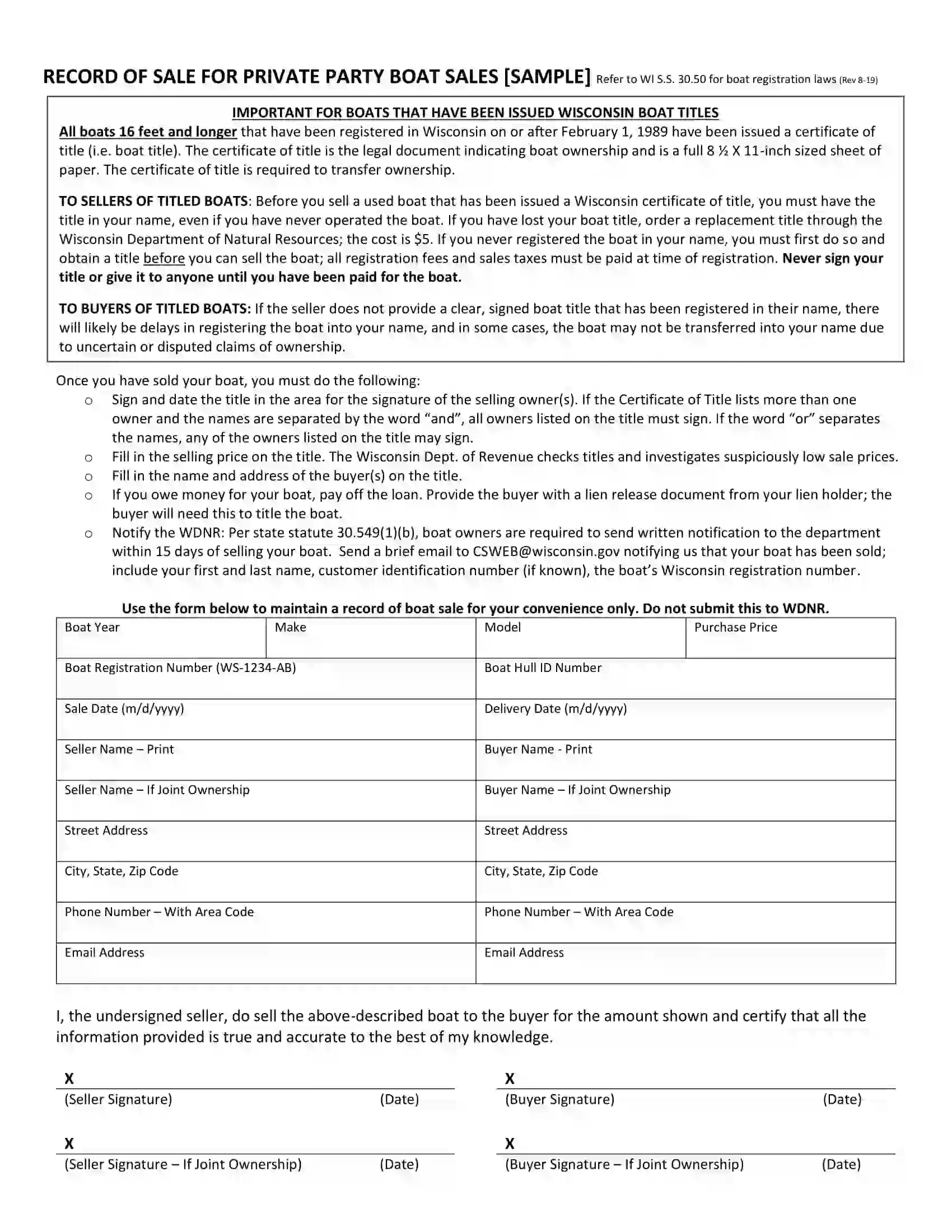

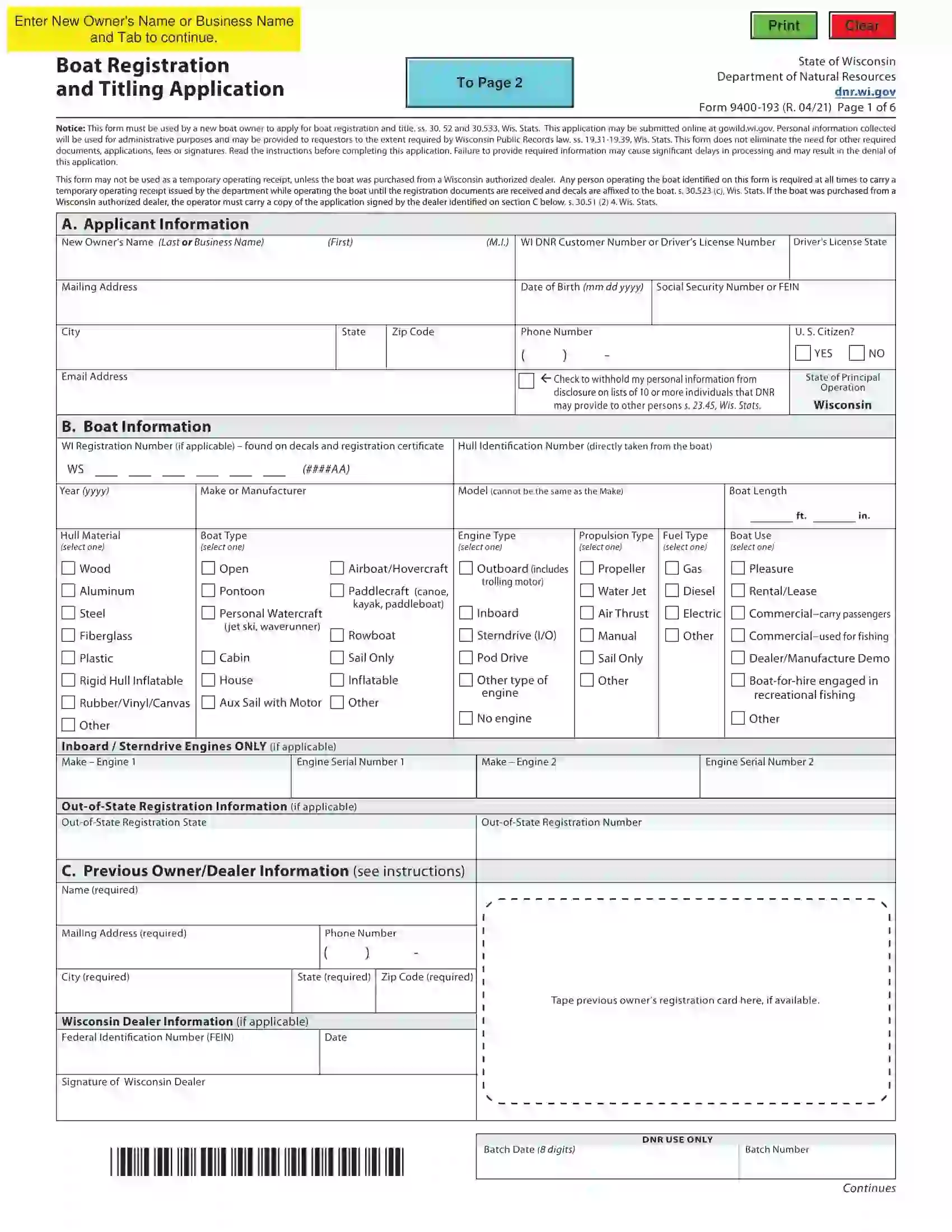

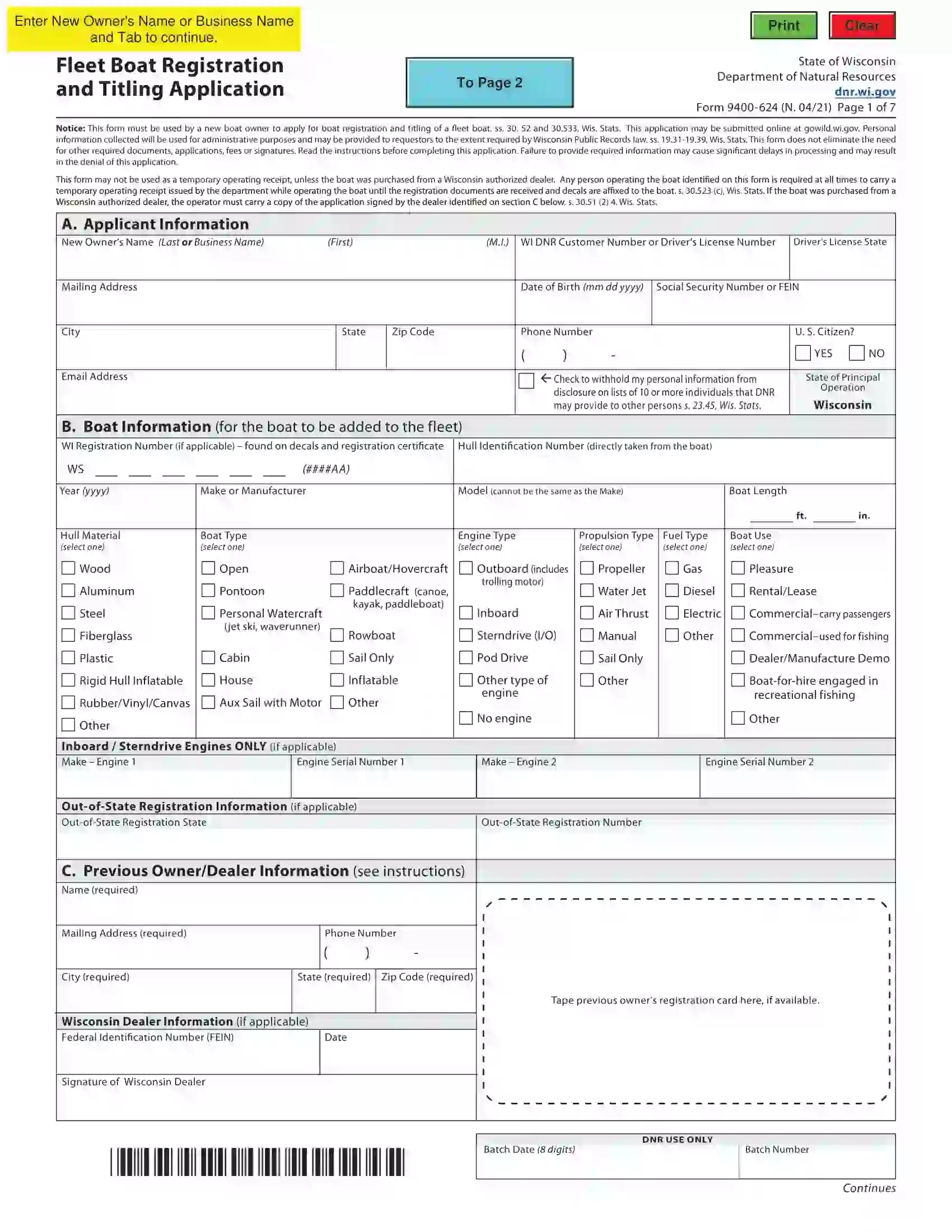

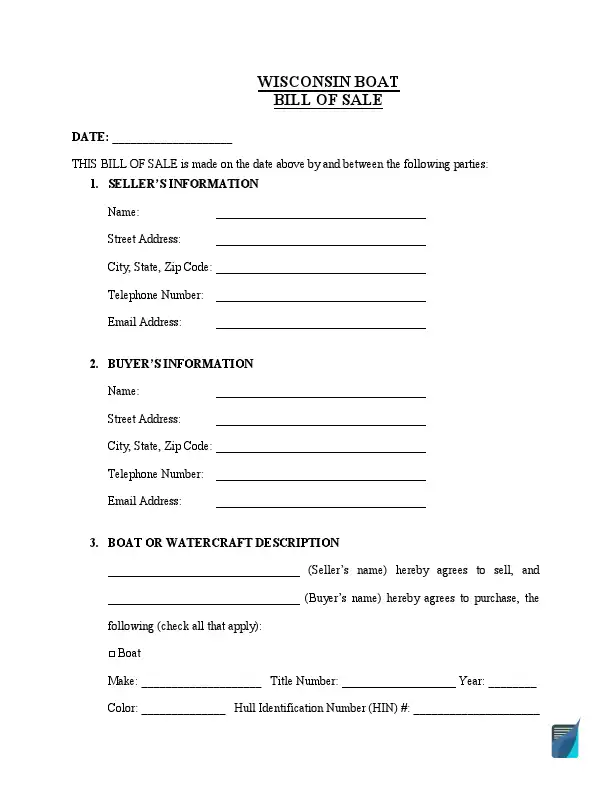

Wisconsin boat bill of sale is designed to transfer the watercraft ownership. The document is required to contain all specific characteristics that can identify your boat. Your boat registration in Wisconsin will be valid for around three years. As a rule, all motorboats and sailboats over 12 ft long are required to be registered.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

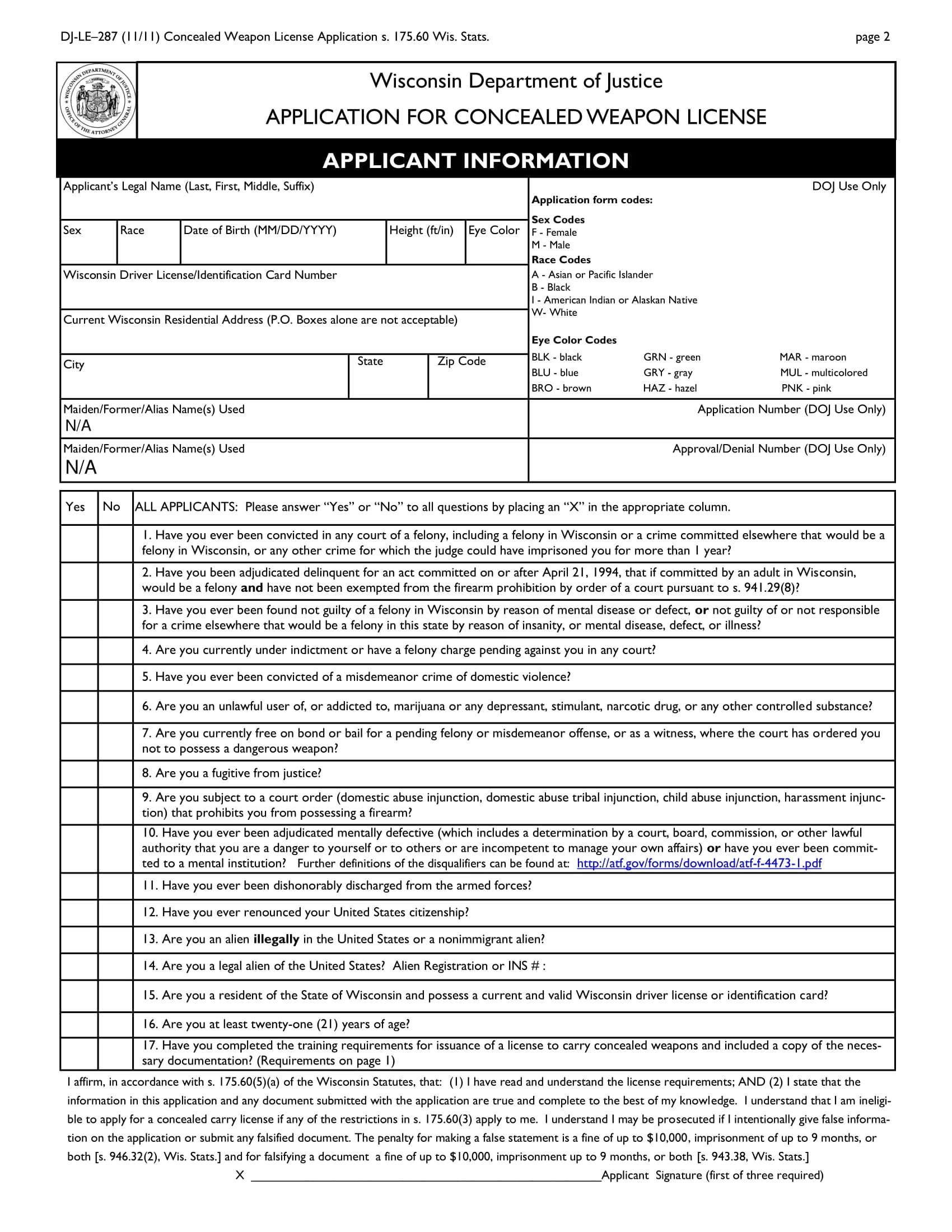

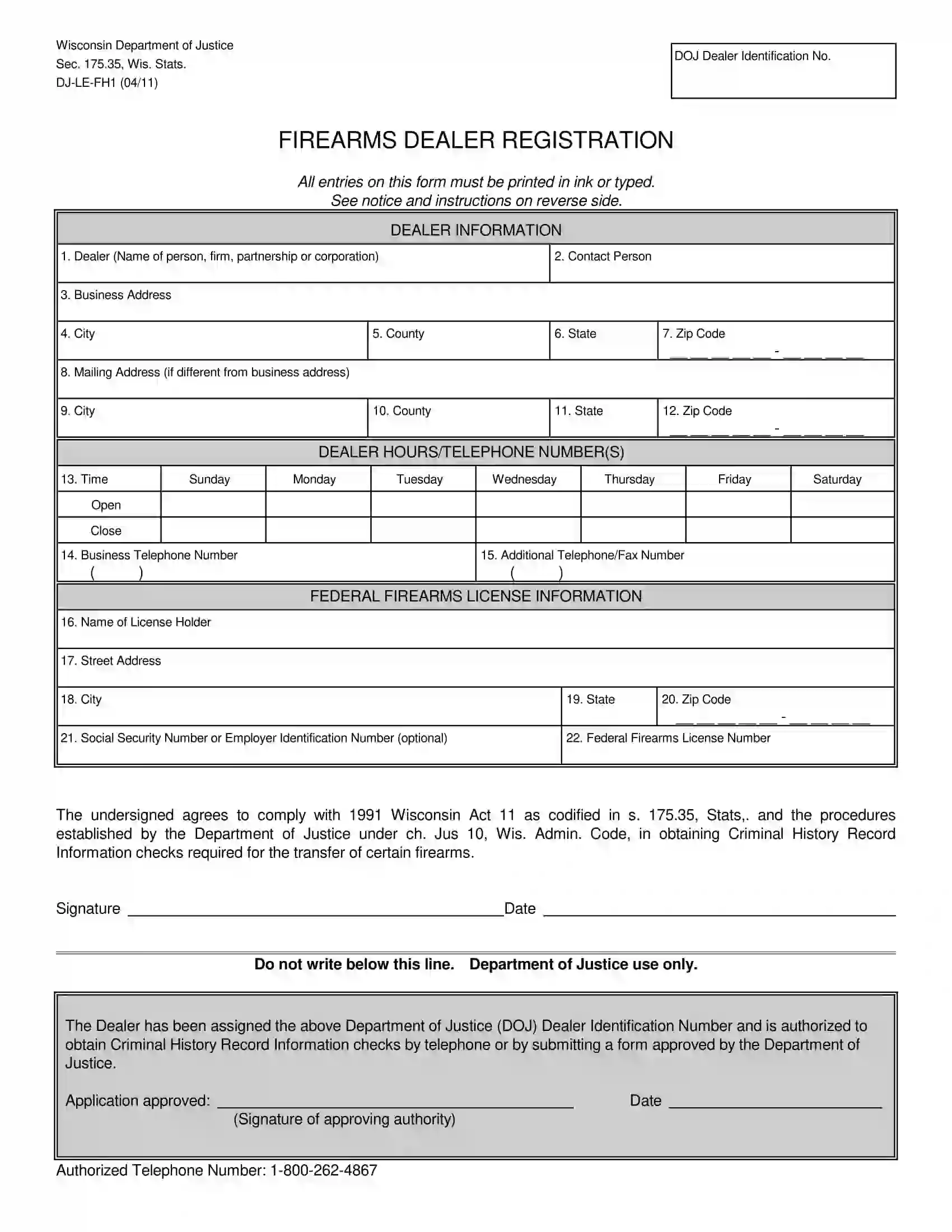

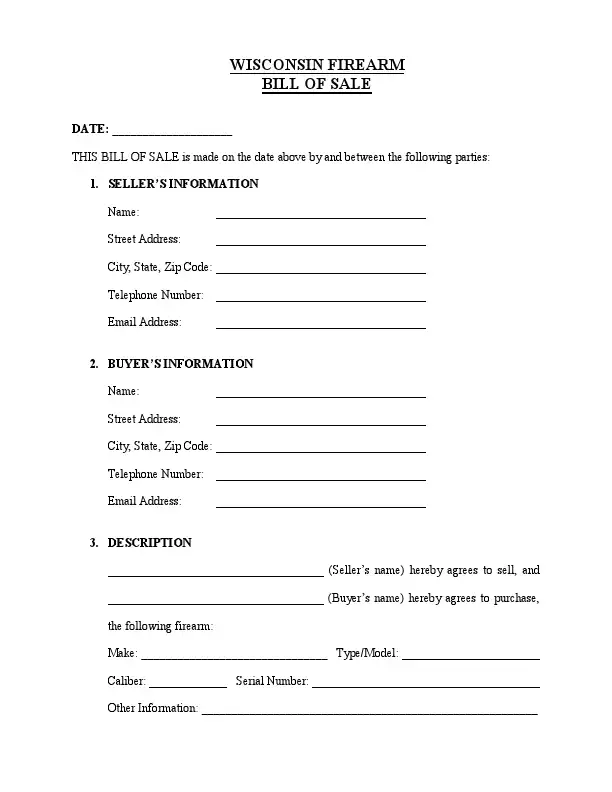

Keep the records of the gun ownership transfer with a Wisconsin firearm bill of sale. The document must indicate your gun’s caliber, model, and make. Wisconsin does not have a special law requiring firearm registration. Documenting firearms that you’re taking with you while moving to the state is neither required. Individuals are permitted to carry handguns openly, but they must apply for a concealed carry license.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

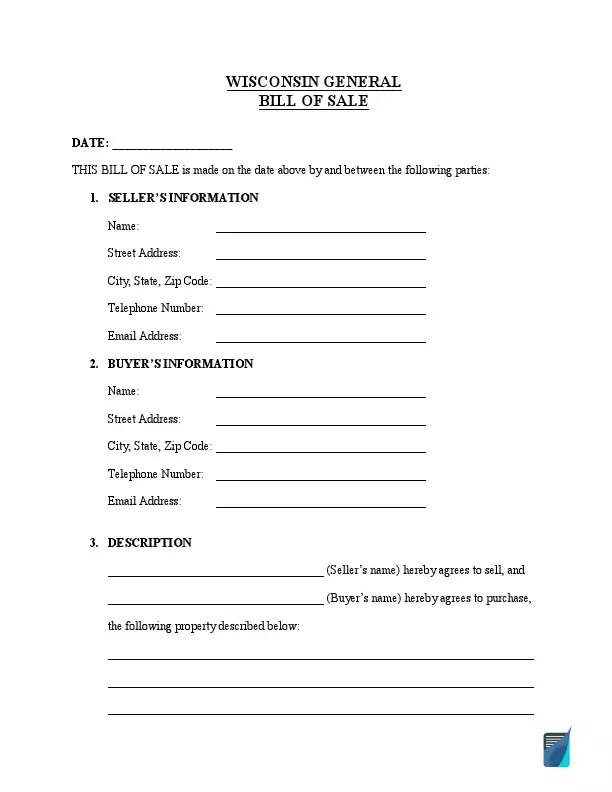

Choose a Wisconsin general bill of sale if no specific bill of sale is required. The document needs to describe in detail the personal property for sale and the conditions of the purchase. General bill of sale forms are used for personal record keeping and include all relevant transaction details, like the price, time, warranty information (if applicable), buyer and seller contacts, and other specifics.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a WI Vehicle Bill of Sale

When purchasing or selling a vehicle in a private sale in Wisconsin, it’s possible to use the official Wisconsin form provided by the local authorities, known as Form MV2928.

For the Wisconsin bill of sale to certify the legality of a vehicle’s transaction, it should specify all the relevant details of the buyer and seller and the vehicle’s description (make, model, VIN, and actual condition at the moment of purchase). The document should also stipulate the price at which the deal was concluded. To avoid making mistakes while completing the document, follow this simple guide.

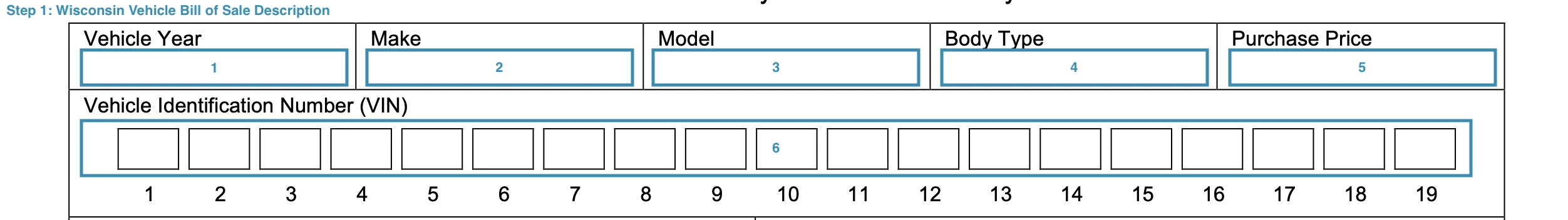

Step 1: Identify the motor vehicle

The first step is to specify the information about the motor vehicle you’re selling:

- Year of manufacture

- Make (manufacturer)

- Vehicle’s model

- Vehicle’s purchase price

- Body type

- Vehicle Identification Number (VIN)

You are also required to specify the purchase price in this section.

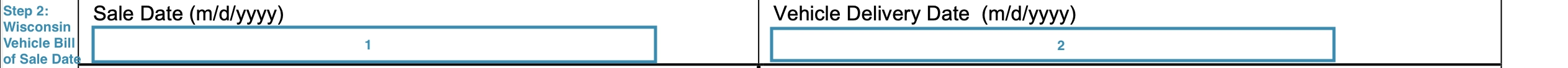

Step 2: Indicate the date of the purchase

You will need to enter the purchase date in this section. If it differs from the date when the vehicle is delivered to the buyer, type in the delivery date as well.

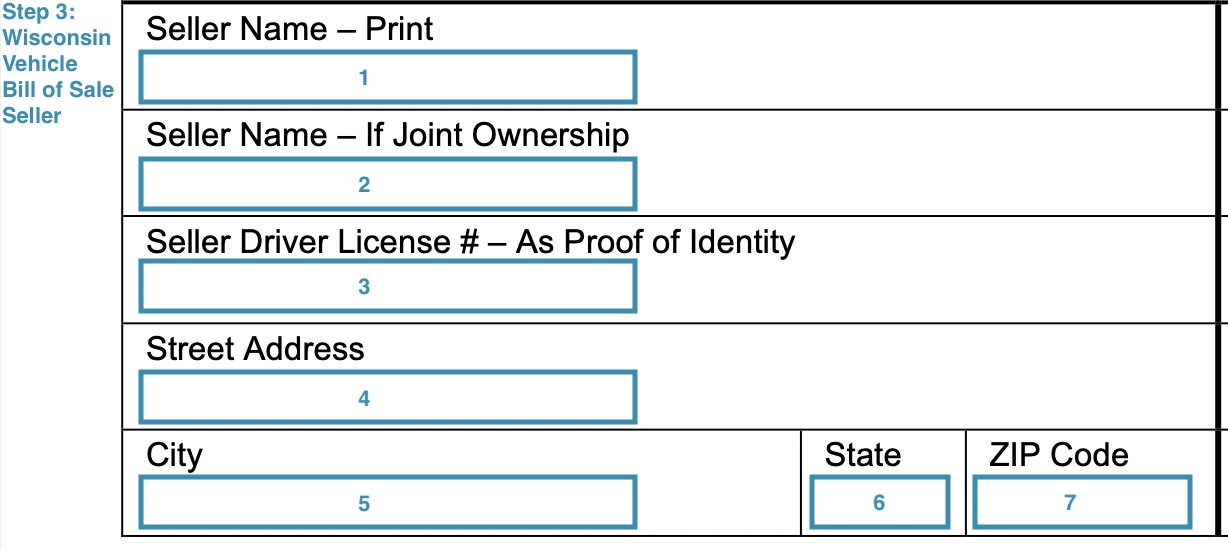

Step 3: Type in the seller’s details

After specifying the purchase date, you will need to indicate the seller’s contact information, including:

- Full legal name

- Seller driver license

- Address (street, city, state of residence, and zip code)

If there is joint ownership, provide the name of the second seller.

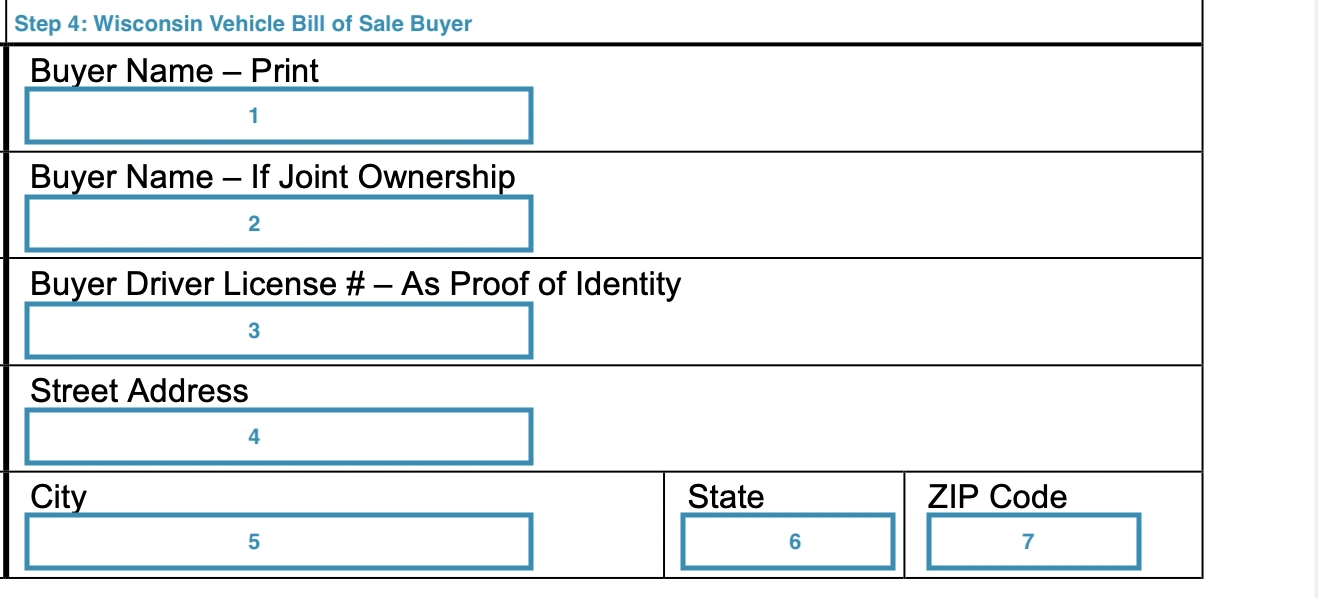

Step 4: Enter the buyer’s details

The following step is to identify the vehicle’s buyer. The buyer’s contact details include:

- Full legal name

- Driver’s license number

- Address (street, city, state of residence, and zip code)

If there are several buyers, type in the name of a future co-owner.

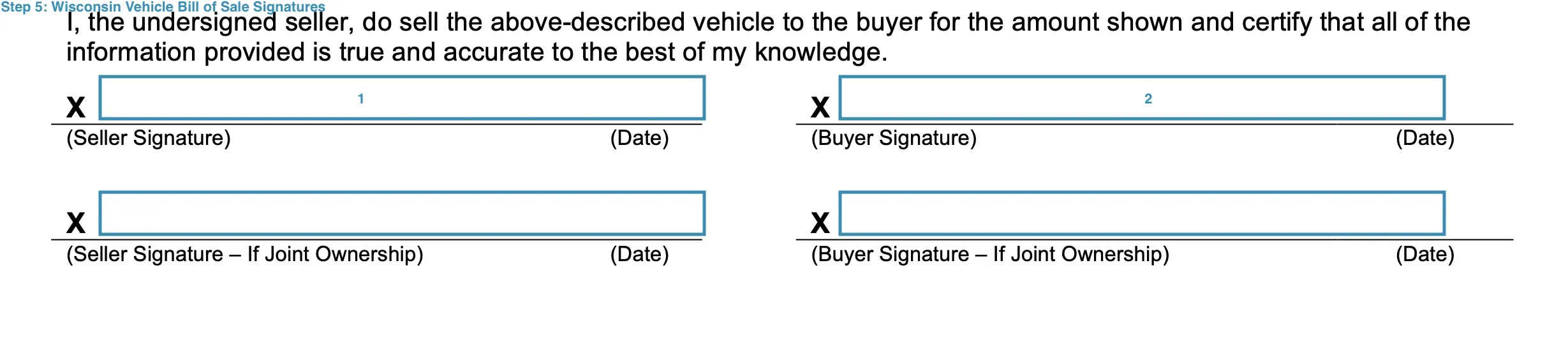

Step 5: Sign the bill of sale

Both parties must sign the document when it is completed.

Registering a Vehicle in Wisconsin

Once the sale is complete, the seller has 30 days to file a sale notification to the local DOT office indicating the VIN of their sold vehicle, the buyer’s details, and the sale date and price.

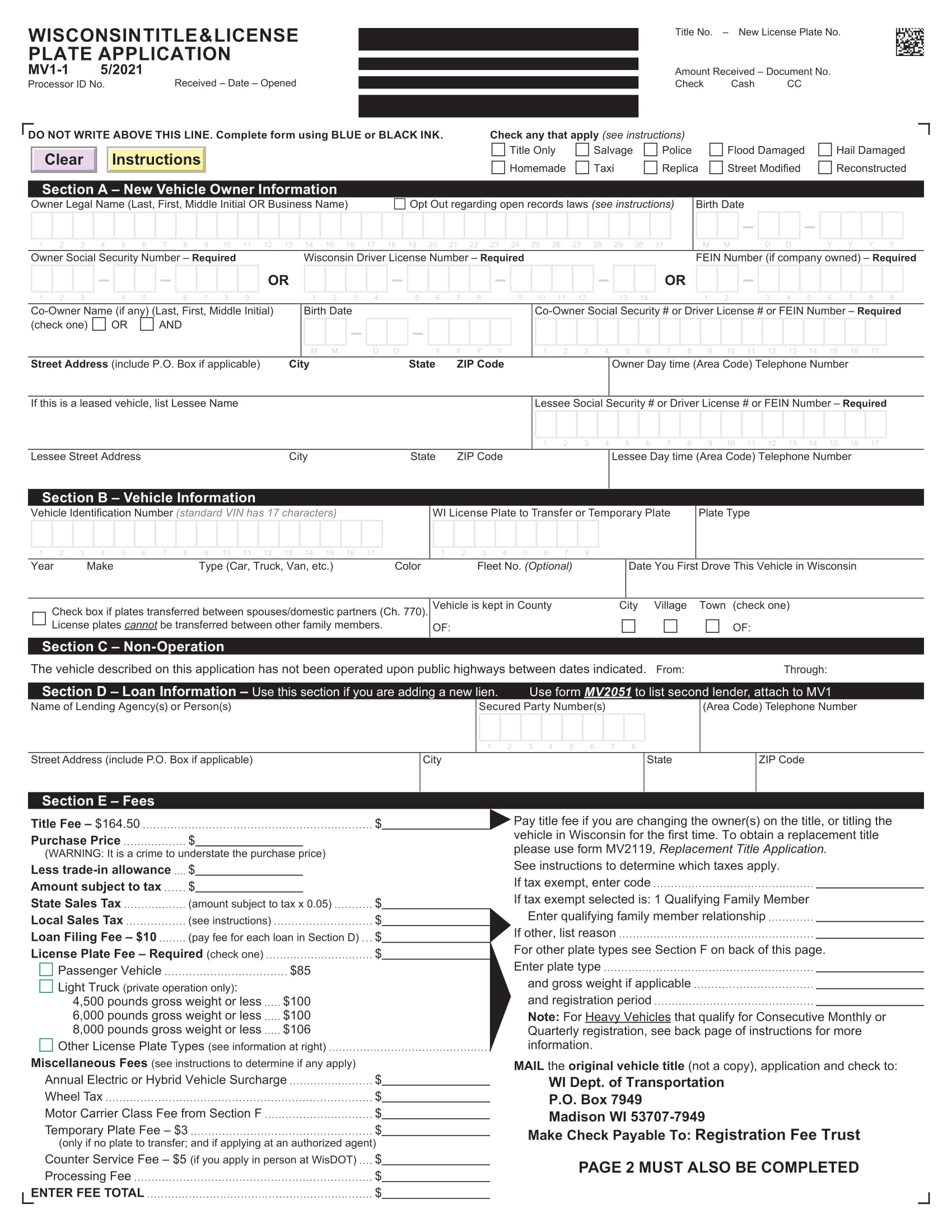

The new vehicle owner must complete the registration process to obtain a legal right to operate a new vehicle on the roads of Wisconsin. The registration procedure may be initiated by visiting the local office of the Wisconsin Department of Transportation (DOT) and filing the following documents:

- An application for new license plates (Form MV1)

- A completed motor vehicle bill of sale (optional)

- A mileage disclosure

- A copy of your driver’s license

- A copy of your ID

- Proof of the covered sales tax for the vehicle

- A copy of valid auto insurance for the vehicle

- Proof of the fee payment (explained in detail below)

- A lien release (if the vehicle is subject to a lien)

Attending the local DOT in person is optional to complete the registration procedure. You may find the closest office and mail them the documents with a registration and taxation fee payment receipt.

The tax structure of Wisconsin is quite specific, so the new vehicle owner should check in advance what fees and taxes apply to their situation. There are separate registration fees, title fees for the new title registration, as well as municipal and county wheel taxes that may also apply. The gross weight fees range from $75 for motor vehicles not exceeding 4,500 pounds to $2,560 for vehicles weighing 80,000 pounds. The wheel tax, for instance, is the one that a vehicle user weighing over 8,000 pounds needs to pay. Other fees include the counter service fee (for those who apply for registration at a DMV Customer Service Center) and the processing fee ($5 for DMV processing and a $20 surcharge).

The state sales tax for motor vehicle purchases is 5% of the actual price. Some exemptions from the tax duty include a vehicle purchase from one of the close relatives, purchase by a Common or Contract Carrier, by a government unit or agency, by a non-WI resident, or by a religious, charitable, and non-profit organization.

Relevant Official Forms

Form MV2928 is official bill of sale form used in Wisconsin to sell or buy a vehicle.

Form MV1 is used to apply for a title/license and includes the relevant instructions on how to complete the application.

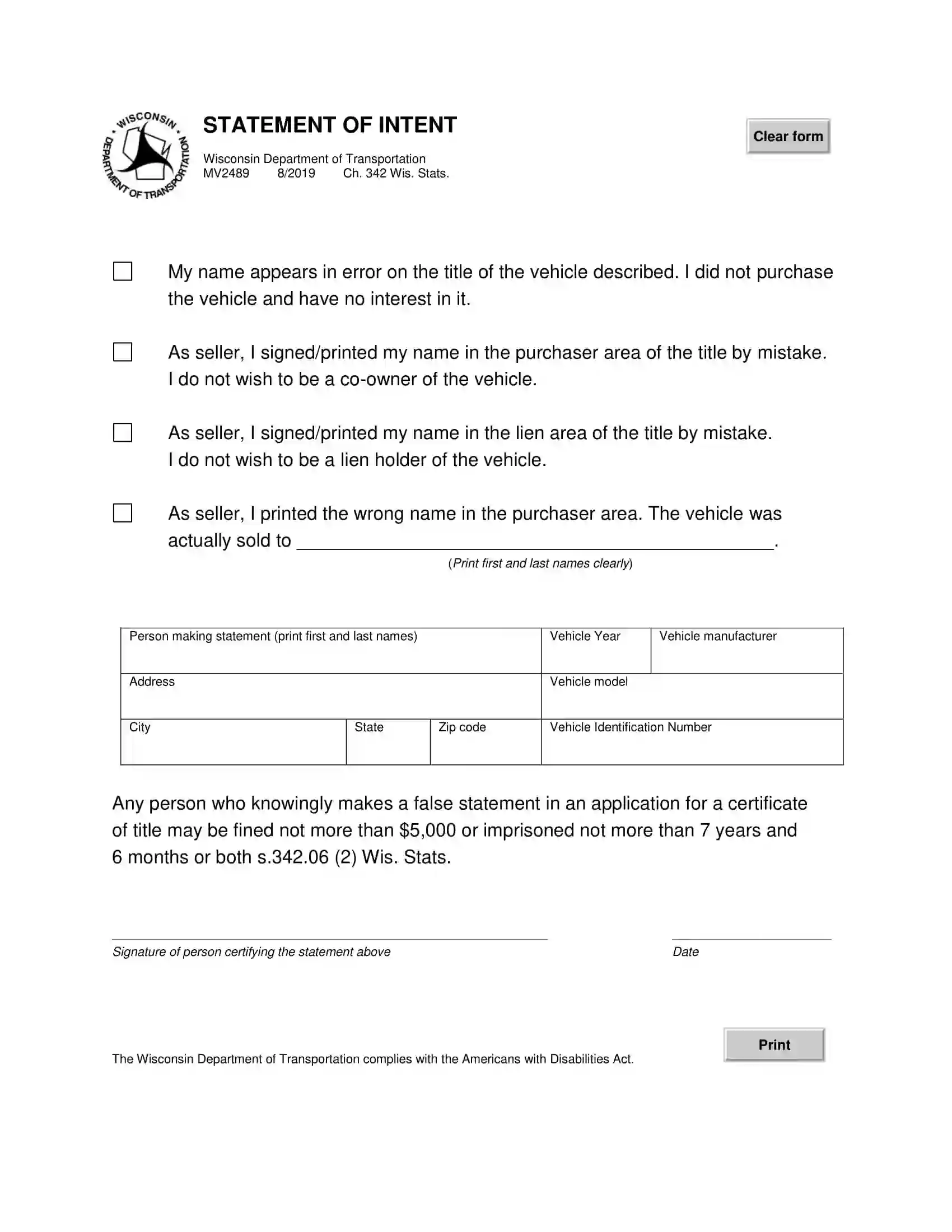

Form MV2489 or Statement of Intent is designed to indicate any alterations on vehicle titles.

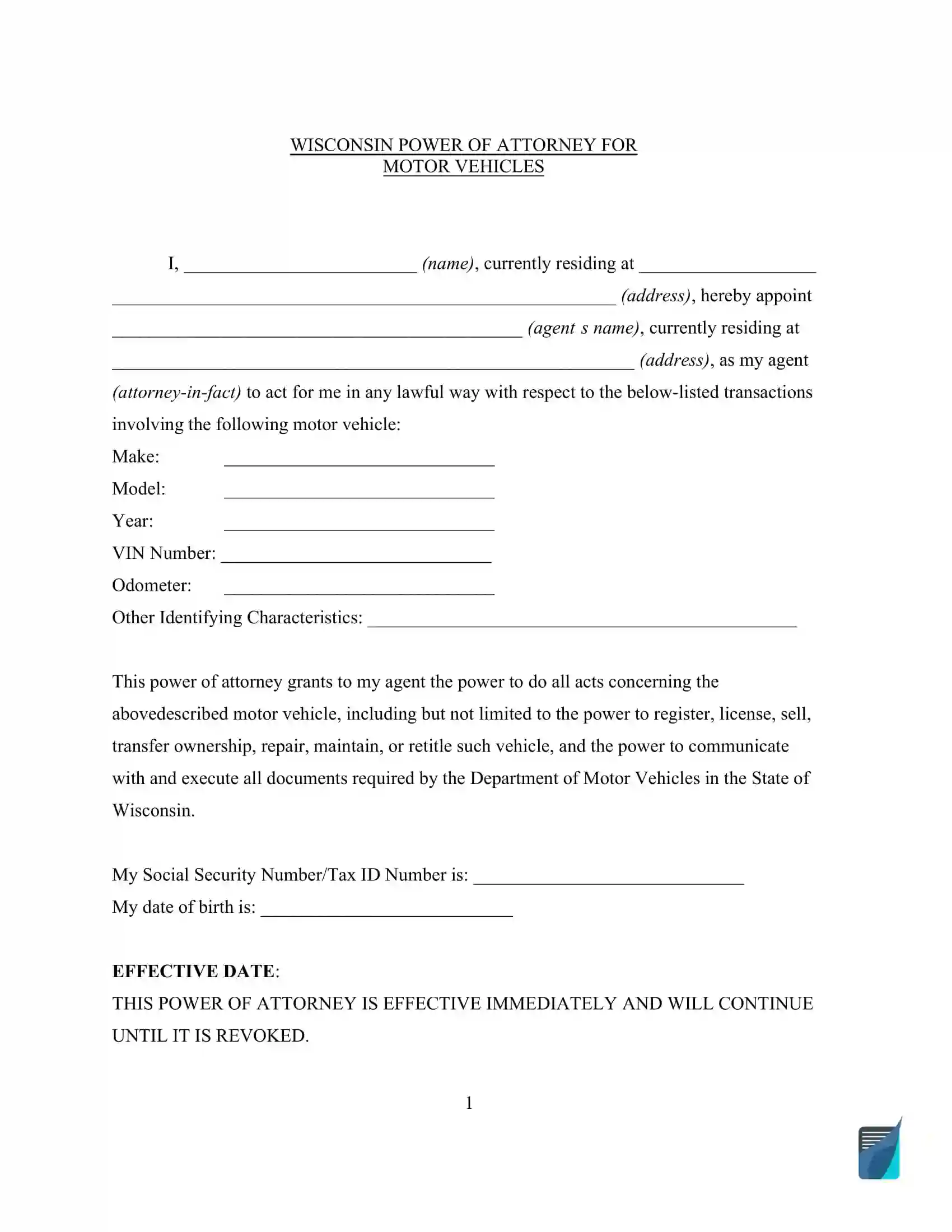

A motor vehicle POA is designed to appoint another person to act on your behalf when selling, titling, or registering vehicles.

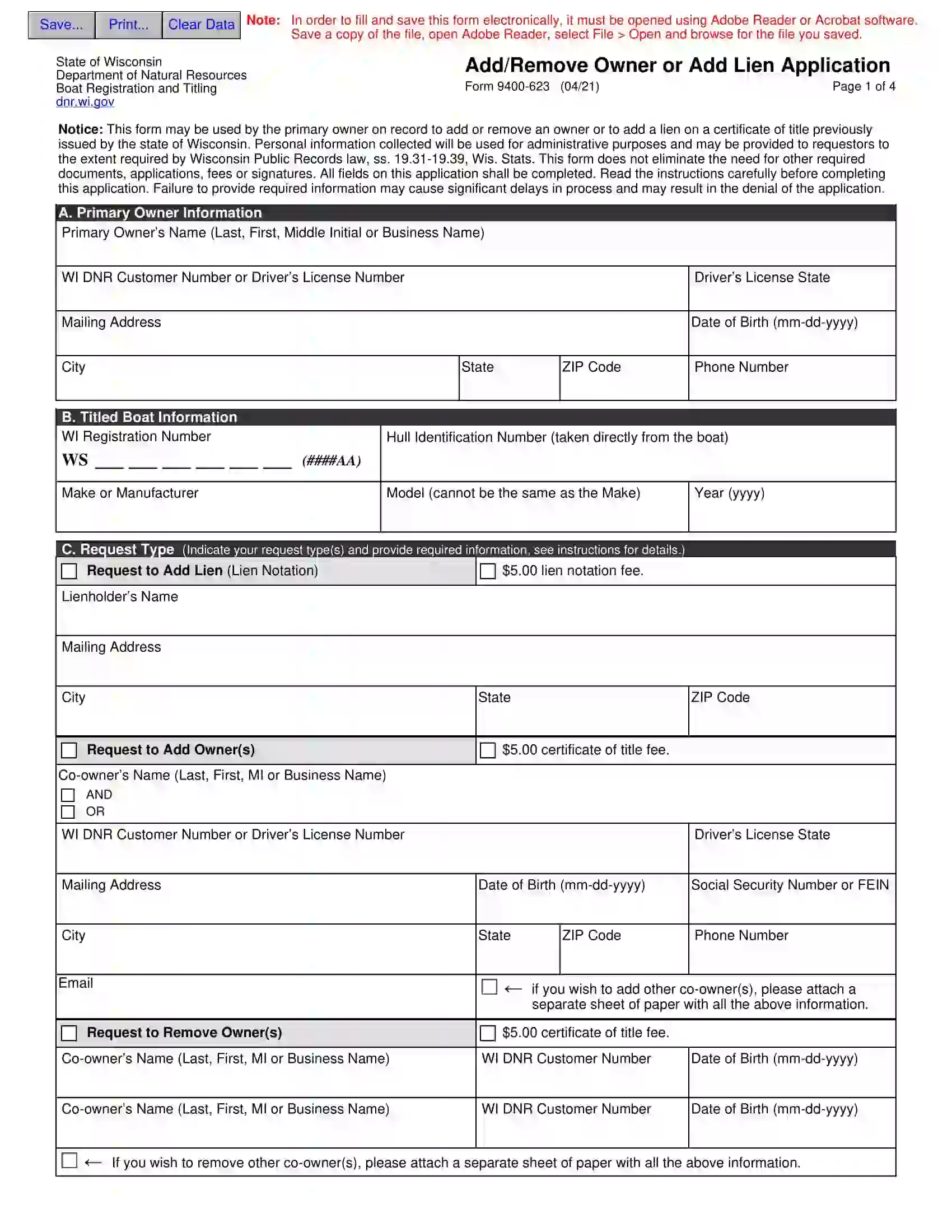

Form 9400-623 is used by the original owner to add or remove an owner or to add a lien on a certificate of title.

Short Wisconsin Bill of Sale Video Guide

Other Bill of Sale Forms by State