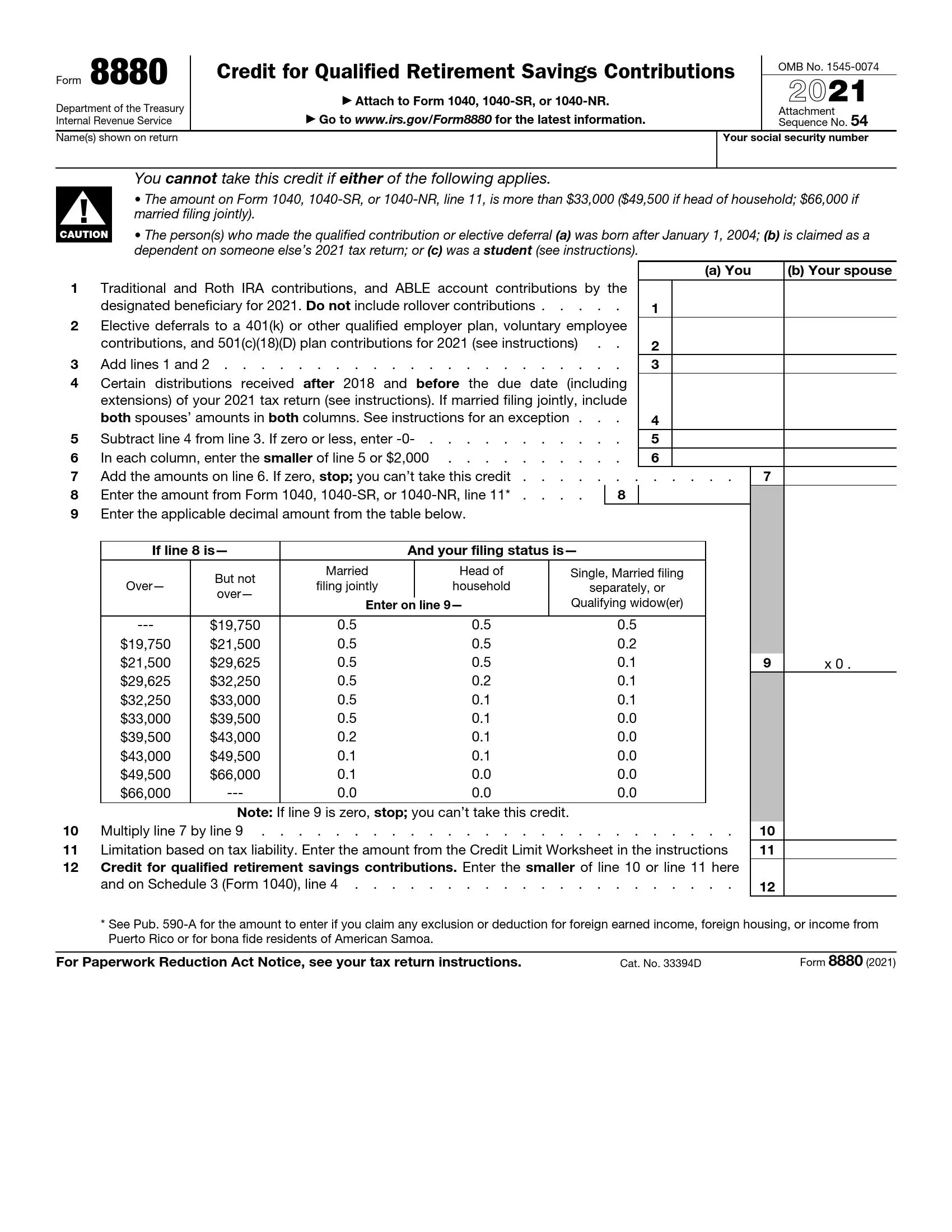

Form 8880, titled “Credit for Qualified Retirement Savings Contributions,” is a form taxpayers use to calculate and claim a tax credit for eligible contributions to retirement plans such as IRAs, 401(k)s, and specific other qualified plans. The form helps taxpayers determine the amount of credit they can receive based on their contributions and income level. This nonrefundable credit incentivizes retirement savings by reducing the tax liability for lower and middle-income individuals and families contributing to retirement accounts.

The purpose of Form 8880 is to provide a financial benefit to those actively contributing to their retirement savings. The credit can range from 10% to 50% of the eligible contributions, depending on the filer’s income, and can be as much as $1,000 for individuals or $2,000 for married couples filing jointly.

How to Fill Out Form 8880

When filling out the form, you need to make some calculations. The amounts to be calculated are contained in the form to which Form 8880 is attached. You can download the file from the official IRS website or fill the document out using our online form builder, so you do not have to print it out. Follow the short instruction to complete the paper:

Enter identification data.

Fill in the first line at the header. Specify your name and social security number.

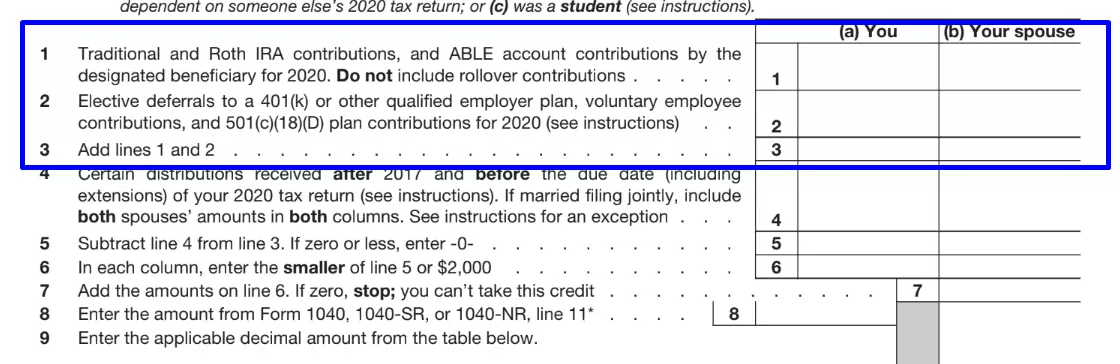

Calculate the contributions.

Write the contributions amount according to the type of your retirement saving account. Remember not to include rollover contributions. Add up the sums you wrote on line 1 and line 2. Enter the numbers in the table.

Specify the distributions.

Give certain distributions within the period specified in the form, namely from 2017 to the expiration of your tax return. If you requested a prolongation of the return, consider the extension period. Subtract the distributions from the total contribution amount (line 3) and write the amount in the table next to item 5.

Indicate a smaller amount.

Line 6 requires you to specify the sum that does not exceed the amount on line 5.

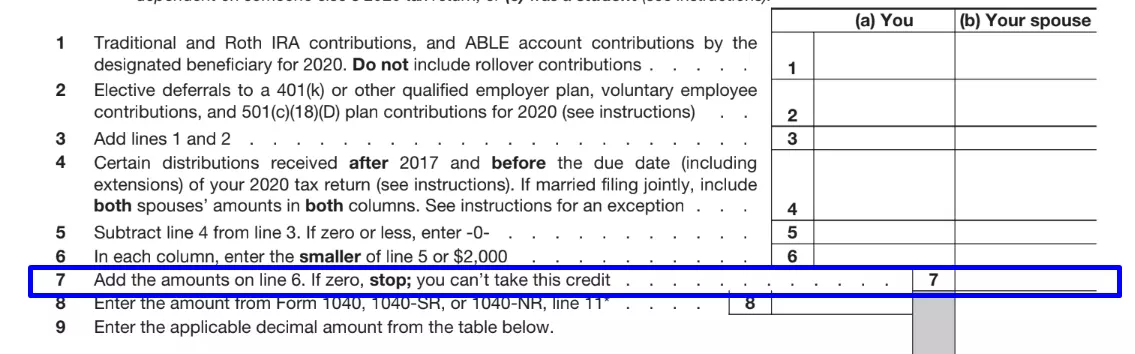

Calculate the total.

Add the sums from line 6, both columns, and enter the total. Please note the Form warning that if you wrote “zero” on line 7, you cannot get a tax credit.

Enter the sum from the main form.

On line 8, specify the amount from the Form to which you attach Form 8880.

Calculate the index.

Given the amount you have just written and your status shown in the table below, find a match and enter the index on line 9. Again, note the warning that if you wrote “zero” here, the IRS does not approve the tax credit.

Calculate the sum.

On line 10, write the sum from multiplying the sum of line 7 by the index of line 9.

Define CLW.

In order to correctly calculate the Credit Limit Worksheet (CLW) that you need to specify on line 11, refer to the instructions:

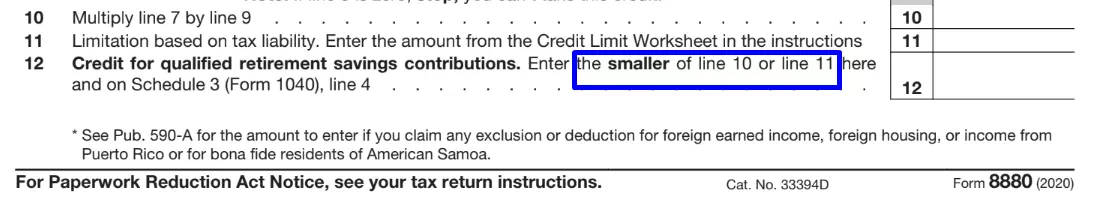

Determine credit amount.

Enter the smaller from line 10 or 11. Duplicate the information on line 4 of Form 1040.

Submit Form 8880 as an attachment to one of the 1040 forms in the same way, i.e., by email or via Post Office Boxes.