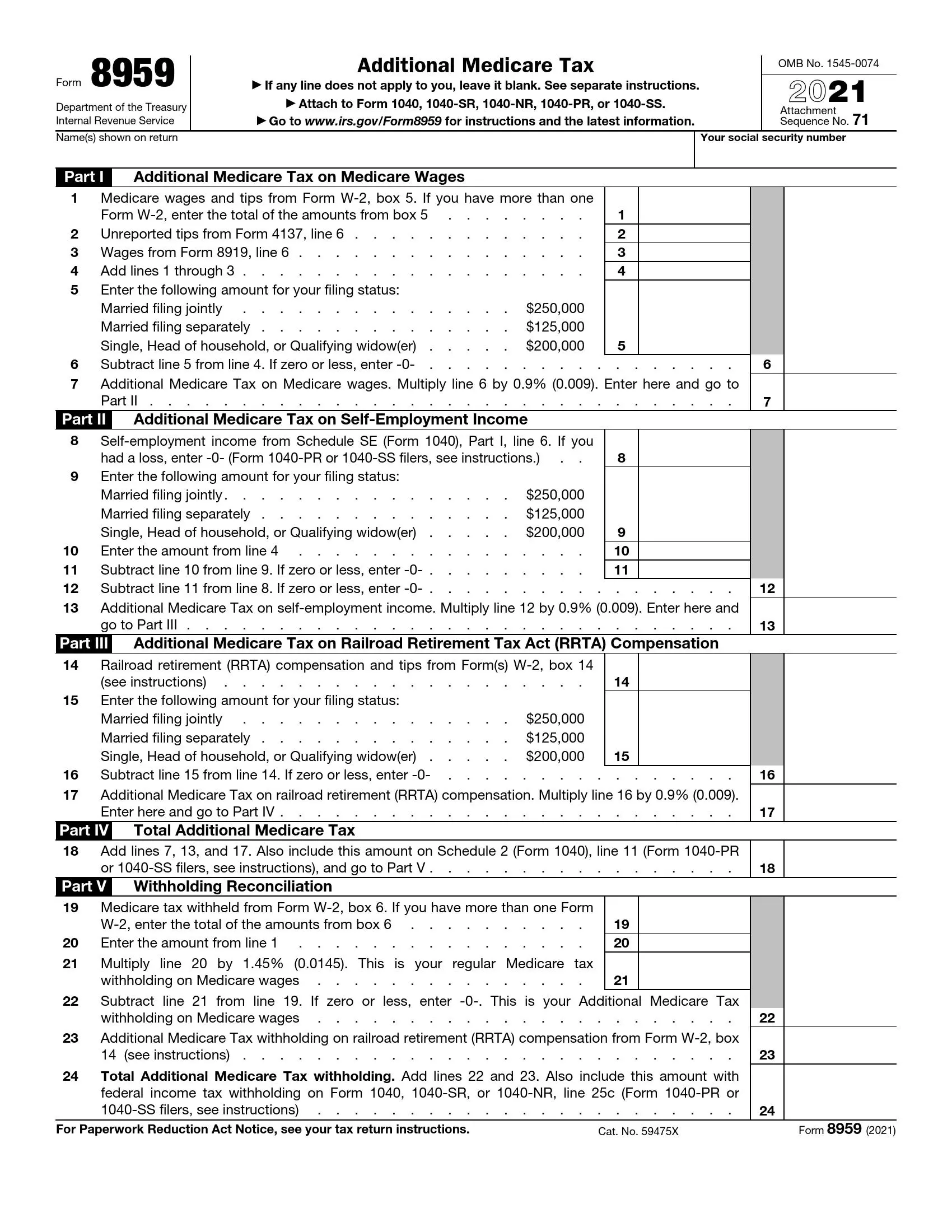

IRS Form 8959, titled “Additional Medicare Tax,” is used by taxpayers to calculate and report Additional Medicare Tax on earnings that exceed the income threshold specified by the IRS. This tax applies to wages, compensation, and self-employment income over certain amounts, and it is intended to support the funding of Medicare. Taxpayers need to provide the following information on Form 8959:

- Wages and self-employment income that are subject to additional Medicare tax,

- Total Medicare wages reported on Form W-2,

- Any Railroad Retirement Tax Act (RRTA) compensation.

The form helps taxpayers determine the amount of Additional Medicare Tax they owe by calculating 0.9% of the income exceeding the threshold. It also facilitates the reconciliation of any additional Medicare Tax withheld by employers throughout the year, ensuring taxpayers pay the correct amount owed.

How to Fill Out the Template

The template might seem difficult to fill out even though there is only one page. You will have to choose which lines apply to you and make plenty of calculations to fill them all out. In case of any doubts, taxpayers are recommended to hire a tax expert who will help them with the document creation.

It does not matter who will fill out the form, you or a paid specialist; you have to prepare your completed tax forms that are relevant (your tax return, 4137, 8919, and W-2). Having your bank statement and all receipts showing all income throughout the year at hand is also a smart move.

If you have decided to fill out the template individually, check our guide about the form completion below. Besides, you will need to get the Service’s instructions on its site. They will help to clarify difficult moments and give you all peculiarities about the template.

Get the Template

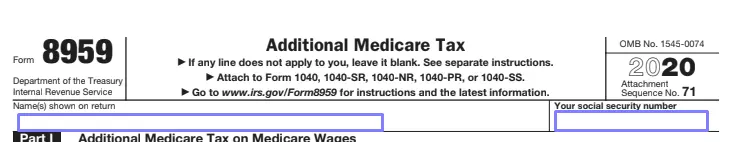

Check the year written on the top of the first page. IRS normally updated the majority of its forms. Even if the content remains the same, sometimes a tiny little thing might change; that is why it is crucial to have the current version.

Those who notice that their template is incorrect or have no template at hand can use our form-building software. This user-friendly system allows you to get any legal form you are looking for in just a moment. Besides, all forms released by the Service, including IRS Form 8959, are available on the official institution’s site.

Insert Your Name and SSN

This document is going to be a part of your tax return; even so, you have to write your name and social security number (SSN), so the Service personnel does not get confused when reviewing a bunch of your papers.

On the left, write your name (it must coincide with the name you added to your return). On the right, insert your SSN.

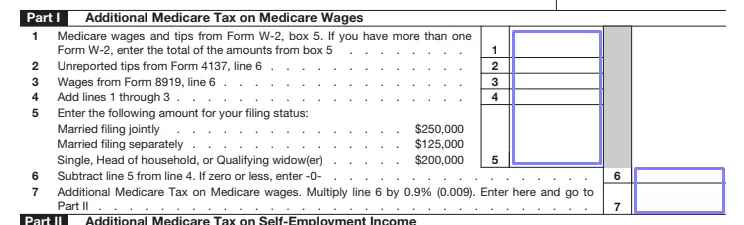

Pick the Part to Complete

You have to select the form’s block that is relevant for you: the first for the income showed in W-2 Form (Medicare wages), the second for the income you have gained from being self-employed, and the third — for railroad retirement compensation (Railroad Retirement Tax Act, or RRTA). It is possible to complete two parts; you have to check the borderline of your income with the Service’s chart in its instructions.

Complete Part I (If Applicable)

You have to take your W-2, 4137, and 8919 forms and add the required figures from them. Then, add all the numbers and put the result in line 4.

Specify your status below by entering the sum in US dollars written in the template (you can file the document together with or separately from your spouse or be single and file on your own). Then, take this sum, subtract the number from line 4, and write the result (you can get zero or less; the template shows what to write in this case). Multiply the number you have received by 0,009 and enter the result in line 7. Move to the second block, then.

Count the Tax on Income from Self-Employment

Insert the required number from Schedule SE of your tax return. Define your status in the next line (married and filing together or separately, or individually). Then, line by line, compute the numbers as demanded and define your additional tax in line 13. Scroll down to the third part.

Compute the Tax from RRTA Compensation

If this compensation applies to you, complete Part III of the form. Take the needed numbers from form W-2 and insert them in line 14. Again, define your status by stating the sum in dollars. From this sum, subtract the number from line 14 and write it as a final result for the section (in line 16).

Calculate the Total Tax

You have to determine the total sum of your additional Medicare tax. Add the mentioned numbers from previous parts and insert the result in line 18. Also, enter this number in other forms mentioned here.

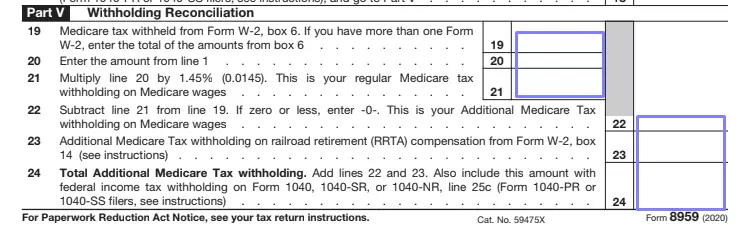

Consider Withholding

A part of the tax might be withheld by your employer. Fill out the last section with the numbers from the W-2 form and the demanded calculations. Lastly, enter the final result with withholding in line 24. Do not forget to enter the same number in your tax return.