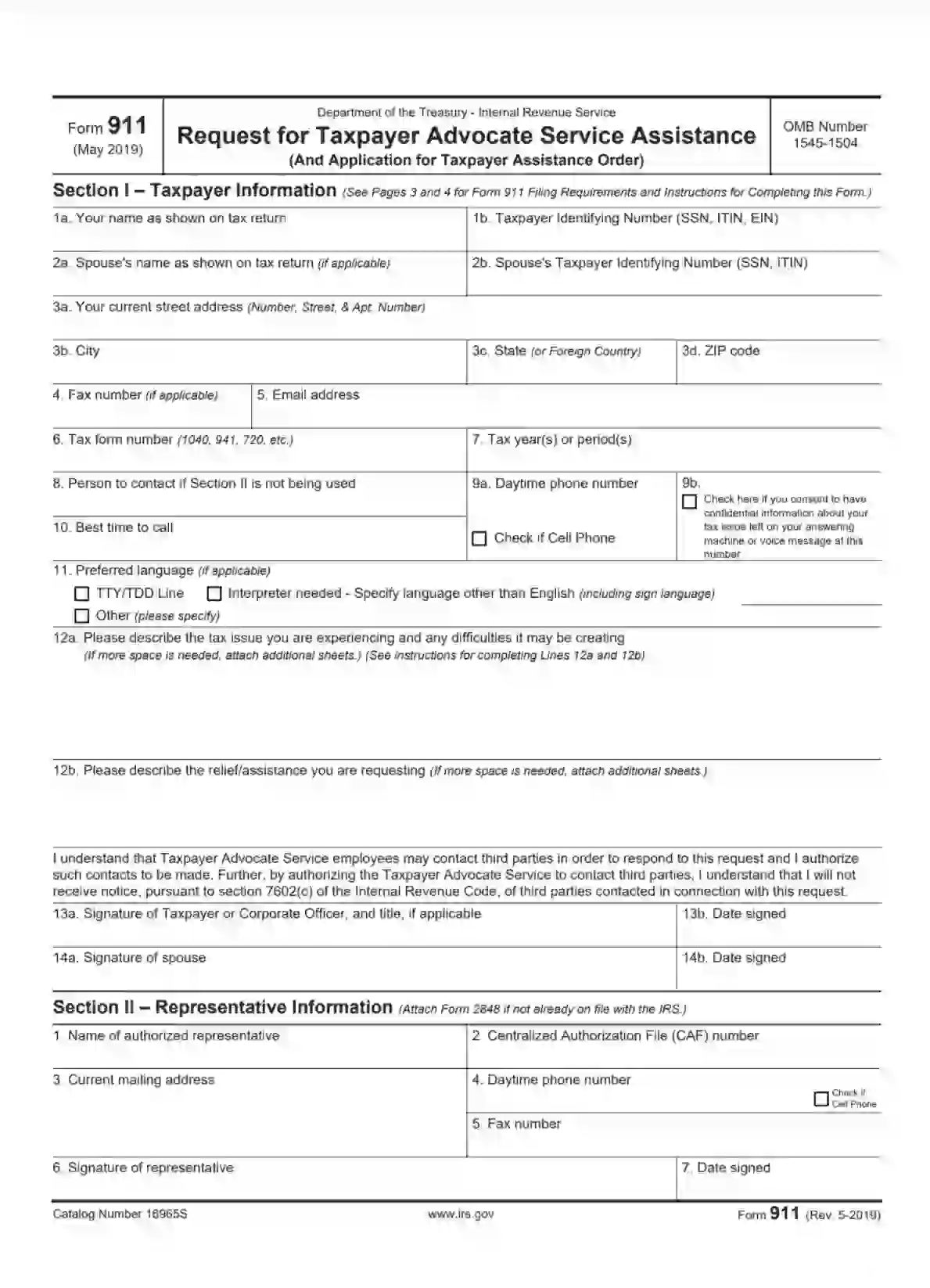

IRS Form 911 is a document taxpayers use to request assistance from the Taxpayer Advocate Service (TAS). This service is an independent organization within the IRS that helps individuals and businesses resolve problems with the IRS. The form serves as a formal request for help when all other options with the IRS have been exhausted or when the taxpayer believes the IRS is not responding adequately to their tax issue.

Form 911 ensures taxpayers receive fair treatment and can resolve issues not adequately addressed through normal IRS channels. By submitting this form, taxpayers can seek help with delays, errors, or other difficulties affecting their tax cases. The Taxpayer Advocate Service is an intermediary that assists in these matters, aiming to provide timely and effective resolutions.

How to Fill Out the Form

Read the step-by-step instructions carefully before completing and submitting this tax application. It is your unique assistant, which allows you to fill out documents without mistakes and miscalculations. Do not rush and do not lie because you are responsible for the data provided. Otherwise, this leads to penalties and cancellation of the request. Also, fill out the form correctly. Besides, any taxpayer may use our form-building software.

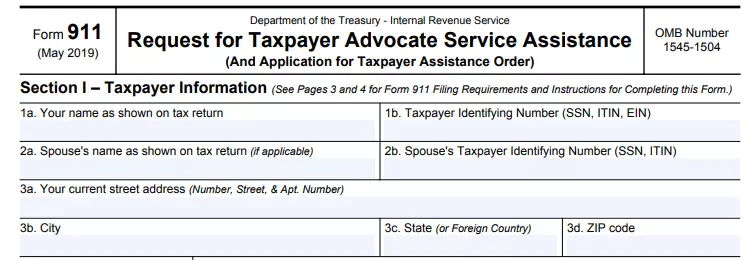

Input personal data

The tax return first asks for information about you. Enter your first and last name, as well as your taxpayer identification number. If you are an individual, provide your social security number. In general, these are digital codes designed to identify your business or your identity. These are mandatory numbers that the tax authorities provide to everyone.

If you want to fill your tax return with your spouse, enter their first and last name and the identification number. The application contains an item about your residential address, including the house, street, and apartment number. If you are a foreigner, specify the name of the country without abbreviations.

Next, each taxpayer prescribes a fax number and e-mail address for communication. The Legal Service does not share your contact information with third parties, and no one will send you spam. In the sixth line, enter the tax form number related to this request, and then enter the quarterly tax year. This procedure reduces the time and your effort and solves your problem faster.

Fill out the contact information

The eighth line requests information about the person the specialists should contact. By the way, if it is an organization, partnership, or trust, specify the name of your company’s authorized representative. Do not forget to write your current phone number and the time for contact with you. As for the answering machine or voice messages, this is subject to privacy regulations. Unfortunately, some attackers use similar methods and then ask for a ransom. Therefore, carefully read the items about voice mail.

All people are different, and some have their characteristics (gestures, articulation of speech). Write all the information about this to make it easier to establish contact and solve the problem.

The application contains empty lines where you can describe your tax problem. You must provide all comprehensive information about this, describing any difficulties that you have experienced. If the Tax Service tried to solve your problem, then write about it. If the tax authorities did not contact you in any way, or ignored your letters, write about it in the line. You also need to specify the assistance you want to get from the legal authorities. Describe what actions you would like to take and provide all the documentation. It will help in any case and simplify the understanding of the danger.

If this is a joint tax return with your spouse, sign both of them. Your signature is one of the ways to express a person’s will to establish, change or terminate rights and obligations. The signature serves as a kind of identification mark of persons, which allows you to identify and authenticate them. Set the date of filling in and check the correctness of the data several times.

Have a representative fill out the next part

The second section of this tax form applies to your representative. This individual may act on your behalf, sign documents and fill them out. A mandatory condition is the presence of a power of attorney from you. As a rule, a power of attorney requires notarization since this is the field of business relations. Enter the authorized person’s name, current phone number, fax number, and identification code. This individual must sign the corresponding line.

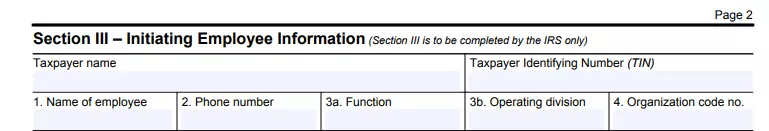

Input additional data

The final section of the tax return falls under the jurisdiction of the Internal Revenue Service. Only specialists of this structure fill out this section of the application. Here you need to specify:

- First and last name

- Phone number

- Purpose of using the form (examination, verification, data collection)

- Organization and division code

- Operating department number

Further, the form contains information about how the need for a law office appeared. Enter the date of receipt of this request from the taxpayer and select the appropriate option to satisfy this request. In specific cases, everything is individual, so these lines are filled in considering the current problem.

Describe issues in detail

What else should I describe in this section? First of all, a step-by-step plan and specific steps for solving this request. If there is a reason or circumstance that prevented the taxpayer from solving the problem, describe it in detail. Finally, give a quick guide to the taxpayer on the economic difficulties that may arise. The task of this section is to view the problem from a different angle, from different positions. In conclusion, ask the taxpayer where he found the information about the law firm.