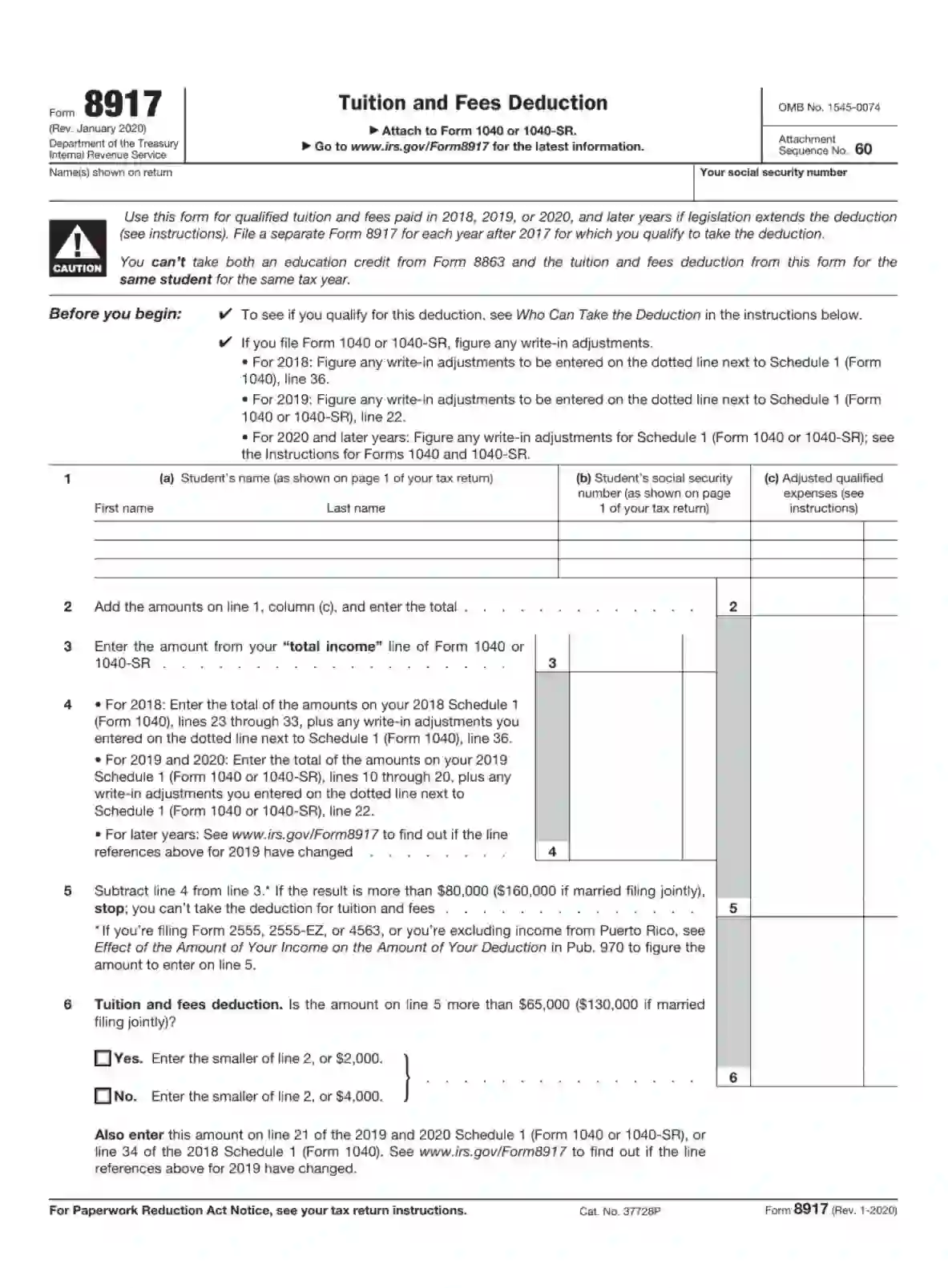

Form 8917 is a tax form used to calculate the tuition and fee deduction. This deduction allows taxpayers to reduce their taxable income by up to $4,000 for qualified education expenses paid for themselves, a spouse, or a dependent. The form determines the allowable amount of the deduction based on the education expenses incurred during the tax year. It helps taxpayers not claim education credits to benefit from their education-related expenses.

By using Form 8917, eligible taxpayers can lower their taxable income, thus potentially reducing their overall tax liability. This form is particularly beneficial for students or parents who are paying for college or other post-secondary education and are looking for tax relief.

How To Fill Out IRS Form 8917

Thus form consists of one page, but it is impossible to fill it out without additional forms. Firstly, you should complete your main tax return as you will have to copy some data from it to IRS Form 8917. We will explain to you which particular lines you should refer to and what you should include in this form. Besides, we offer you our building service on our website that will fill out your form without mistakes.

Provide personal data

Write in your name and SSN into boxes on the top of the form. Make sure this data corresponds to information in your tax return.

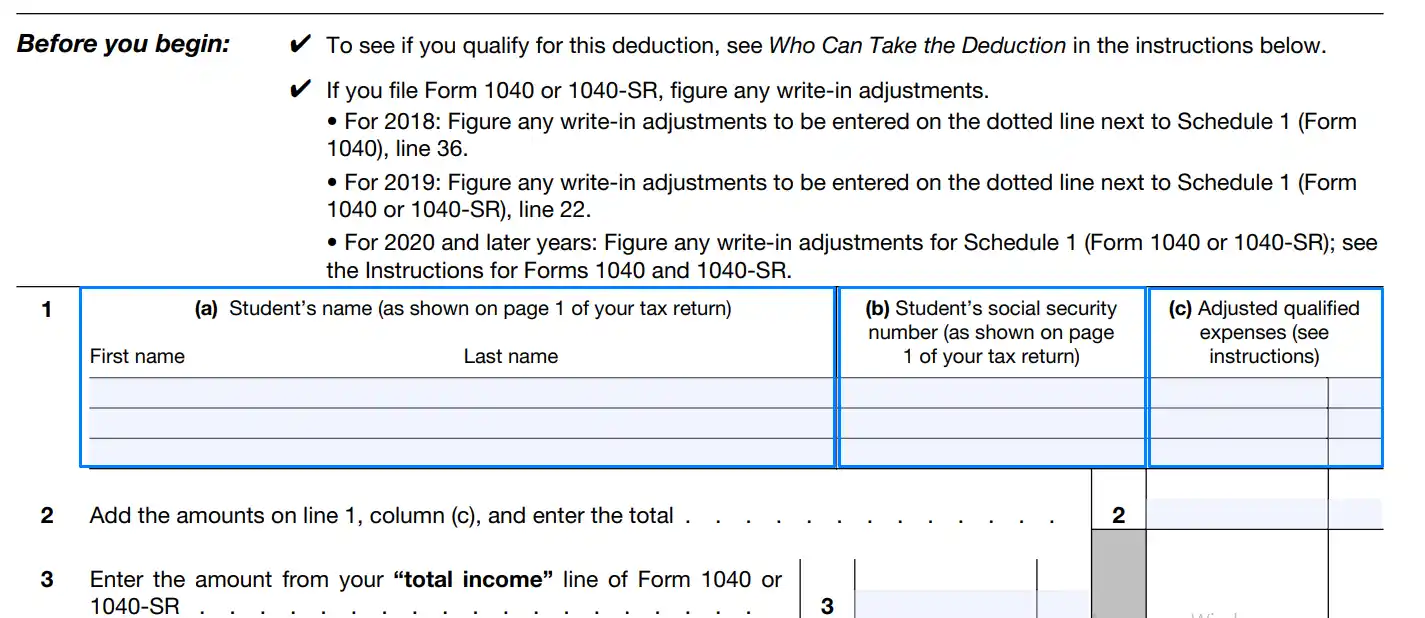

Introduce student(s)

Fill the table with the full name of the student, his or her social security number, and the amount of adjusted qualified expenses. The first two columns should be filled similarly as this data is written in the tax return. As regards qualified expenses, it is a group of payments that were necessary to pay to the qualified university. It can be a fee for education, purchase of books in the university, and other types of purchases. However, you should not include tax-free charges in this form. Tax-free educational assistance is services that are not taxable, for example, some scholarships, education paid by the employee, education followed by a veterans program, and other programs that are not paid from your gross income.

If you have to fill the form for more than three students, you should fill out an additional form and attach it to the first one. Do not forget to enter “See attached” in line 1 in this case and to include values from the third column into the sum of expenses for all students in line 2.

Summarize expenses

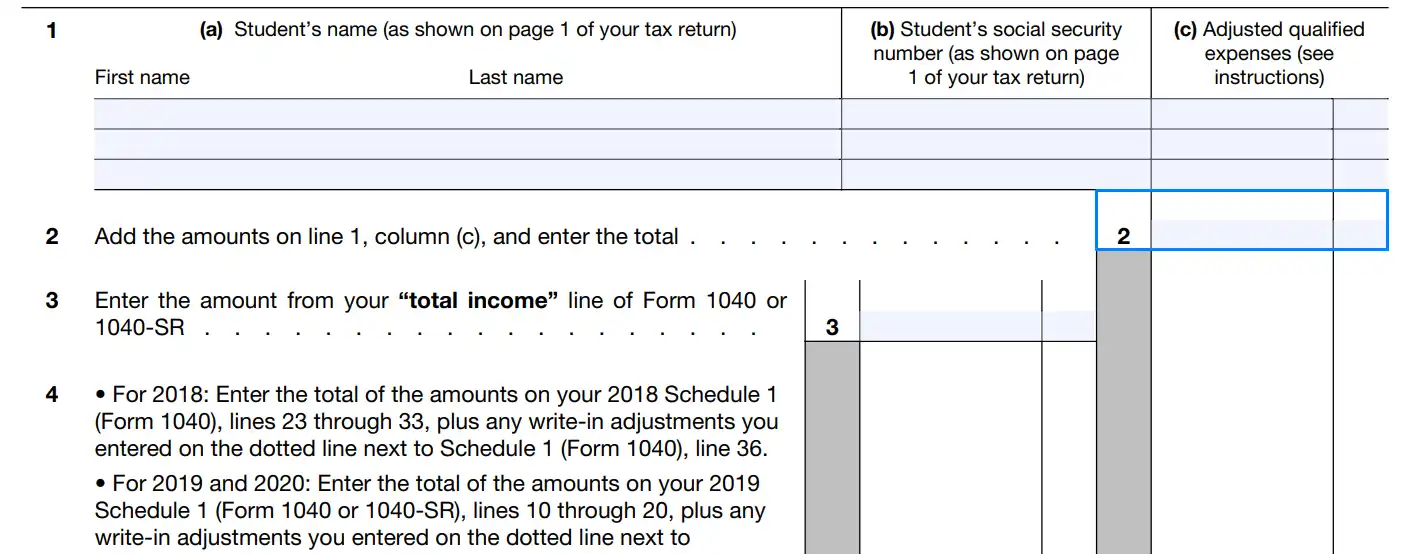

Sum up qualified expenses for all students introduced before and put the result in line 2.

Describe your total income

Use IRS Form 1040 to copy your total income and enter it in line 3 of this form.

Provide data from IRS Form 1040

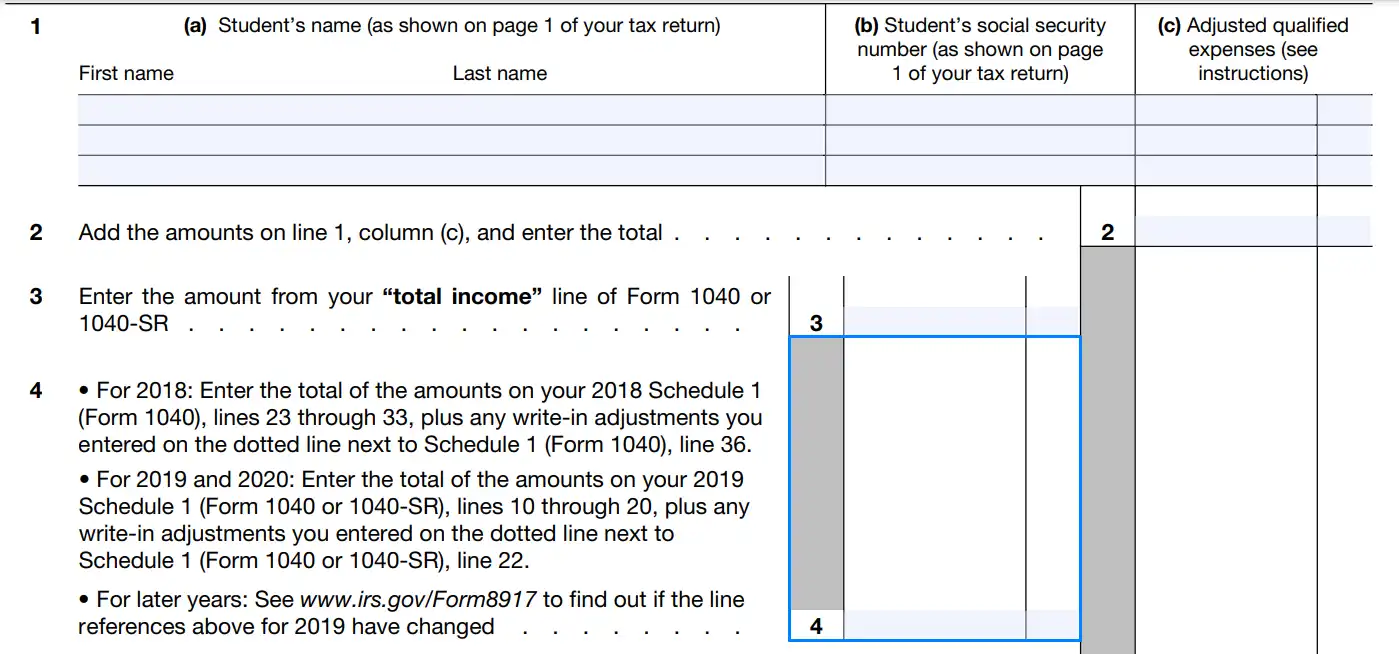

You should refer to form 1040 again to complete line 4 of this form. You need to use appropriate lines from another form based on the year when you paid for education.

- If you want to get the deduction for the 2018 year, you should sum up lines 23-33 from Schedule A of Form 1040 and add adjustments from line 36.

- If you fill out the form for 2019 or 2020, you need to sum up lines 10-20 of the same form and add adjustments from line 22.

- If you use this form for years after 2020, you should check whether the form has been changed or not.

Enter the result that you have computed in line 4 of Form 8917.

Make calculations

You should subtract the value in line 4 from the value in line 3 and enter the result in line 5. Make sure the result is less than $80,000 for personal tax return and $160,000 for joint tax return. If the number is bigger than these values, you cannot have deductions for educational expenses.

Select amount of deduction

If the result in line 5 is bigger than $65,000 or $130,000 for a joint return, you should put a checkmark in the box “Yes,” then select the number that is bigger among line 2 and $2,000, and write it in line 6.

If what is put in line 5 is smaller than this amount, you should put the biggest value among line 2 or $4,000 in line 6 and check the box “No.”

Do not forget to fill the result from line 6 to line 21 in Schedule 1 IRS Form 1040 (2020 or 2019) or line 34 of the same form (2018).

So, the form is easy to complete, as you may see, and it will not take much time to file it. Do not miss an opportunity to receive a deduction for educational expenses because there is not much paperwork to do.

Remember that you need to file a different form for every tax year, even if the academic period lasted for several years. Also, you should not file this form separately from your tax return — just attach IRS Form 8917 to IRS Form 1040 to confirm the legality of requested deductions.