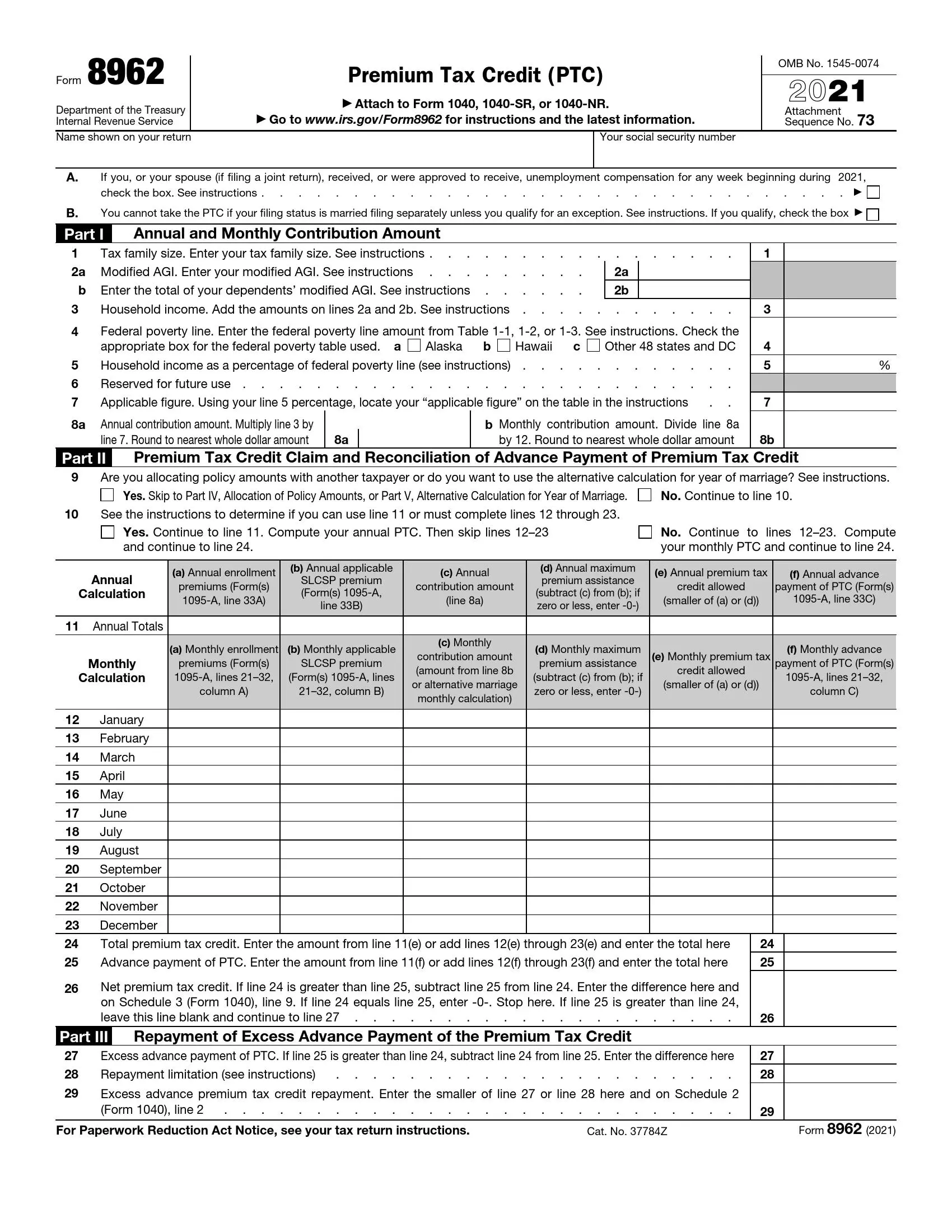

IRS Form 8962, titled “Premium Tax Credit (PTC),” is a form used by taxpayers to calculate the premium tax credit they are eligible to receive if they purchase health insurance through the Health Insurance Marketplace. This form is necessary for individuals claiming the premium tax credit or who need to reconcile any advance payment of the premium tax credit (APTC) made on their behalf to their health insurance providers. The PTC is a refundable credit that helps make purchasing health insurance more affordable for individuals with moderate incomes.

The purpose of Form 8962 is to ensure that taxpayers receive the correct amount of premium tax credit based on their actual income and family size compared to the estimates provided when they enrolled in an insurance plan through the Marketplace. Suppose the advance payments of the credit that the Marketplace paid to the insurance provider exceed the actual premium tax credit calculation. In that case, taxpayers must repay the excess with their tax return. Conversely, they can claim the difference on their tax return if the advance payments were less than the credit they qualify for.

Filling Out the Form

You may opt for filling out the document either electronically or on paper. You are recommended to use form-building software to obtain a personalized IRS Form 8962.

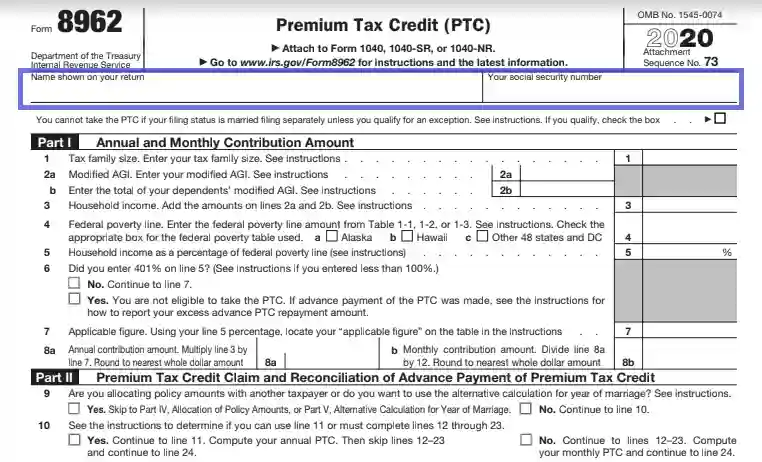

- Input Essential Information

Begin completing the lines with your full name, reproduced exactly as in the tax return. Those individuals who are filing together with their spouse should enter the name that appears on their tax return.

The same requirement is relevant for your SS number that must be indicated thereafter.

Notice: if you have been victimized by domestic violence or are experiencing spousal abandonment, you may wish to file a joint return under special conditions. Check the slot to indicate you qualify for benefits.

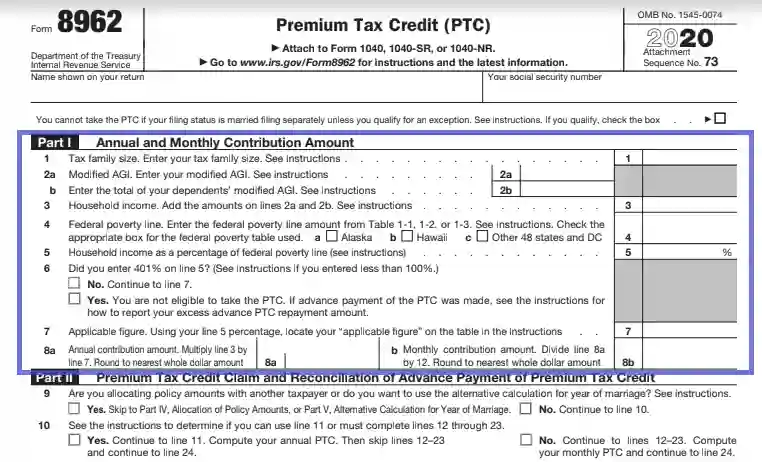

- Calculate Your Annual and Monthly Contribution Amount

Insert the number of persons in your family who are using the tax return first, including the dependents. Secondly, indicate your and the dependents’ adjusted gross income separately, and provide the summarized number.

After that, check the box determining the state where you reside (which will automatically provide information about your state poverty line) and compute your household income as a percentage of the federal poverty line.

If the number you have entered does not appear to be bigger than 400%, proceed to write down the applicable figure (depending on the percentage you have mentioned on Line 5 in the form). Finally, you will be required to count the eventual contribution amounts, rounded to the nearest even dollar.

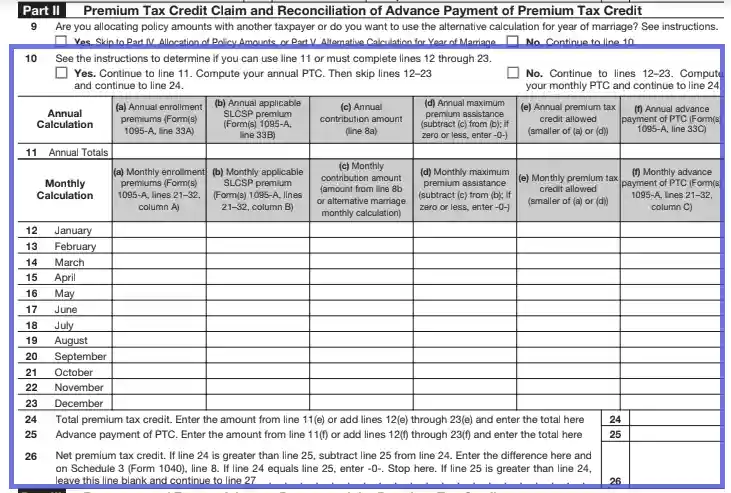

- Claim the PTC and Reconciliation of the APTC

Line 9 is dedicated to determining whether you need to allocate policy amounts with another individual or wish to use the alternative calculation for the year of marriage, or neither of these.

Depending on whether you are able to represent only annual PTC or are required to provide information about your monthly calculations, check the “yes” or “no” box, complete the related lines, and enter the total PTC followed by the advance payment. If the first number is greater than the second, calculate the difference and insert the result on the Net PTC line.

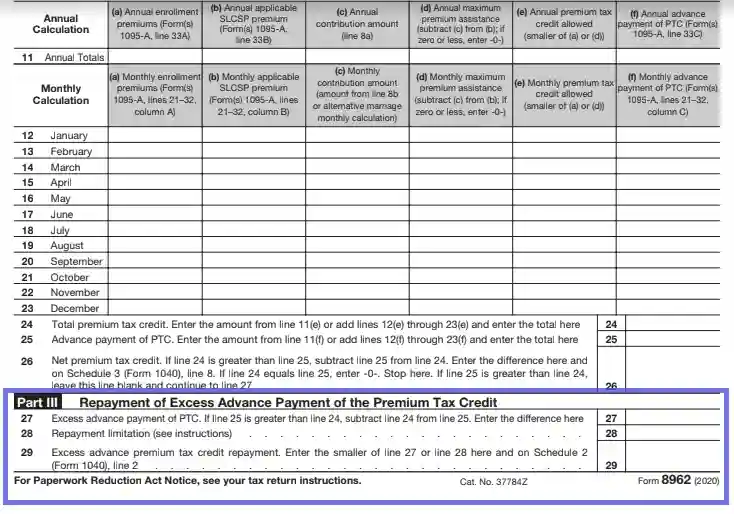

- Indicate the Repayment of the APTC Info

In this part, you will have to indicate the sum of your APTC compensation. If the number you have provided on Line 25 appears to be greater than the one on Line 24, calculate the subtracted number and fill it in on Line 27.

Consider that the excess APTC may be limited, and check the Instructions to find out whether repayment limitations apply to you or not. If you have completed both Lines 28 and 29, provide the smaller number of these two on the Excess APTC repayment line.

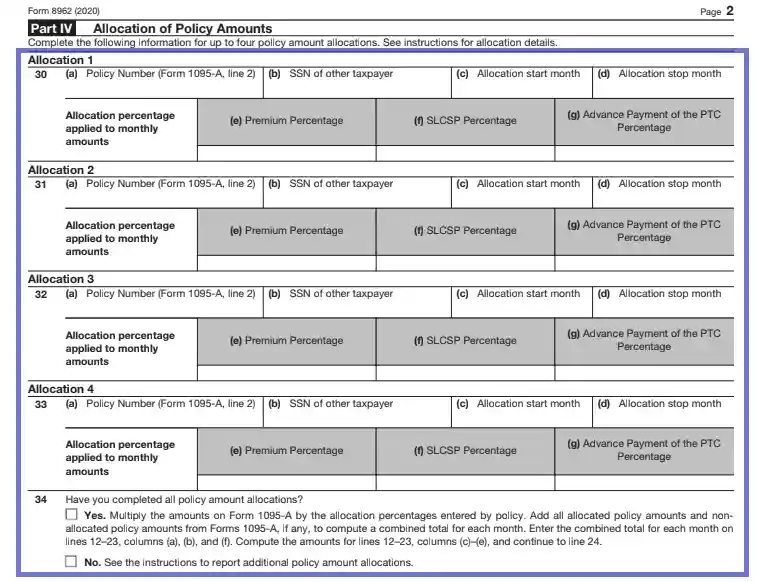

- Allocate the Policy Amounts

Before you proceed to complete Part 4, recheck whether you are required to do it. If yes, choose the allocations you are about to fill out. The situations involve the following:

- divorce or official break-up in 2020

- filing separate returns by a married couple at the end of the tax year

- no APTC, and having the policy divided between two tax families.

If you have entered information about all the situations mentioned, it is required to count the total sum and report it in the form. Otherwise, check the “No” box.

- Complete the Alternative Calculation for the Prenuptial Months

Those taxpayers who have opted for completing Part 5 should provide their and the spouse’s SSNs, alternative family size, monthly contribution amount, alternative start month, and alternative stop month. The start month of you or your spouse should match the first month on Line 12.