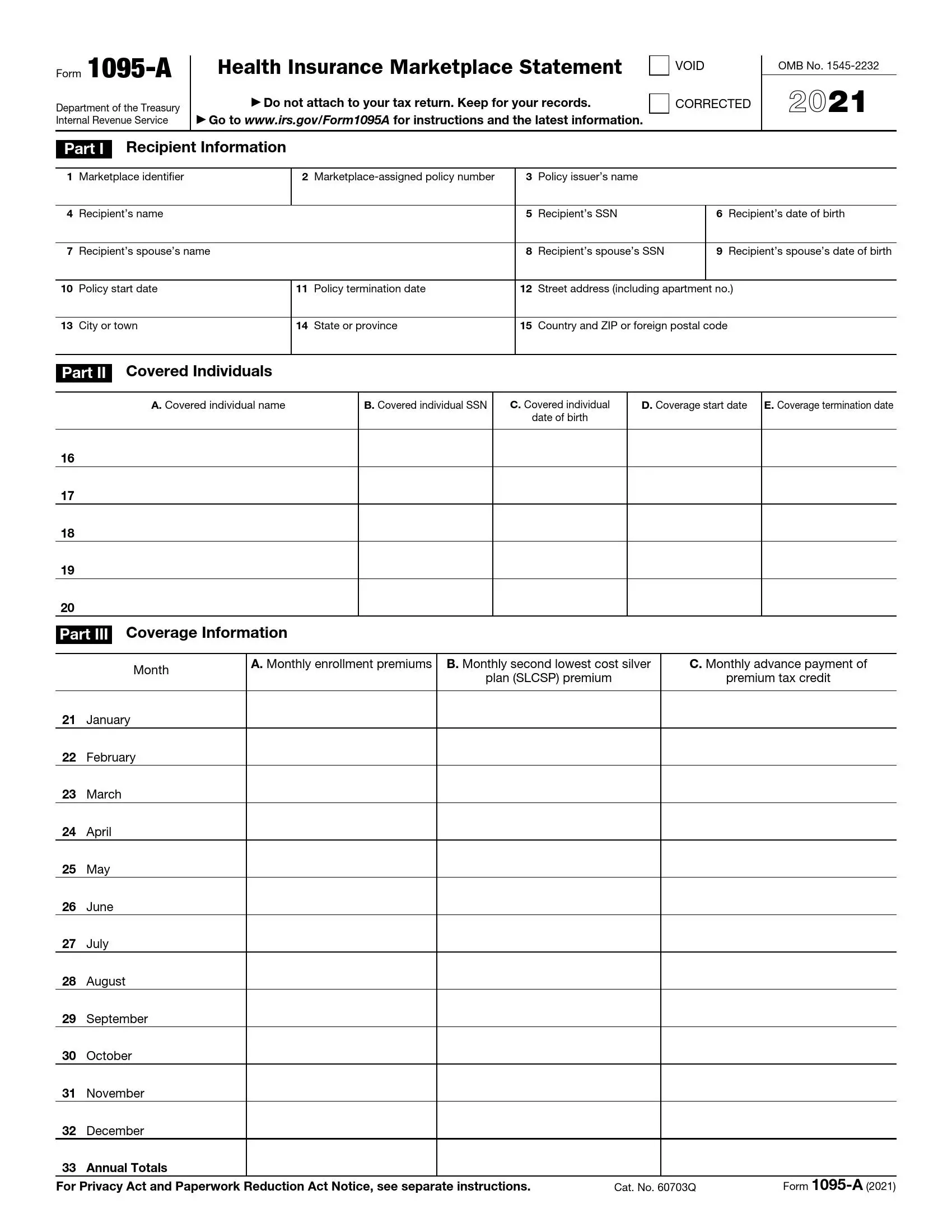

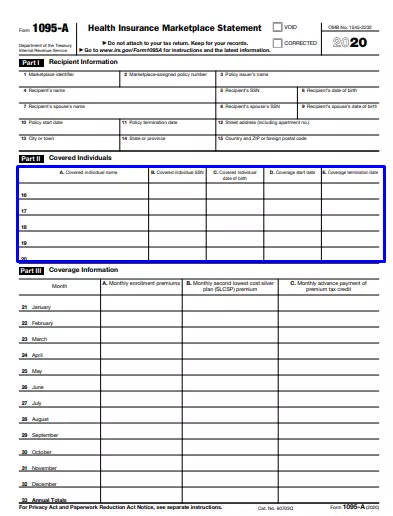

Form 1095-A is a tax form sent to individuals who purchase health insurance through the Health Insurance Marketplace, part of the system set up by the Affordable Care Act (ACA). The form contains information about the health insurance coverage, including the start and end dates of the coverage, the premiums paid, and any advanced premium tax credits received. Form 1095-A is crucial for individuals as it provides the necessary details to support the reconciliation of these credits on their tax returns and other parts related to health insurance coverage.

The primary purpose of Form 1095-A, titled “Health Insurance Marketplace Statement,” is to assist taxpayers in accurately reporting their health insurance information on their federal tax return. It includes adjusting any tax credits they are eligible for based on their income and actual premiums paid throughout the year. Taxpayers use the information from Form 1095-A to fill out Form 8962, “Premium Tax Credit (PTC),” which is used to calculate the premium tax credit or to reconcile any advance payments of the premium tax credit with the actual premium tax credit they qualify for. Thus, Form 1095-A is essential for ensuring that individuals properly claim the correct amount of tax credits or repay any excess advance payments, maintaining compliance with tax laws regarding health coverage.

Other IRS Forms for Individuals

In our collection, there are IRS forms for different taxpayers and life situations. Read what other forms you might need to file as an individual taxpayer.

How to Complete Form 1095-A

The whole form is divided into three sections, and each of them requires different information from the filer. So, when filling in the first part named “Recipient information,” you need to complete 15 empty fields. Here are step-to-step guidelines for filling out the Part I section:

Indicate Your State Jurisdiction

In the first line, fill in the data about the state where you have currently registered and Marketplace coverage info.

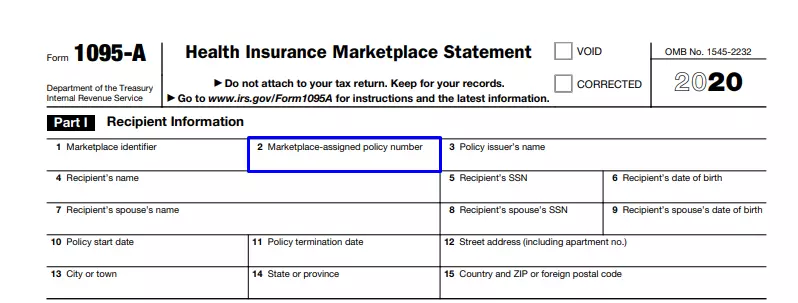

Enter Policy Number

In the second line, the applicant needs to identify the policy number they are currently enrolled in.

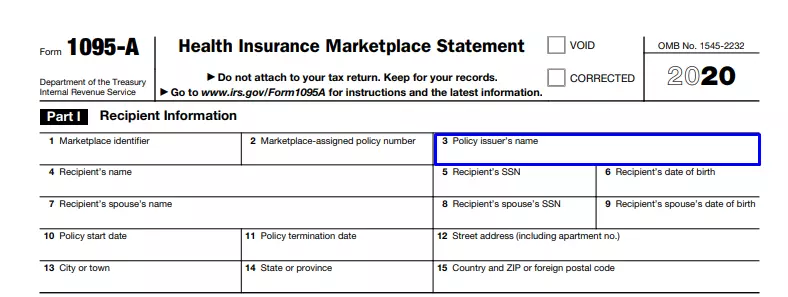

Identify Your Insurance Company

Write down the name of your insurance company to the next field.

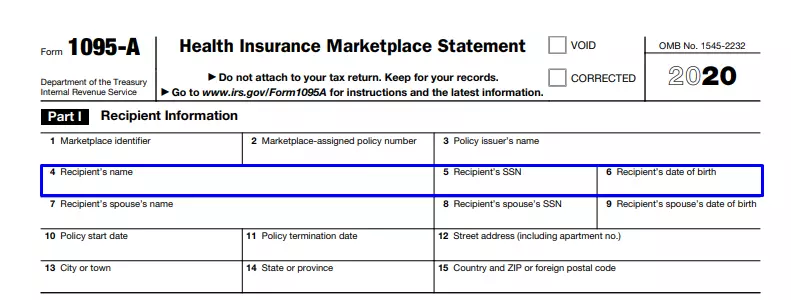

Provide Personal Data

Enter your personal data in lines 4 through 6. Ensure to fill in your own name and Social Security Number in the corresponding blank fields. Fill in the date of the birth in the fifth line if it is empty. If you are the recipient, it is because the Marketplace identified you during the enrollment process, and now you are considered to file the tax return records.

Provide the Spouse’s Personal Info

Fill in lines number 7, 8, and 9 out the same way but with respect to your spouse’s data.

Enter the Policy’s Effective Period

In fields number 10 and 11, you should indicate the start and the end policy dates.

Fill In Your Current Physical Address

Enter your full address in fields 12 through 15, including the name of your city, state, add ZIP.

Fill In the Second Section

The second section is called Covered individuals, and it consists of a 5×5 table that you are considered to complete.

Columns A through E requires filling out certain personal data of the applicant. In the mentioned sections, you should cover the individual name, SSN, date of birth, and the respective program coverage, as well as the program’s beginning and termination date, respectively. Ensure to fill out the info in the corresponding boxes.

Next up, you should also include your spouse’s info (if you have one). Please note that column C is supposed to be filled only if column B is empty. Fill out columns D and E based on the coverage beginning and termination date (only if the medical plan coverage had stopped during the previous financial year). Otherwise, if the coverage was in effect throughout the year, then indicate the last day of coverage – December 31, 2020.

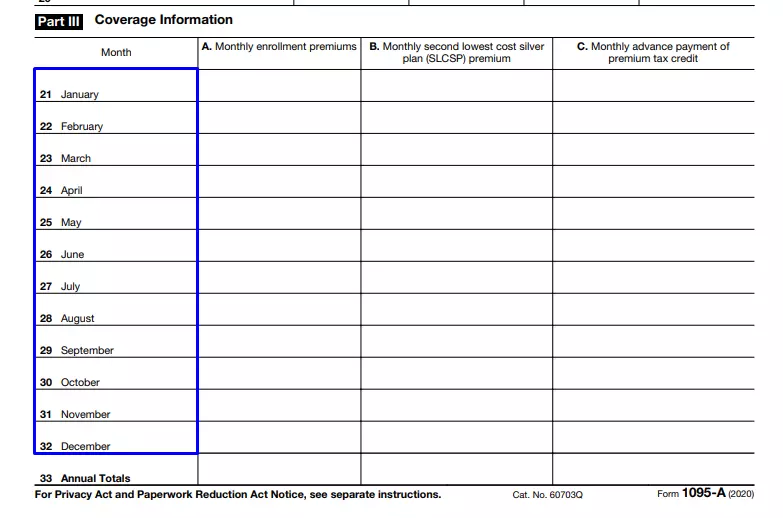

The third part (and the last) is devoted to the coverage information, and there is yet another table you need to fill out.

The table has 13 Rows, 12 of which are headed with the respective months’ names, and the last one is called “Annual Totals.”

For completing these rows, you should enter the coverage information for each month and summarize all the numbers in row 23.

Also, there are three columns A through C, which you need to fill in as well. In Column A, you should enter the total monthly enrollment premiums for the policy in which the covered individuals enrolled, including only the premiums for essential health benefits.

In Column B, write down the applied Second-Lowest-Cost Silver Plan (SLCSP) premiums to compute monthly advance credit payments.

Finally, for the last column, you need to insert the customer’s number of advance credit payments you do each month.