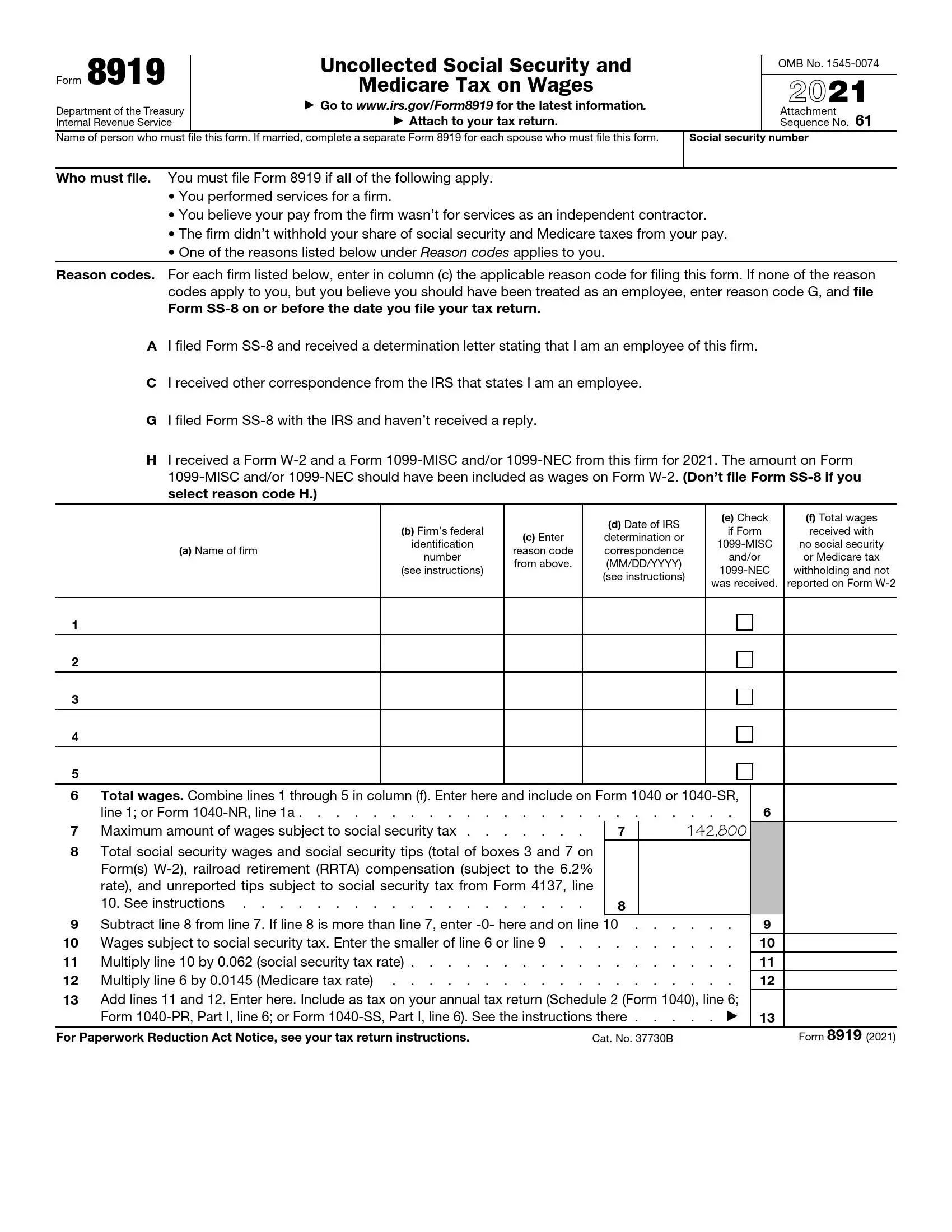

IRS Form 8919 is used by taxpayers who want to report and calculate uncollected Social Security and Medicare taxes because their wages are incorrectly treated as nonemployee compensation. This situation typically arises when an individual’s employer has classified them as independent contractors rather than employees, and consequently, the employer doesn’t withhold the appropriate taxes. The form includes several codes to specify the reason for filing:

- Reason code A: You filed Form SS-8, and the IRS determined you were an employee.

- Reason code B: Your employer did not file a Form W-2, and you have a reasonable basis to believe you are an employee.

- Other codes correspond to various specific situations outlined by the IRS.

By using Form 8919, individuals ensure that only their share of Social Security and Medicare taxes is paid, helping to correct their tax records with the IRS. This form also helps the IRS track employers who may be misclassifying employees to avoid paying their portion of payroll taxes.

How to Fill Out Form 8919

Sometimes it is really hard to fill out all of the legal forms as the language of the legal documents is indeed complex and sometimes not even understandable. To resolve any problems connected with legal forms completion, you can utilize our new document-building software that will build a form for you. Form 8919 is not an exception. Just follow some simple guidelines below to ensure the best result:

Identify yourself

The first step is to enter the full name of the person who writes out and files this form. In case the person who files the form is married, their spouse must complete a separate application in case they, as well, need to file the form;

Input Social Security Info

On the right side of the page, make sure to fill out your personal Social Security Number;

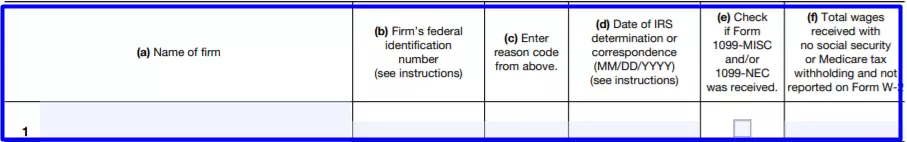

Complete the table in the next step:

- In column ‘a’, write out the name of the organization you worked at;

- In column ‘b,’ fill out the federal identification number of the company (its also called EIN, FTIN, or FEIN);

- In column ‘c,’ one will have to fill out the Reason Code. All of them were listed above in the application. If none code suits you, but you claim that you should have been thought of as an employee, enter the Reason Code ‘G’ and file Form SS-8 on or before the tax filing date;

- In column ‘d’, one must incorporate the date of Internal Revenue Service determination or correspondence. make sure to enter the date in a required format;

- In column ‘e’ mark if the forms 1099-MISC or 1099-NEC, or both of them were received;

- In column ‘f,’ you must include information such as the total salary received without withholding Social Security or Medicare taxes and not reflected in Form W-2.

Provide additional data

In line 6, combine everything from line 1 to line 5 in column ‘f’ and enter the sum in the spare space;

Define wages

In line 8, one must write out the full social security wages and social security tips (sum of boxes 3 and 7 on W-2), RRTA compensation (subject to the 6.2% rate), and unreported tips subject to social security tax from Form 4137, line 10;

Do subtraction

In line 9, fill out the spare space. You just have to subtract line 8 from line 7. If line 8 is more than line 7, enter ‘0’ here and on line 10 as well;

Fill out social security tax wages

In line 10, fill out the wage subjected to social security tax. Enter the smallest amount of line 6 or line 9;

Do multiplication

In line 11, you should put the product of multiplication of the sum of line 10 by 0.062 (this is a social security tax rate);

Continue

In line 12, you must put the product of multiplication of the sum of line 6 by 0.0145 (this is a Medicare tax rate);

Complete the form

In line 13, one must add line 11 to line 12 and put the result in the spare space.

As you see, it is really easy to mix up something in Form 8919, so make sure to read the instructions provided on the form and read the guidelines provided above.