IRS Form 656-B is a document titled “Offer in Compromise Booklet.” This booklet provides detailed instructions and information for taxpayers who wish to submit an Offer in Compromise (OIC) to the Internal Revenue Service (IRS).

Form 656-B guides taxpayers through submitting an Offer in Compromise, a formal request to settle their tax debt for less than the full amount owed. The booklet contains information on eligibility requirements, instructions for completing the necessary forms, and details on the various payment options available to taxpayers. It also includes essential information about the potential consequences of submitting an OIC and tips for avoiding common mistakes during the application process. Overall, Form 656-B is a comprehensive resource for taxpayers seeking to resolve their tax debt through the Offer in Compromise program.

Instructions For This Application

We remind you that before filling out the form, be sure to collect all the information about your solvency, tax debts, interest, and penalties. It will allow you to focus on the main thing and fill out the document correctly. Sign and send to the appropriate address. As a rule, the decision is already made by the Tax Service, and if it approves the application, you will receive a notification.

1. Basic Information

The first section of the form asks for data about you. Enter your first and last name, residential address, and current contacts. Also, write your social security number, contact email address. Put a checkmark in the appropriate place in the status column. Do not forget to enter the employee identification number. It is the official code of your organization.

Below is also a table about other relatives and close associates. You may not complete these lines. But if something happens, these contacts will allow you to solve problems or contact you.

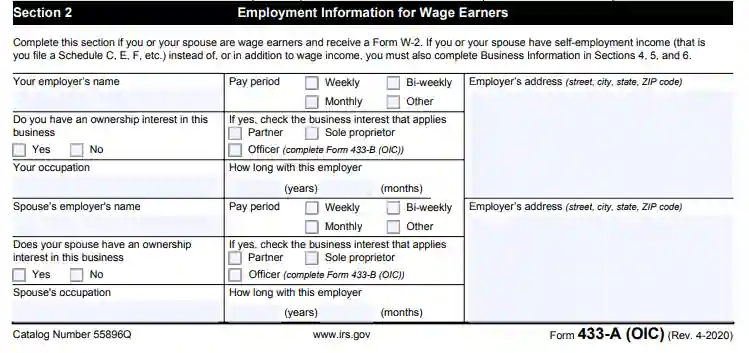

You must complete the following section if you are an employee. In this context, the presence of business income is the reason for filling in these lines. This information is not only about you but also about your spouse. Follow the step-by-step instructions and specify all the business information. By the way, you may use our form-building software.

2. Assets And Finance

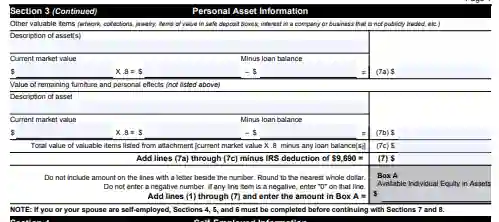

This official agreement and the form itself include data on current finances, debts, and expenses. Use the most recent bank statements (checks, savings accounts, money transfers) to fill out these items. You can also write about the availability of bonds, certificates, and shares. After filling in the form, check the information you entered several times to avoid mathematical errors.

The same goes for business information. You also fill in the necessary items but already take into account your income. If you are submitting a report on current expenses and profits, enter your total gross monthly income.

The IRS requests the full amount of information about any profit. Do not hide it, and do not neglect your opportunity to get approval.

3. Additional Form

Thus, you will gradually fill out the 433-A form if you are an individual or an individual entrepreneur with a low income. On the other hand, you may fill out the form 433-B. This document is for business owners, corporations, and large companies. You do not need to fill out two applications, as you only need to select one. In general, this application is identical to the first one. The only difference is in the conditions.

Check all the information about your business, including the identification number. Unfortunately, false data is the main reason for rejecting the application. It is in your best interest to provide a systematic overview of bank accounts, statements, and repaid taxes. After filling out this document, go to form 656-B itself.

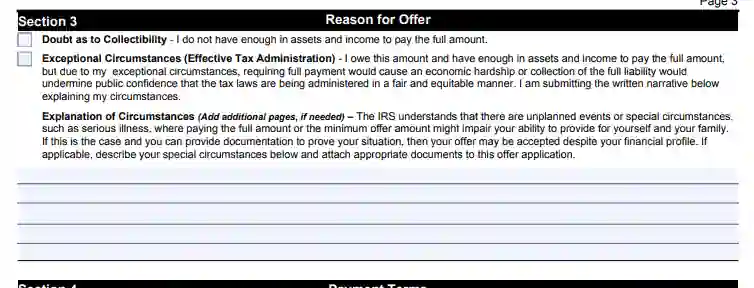

4. Tax Periods And Explanation

As noted earlier, any official tax document contains information about tax periods. Select the type of tax, tax periods, and returns provided in the application. If you suddenly do not have enough space to fill in, attach additional sheets with a description. A prerequisite for filling in the form is an explanation of the request for a compromise proposal. If you specify exceptional circumstances, attach a statement.

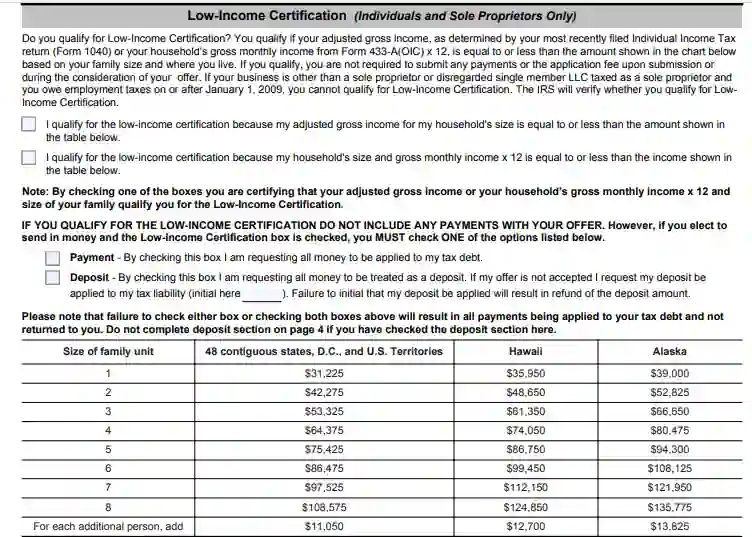

5. Low Income

The section on low incomes is filled in only by individuals. You initially assess the situation of your family, monthly incomes, and expenses. It will accurately determine whether you are eligible for a low-income certificate. If you are approved of such a document, you may not pay the service fee.

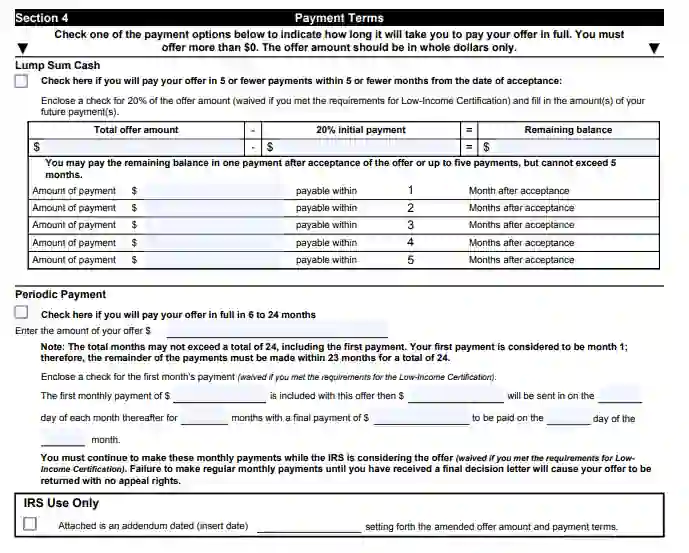

As for the payment terms, the methods are listed above. If you have any difficulties, use our form-building software.

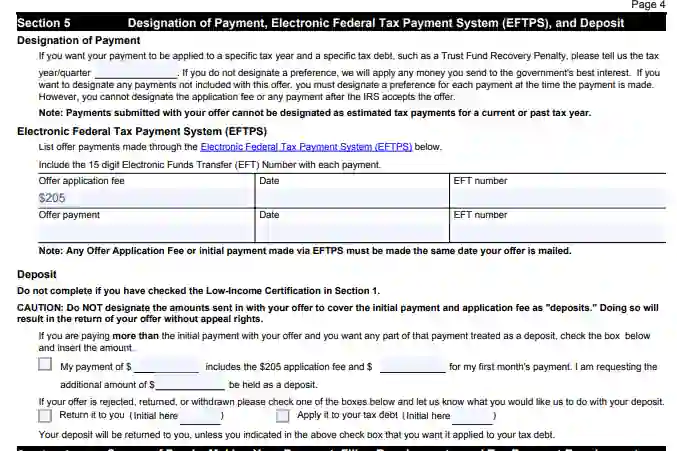

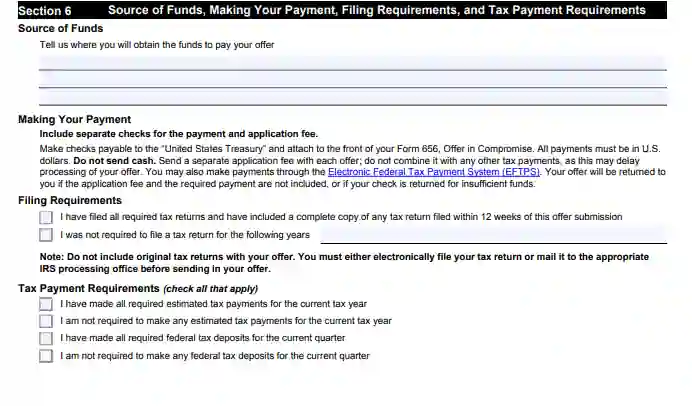

6. Initial Payment And Source Of Fund

This section of the form is optional. You may include a payment applied to a specific tax debt for a year. Note that it is not possible to pay off the debt in full immediately. In the section on financing, you should describe the source of the funds to pay your tax debt. Don’t forget to sign the document and put down the dates. After that, send all the forms to the Tax Service at the address.

7. Term Of This Agreement

It is no secret that the submission of official documents to the authorities is a lengthy procedure. You must not only find time to fill out the form but also carefully read the terms of the offer. At the very end of this form, the relevant requirements and your responsibilities are presented. Do not neglect this, as you are responsible for the signed document. Not knowing the fundament of the agreement does not relieve you of your responsibilities. There have been many cases when business owners unknowingly found themselves in terrible situations. Late payments lead to fines and even the seizure of property. We believe that no one needs such an outcome. Therefore, we strongly recommend that you read the terms of the agreement.

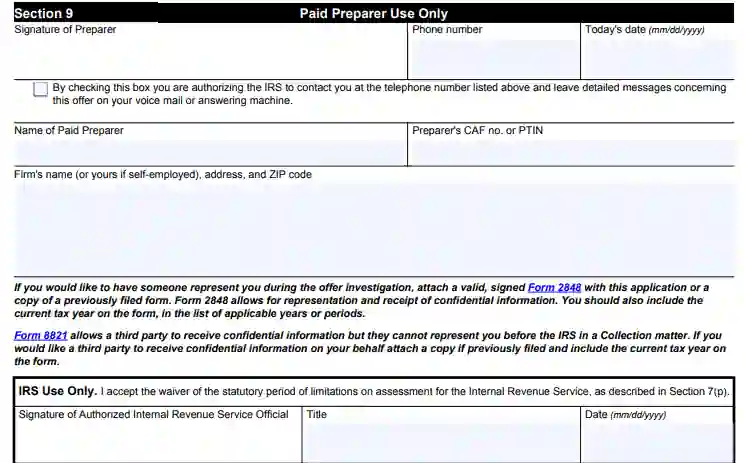

8. Paid Preparer

Not every taxpayer needs to fill in these columns. If you use the paid preparer help, this person fills out the section and signs it themselves. The authorized person shall indicate the full name, residential address, and telephone number. You must also specify a code for identification. If you do not use such help, leave the section empty.

What else do you need to remember? Submit the form on time, without delay. Unfortunately, the Tax Service has its schedule for accepting documents, and if you do not have time, your application will not be considered. Take into account the above data to quickly fill out all the legal papers and continue your business with a clear conscience. Your task is to pay off all your debts as quickly as possible and increase your profit.