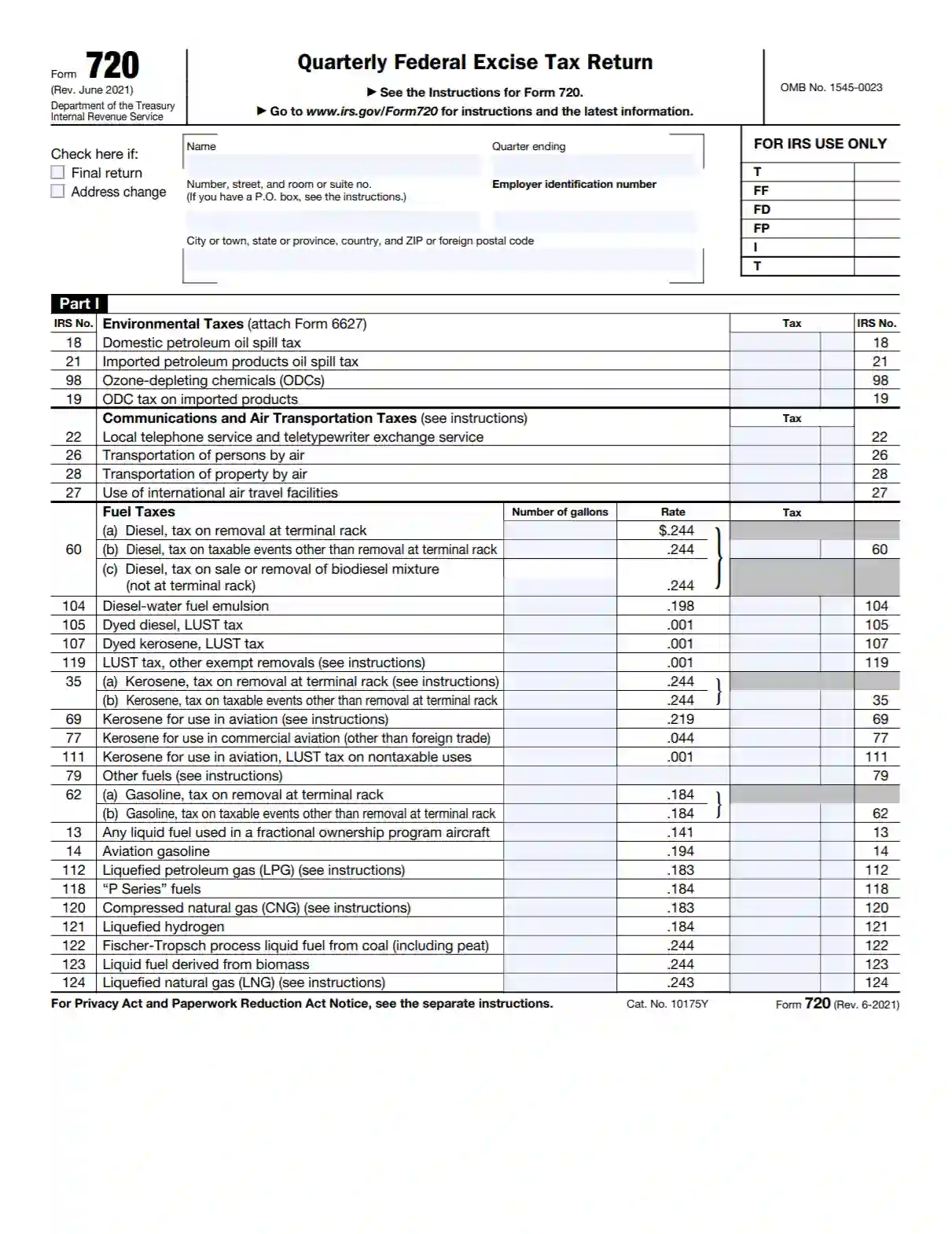

IRS Form 720 is a document used to report and pay the federal excise taxes on specific goods, services, and activities. This quarterly form is utilized by businesses that manufacture or sell certain products, operate particular types of businesses, or use various equipment, facilities, or products subject to federal excise tax. Examples include environmental taxes, communication and air transportation taxes, and fuel taxes.

The purpose of Form 720 is to collect taxes that are then used to fund specific federal programs. For example, taxes collected on fuel help fund highway maintenance and construction. Filing this form accurately and on time is crucial for businesses to ensure compliance with federal tax regulations and avoid penalties and interest for late or incorrect filings.

Other IRS Forms for Individuals

If your business trades certain goods, you have to file the Form 720 with the IRS, but there are plenty of other IRS forms businesses need to use to report financial information with the IRS. Make sure you are familiar with all of them.

Instructions For This Form

Before sending the application, check the correctness of the entered data several times. Enter exact mathematical sums so that you don’t make mistakes.

1. Basic Information

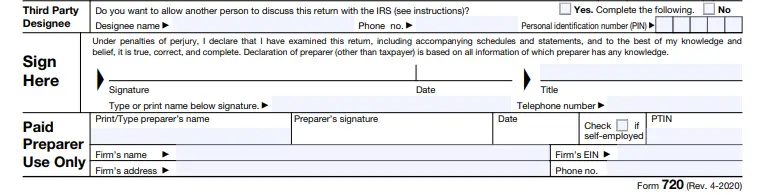

Any official tax document contains information about you. Enter your first and last name, address, and end date of the quarter of the year. If for, some reason, the address has changed, check the corresponding field in the form. We also recommend that you specify the mailbox if suddenly the postal service will not be able to deliver the documents.

Next, enter your organization’s identification number (EIN). This code is assigned to all companies in the United States to simplify filling out blanks and maintaining tax records. If you do not have this number yet, apply online for it. If you are authorized to conduct business on behalf of the company and pay tax excise taxes, sign the form. It is a mandatory condition when submitting documents. Otherwise, the authorities won’t accept them.

You also have the right to grant access to a third party to provide information or fill out a form. In this case, in the “Authorized Third Party” field, specify their name, the phone number, and any five digits for that person’s PIN. Check the box ” Yes ” if you agree with this. What does it mean? This person may share information with official state authorities, answer any questions. If in the future you want to remove these obligations from the designated person, send an application.

By the way, there is another rule regarding the preparation of the application. If you fill out the documents with the help of a paid preparer, specify it. This authorized person signs the application in this case and provides you with a copy. They must also provide the taxpayer identification number, their full name, and address.

2. Types Of Taxes

The first part describes the types of excise taxes. The first lines relate to environmental taxes. Since some products are dangerous to the environment, taxes are levied on them in the United States. For instance, it provides for liability for oil spills and taxes on ozone-depleting chemicals and toxins. You are also required to pay communication taxes. It is usually three percent of the total amount paid for the local connection. Besides, you may request a loan or even a refund if you have previously paid taxes.

This form also includes taxes on air transportation (transportation of people and their property). Enter a specific amount by using the column. For not paying taxes, you run the risk of receiving punitive penalties and non-tax collectors.

The most extensive section on excise taxes is the fuel items. So, there are several rules for paying taxes on these products. If this is your first time filing a gallon fuel tax return, you may need to complete your first taxpayer report. What actions do you need to perform to do this?

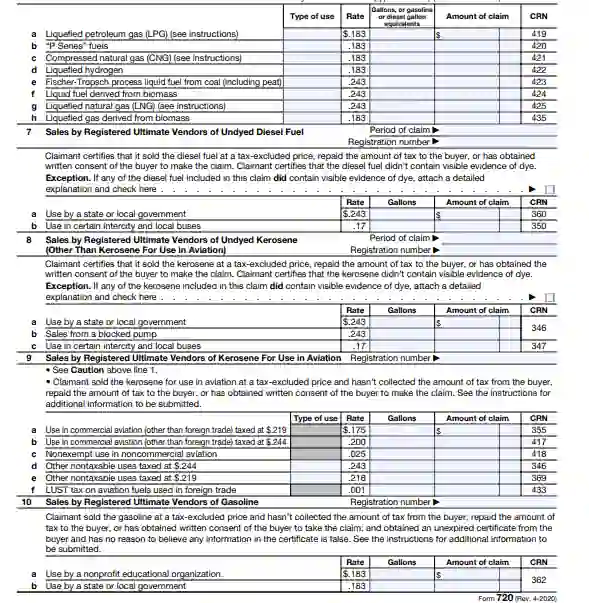

- send the buyer a copy of this report

- submit a tax report on this form for a specific quarter

- write the phrase “Excise tax and the first taxpayer report” on top of the copy and send the documents

Calculate all the tax payments and fill in the lines. These are mainly taxes on kerosene, gasoline, explosive materials, and natural gas. By the way, kerosene is quite common in this form. As a rule, the tax on it when used in aviation is $ 0,244 per gallon, and if in non-commercial aviation, then $ 0,219. In general, pay attention to these taxes because the different scope of application determines different amounts. There is a column about taxes on other types of fuel. Remember, you are responsible for the payouts, so use each column to fill in and count the gallons. There is an income tax applied to any other taxes levied on the import or export of fuel. However, not everything is so simple. If this type of tax is imposed, the following taxes do not apply:

- Tax on air transportation of people and property

- Use of international air transportation facilities

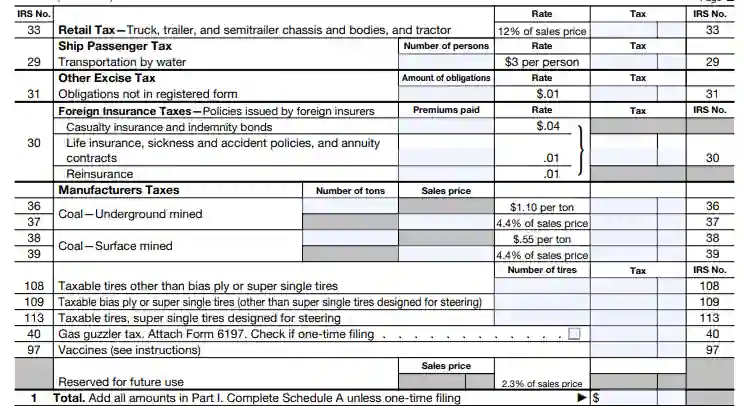

The next tax excise tax is retail. This item includes goods such as chassis, tractors, truck parts, and trailers. In total, the tax is equal to 12 percent of the sale price at the first retail sale. As for the taxation on passenger ships and other excise taxes, you also fill in the amounts in the columns. The first type of tax is levied on the owners of commercial vessels. The amount is three dollars per passenger. There are two mandatory conditions for this: the duration of the trip is more than a day, and the number of passengers is more than seventeen. Also, fill in the items about foreign taxes on insurance and manufacturers.

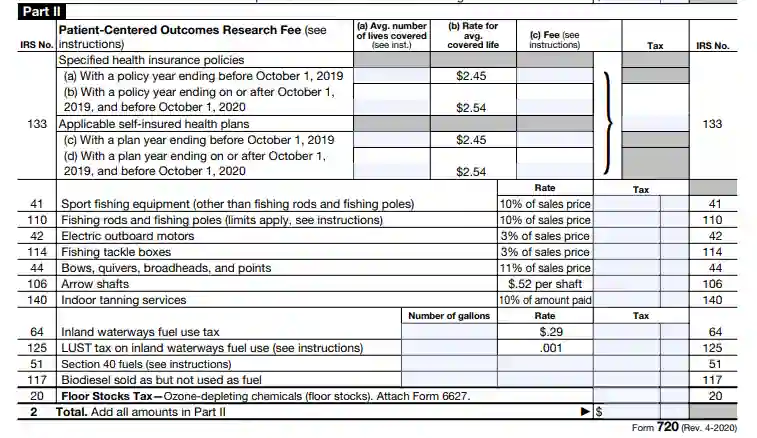

3. Research Results

What do I need to know about this part of the form? The fact is that there is a fee for research results (PCOR). This amount is usually charged to health insurance policy issuers as well as sponsors. In this form, just the same, there are points for filling in these fees. Use one of the options for calculating the average number of lives on the policy year:

- actual count

- snapshot

- method member months or state form

Adding up the numbers for the specified health insurance policies and self-insurance plans, write down the amount received in column 133. This section applies taxes on fishing rods, electric motors, fishing accessories, blades, and tools. At the end of the second part, write down the final amount of all the above taxes.

4. Final Amounts

The third part of the form is mainly concerned with mathematical calculations. Follow the above rules for filling in because these are the total amounts. Do not forget to sign the document after checking and filling in the application.

5. Significant Information

As noted earlier, this form is not simple. Next, you should fill in additional information about taxes related to your business activity. You must complete Section A if you have specified excise taxes in the first part above. Do not fill out this section if you have written taxes in the second part and a one-time filing of a fuel tax return. Fill in the first and second tables according to the permanent and alternative methods, respectively. In any case, add taxes for each quarter and enter the total amount in the corresponding line.

The two-way exchange of information (Section T) covers a wide range of excise taxes on various goods. A two-way exchange of information under this form means a mutually beneficial transaction between two persons. The person who carries fuel, and the person receiving it, shall pay taxes. In this regard, the following steps should be taken:

- transfer of the taxable goods

- the transaction takes place at the terminal under the control of authorized persons

- receipt of the operator’s report

- receipt of written documentation and information

Don’t forget to calculate the gallons and amounts correctly. If necessary, use our form-building software to save time and effort.

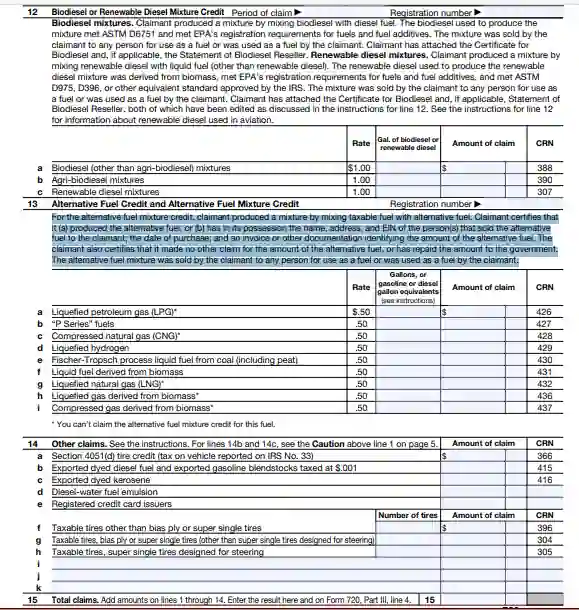

The final section is about claims. In this field, fill in all the necessary information, including dates. Unfortunately, if you make mathematical errors or provide false data, your application will be rejected. You do not need to use this section in the following cases:

- you do not take responsibility for the first two parts of the form

- you demand a refund of excise taxes or credit for federal tax

- you ask for a reduction in interest or a fine, or even for cancellation

All the columns and tables are identical for taxes on different types of goods. Some products are not subject to excise taxes:

- goods for agricultural purposes

- off-road commercial use

- intercity and local buses

- foreign trade

- for diesel fuel and kerosene

- for commercial fishing

- in the military and commercial aviation

Regarding claims, only one claim can be submitted for each quarter until April 30. Usually, the amount is at least $ 750.

6. Other Issues

By the way, carefully read the positions on biodiesel fuel. This mixture is often used for sales in the United States and outside the state, so it is taxed. Calculate the amounts for claim payments. It applies to items on credit requests, attaching the necessary documentation. After filling out the form, do not forget to check the data several times and sign it. If necessary, use our form-building software to simplify the application process.