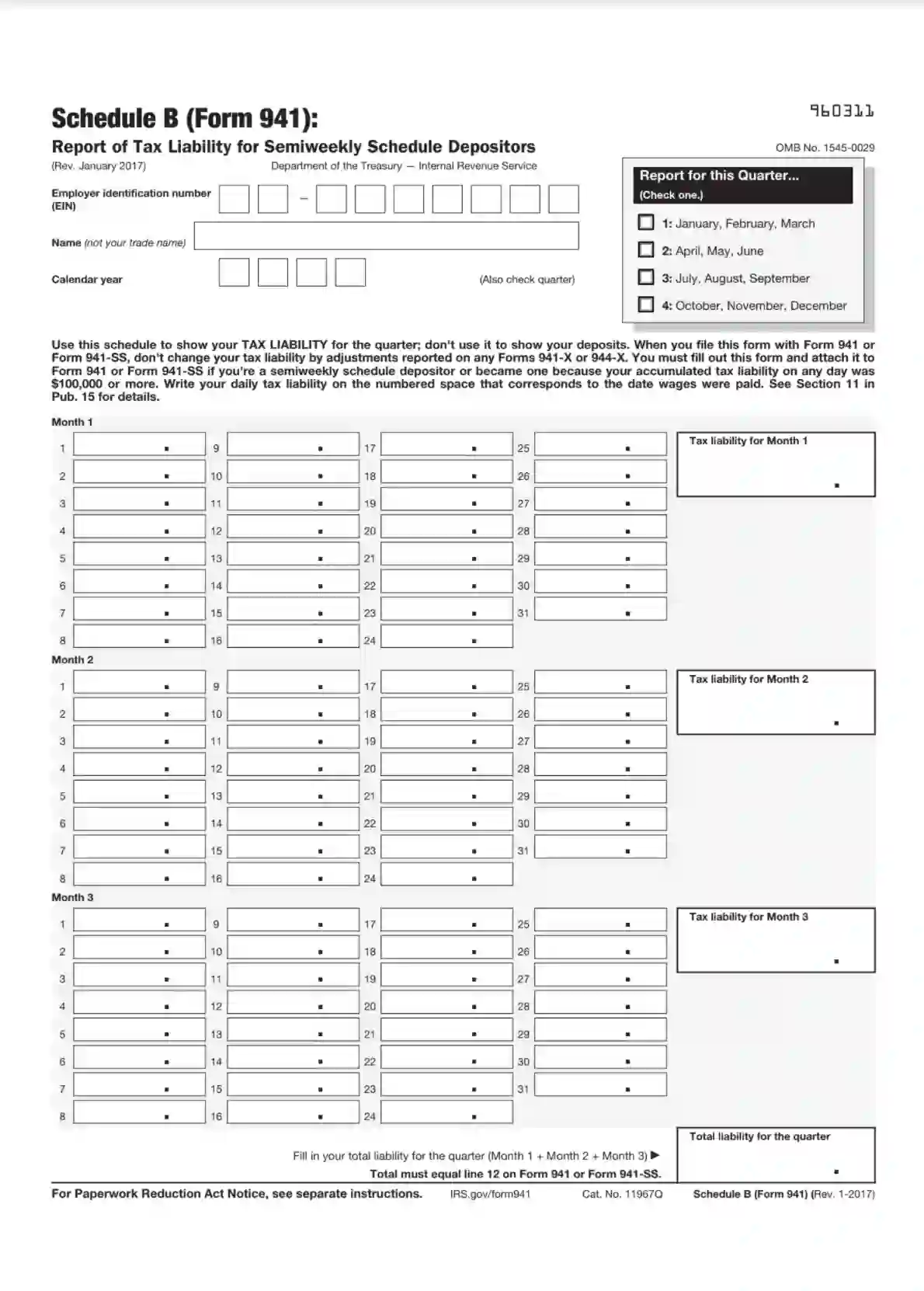

IRS Schedule B (Form 941), titled “Report of Tax Liability for Semiweekly Schedule Depositors,” is an attachment to Form 941, which employers use to report payroll taxes. This schedule is specifically designed for employers who must deposit employment taxes on a semiweekly rather than monthly. This typically applies to larger employers or those who have accumulated $100,000 or more in taxes on any given day during a deposit period. The purpose of Schedule B is to report on a more frequent basis and includes:

- Detailed breakdown of taxes owed for each semiweekly deposit period,

- Accumulation of all tax liabilities by date within the quarter,

- Confirmation that the total amounts reported on Schedule B match the taxes reported on the main Form 941.

Filing this schedule allows the IRS to track and ensure that employers comply with the deposit requirements for payroll taxes, helping to manage the flow of funds necessary for social services like Social Security and Medicare.

Other IRS Forms for Business

The Schedule B Form 941 is devised for companies with a huge amount of taxes to pay. If this is not the form you need, you might find valuable information on pages with other IRS forms.

How To Fill Out IRS Schedule B Form 941

To complete this form, you should have accurate recordings of all tax liabilities you had. If you have the opportunity to refer to this information, it will be easy for you to fill out IRS Schedule B Form 941. Besides, you can always use the software on our website to enter all the data properly.

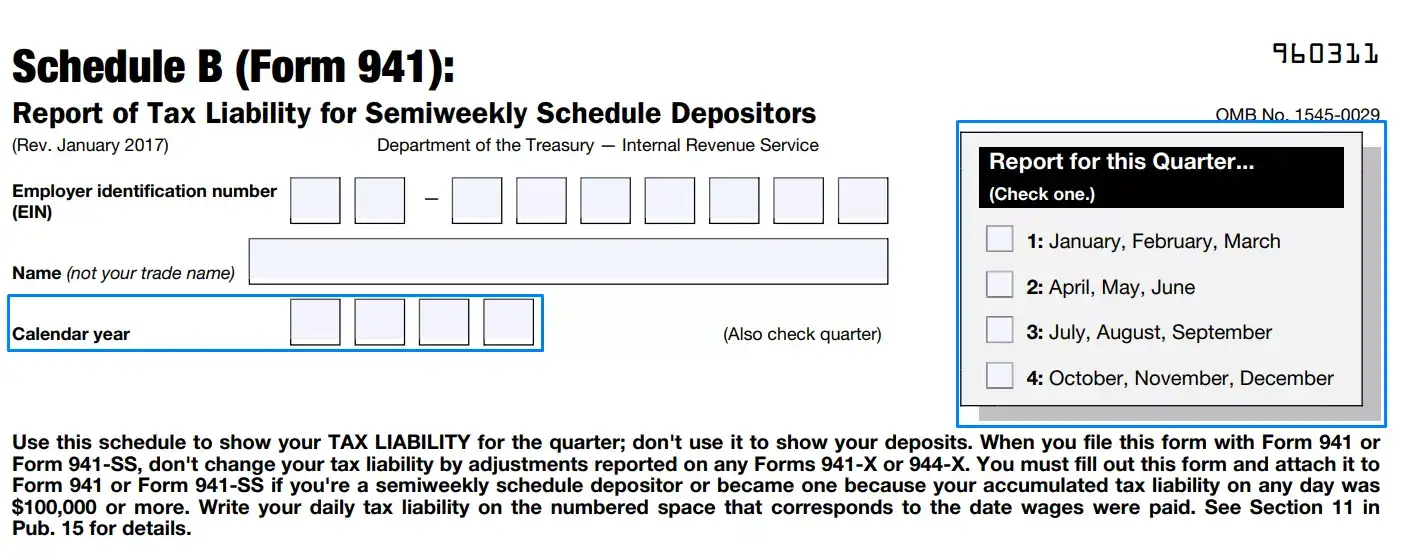

Write in personal data

Include identification data about you in the first fields of this form: your name and employer identification number (EIN). Check whether this information matches the data in the official documents of your organization.

Determine term

Write in the year of payments that you want to confirm and the part of this year based on the months. You can use this form to report your liabilities for three months only.

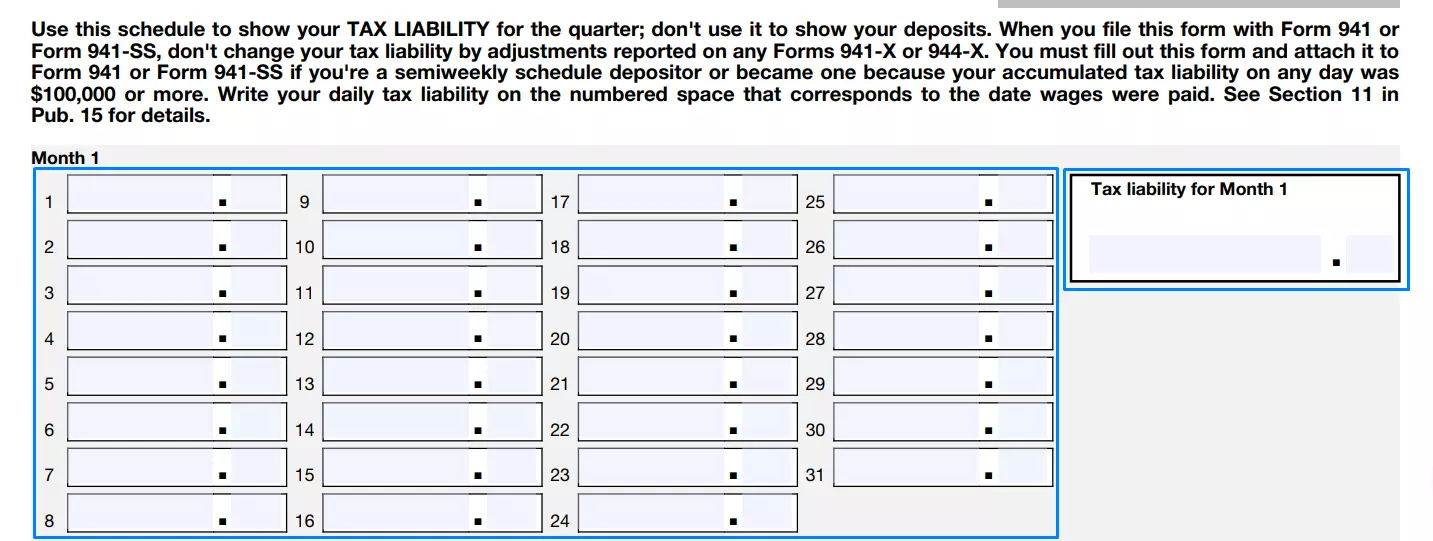

Fill in the table

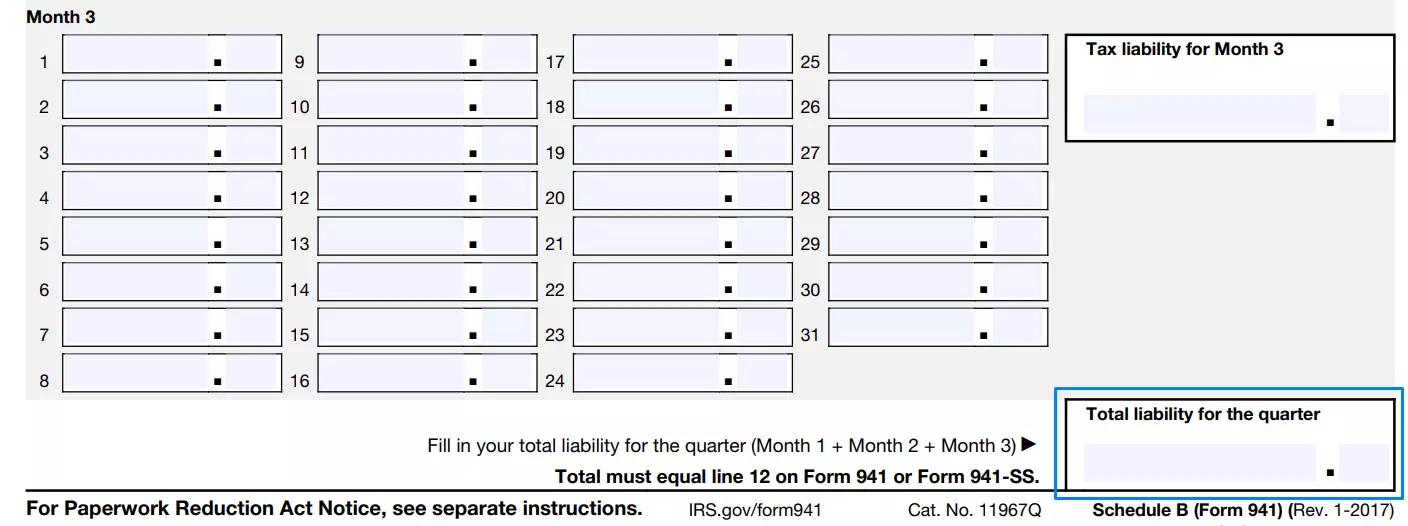

In the main part of this paper, you should report all the liabilities you have in the days when you paid employees’ salaries. There are different tables for each month of the quarter. Make sure that you use a box for the correct month and day of payout.

When you finish filling the table for a month, do not forget to calculate the sum of all liabilities for this period and put the result in the field on the right. Make the same procedure for every chosen period.

Calculate total tax liability

Summarize results for each month and put the final value in the field at the bottom of this form.