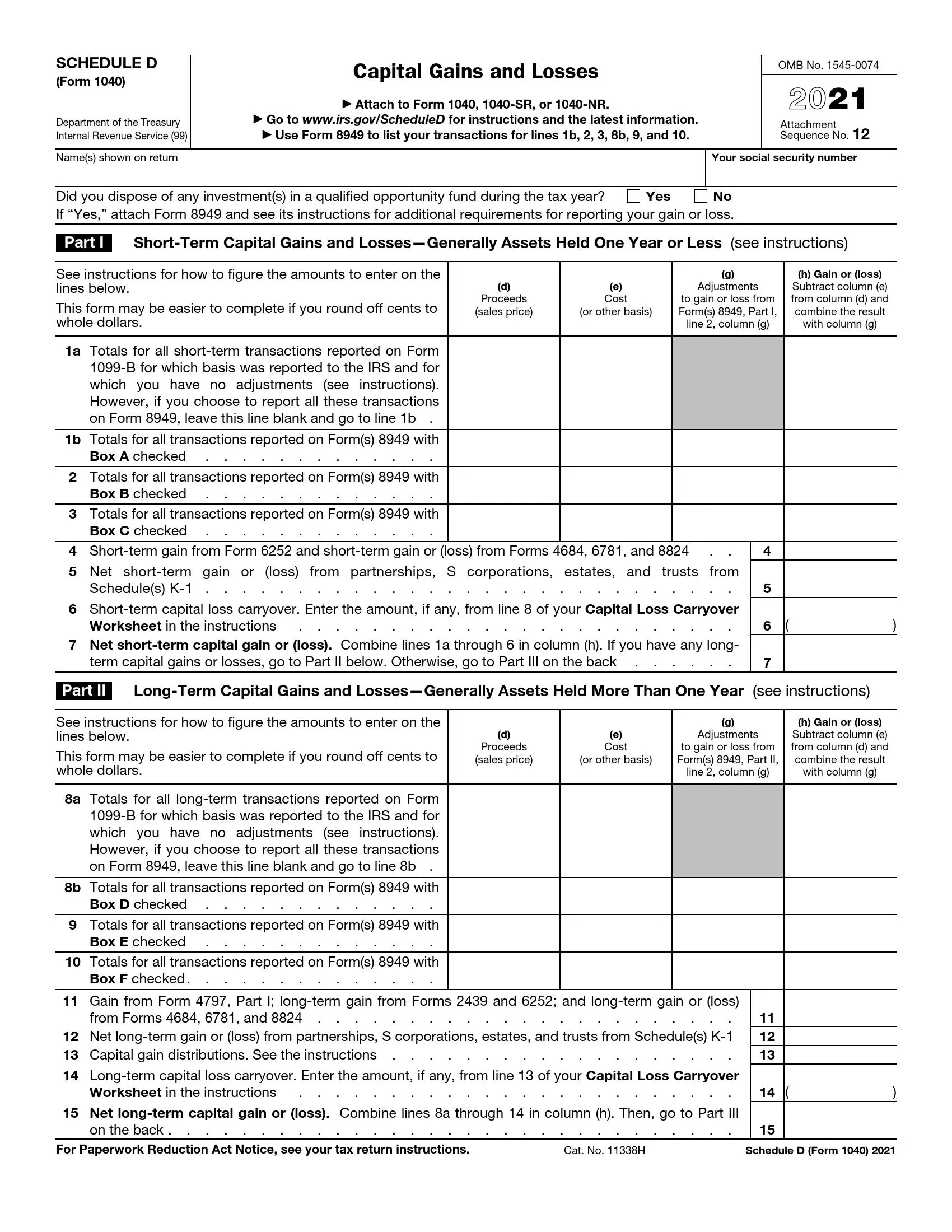

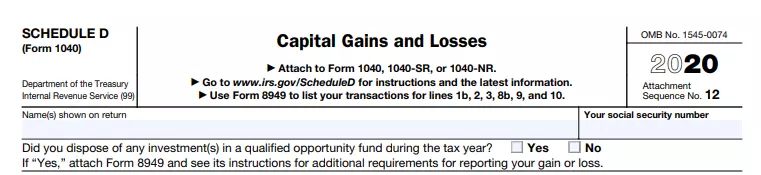

IRS Schedule D (Form 1040 or 1040-SR) is a tax form taxpayers use to report the capital gains and losses resulting from the sale or exchange of capital assets. This includes profits or losses from assets such as stocks, bonds, real estate, and other forms of property. The primary purpose of Schedule D is to calculate the total capital gains tax that may be owed based on these transactions.

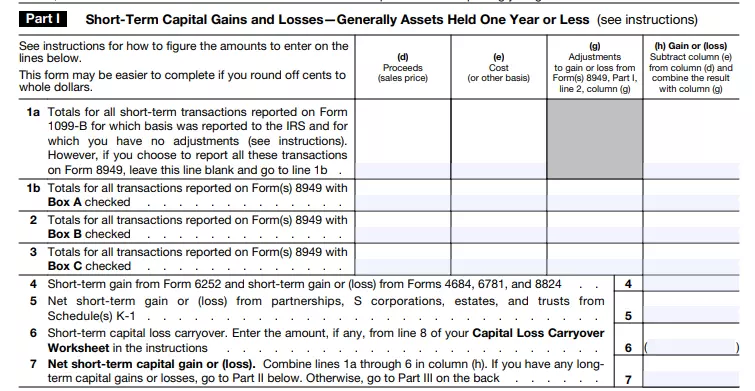

Schedule D is divided into sections to differentiate between short-term and long-term capital gains and losses. Short-term capital gains from assets held for one year or less are taxed at the taxpayer’s ordinary income tax rate, whereas long-term gains from assets held for more than a year benefit from lower tax rates. This form also helps taxpayers apply losses against gains to reduce taxable income, with the ability to carry excess losses to future tax years.

Other IRS Forms for Individuals

An individual’s tax return might go with some schedules that contain additional information for the IRS. Read about other schedules and IRS forms that you might need.

Instructions For This Application

Carefully fill in all the points of the application, as it depends on its approval. Check the entered amounts several times to avoid mathematical errors. You may also round cents to the nearest amounts. Note that false information leads to the rejection of the application and even to fines. If necessary, use our form-building software.

1. Basic Data

The official document requires information about you. Specify the organization’s identification number or taxpayer number, as well as your first and last name. The same form requests information about the address, mailbox, and contacts for communication.

2. Your Profit And Loss

Next, fill in the profit and loss columns. The first and eighth lines are related to financial activities that are not reflected in the supplementary declaration 8949. They contain information about the aggregate results of your transactions. In this case, you do not need to specify the same thing in an additional document and attach an explanation. Correlate the profit and loss with the corresponding lines.

By the way, the first part also includes the points reflected in the additional form. You use the same scheme to fill in the amounts, indicating even a negative total.

3. Other Forms

As noted earlier, this section D is related to other tax returns. Fill in the required data by the points. If you have received an asset allocation as a nominee, indicate this. If there are difficulties in filling out the form, use the help of a highly qualified specialist. It will ensure the correct interpretation of this form and calculate all the amounts.

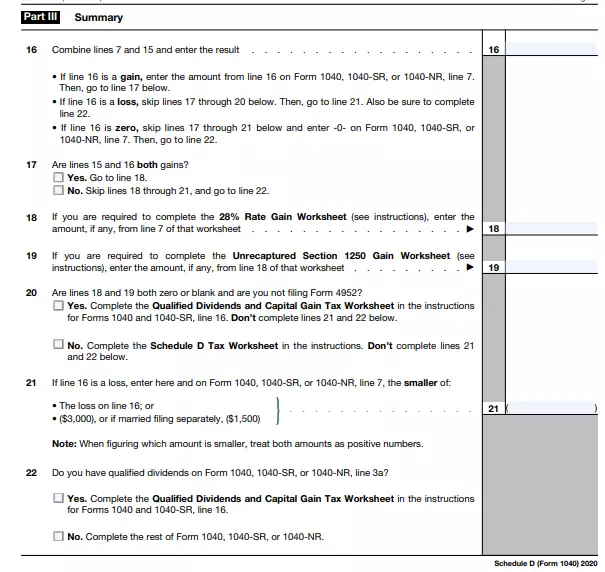

4. Total Amount

The final part asks for a total count of all the numbers. It is the complete set of the specified data. If you marked “yes” in line 17, then fill in lines 18 through 21. Otherwise, leave these items blank. So, many people profit from collecting and selling these items. The collection mainly includes valuable paintings, sculptures, carpets, precious stones, or coins. Specify the profit earned from the sale of these items.

Answer all questions very honestly so as not to be in an embarrassing situation. In general, filling out the form is not such a complicated process. The main thing is to follow all the rules. Also, the tax collection form itself requires a signature. Therefore, after filling out all the documentation, sign the sheets.