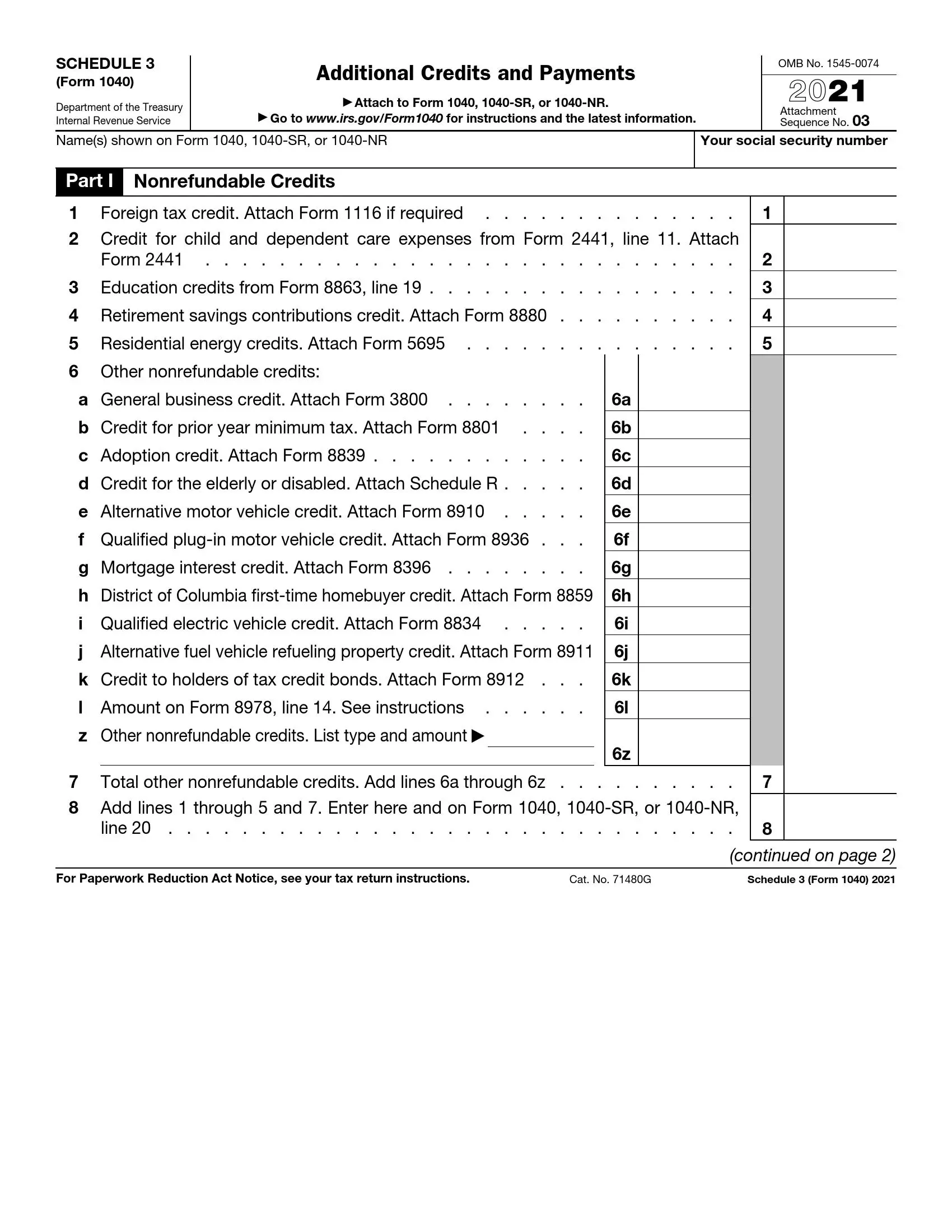

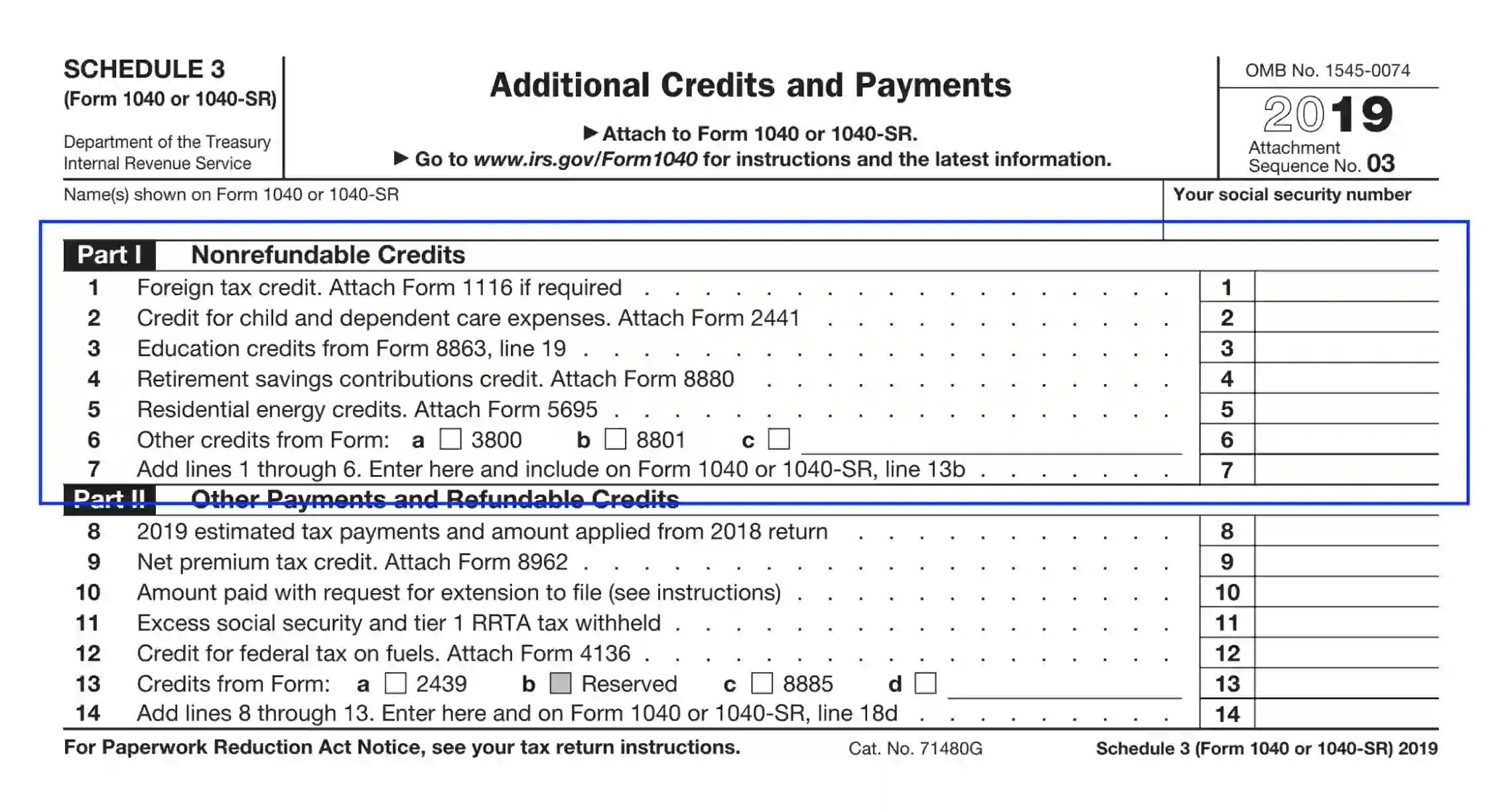

IRS Schedule 3 (Form 1040 or 1040-SR) is a tax form used for reporting nonrefundable tax credits that aren’t included directly on the main Form 1040 or 1040-SR U.S. Individual Income Tax Return. This schedule helps taxpayers reduce their tax liability with credits for which they’re eligible without affecting the amount of taxes they’ve already paid throughout the year.

Schedule 3 is organized into two parts: Part I includes credits that can directly reduce the amount of tax owed, such as the foreign tax credit, education credits, and general business credit. Part II reports other payments and refundable credits not listed directly on Form 1040, such as the estimated tax payments made during the year and the amount of extension payments. Using Schedule 3 allows taxpayers to consolidate these credits and payments effectively, ensuring they maximize their potential tax benefits and accurately report their tax situation.

Other IRS Forms for Individuals

IRS schedules are used to provide more financial information to the Internal Revenue Service. When preparing your tax return, check whether there are any schedules you are required to attach.

How to Fill Out IRS Schedule 3

Additional Credits and Payments Schedule 3 templates can be downloaded from the IRS official website, or you can use our form-building software to generate a needed PDF file, fill out, and download the form instantly at our website.

Complete the Heading

Begin completing the form by entering your legal name and social security number as indicated in the related form 1040 (or 1040-SR).

Specify Any Nonrefundable Credits

This Section contains six types of credits that are not specified in 1040-related forms. Follow each statement to submit the required data:

- Foreign tax credits

To be able to use the privilege, you need to have positive income tax background regarding the US or foreign assets. You can claim the credit by filing Form 1116.

- Child (dependent) care expenses credit

Request this credit if you have a child or a dependent in charge and you have paid for their care.

- Education credits

Claim this credit to cover expenses for qualified education service for yourself, your husband or wife, child, or dependents.

- Retirement investment credits

Use this advantage if you have contributions to other than IRA or retirement programs, Roth investments, and other related contributions. Details are reflected in the IRS 1040 (1040-SR) brochure.

- Residential energy credits

If you have used alternative sources of energy in your permanent dwelling located within the US, you are qualifying to claim the credit.

- Other credits not mentioned elsewhere in 1040-referred papers

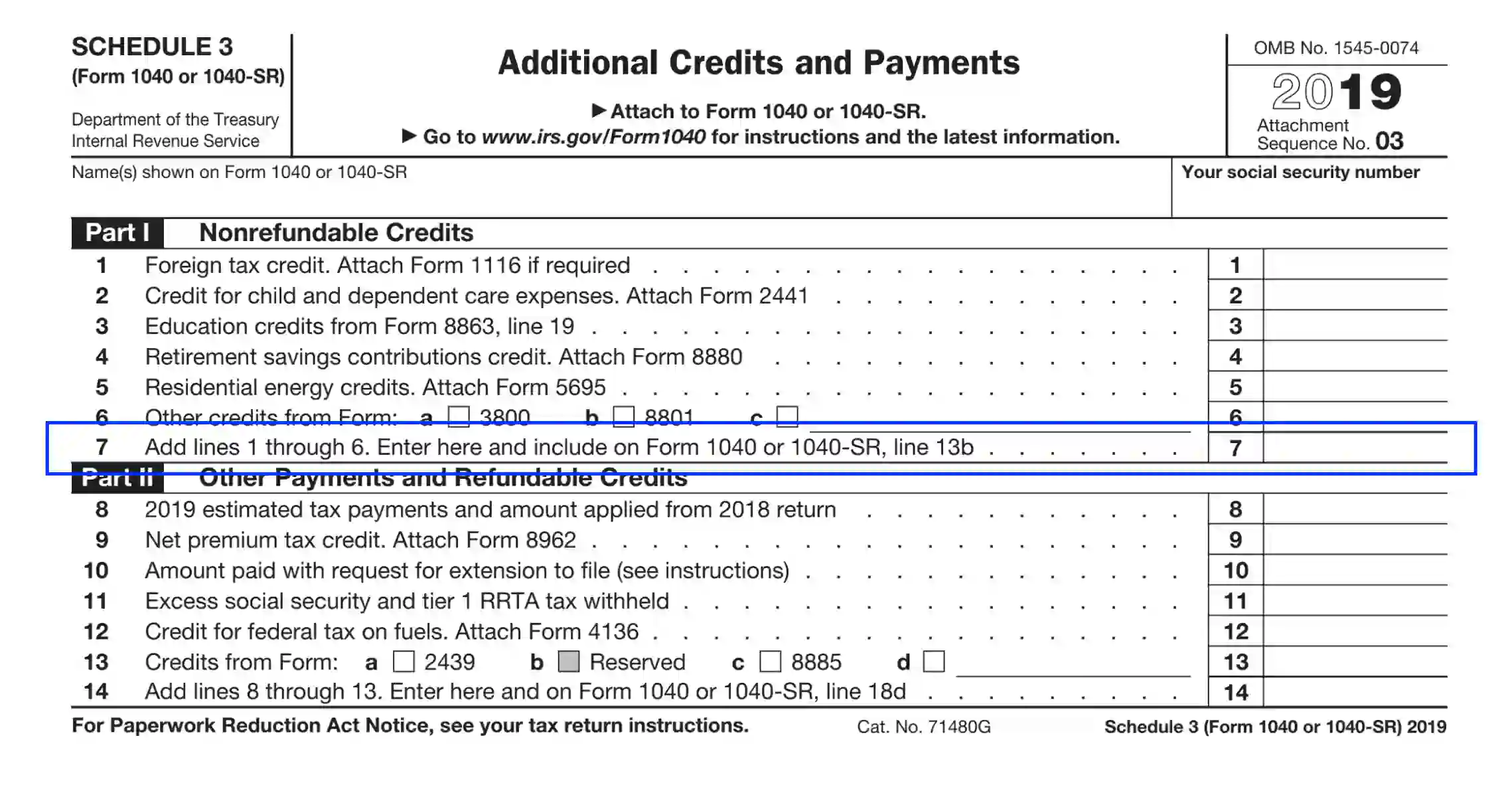

Compute the Credits Total

In Unit 7, the declarant should add all amounts 1 through 6 and register the objective in Unit 13 (b) of 1040 or 1040-SR form.

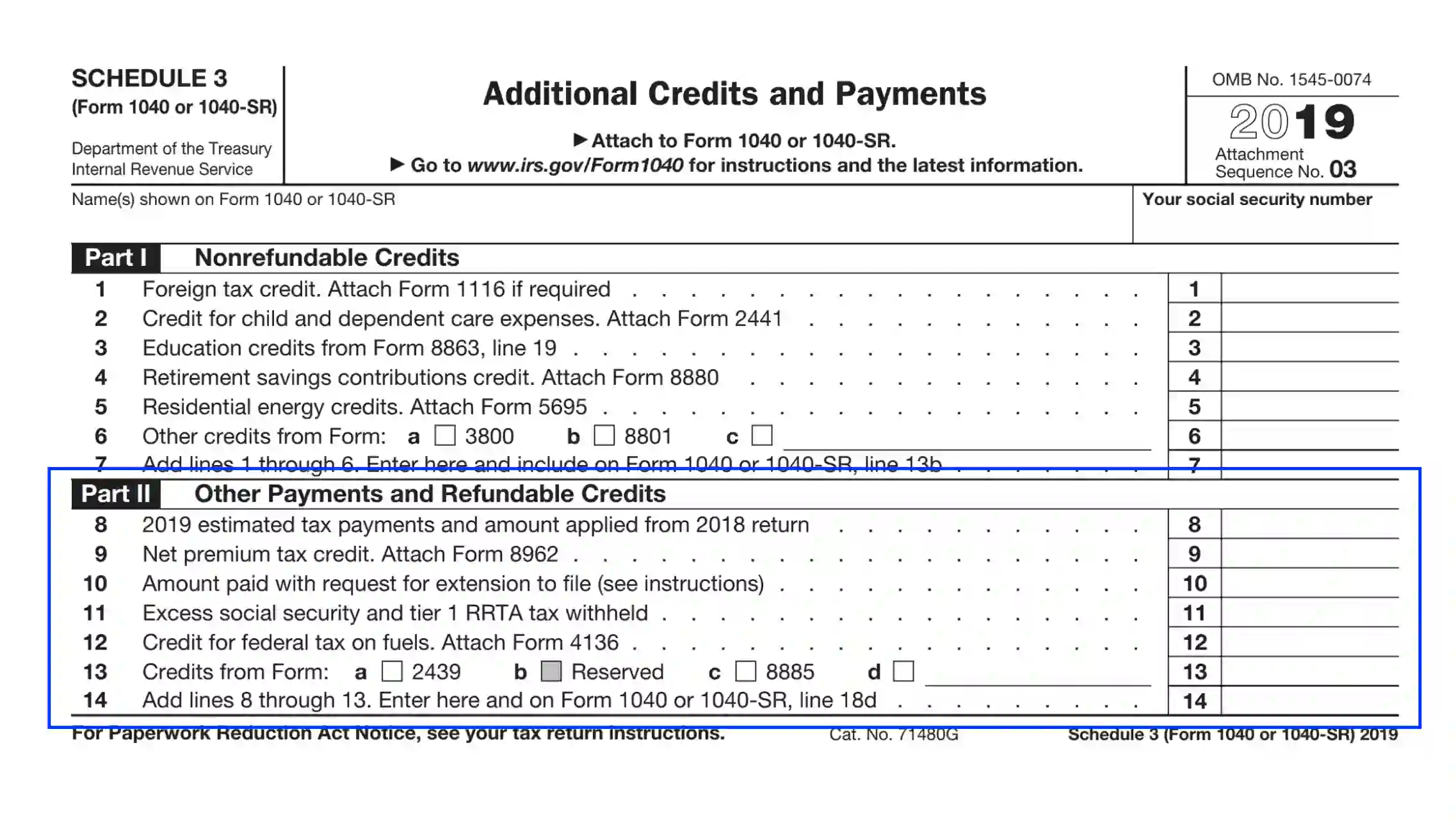

Complete the Other Payments and Refundable Credits Section

- The amount you used to cover the current year’s taxation withdrawals.

Clarify the amounts if you have redistributed tax payments applied to the prior tax periods.

- Net premium tax credit

In case you, the spouse, or the dependants have joined Marketplace services regarding health insurance and care, you may be qualifying for this credit type.

- Extension request payments

Should you have claimed and paid for prolonging the filing period, submit the required info.

- Payments to cover redundancy in social security services

- The federal tax on fuels credit

- Other reimbursable credits not mentioned elsewhere in 1040-related forms

Calculate the Total of Reimbursable Credits and Payments

Use Unit 14 to compute the total of amounts submitted on lines 8 through 13. The total objective should also be entered in Unit 18 (d) of the referred 1040 (1040-SR) document.