IRS Form 1094-C is a transmittal form used by applicable large employers (ALEs) to report summary information for each group health plan they offer to their full-time employees. It’s a cover sheet for the IRS Form 1095-C, which details employer-provided health insurance coverage and offers to employees. Form 1094-C is essential for compliance with the employer mandate under the Affordable Care Act (ACA), which requires ALEs to offer affordable and minimum standard health coverage to their full-time employees or face potential penalties. The form contains several critical pieces of information:

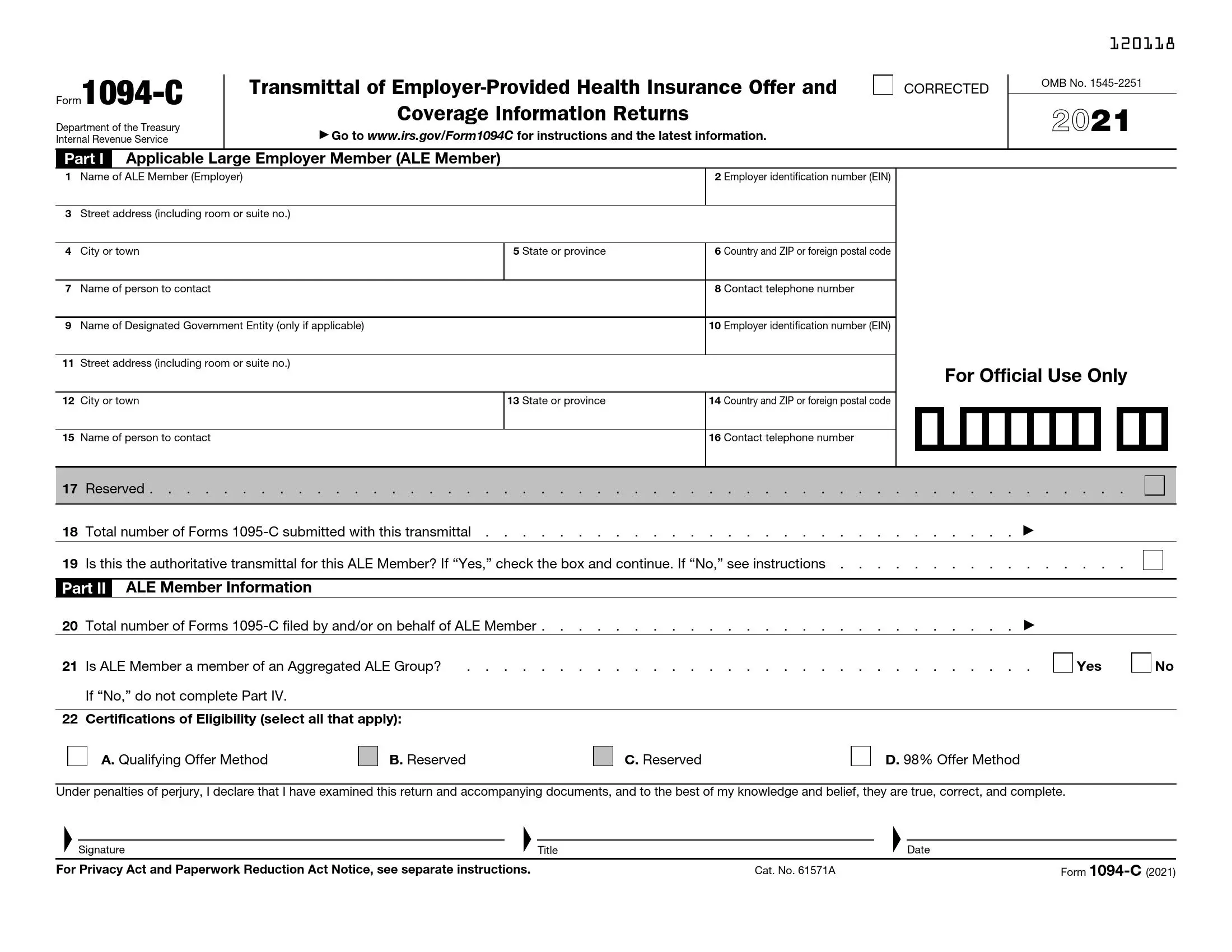

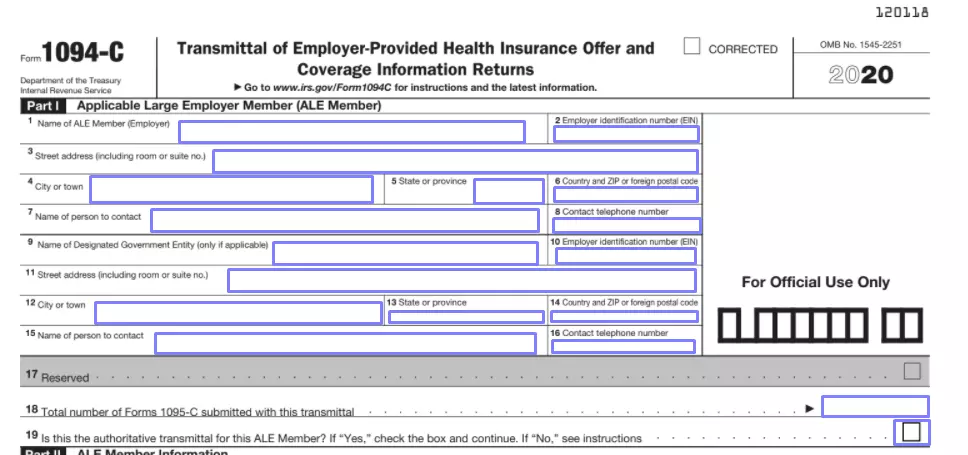

- The employer’s name, Employer Identification Number (EIN), and address,

- Total number of 1095-C forms submitted to the IRS,

- Information on whether the employer offered health coverage,

- And months coverage was available.

Form 1094-C enables the IRS to verify that ALEs meet their obligations under the ACA and provide necessary data to administer compliance effectively. This form plays a critical role in enforcing health policy compliance and ensuring that employees receive sufficient health coverage from their employers.

Other IRS Forms for Business

The Internal Revenue Service requires employers to file a lot of various forms. Check whether you are familiar with IRS forms employers commonly use.

Filling Out the Form

If you are one of the huge company’s members, most likely, the form completion and delivery to the Service is not your responsibility. You probably have hired at least one accountant and one worker responsible for human resources activities.

Accountants deal with the money and all related issues, including taxes; a human resources department in every entity normally keeps all records and details about all employees’ benefits the entity offers. The best idea is to ask them to complete the form jointly (as well as the demanded 1095-C).

If you are the person who was asked to create and send the form, you almost certainly already know what to do. This form is submitted every year, and such tasks are delegated to more or less experienced workers.

However, if it is the first time when you work on the template, we strongly suggest discussing the form with more experienced co-workers and thoroughly read the IRS guidance on the template. It will help you avoid silly mistakes and getting a successful result right away. You can also use our brief and general instructions below to find out what template fields you must complete.

Get the Relevant Template

The Service updates its templates every year, so you must ensure that you are using the proper one. There are two proven methods of getting the IRS Form 1094-C: either visiting the Service’s official website and downloading the requisite file there or stopping at our site and trying our helpful form-building software.

Designed for users of any level, it is intuitively understandable and easy to use. Generate the needed form with its help.

Insert the Employer’s Details

After you have found the template, you shall begin with inserting the info about the employer you represent.

Write the entity’s name and EIN (or employer identification number). Enter the entity’s full address below. If the entity is located outside the United States, remember to include the county here.

Further, write the details of the person who can be contacted by public authorities that will review this form: add this person’s name and telephone number.

Leave the next line empty as well as the field on the right-hand side: they are reserved for the form processors’ use. Move to lines 18 and 19, where you have to determine how many 1095-C records you will submit with this document and whether this document is authoritative in your case (if no, check the Service’s guide to find out what to do).

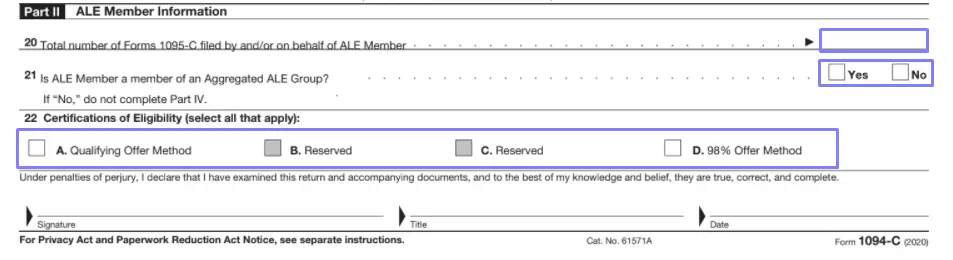

Answer the Questions about the Employer

In the first block, you have added the basics about the entity; now, you will answer various questions and complete some charts.

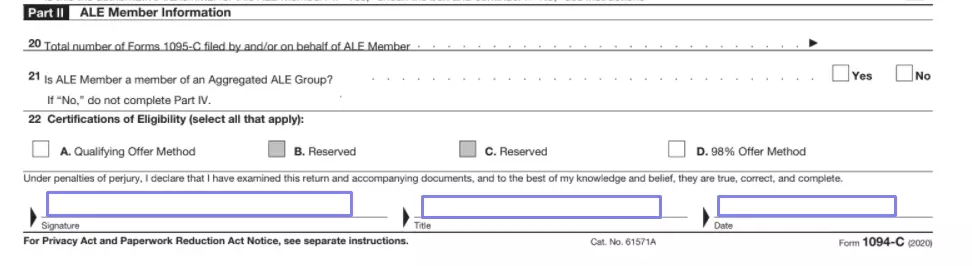

For a start, indicate how many 1095-C records you have filed in total (not only with this specific form but previously). Check if your entity is a member of Aggregated ALE Group. If no, you do not need to fill out the form Part 4.

Mark the Certifications of Eligibility relevant for your entity (there are two options, and both can be relevant for you).

Sign the Record

The template’s first page requires you to sign it on the bottom. Insert your title and the date of signing in suitable lines and sign the form.

Complete the Required Part 3

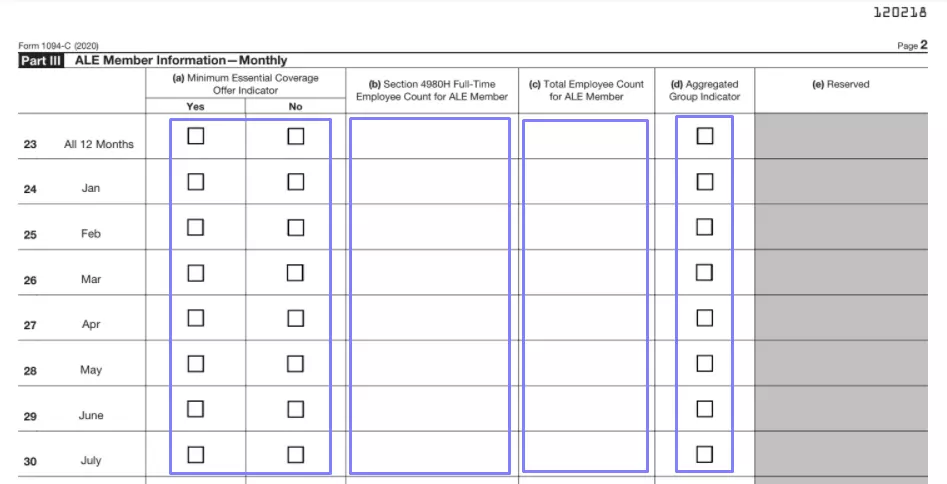

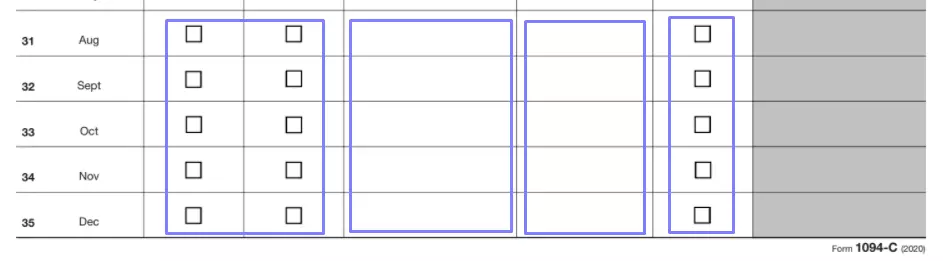

This part is mandatory for every entity that provides the form—recall in which months of the considered year you offered your workers minimum essential insurance coverage. Use a cross to check the relevant boxes defining certain months or the whole year.

Then, count the number of full-time workers per month in accordance with the template requirements and enter the results in the designated fields. Check the boxes that state in which months you were considered an aggregated ALE group member.

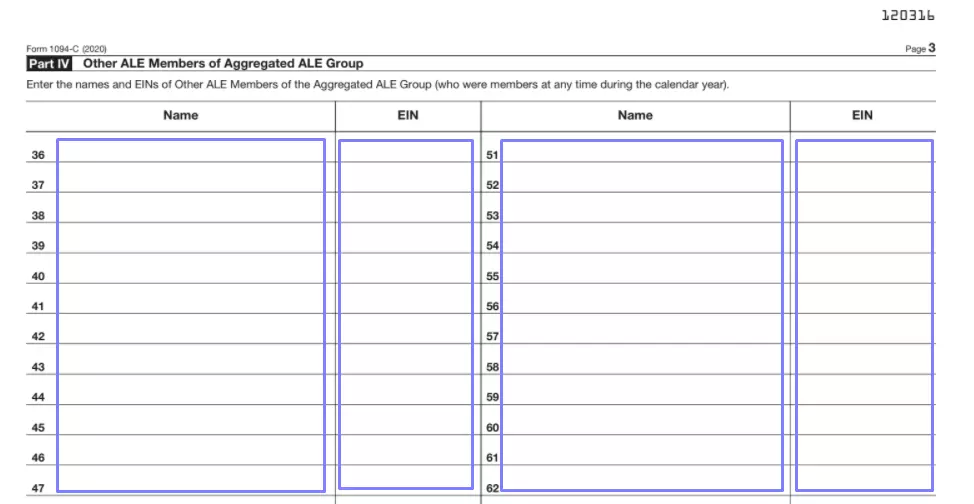

Fill Out Part 4 (If Applicable)

If you are a part of the above-mentioned group, here, you shall add the data of other group members. You can point up to 30 entities. In the relevant lines, enter their names and EINs.