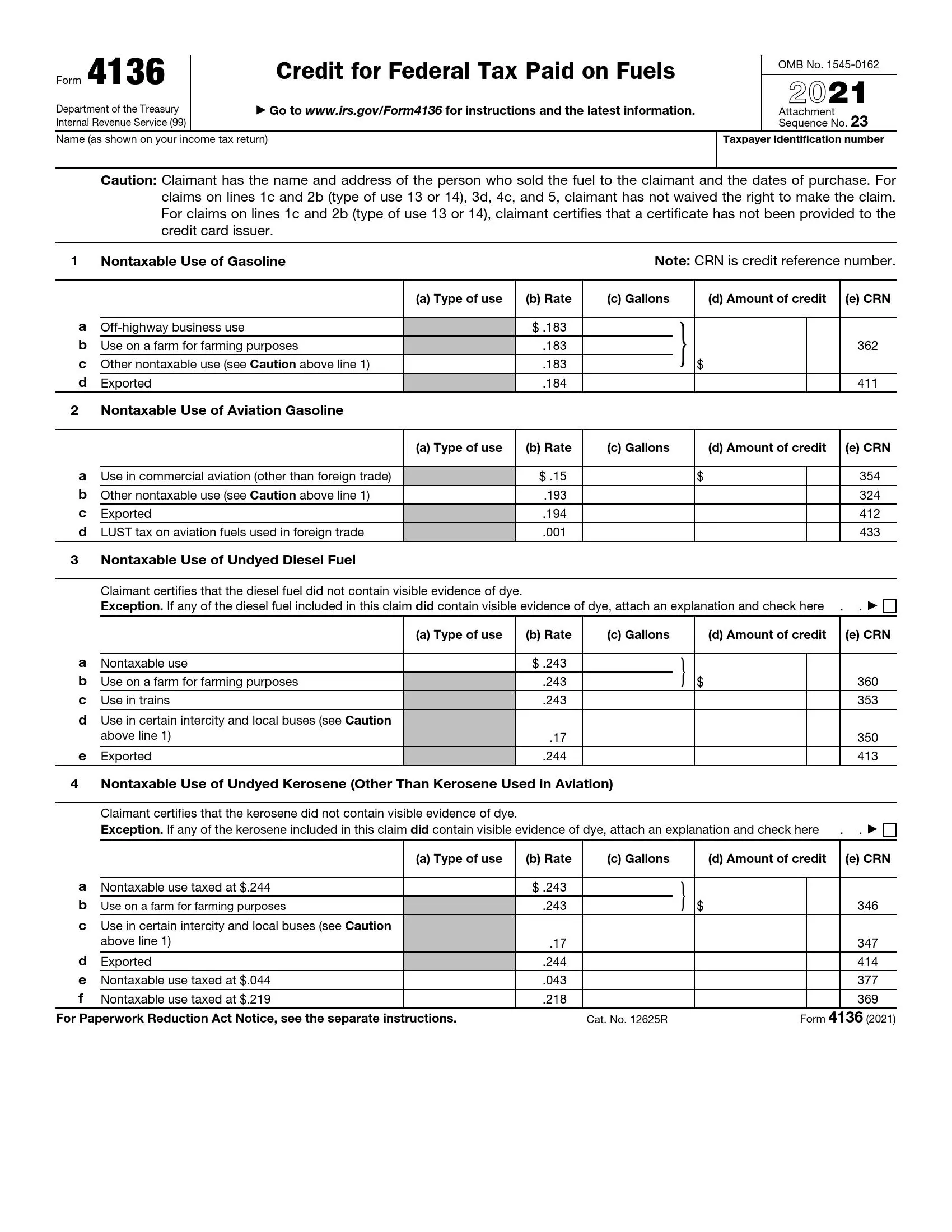

IRS Form 4136 is a tax document used to claim a tax credit or refund for federal excise taxes paid on certain fuels used for specific purposes. It is typically filed by taxpayers who use gasoline, diesel fuel, or other taxable fuels for purposes other than powering a motor vehicle on public highways. The form allows taxpayers to recoup some of the excise taxes paid on these fuels when used for qualified purposes, such as farming, aviation, or certain off-highway business uses. Information provided on Form 4136 includes:

- The taxpayer’s name, address, and taxpayer identification number (TIN),

- Details about the type and quantity of fuel used,

- The purpose for which the fuel was used,

- And the amount of federal excise tax paid on the fuel.

By filing Form 4136, taxpayers can claim a credit or refund for the excise taxes paid on eligible fuels, reducing their overall tax liability or obtaining a refund for taxes previously paid. This form helps ensure that taxpayers are not subject to double taxation on fuel used for specific non-highway purposes and provides financial relief for those engaged in qualifying activities that require significant fuel consumption.

Other IRS Forms for Business

Along with the Form 4136, your business might need to prepare plenty of other forms for the IRS. Here are some of the forms businesses most often use.

How to Fill Out the Template

The document is tricky, with a lot of sections that describe various fuel types usage. Because we have already mentioned the frauds many people commit using the form, we advise you to complete all the fields honestly and gather all the receipts or documents proving all the inserted numbers.

Moreover, it would be a smart move to ask either your accountant or an external specialist to make the form for you. They definitely will deal with the content quicker and get all the required data from the entity’s books (or your personal books). The form presumes you have to do a bunch of calculations, and the whole process might be too harsh.

We hope you decide to delegate the form creation. However, if you want to get the idea of how the template looks like and what info people enter there, see our short guide below. Also, always remember to use the Service’s guidelines for more details (presumably, you will not be able to complete the template without them).

Find the Template

At first, you need to get the newest template so the Service accepts your document. You can visit the authority’s official site and look for it there, but it might take some time you do not want to waste.

So, we recommend using our well-made form-building software. It allows you to generate IRS Form 4136 along with many other legal forms that exist in the United States.

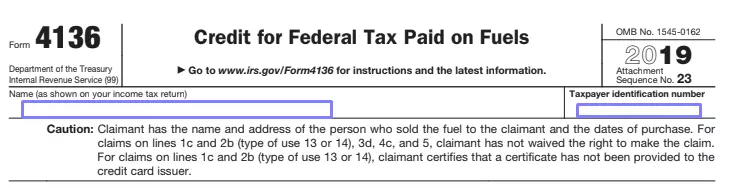

Enter Your Name and TIN

You should begin completing the template by entering your name (the same as you have provided in your tax return) and TIN (or taxpayer identification number).

Read the Caution Attentively

There is a caution you need to read before you start. It has a few instructions about the template’s specific lines.

Choose the Sections to Fill Out

You have to look through the template and define what credit you will claim. There are various sections that let you claim credits for gasoline, kerosene, biodiesel, aviation gasoline, and other fuel types usage. Complete only those relevant for you.

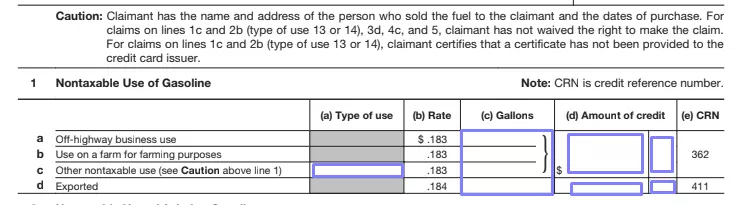

Inform about the Gasoline Usage

You must write about gasoline usage throughout the year in the first section. Insert type of use (where applicable), number of gallons, and requested credit sum (take the rates from this chart and multiply them to your gallons).

Do the Same for Gasoline Used for Aviation Purposes

Fill out the chart describing the credit for such fuel usage.

Determine Credits for Undyed Diesel and Kerosene

The principle is the same: complete the following three charts as the template prescribes. If there are any traces of dyed fuel, you need to check the relevant box and add a statement explaining the matter.

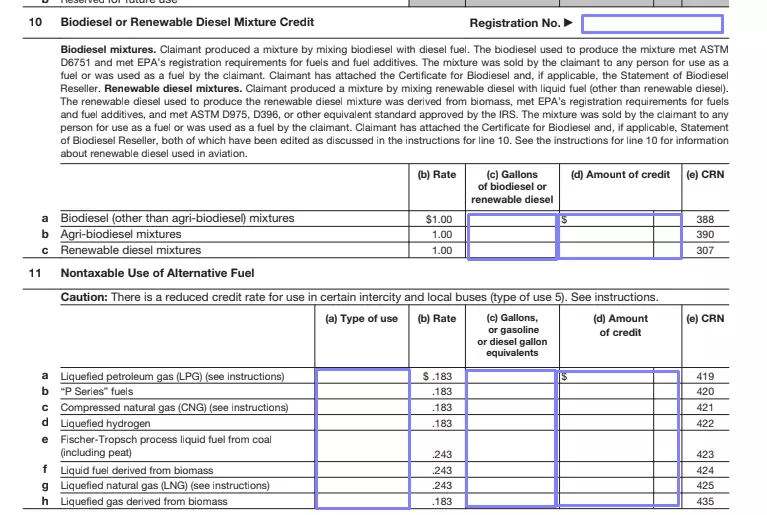

Claim for Fuel Sales by Registered Ultimate Vendors

If you are a vendor and this is your case, complete the charts as required (the same way as previously) and remember to add your registration number in the designated line.

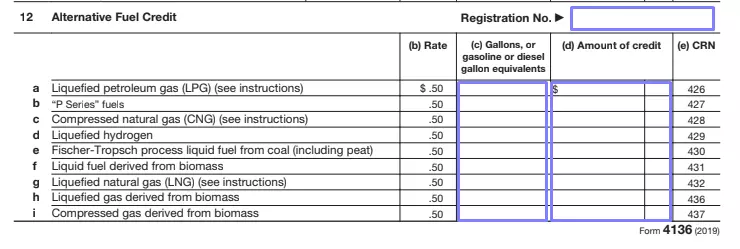

Ask for the Credit for Biodiesel, Alternative Fuel, or Renewable Diesel Mixture

Complete three charts below if you want credit for these fuel types’ usage.

Complete the Credit Card Issuers Section

If you issued credit cards others used to buy fuel from you, fill this section out in accordance with the Service’s instructions.

Determine the Diesel-Water Fuel Emulsion and Its Blending

If applicable, describe these items in the two following charts.

Add Info about Export

If you exported dyed fuels during the considered year, add the data in the last chart.

Sum Everything Up

You have to write a total credit you ask for in the last section. Sum all the numbers you have inserted previously and enter the result here.