Form 1098-T is a tax document provided by educational institutions to both students and the Internal Revenue Service (IRS). This form reports amounts billed to students for qualified tuition, related expenses, and any scholarships or grants received. The purpose of Form 1098-T is to help students and their families determine eligibility for certain tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit, which can reduce the amount of tax owed.

The importance of Form 1098-T lies in its role in managing educational expenses through tax benefits. It allows taxpayers to calculate and substantiate claims for education credits or deductions accurately. Additionally, this form is crucial to ensure compliance with IRS regulations regarding the taxation of scholarships and the proper reporting of educational expenses. Correct usage of the information provided on Form 1098-T can significantly impact a student’s tax liabilities, potentially leading to substantial savings.

Other IRS Forms for Business

The IRS Form 1098-T should be filed by educational institutions for their students. Look through other IRS forms that similar businesses typically need.

How Is the 1098-T Tax Form Filled Out?

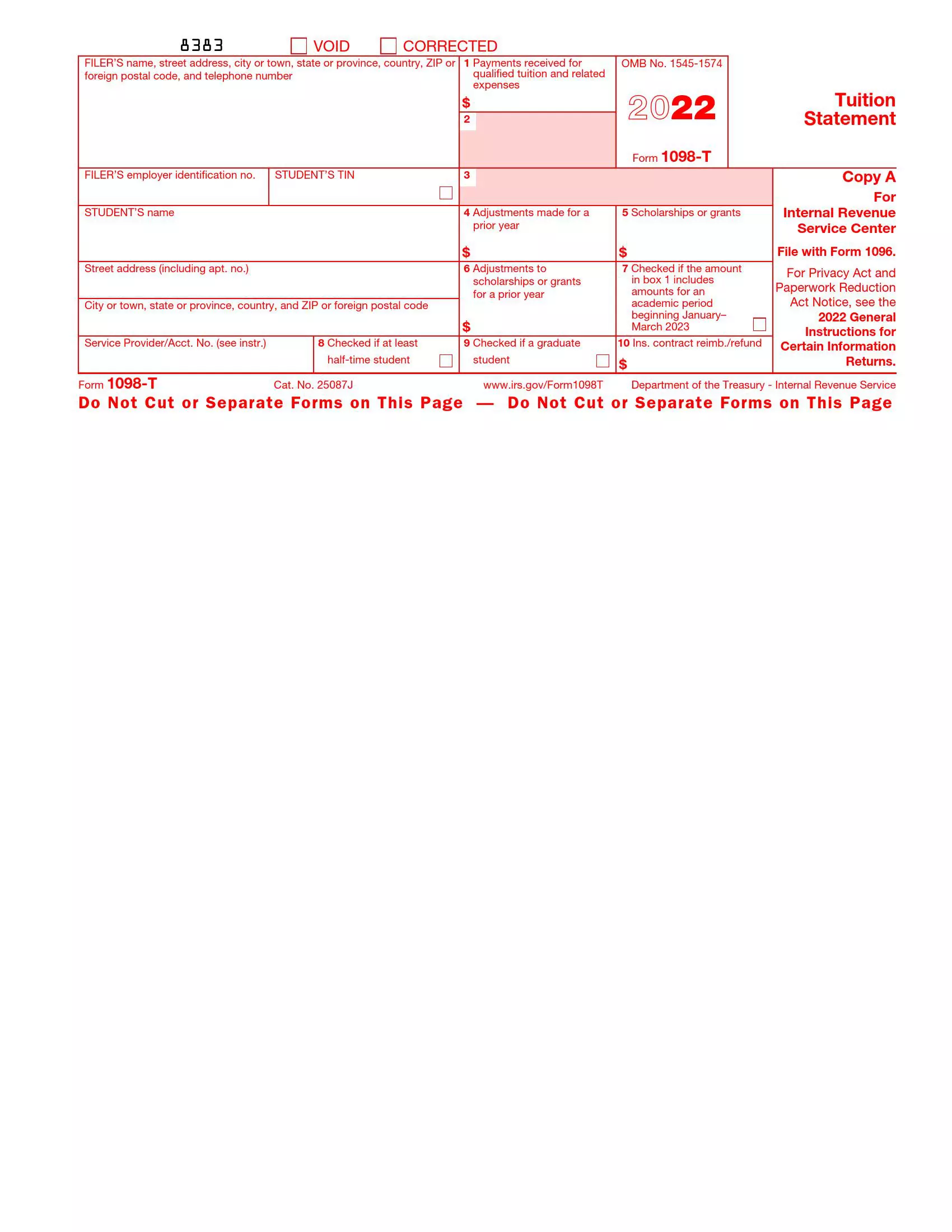

The document we are talking about consists of one page that includes several lines and ten boxes to fill out. It is prepared in three copies. The “A” copy is directed to the IRS by the author of the document together with the 1096 Form. It can be sent by mail or electronically, and the deadline for sending it depends on the way of filing.

The “B” copy is assigned for the student. It must be delivered to him no later than by January 31, so he can use it for his educational purposes. It is important to mention here that the student’s copy may show only the four last digits of his TIN for security reasons. Nevertheless, the educational authority reports the complete number to the IRS.

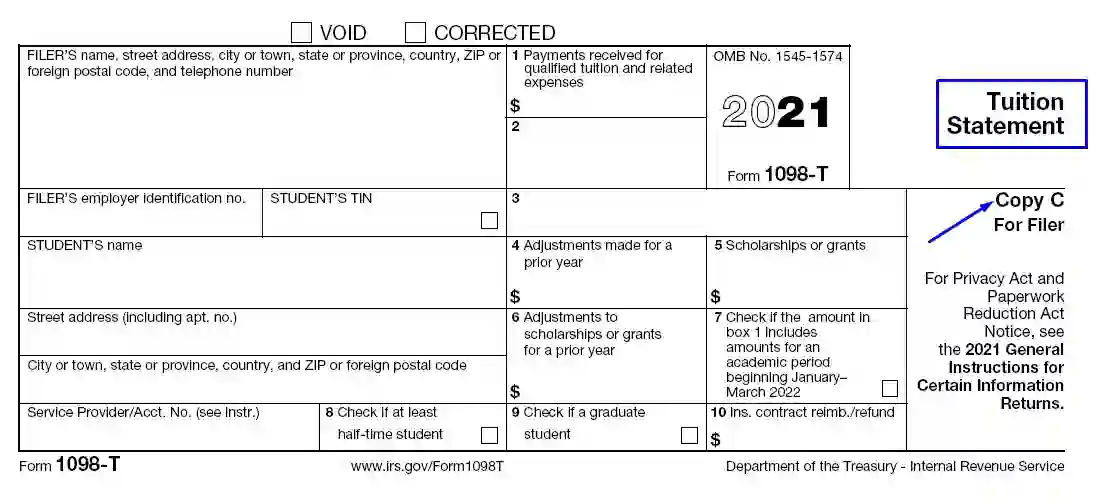

The third copy is left by the filer for his own informational and reporting services.

Guide for Filling out the Tuition Statement

Though the 1098-T form is relatively short and includes only ten boxes, it still requires making some complicated counting. This process can be difficult and cause mistakes. Therefore we recommend using our form-building software to facilitate the process.

Write Down the Information to Identify the Filer and the Student

The first lines of this form require to indicate the name and all contact information of the person filling out the document, as well as to report the student’s TIN. The first line is assigned for the filer himself, not the name of the institution.

Put in the Name and Address of the Student

For the purpose of this form, the student’s permanent or long-term address is needed here so that the student could receive the mail. Certainly, it is possible to indicate the temporary address too, but only if the long-term address is unknown.

As for the line with the account number, it is required to fill out only if several accounts are used for this form purposes. Let us remind you that our built-in form filling software can help you with any uncertain or complicated issue in this form.

As for checkbox 8, it shows the degree of the student’s participation in the education process. It covers one of the most important conditions to acquire education credit.

Show the Total Amount of Payments Made During the Calendar Year

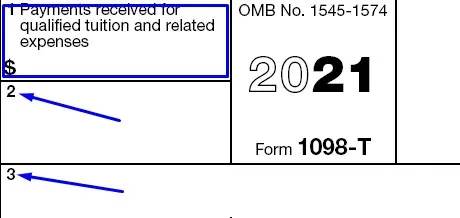

The figure in the Box 1 must show all the payments already received by the eligible institution where the student is currently studying. It indicates the means paid from any sources and includes payments for the tuition and all the other expenses related to the education.

Boxes 2 and 3 are usually left blank for future use.

Indicate Any Adjustments Made and Allowances Granted

The next two boxes – 4 and 6 – are used to indicate whether any corrections occurred during the previous year. Box 5 is for the total sum of any kind of stipends or subsidies given to the student within the calendar year. The latter amount will be considered when the student appeals to get the education credit and may reduce it.

Fill in If a Graduate Student and Any Refunds Were Made

One of the last two sections, Box 9, is to show whether a student participates in any of the educational programs, resulting in graduation. Box 10 is assigned to show the final quantum of refunds made by the insurer for the educational and any other associated purposes of this student.