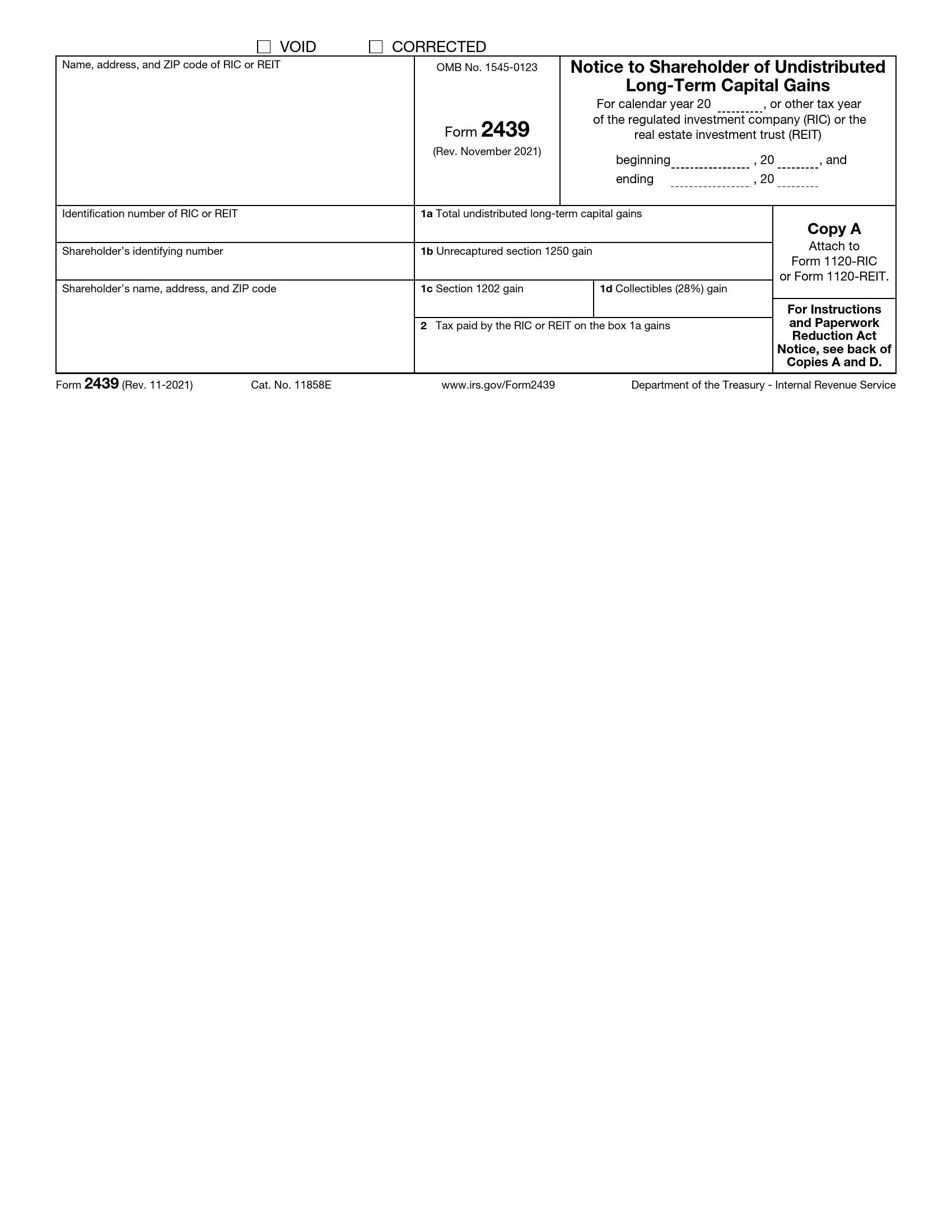

Form 2439 is a tax document that reports undistributed long-term capital gains from a regulated investment company (RIC) or real estate investment trust (REIT) to its shareholders. These entities typically issue it to shareholders, who must report their share of undistributed capital gains on their individual tax returns. The form ensures that shareholders accurately report and pay taxes on their investment income, even if it has not been distributed in cash. Key information provided on Form 2439 includes:

- The shareholder’s name, address, and taxpayer identification number (TIN),

- The RIC’s or REIT’s information,

- The total amount of undistributed long-term capital gains allocated to the shareholder,

- And any foreign tax paid by the RIC or REIT that the shareholder may be eligible to claim as a credit.

By issuing Form 2439, RICs and REITs inform shareholders of their share of undistributed capital gains and provide the necessary information to report this income on their tax returns accurately. This helps ensure compliance with tax laws and regulations governing investment income and capital gains distributions.

Other IRS Forms for Business

To make sure you haven’t missed out on anything important when analyzing what IRS forms you need to file, read about other IRS forms for businesses.

How to Fill out Form 2439

Filling out this application requires reliable information and mathematical calculations for the accuracy of the tax payment. Therefore, consider the instructions below and take into account all its requirements.

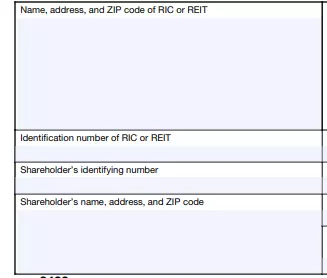

1. Provide the Basic Information

All four copies (A, B, C, and E) have the same structure. Specify the name, legal and postal address of the employer, as well as its identification number. An identification number is a digital code that identifies a specific organization for establishing tax payments and submitting tax returns. This number allows identifying the company for the Tax Service that deals with tax issues. Don’t forget to provide the identification code, name, and address of the shareholder, including the social security number.

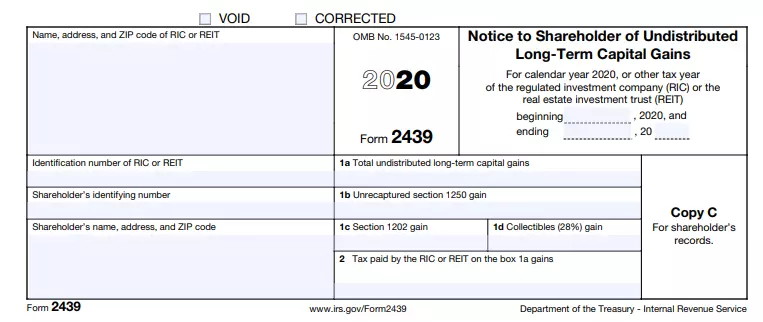

2. Define the Accounting Calendar Year

In the upper right corner, write the calendar year for which the tax return is submitted. Enter the appropriate dates in the lines. The shareholder of the individual pension agreement must send B and C copies to the trustee. Check the correctness of the entered data several times to avoid misunderstandings.

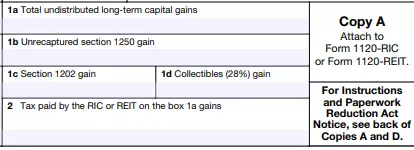

3. Insert the Tax Payment Amount

Enter the required amounts in the corresponding lines. We recommend that you calculate your tax payments in advance to avoid mistakes. In the first line, specify the total amount of retained long-term capital gains. Next, enter the data according to the proposed scheme. Please note that you must attach this copy to the additional forms 1120-REC and 1120-REIT. If necessary, use our form-building software.

4. Fill in Additional Copies

As already noted, this form consists of four copies. Their structure is the same, but their purpose is different. When filling out the form, you must attach a copy of B to the shareholder’s income tax return for a specific period. You also mark the profit in the lines, including the 28 percent rate increase. Enter the organization’s data and your information.

Copy C is intended for the accounting of shareholders. By the way, if you are the actual owner of the shares for which issued this form, do the following:

- Complete Copies A, B, C, and D of this form for each owner of shares;

- Enter your name as “candidate” in the corresponding line, and the address;

- In Copy B, put your name and attach it to the first copy;

- Apply the second copy to the Center of the internal revenue;

- Identify the owner of the shares in the executed copy.

According to the rules, the candidate has about 90 days to complete these items. If you are a candidate and at the same time a resident of a foreign country, you have 150 days. Copy D applies to Investment companies and trust funds.

and