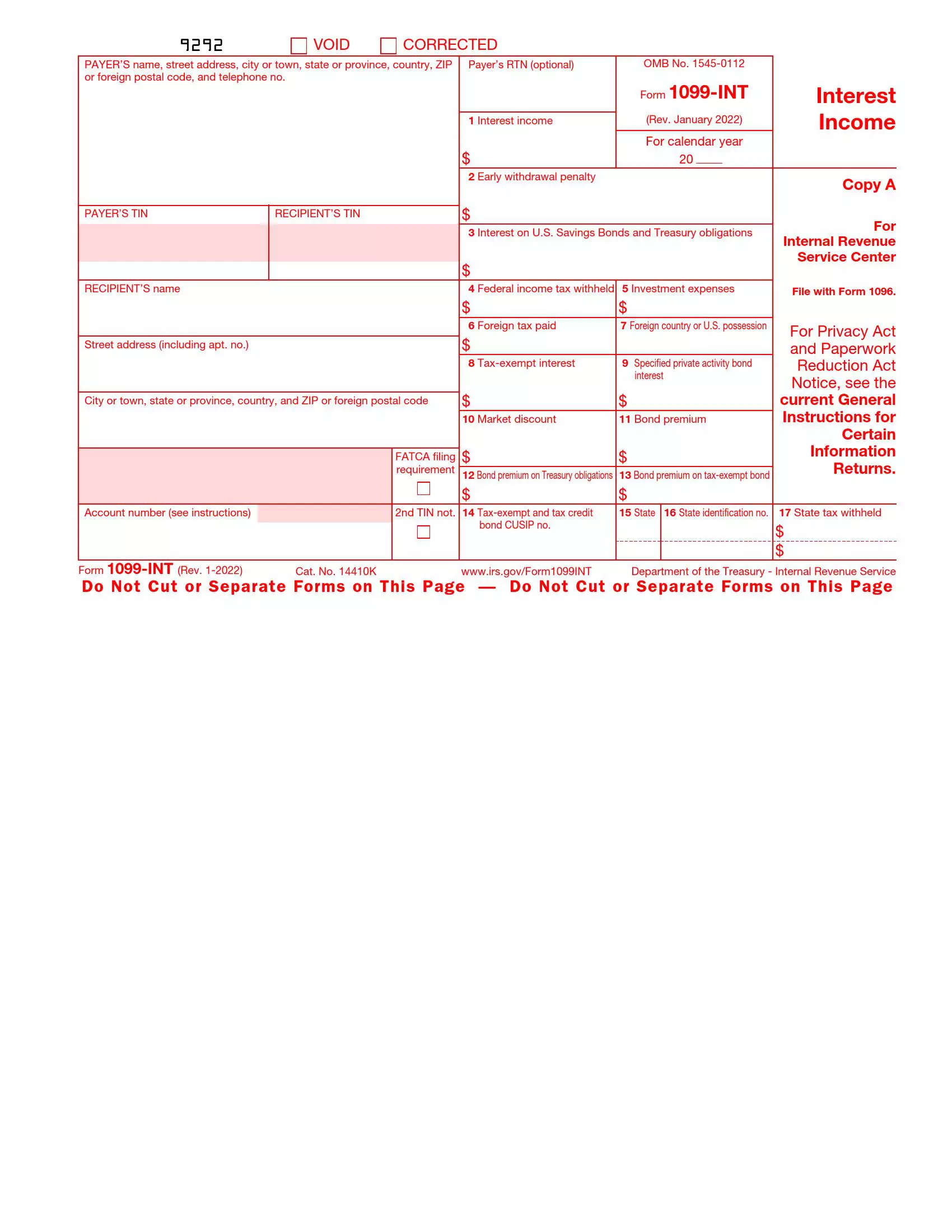

Form 1099-INT is a tax document used by payers to report interest income paid to individuals or businesses throughout the tax year. The form is typically issued by banks, financial institutions, and other entities that pay interest on investments, loans, or accounts. It informs recipients of the amount of interest income earned during the year, which they must report on their federal income tax returns. Form 1099-INT includes several important details, such as:

- The recipient’s name, address, and taxpayer identification number (TIN),

- The payer’s information,

- The total amount of interest income paid to the recipient during the tax year,

- And any applicable withholding tax.

This form helps taxpayers accurately report their interest income to the IRS, ensuring compliance with tax laws and regulations. Recipients must include the information from Form 1099-INT when preparing their tax returns, as failure to do so may result in penalties or audits by the IRS.

Other IRS Forms for Self-employed

IRS forms are quite often complex and lengthy, so using the help of a legal specialist is very common. Check what other IRS forms you might want to get help with.

Form Completion

This document consists of fillable boxes, each of which should not be left blank. If you decide to obtain a template through the official IRS website, you will see that Copy A, which appears in red, is not allowed to be filed (this will lead to legal punishment). However, the official printed version is scannable. Other copies are downloadable and printable. You may also wish to use our form-building software and complete the document electronically. Do not forget to create a payer’s statement if you are the one filling out this form.

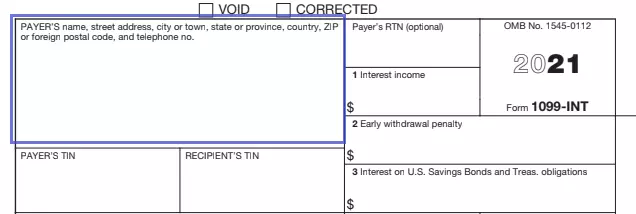

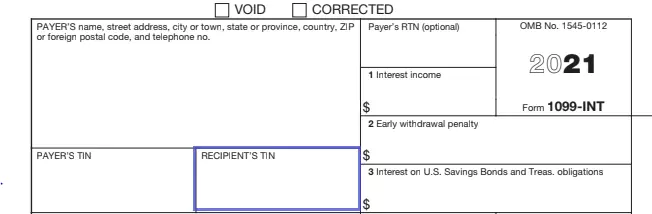

- Provide the Payer’s Essential Data

The first field of this document will contain the taxpayer’s full legal name, complete residential address, ZIP or foreign postal code, and a daytime telephone number you can be reached at.

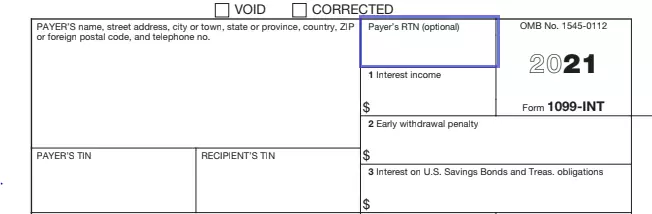

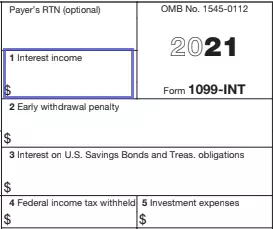

- Input the Payer’s RTN

RTN stands for routing and transit number. Inserting one is not obligatory. You may wish to indicate your RTN if your company intends to take part in the direct deposit of refunds program.

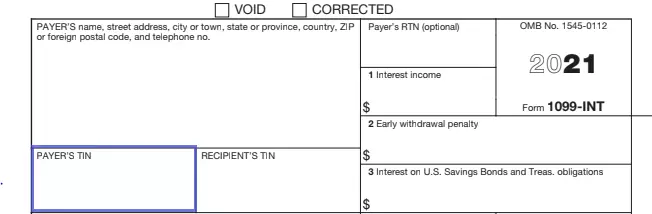

- Enter the Payer’s TIN

TIN stands for a tax identification number and is a nine-digit code.

- Insert the Recipient’s TIN

The recipient has to be identified by the IRS as a taxpayer as well.

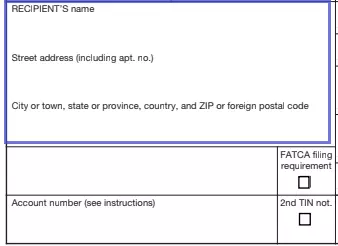

- Indicate the Payee’s Basic Info

The payer must fill in their full legal name and mailing address (including state, county, city, street, ZIP code (or a foreign postal code, if applicable). Submit the relevant info in the respective boxes (as shown in the picture).

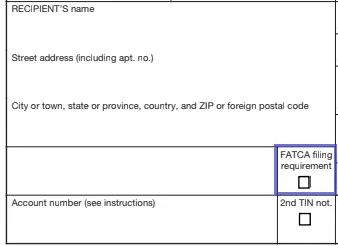

- Check the FATCA Filing Requirement Box

One has to checkbox this option if they represent an FFI and report payments to a US account. If you are a US citizen or a business unit’s owner acting on its behalf, create this form and check the corresponding box.

- Provide Account Number

Not everyone should do that. However, if you have checked the box hereupon or own several accounts for the payee, you must not leave this field blank.

- Specify the Interest Income Amount

Hereunder, you must Indicate the sum that you did not include in box 3 (at least $10). No additional description is required here.

- Enter the Early Withdrawal Penalty

The amount of interest caused by an early withdrawal of a time deposit is provided in this part of the form. Please refer to the picture below to do that correctly.

- Input Interest on the US Saving Bonds (or Similar Obligations)

In the part of the 1099-INT Form, the applicant needs to indicate all requested info on the bills, bonds, and notes referring to the Treasury. If you have performed interest payments in one of the above segments, please indicate the amount in US dollars.

- Insert Backup Withholding

This amount should be only specified in certain situations. For instance, if the payee has not provided you with a correct TIN.

- Indicate Investment Expenses

Please pay special attention to this amount, as it is not deductible.

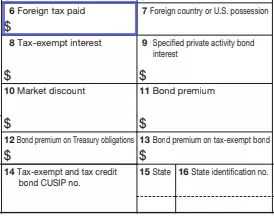

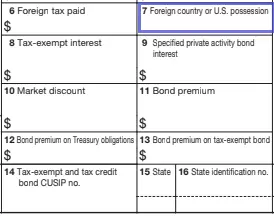

- Provide the Foreign Tax Amount Paid

If you are currently paying foreign taxes on interest, ensure to insert the respective amount in US dollars.

- Enter the Foreign Company’s Name

After completing the previous boxes, specify the entity for which the foreign tax was paid.

- Insert Tax-Exempt Interest

Indicate the tax-free interest that is not OID of $10 or a bigger sum (if applicable).

- Type the Specified Private Activity Bond Interest

Refer to Section 141 to fill out this particular field. This type of bond means that you have to provide (or repeat) any private activity bond info that you have defined in Section 141.

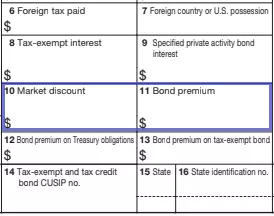

- Insert Market Discount and Bond Premium

You need to enter all the necessary bond-related information in this section. They require you to provide the current amount of income and indebtedness that you have obtained during the current financial year and use this data for tax purposes; so, ensure to provide the most accurate and up-to-date info.

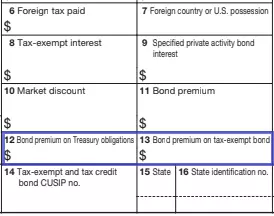

- Complete Additional Bond Premium Info

In boxes 12 and 13, provide data about the bond premium for a US treasury obligation and

tax-exempt covered security.

- Enter the CUSIP Number

Here, one should provide the indicated number of single bonds or valid accounts containing a single bond. Fill out the blank slots as shown in the picture.

- Complete State Information

You only need to fill out these boxes if you are a participant in the Combined Federal/State Filing program. If you are not part of either of those, leave the boxes empty.

The form appears to be complicated, and certain knowledge of the terms and procedures is required to guarantee the success of the operation. We recommend using automatic form-building software you can obtain on our official website.