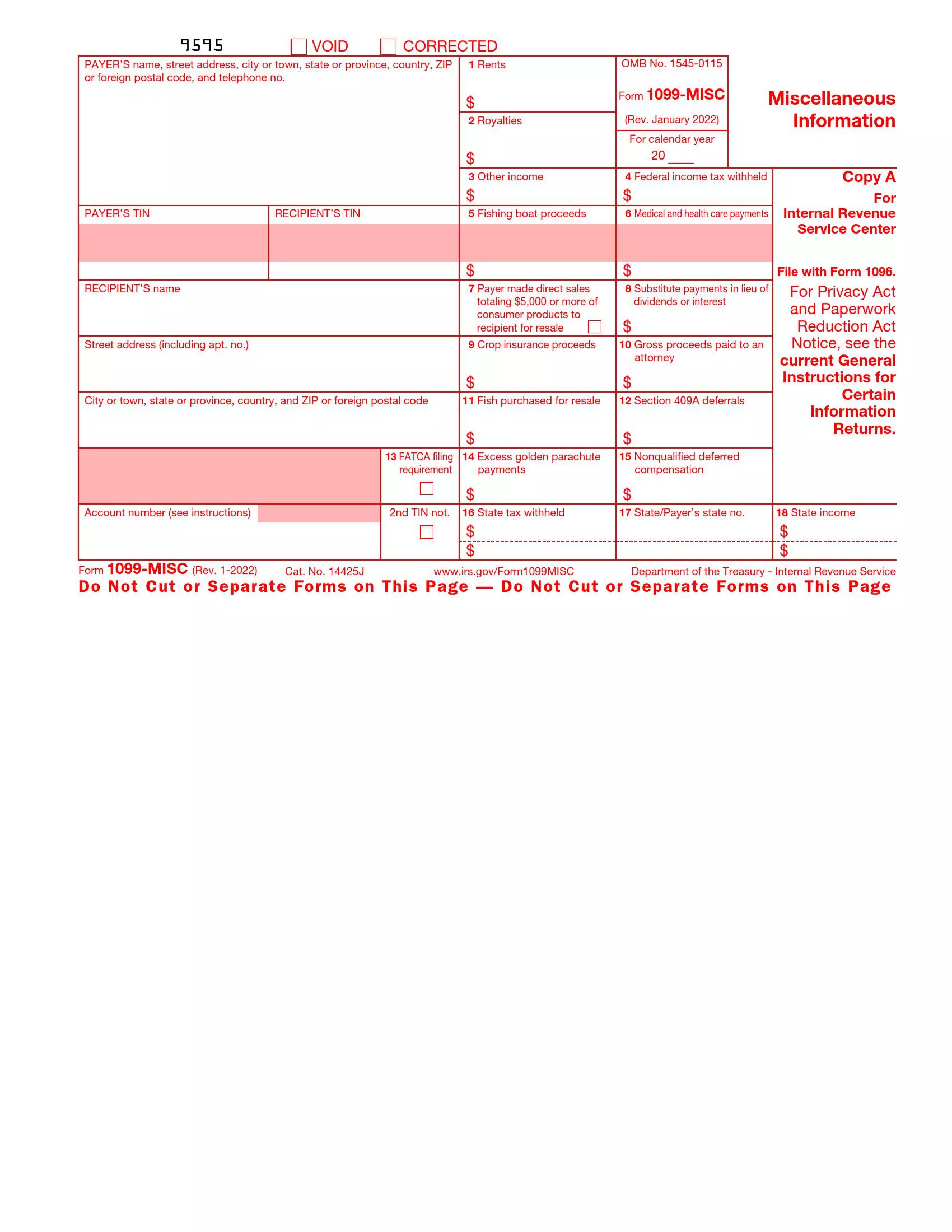

Form 1099-MISC is a tax document that reports payments made during a business or trade to individuals and entities that are not employees. This form covers various payment types, such as rents, royalties, prizes, awards, and other forms of compensation. It’s particularly important for self-employed individuals, freelancers, and independent contractors who receive payments not subject to withholding. Form 1099-MISC helps these recipients report their income accurately on their tax returns.

The primary purpose of Form 1099-MISC is to ensure that the IRS has a record of the miscellaneous payments businesses make that do not fall under typical wage-based employment. This form is critical for the IRS to track and tax income that might otherwise go unreported. It also aids recipients in maintaining clear and compliant financial records, ensuring they correctly account for all sources of income when they prepare their annual tax returns.

Other IRS Forms for Self-employed

Along with the IRS form with miscellaneous information, there might be some other forms devised for individual taxpayers you might want to read about.

How To Fill Out The Form

The form is not very difficult to fill out once you have understood the basics of its creation. We hope that our form-building software will help you generate the relevant PDF file. If you have many forms to send out to the agency, you are welcome to do it electronically via email. However, to give the copies to your independent contractors in this way, you should get their consent. In case they object to receiving the document electronically, print it out for each worker.

The form contains a great number of boxes that can make the process rather challenging. However, each box has inscriptions indicating what details you should insert in each box. To create a correct file with precise information, read our step-by-step instructions below, and be attentive.

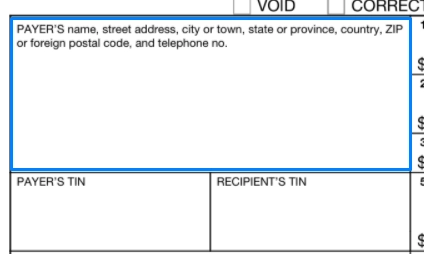

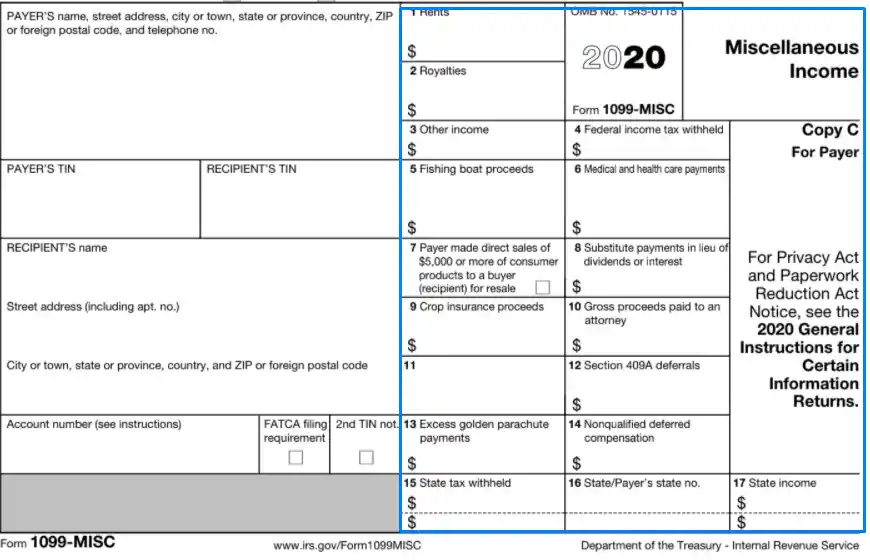

Step 1. Insert the Payer’s Personal Info

Like any other tax form in the U.S., this one starts with the personal information about the two parties (the payer and the recipient). Therefore, the first thing you need to do is fill out the section indicating who has paid the written amount of money to a freelancer or independent contractor. This party should write their legal name and residential address. The address (written in the following order: city, state, county) should be mentioned along with its ZIP code. The payer must input their phone number in case they need to be contacted in the future.

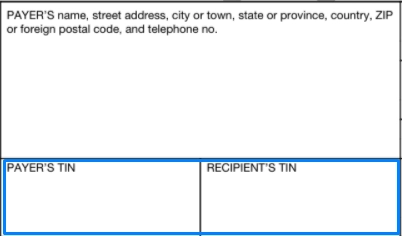

Step 2. Insert the TIN

In the next two boxes, the parties must write their taxpayer identification numbers. The box on the right should be filled out by the payer, while the left section is meant for the recipient. The number contains nine digits. The number “9” goes the first.

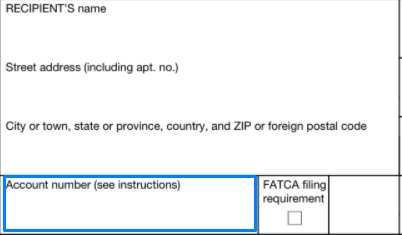

Step 3. Identify the Recipient

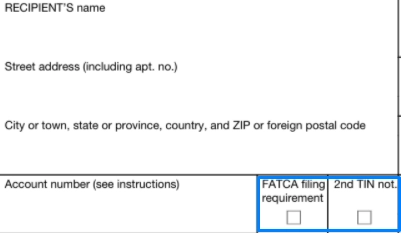

Below the two boxes with the taxpayer ID numbers, there is a large box similar to the first one (the payer’s info), in which the recipient is to insert their personal details. Unlike the first one, this section is divided into three parts. The first part is devoted to the recipient’s legal name; the second one — to their street address, which must include the apartment number. Finally, the third part in the section requires that the recipient add their full physical address (city, state, county, and ZIP code).

Step 4. Write the Account Number

You will see the section that must be filled out below the previous box if the payer has more than one account number for the recipient. The recipient must indicate what account number was involved when making the payment.

Step 5. Check the Box

The two sections next to the box “Account Number” require you to select the box if necessary. The first one is called the FATCA filing requirements. To find out when you need to check it, read the instructions in the official form. The second box is for the second TIN. It is selected if the payer is informed two times that the recipient’s TIN was inserted in the wrong way.

Step 6. Enter the Income

Boxes 1-17 indicate the total amount of payments for different types of service and income. Each box is meant for one type of income (including rents, royalties, medical services, prizes). Some of the boxes indicate the amount of income tax (either federal or state) withheld. Boxes 16-18 are related to state information, which is not necessary to be inserted by the payer.

Step 7. Distribute the Copies

As we have mentioned earlier, the official document has several copies, each meant for a particular organization or individual. Do not forget to send the first copy that is colored red to the IRS. You, as the recipient, leave Copy B to yourself. The payer receives Copy C. The other copies are supposed to be submitted to the state tax department.