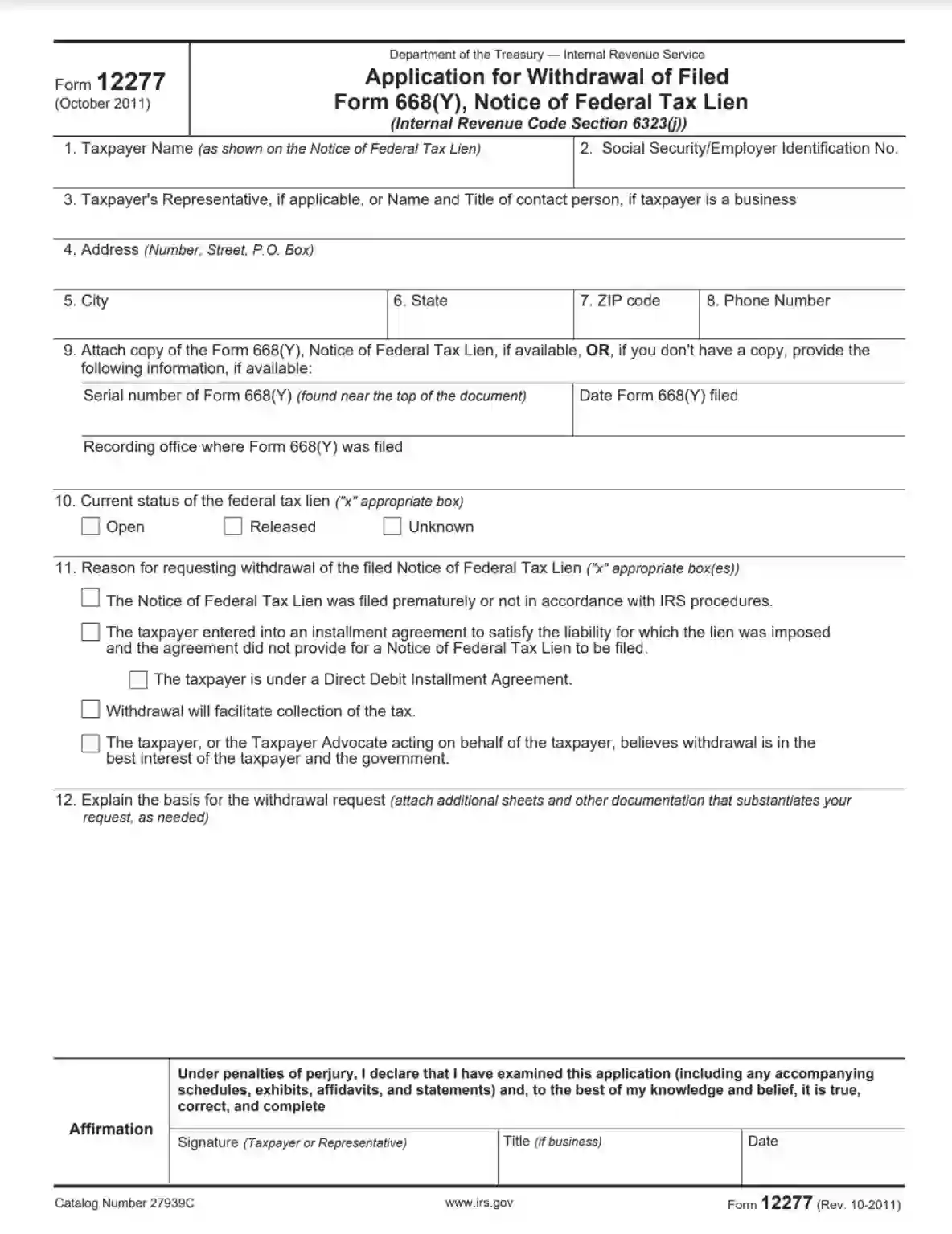

Form 12277 is an Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. This form is utilized by taxpayers who wish to have a Notice of Federal Tax Lien removed from public record, usually after satisfying the tax liability or agreeing to payment terms acceptable to the Internal Revenue Service (IRS). By submitting Form 12277, taxpayers can formally request the withdrawal of the lien, which can help improve their credit score and remove obstacles to obtaining credit.

The successful processing of Form 12277 can result in the IRS issuing Form 10916(c), which confirms the withdrawal of the lien. This action doesn’t erase the underlying tax obligation unless fully paid or otherwise satisfied but removes the public Notice of Federal Tax Lien. For taxpayers, this means potentially restoring their financial standing and easing the process of engaging in future financial activities, such as securing loans or refinancing properties, as the lien no longer adversely affects their credit report.

Other IRS Forms for Individuals

Here, you might find some other IRS forms designed for specific tax situations that might happen to every taxpayer.

How to fill out IRS Form 12277?

Read the general instructions

On the second page of the document, you will find requirements and tips on how to fill out the paper correctly. We recommend you read the instructions thoroughly before you start filling out the Form. The document uses some terms that are necessary to understand in order to submit an application to the IRS. Errors may lead to rejecting the application or make the information that the applicant wants to indicate to be distorted.

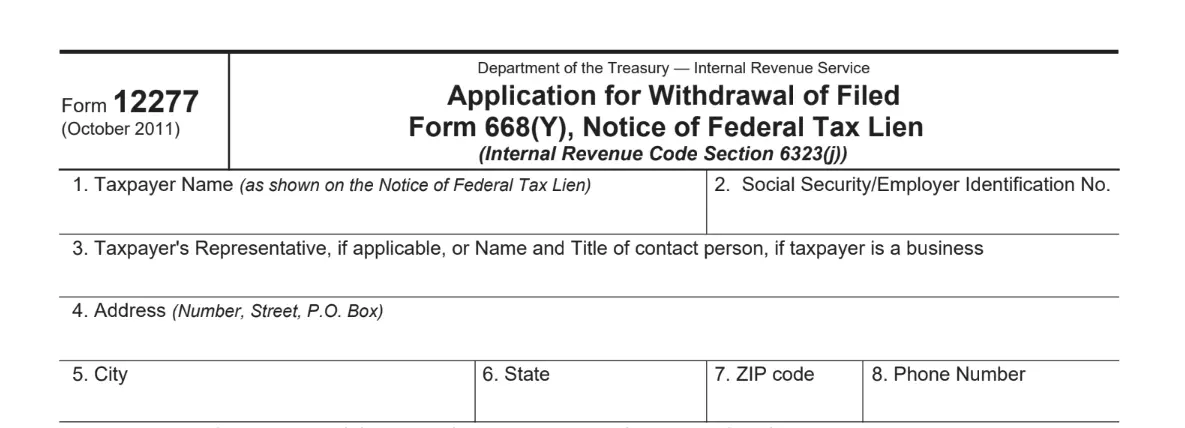

Enter your personal data

Fill in sections 1-8 with your personal data that the document asks for. Be very careful when filling out these forms, as if one of these lines is completed incorrectly, the IRS will not be able to identify the applicant in their database.

Fill out the information on Form 668(Y)

Section 9 deals with the NFTL and specifies the details of the Form 668(Y) that contains data of the federal lien and must be cleared through appealing Form 12277. The introduction of data on this form will speed up the process of interaction with the IRS.

Please note that if you attach Form 668(Y) to the application, you do not need to fill out section 9. Data about Form 668(Y) must be entered only if the Form is not available.

Specify the taxpayer status

In section 10, you need to specify the current taxpayer’s status of the federal tax lien. The document offers three options: Open / Released / Unknown.

The taxpayer chooses “Open” if he/she has not yet paid the tax debt or if the debt has been repaid within the last month. If the debt was paid more than 30 days ago and you can ensure that it does not have the mark of outstanding debt, then you need to select the “Released” point. In another case, if the filler does not know the exact status of their position in the IRS, it is necessary to select the last item, “Unknown.”

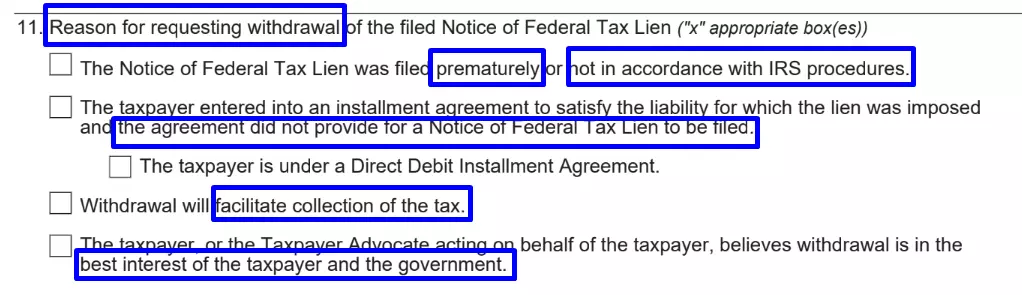

Indicate the reason for submitting Form 12277

Part 11 offers to choose one of the reasons that force the taxpayer to request the possibility of withdrawing federal tax lien. Since these points are already discussed in another section of this article, we will not dwell on them now.

Provide additional information

In section 12, the taxpayer can attach additional data and papers such as tax filing records, confirmation of the payment plan to the IRS, and other documents. Accompanying the Form with documents will increase the chances of success because it will contain not only a request but also evidence.

Verify the information

The last step is to sign and date the Form. Thus, the taxpayer confirms the truth of all the information that was entered above in sections 1 – 12.