Form 3800, known as the “General Business Credit,” is a form taxpayers use to calculate and claim the total amount of business credits for which they are eligible. This form is a consolidation document for various business-related credits, ensuring taxpayers efficiently claim all applicable credits on one form. These credits can include incentives for investment, employment, research and development, and environmentally friendly practices.

Form 3800 is crucial for taxpayers who qualify for more than one business tax credit. The form is designed to aggregate the amounts from separate credit forms — such as the Work Opportunity Credit (Form 5884), Investment Credit (Form 3468), and Research Credit (Form 6765) — to determine the total amount of business credits that can be applied against their tax liability. This organized approach prevents the double claiming of credits across different forms and simplifies the process of applying multiple credits to reduce tax liabilities.

Other IRS Forms for Business

Apart from claiming any of the general business credits in the Form 3800, you might need to report other information to the Internal Revenue Service. Check some other commonly used forms for businesses here.

How to Fill Out Form 3800

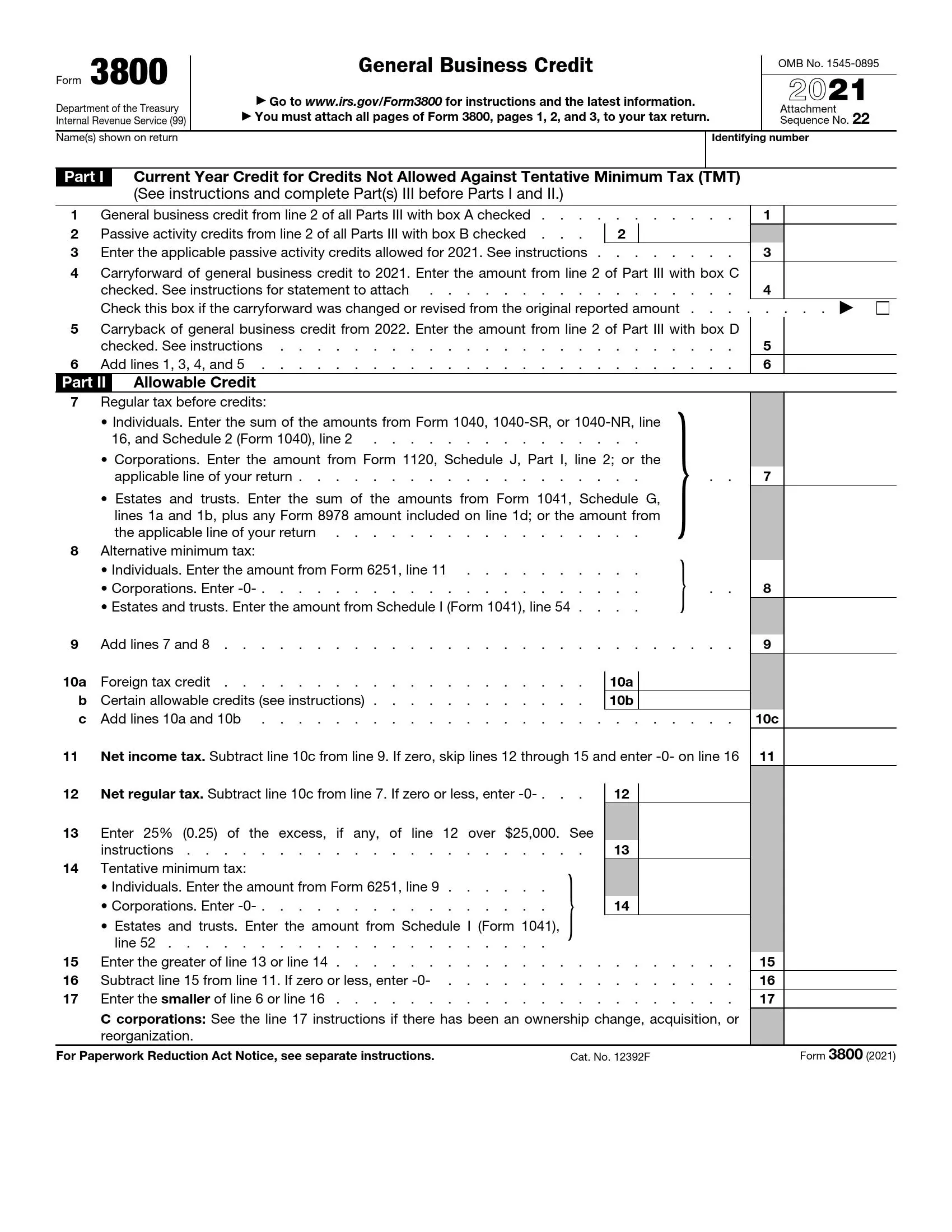

The form consists of three parts. Here you will find a comprehensive list of requirements and instructions for each section that you can follow step-by-step. To fill out the form without any mistakes, we suggest not going from the first section to the last as they are placed in the form. It might be important to complete the third part first.

Complete the first part

Here you will need to fill in the information concerning credits of the current year for credits that were not allowed against TMT.

- When filling in the third line, remember that you only should enter credits that are allowed in this part. Enter the whole sum of credits for business purposes which were not possible to write in the previous line because of TMT. You should also write a credit of the same kind taken previous years;

- To fill in the information in the fourth line, you should check the box on the right and provide a required statement. It should contain information about the original year of the credit as well as the original amount and the amount which was allowed that year. Write down if you changed the amount and specify which credits did you involve;

- You should complete the fifth line only if you have corrected the amount of your return from 2020. That might be done to carry back credits which are not used from 2021. In this case, you should check box D and enter the amount that is reported from line 2 (section 3).

Now move on to the second part about allowable credits

- In the line 10b, rewrite the allowable credit from the tax return;

- For C corporations, some problems may occur while filling in the seventeenth line. If one of the following situations that make the process of reporting credits and taxes more complicated has ever taken place, you must provide another document to prove it. These cases include an ownership change, or a corporation acquired control of another one. Please attach a computation of the allowable general business credit and fill in the amount. Also, you should not forget to mention sec. 383 or 384 on this line;

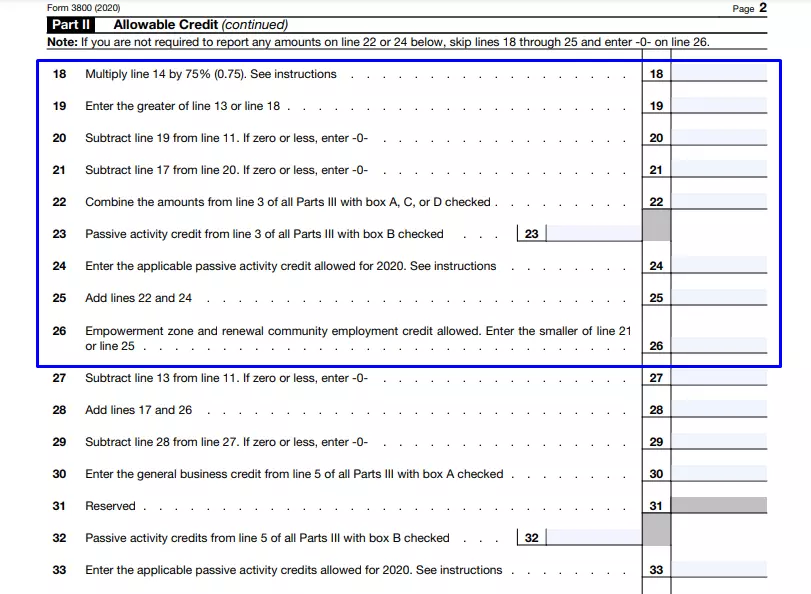

- You should not fill in the lines from 18 to 25, and you must only write zero on line 26. This rule is not applicable for a few exceptions;

- On line 24, you should enter the passive activity credit amount. You can only write about the empowerment zone and renewal community employment credit. Other types of money sources must not be mentioned here;

- You should write only allowed passive activity credit on line 33. Those are the general business credits (see the previous line), eligible small business credit, and an unallowed credit from previous years;

- On line 34, you must write down the number of carryforwards to 2020 of unused credits. Check the box and attach required documents to calculate the charge or revision;

- If you amend the return from 2020 to carry back unused credits from 2021, you should fill in line 35. Compare the needed sum with the fifth line and make sure that the D box is marked;

- For line 38, you should see carryback and carryforward of unused credit when the amount on this line is smaller than the total amount of lines 6, 25, and 36 calculated together.

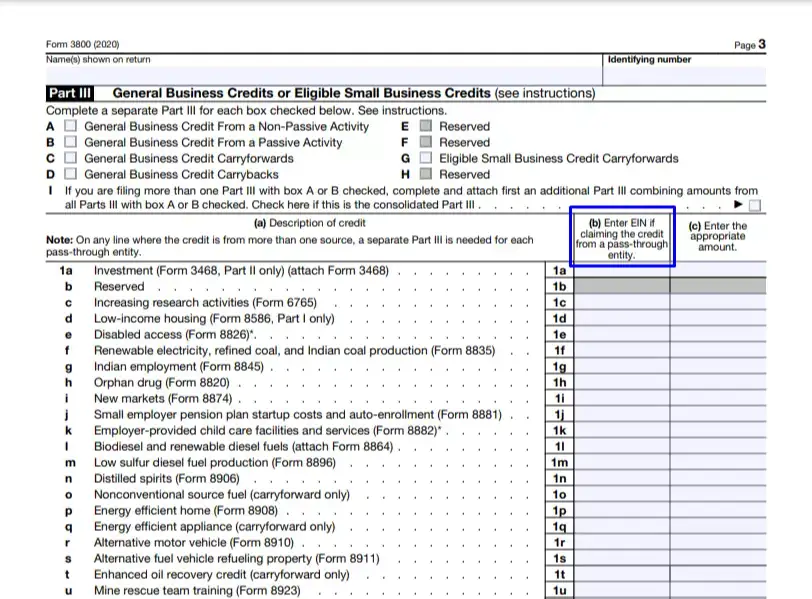

Fill in the information on general business credits or eligible small business credits

Remember that you have to fill in this part separately for each credit source (each box that you checked) and even for each pass-through entity in certain cases.

- Start from checking the box that reports a type of credit;

- Notice that boxes from A to D and also G are marked by white compared to other boxes that are grey-colored. We will focus on these boxes;

- Do not forget to check box I just below boxes from A to H if If you are filing more than one Part III with box A or B checked;

- You should write down your pass-through entity’s employer identification number (EIN) below column (b) when you are reporting credit from a pass-through entity or your cooperative’s EIN for the credit reporter on form 1099-PATR;

- Be aware of some limitations on credits such as: for the overall credit and for qualified small wind energy property;

- Complete all lines in the third part following instructions given in the form;

- Completing form 3800 is compulsory for small companies owners before the section D in form 6765A in the case of reporting the payroll tax credit;

- Appropriate minor companies’ research credits should be reported on line 4i. Others should enter their sources and sums on line 1c;

- The rules are different for separate taxpayers. The maximum number of credits must be taken into consideration. Calculate the limitations and remember that the resulting number must not exceed one;

- Mind some prohibitions. For instance, it is prohibited to report more than 5,000 dollars in line 1e, column (c);

- When completing this document, you should also be aware of some restrictions like the carryforward must be written on the particular line in this section depending on the type;

- Those individuals who only took credit from pass-through entities should fill in line 4h. The majority of minor employers should report the credit on lines 16 or 18 (check form 8941);

- Remember that line 4z will only be needed in the future. You should not write there now.