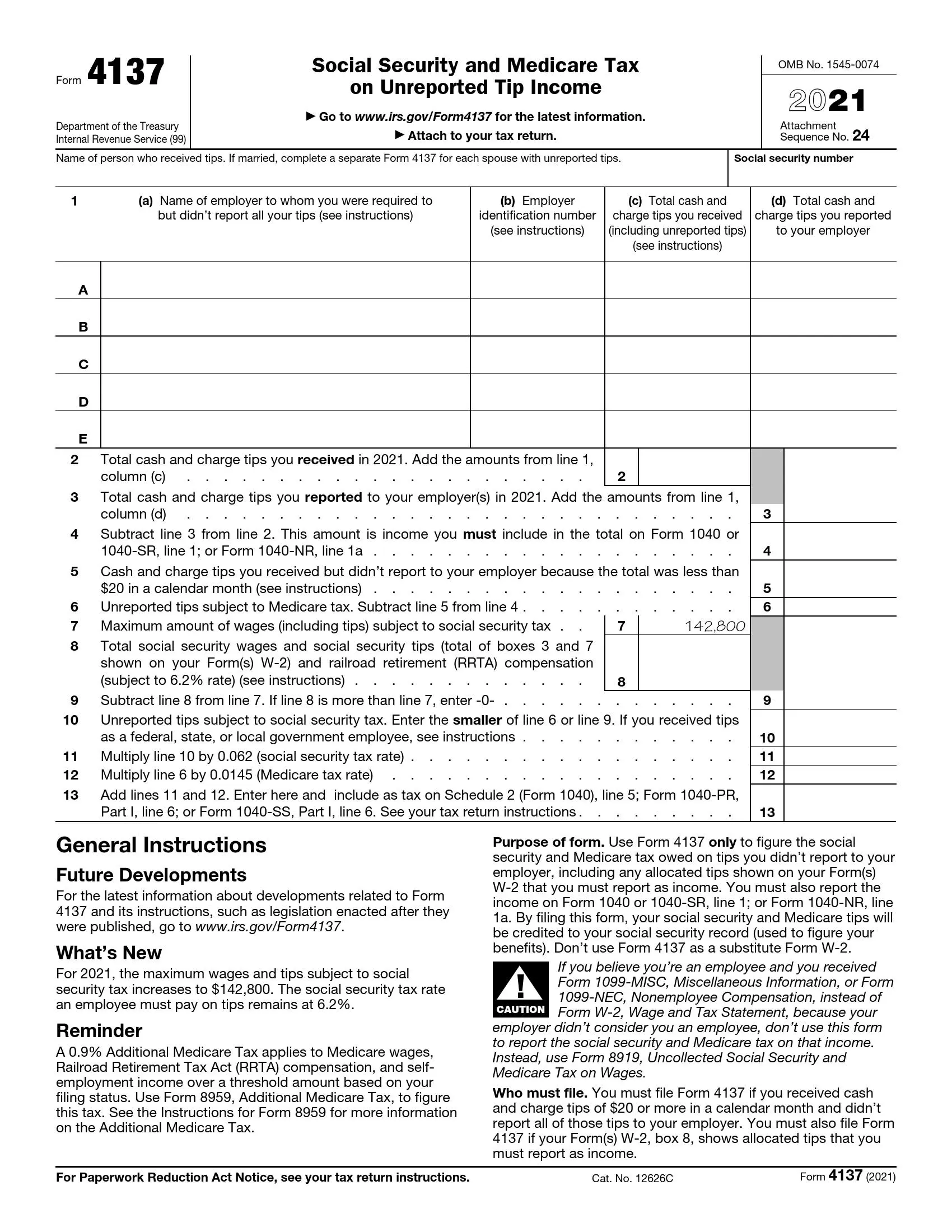

Form 4137, titled “Social Security and Medicare Tax on Unreported Tip Income,” is a tax form used by employees to report and pay their share of Social Security and Medicare taxes on unreported tip income. This form is typically used by food and beverage industry employees who receive tips directly from customers but fail to report them to their employers for tax withholding purposes. Form 4137 allows these employees to calculate and report the Social Security and Medicare taxes owed on their unreported tip income, ensuring compliance with tax laws and regulations.

The primary purpose of Form 4137 is to help employees who receive tip income accurately report and pay their taxes, particularly their share of Social Security and Medicare taxes. By using this form, employees can avoid underreporting their income and potentially facing penalties from the Internal Revenue Service (IRS). Form 4137 provides a structured process for calculating and reporting unreported tip income, helping employees fulfill their tax obligations and maintain compliance with tax laws related to tip reporting.

Other IRS Forms for Individuals

Here, we have plenty of other forms that you might need as an individual taxpayer.

How to Fill out IRS Form 4137

We have outlined an illustrated form compilation guide for you to make the filing process a bit easier. Please refer to it below.

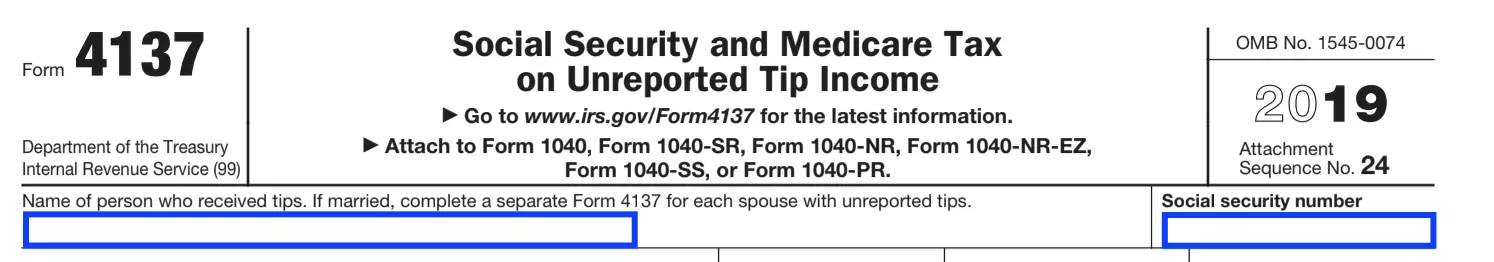

Enter Your Details

Start filling out the form by filling in your full name and Number of Social Security.

Fill in the Tip Information

If you work for several companies, then the data on each must be provided separately.

You must specify the following data:

- The name of the company;

- EIN as indicated in your W-2 Form;

- Total tips both reported and unreported.

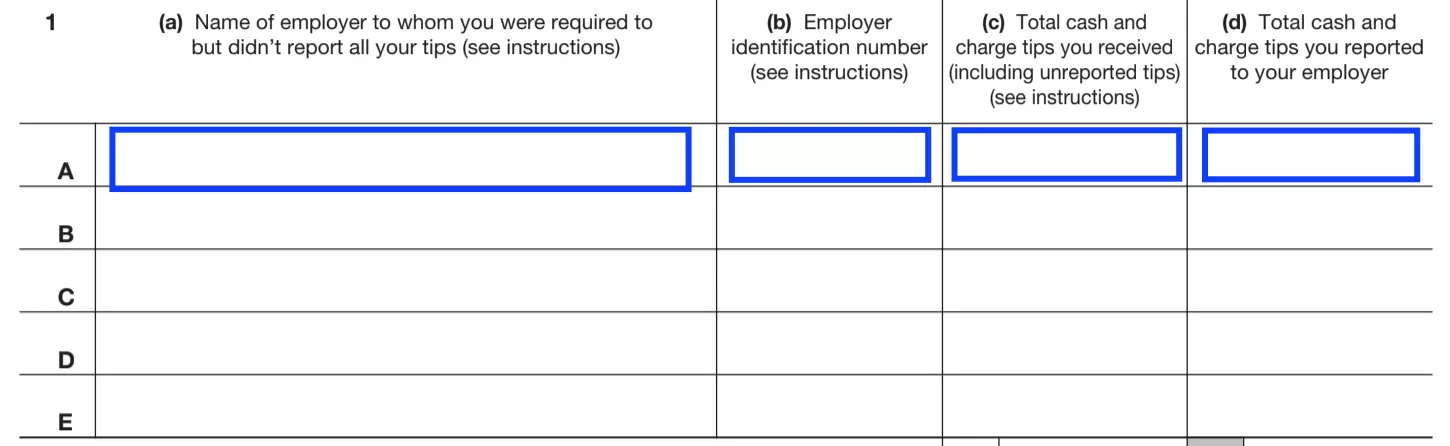

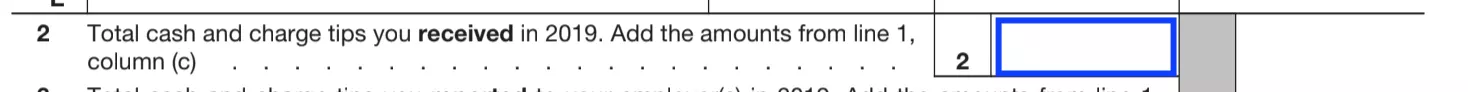

List All Tips For 2019

You need to add up all tips earned in 2019. This should include tips:

- Accepted in cash;

- Received on bank cards;

- Less than the $20 per month threshold;

- Which you informed and did not report to your boss;

- Allocated ones from the W-2 form.

Enter the Tip Amount Reported to the Employer

You can rewrite the number from your W-2.

Calculate the Sum of Additional Tips

Following the instructions for calculations, you will receive the amount for which you must calculate taxes.

Get the Sum That Is Subject to Medicare Tax

On point 5, enter the tip amount that was less than $20 per month. Then subtract the metrics as written on line 6 and write down the result.

Point 7 is already filled in; you do not need to touch or change it.

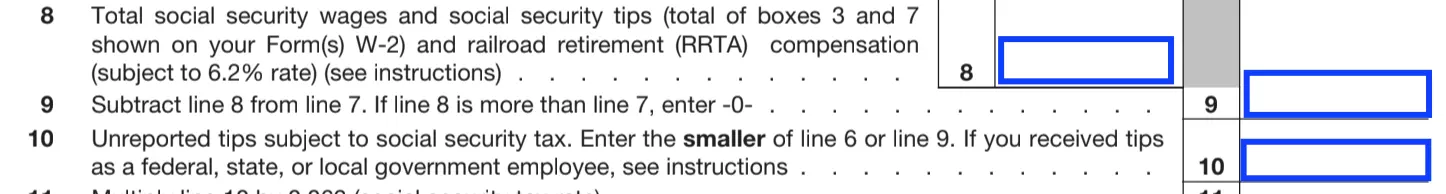

Get the Amount That is Subject to Social Security Tax

Enter in point 8 the result of the addition of all wages you specified in W-2.

Enter in point 9 the result obtained by subtracting the indicated values. If you get a negative number, then write in zero. Then compare the indicators from points 6 and 9, and you should enter the lower number in point 10.

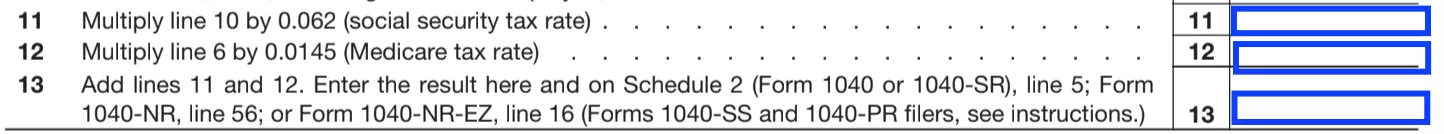

Get Tax Amounts

By following the instructions on points 11 and 12, you will receive the exact tax amounts. On point 13, you will receive additional taxes, which must be reported on the rest of the documents.