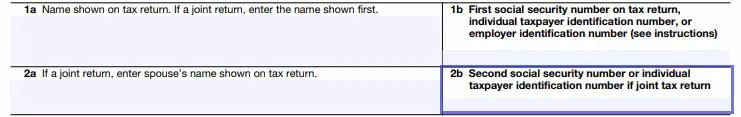

Form 4506 is a document used by the Internal Revenue Service (IRS) to facilitate requesting past tax returns or other tax-related documents. Officially titled “Request for Copy of Tax Return,” this form is essential for individuals or entities needing to obtain copies of previously filed tax returns, which may be required for loan applications, legal matters, or financial planning. By submitting Form 4506, the requester can obtain exact copies of their federal tax returns, including all attached schedules and forms, as originally submitted to the IRS, along with any amendments or changes made after the initial filing.

Form 4506 is crucial for verifying income and tax compliance in various scenarios. For example, mortgage lenders often require tax return copies from applicants to confirm their income and tax payment history, making this form an essential part of the mortgage application process. Additionally, individuals handling estate settlements or legal disputes related to taxes might need to access exact copies of tax documents. Form 4506 involves a fee for each tax year requested, and it typically takes the IRS about 75 calendar days to fulfill these requests, providing a thorough and official record of past tax filings.

Other IRS Forms for Individuals

Here, we have prepared some other IRS forms to report various financial information and make requests to the Internal Revenue Service.

Filling Out the Form

Unlike many others on the official IRS website, this document consists of only one fillable page and is comparably simple to complete. The service itself estimates the approximate time of preparing this paper to be 16 minutes. If you happen to have any suggestions on how to simplify the form more, do not hesitate to contact the IRS office.

Study the Info about the Form

Do not skip this step to ensure you have looked into the law.

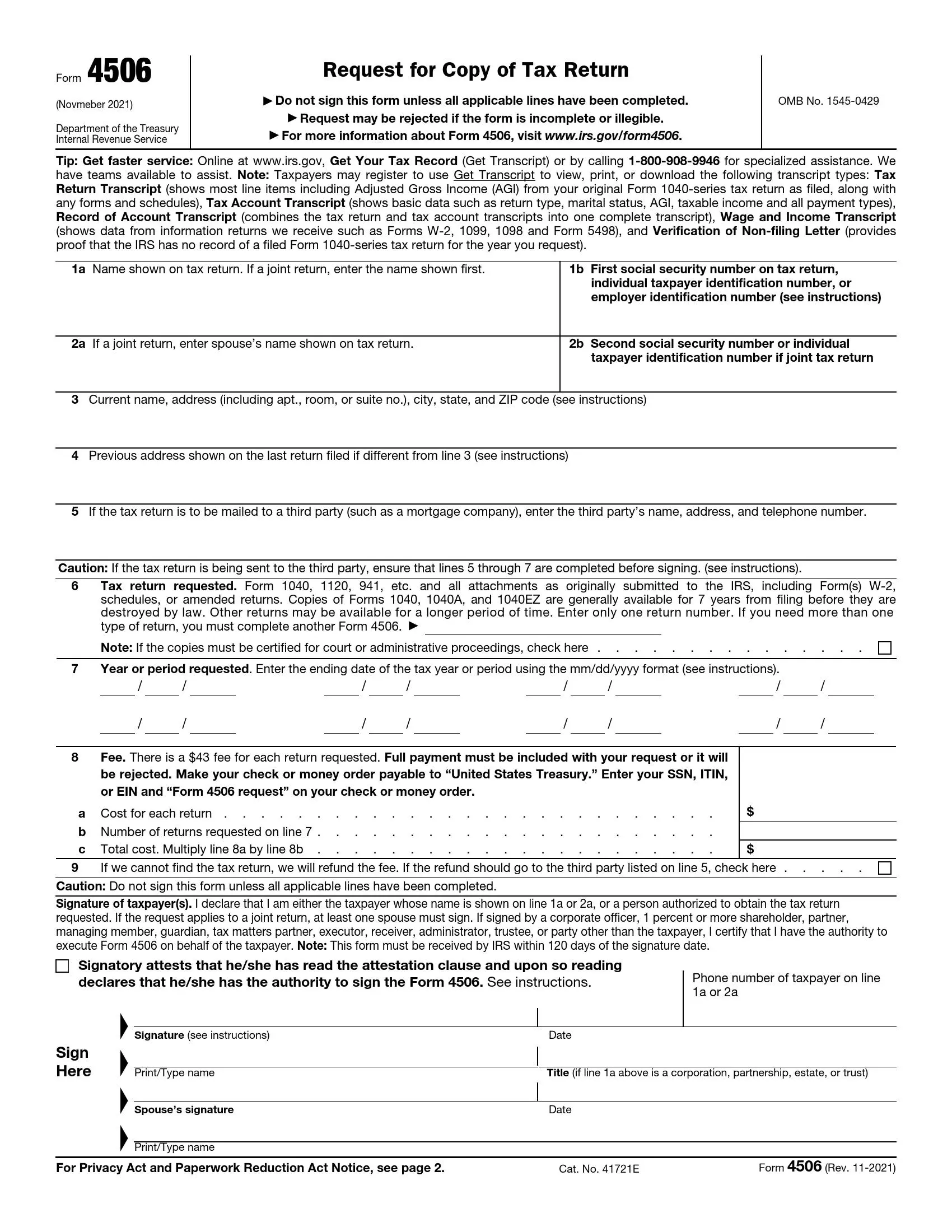

Provide Your Name

You should indicate your complete name matching the one shown on the original return. If you have filed a joint return, input the name that was entered in the paper first.

Insert the SSN

The ITIN or EIN may also be entered if they were indicated in the original return form.

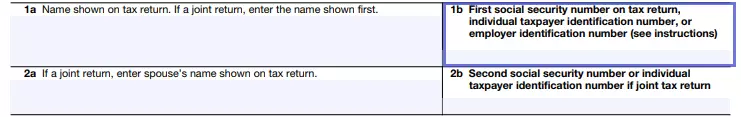

Write Your Spouse’s Name

If the return you are asking for the copy of was a joint return, do not forget to indicate your legal wife or husband’s full name.

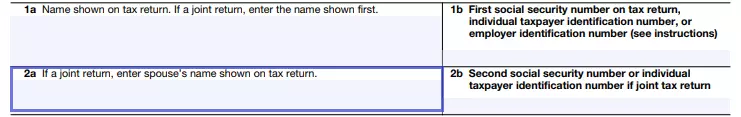

Insert the Spouse’s SSN

The same data you have submitted in line 1b must be written herein if applicable.

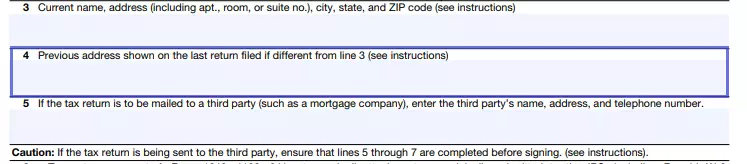

Enter Mailing Address

You are probably requesting a copy of your tax return because your residential address has changed. Input the current address, including apartment, city, state, and zip code.

Enter the Previous Address

Indicate the address that was shown on your last return if it differs from the one you submitted above.

Designate the Third Party

There is an option of delivering the document to the designated person. The IRS imposes restrictions on using and sharing the information that your tax return contains. If the recipient discloses any of that without your consent, they will be subject to penalties.

Specify the Form You Need

The applicant can request only one document at a time. If the filer needs two or more copies, they should complete other forms 4506.

Mention the Requested Period

Insert the calendar year, fiscal year, or quarter (month, date, and year).

Pay the Filing Fee (per Copy)

The paper will not be processed unless you pay the fee for each of the copies you need. The IRS informs you that if they fail to provide you with the original return, this sum of money will be refunded. Check the corresponding box in case you wish this money to be transmitted to the designated third party.

Declare the Signatory’s Right

If you do not check the box herein, your completed form might be rejected.

Append the Signature(s)

Enter the telephone number of the person whose name is on line 1a or 2a. An individual who has provided their name on the first two lines has to type their name, sign, and date this paper. If the taxpayer is a representative of any business entity, insert the title and attach an official document proving your authority to append the signature.