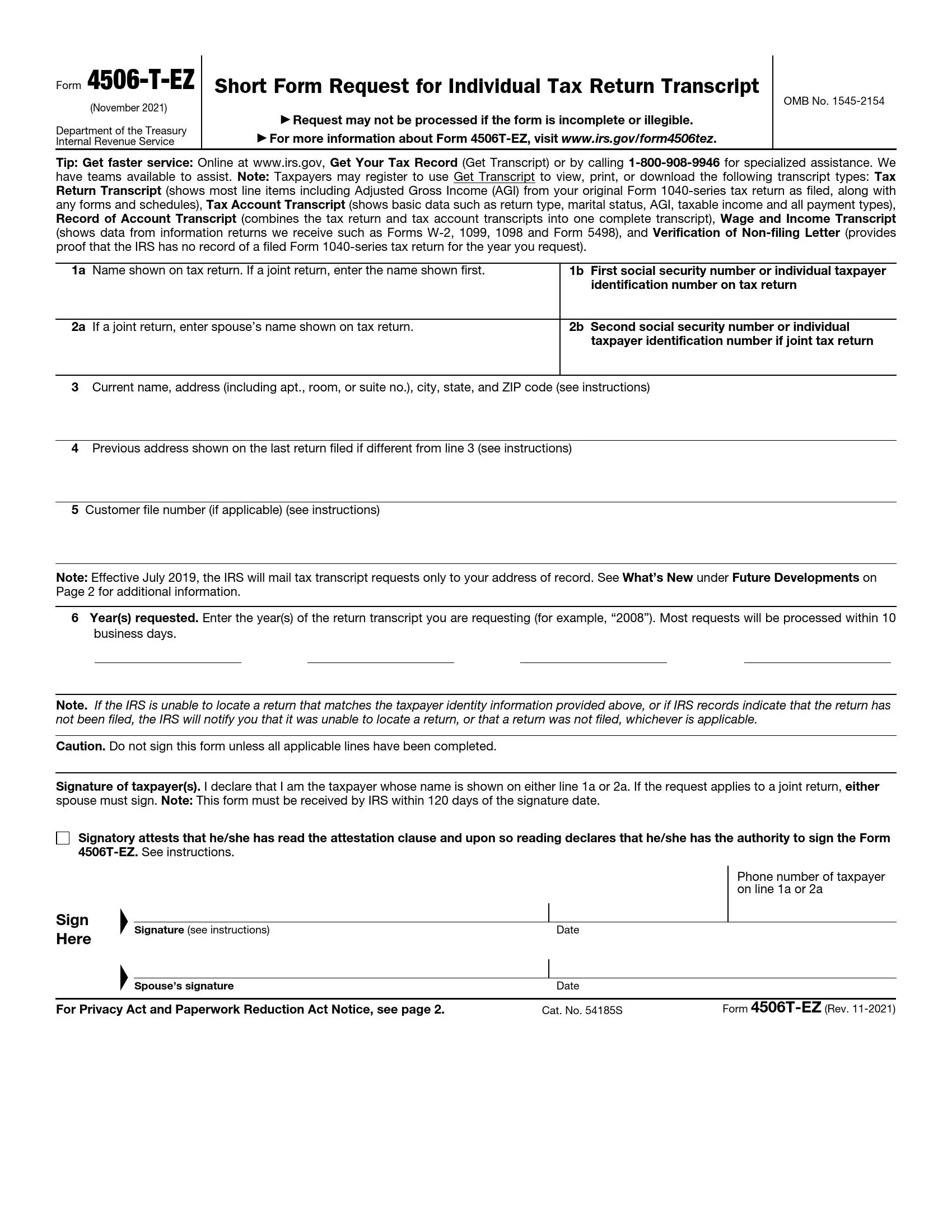

Form 4506T-EZ, titled “Short Form Request for Individual Tax Return Transcript,” is a tax form used by taxpayers to request a transcript of their tax return from the Internal Revenue Service (IRS). This form is a simplified version of Form 4506-T and is typically filled when taxpayers need a transcript of their tax return for purposes such as applying for a mortgage, student loan, or financial aid. Form 4506T-EZ requires less information than Form 4506-T, making it quicker and easier to complete.

The primary purpose of Form 4506T-EZ is to provide taxpayers with a streamlined method for requesting transcripts of their tax returns from the IRS. By completing and submitting this form, taxpayers can obtain the information they need to verify their income or tax filing status for various financial transactions. Form 4506T-EZ helps simplify obtaining tax transcripts, allowing taxpayers to fulfill their financial obligations or requirements efficiently and accurately.

Other IRS Forms for Individuals

If you are an individual taxpayer, there are some other IRS forms you might want to be familiar with.

How to Fill Out Form 4506-T-EZ

You can file the 4506-T-EZ Form electronically, so you can customize it online too. We encourage our users and readers to use our advanced and automated software to create any legal form they need. Plus, we now provide a unique PDF editor, which you can easily use to fill out all the necessary information online.

Below, you will find detailed recommendations and instructions on how to fill out the form step-by-step. You can use them as you go to fill out the form correctly.

Read the General Instructions and Provisions

The form itself contains General Instructions, which you can find on the second page. We strongly advise you to read them before you proceed to fill out the form, as they contain all the novelties and legal terms that you have to understand when entering the required information. Any mistake made in the records may be misleading, which, in turn, may result in you not getting the correct records from the IRS.

Enter the Name of the Taxpayer(s)

In the first blank line of the document, the applicant shall enter the legal name that was stated in the requested tax return report. Ensure it is the same name, it is very important, or the IRS specialists will not be able to find the necessary records.

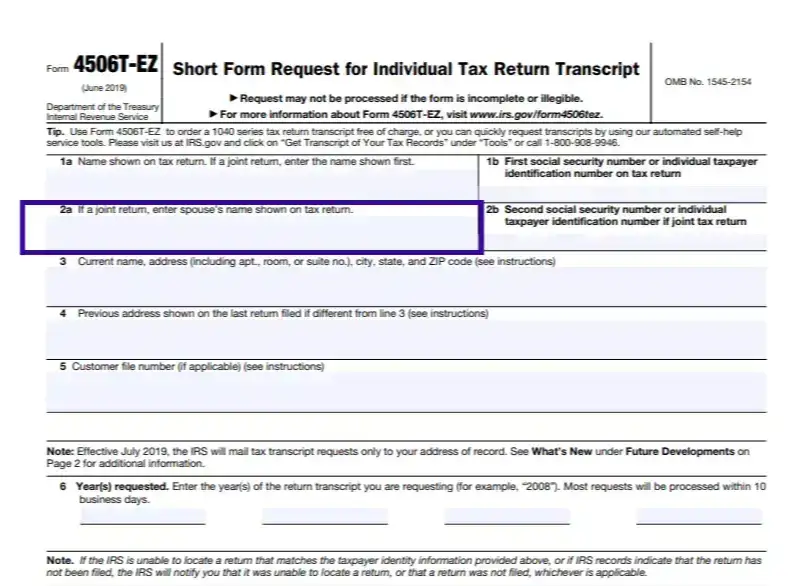

If it is a joint tax return report you are requesting, then enter only the first name indicated in the original form.

The second line is to be filled out if applicable. If it used to be a joint tax return you are now requesting, you need to indicate the name of the spouse you filed the tax return with. Again, make sure you enter the second legal name correctly as well.

Provide the respective SSN

In boxes 1b and 2b, you need to enter the respective Social Security Numbers (SSN) of the taxpayer(s). If you want to request a joint tax return form, then you have to enter the SSN of your spouse too. Thus, box 2b is only to fill out if applicable; if there is a single taxpayer, leave the line empty or cross through it if filling out by hand.

Provide the Applicant’s Current Name and Address

In this section, you need to fill in your current data. If you have changed your name since filing and your current name is different from the one indicated in the original form, you shall provide your current name.

The same goes for your current address. Enter your effective mailing address, including the state, ZIP, city, street, apartment, and room number (if applicable).

If you have not yet registered your new physical address at the IRS office, you should fill out and send the IRS 8822 Form for the legal change of address. Ensure to file it in the first place, or otherwise, your application might be recognized as invalid.

Indicate the Previous Address

Here, you should enter the last address you have indicated in your previous tax return form. It may differ from your current address as well.

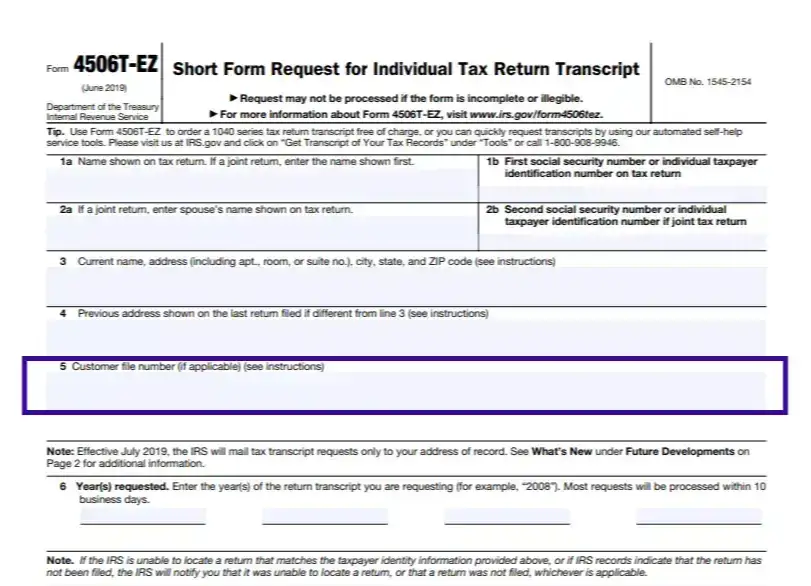

Enter the Customer’s Number

This number is required so that the responsible IRS specialists could find your requested form easier, as all of them are registered with the Service by a specific customer number. It is a modification the Service has implemented recently and now uses to protect your personal data from intrusion. The field is optional to fill out, so if you do not know your customer’s number, you can leave the line empty or contact the IRS office and ask them to assist in finding it. See the General Instructions for more info.

Designate the Year of Requested Tax Return

Enter the year of the requested tax return information. It should be the financial year you were filing your tax returns for and not necessarily the year when you filed it, so pay special attention to fill out this section. There are four blank boxes where you can enter the year’s digits.

Most requests for tax return reports are proceeded and replied to by the IRS within ten business days.

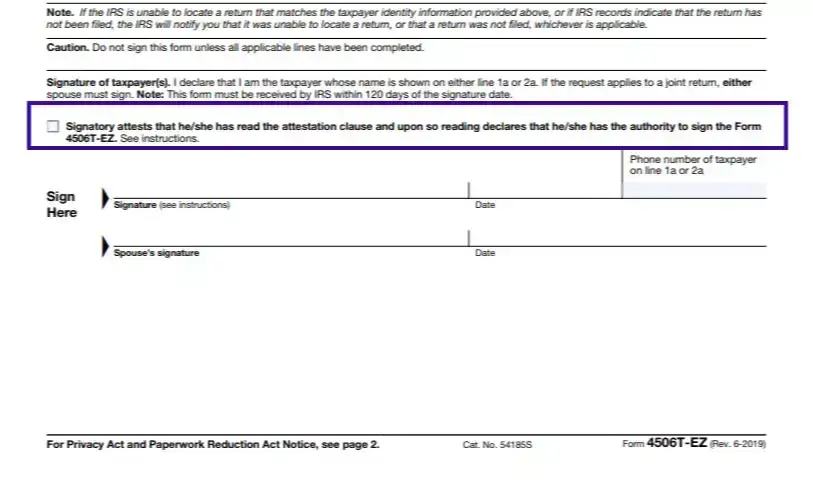

Provide the Disclosure

By ticking this box below, you state that you have thoroughly read the attestation clause and are ready to declare that you have full authority over this request and info (the requirement is new and connected to the latest novelties implied by the Service).

Insert Date, Signature, and Contacts

In the remaining sections, you shall put the signature(s) and current calendar date. The spouse shall do the same if it is a joint tax return information you are requesting. Also, you need to provide the daytime contact number of either taxpayer designated in this form (if there is more than one).