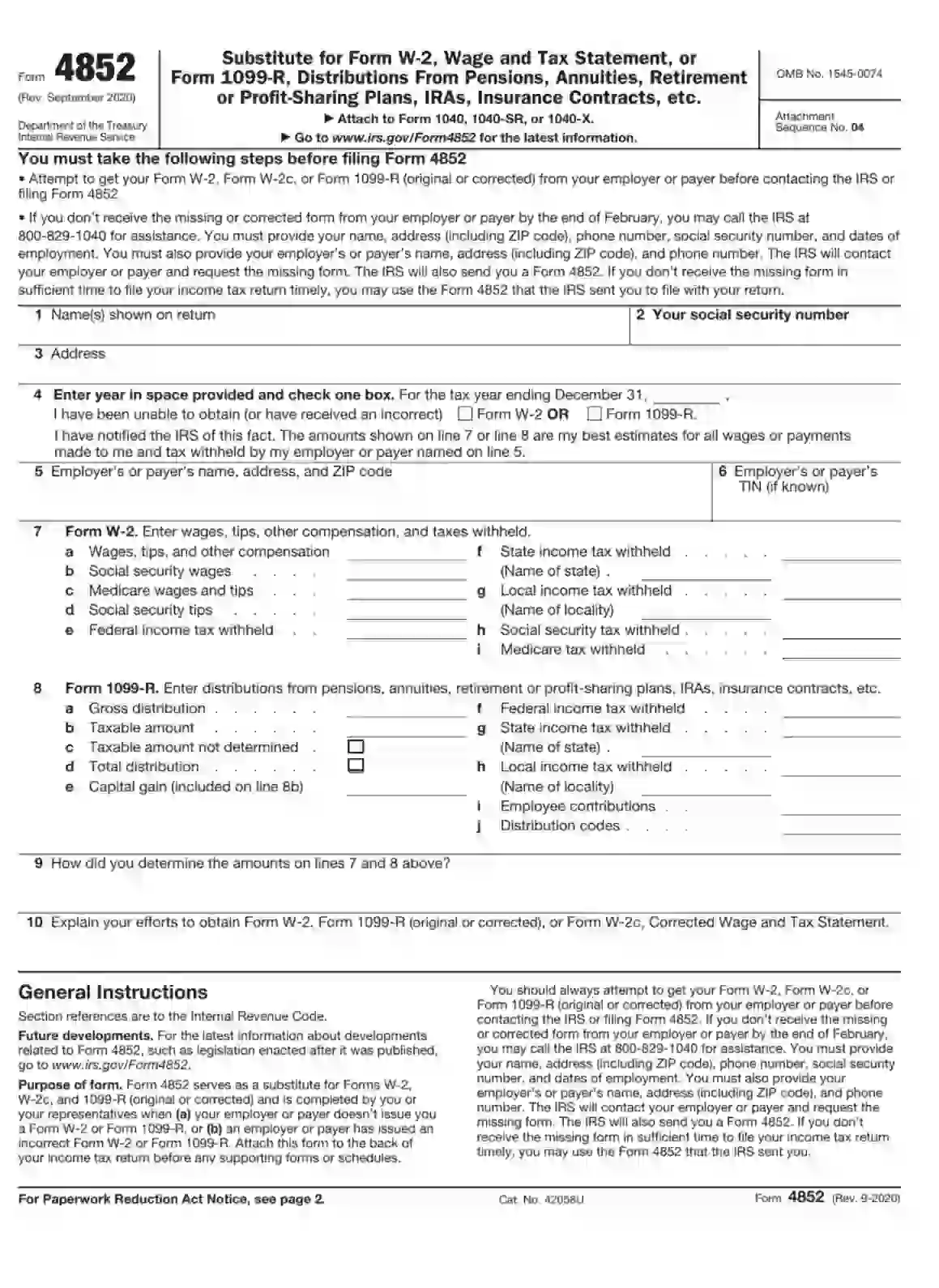

Form 4852 is a tax form issued by the Internal Revenue Service (IRS) in the United States. It is primarily used as a substitute for Forms W-2, W-2G, and 1099-R when the taxpayer does not receive these forms before the filing deadline. This form allows taxpayers to accurately report their income to the IRS even if they haven’t received the necessary documentation from their employers, payers, or other sources of income. It is a declaration of income when official forms are unavailable or incorrect.

When taxpayers use Form 4852, they must provide information about their income, including wages, tips, other compensation, and any taxes withheld. They may also need to explain why they cannot obtain the required forms and make a good-faith estimate of their income based on available records. By submitting Form 4852 along with their tax return, taxpayers can fulfill their obligation to report income to the IRS and avoid penalties for failing to file accurate returns, even in cases where they have not received the necessary documentation from their employers or income sources.

How to fill out IRS Form 4852

Now when you have general information about why you should design the 4852 Form, I want to show you how to fill the Form out by yourself. This process is quite easy if you get the basic knowledge you might need.

For the record, experts usually recommend keeping a copy of the IRS 4852 Form to protect yourself and the social security benefits of yours. In some cases, for instance, there might be questions about your earnings in one of the previous years, so you should have a copy of this form for the records.

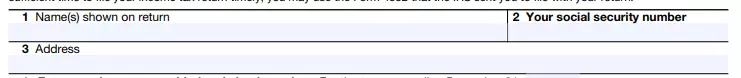

Fill out your personal information

The very first thing you should do is to fill in your personal data in the first 1-3 lines of the 4852 form. In the first field, you need to enter your full name and do it as it is shown on the return. The second field is for filling in your social security number. In the third field, you need to write your current address, including state, city, street, and ZIP code.

Complete the information from the W-2 Form

On line four, you can find the space where you should write everything about your W-2 Form of Form 1099-R delay. Firstly, you fill in the tax year for which you have not received your form or when it was incorrect. Then select with what type of form you have a problem.

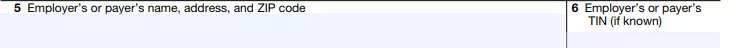

Fill out your employer’s personal data

The fifth line is devoted to the information about your employer. Complete the space providing their full name, current address, and ZIP code as it was in section 1 when you were filling fields about yourself.

Also, if you have this information, you can write your employer’s TIN in the sixth space. If you have been working for this employer for several years, you can find their EIN on one of the old tax forms and use it for completing the 4852 form.

Fill out the W-2 Form information

Here is the place where you should write accurate information from a Form W-2 or your final pay stub if you don’t have any. There are nine paragraphs in total, marked with the letters a-i, where you are supposed to provide the following details:

- Your Total income including all types of compensations, wages, etc.

- Your social security wages and the total amount of social security tips

- Medicare tips and wages

- Federal income taxes deducted from you

- Info about the state income taxes deducted from your wages. Don’t forget to indicate the state

- Specification of local income tax deducted from you

- Social security tax deduction

- Medicare tax deduction

Write the 1099-R Form information

Section number 8 should include the correct information from your Form 1099-R. Here you need to fill out the complete data about distributions from your retirement, pensions, annuities, etc. This part consists of 10 paragraphs in total, marked with the letters a-j, and you are supposed to fill all of the fields here.

Thus, your aim is to provide complete information about a gross distribution you received for a year as well as the taxable amount of distribution. If you cannot identify the latter, you should mark the box in section 8c. The line 8d also consists of a box that you should mark if your gross distribution equals the total one. Then, add your capital gain, Federal, State, and Local income tax withheld. Each of the last two sections needs specifications of locations such as the name of the state and locality. Fill out the amount of your investment if you made one. And finally, enter your distribution code (use a comma if you have more than one).

Determine the amounts of money you mentioned in Sections 7 and 8

Explain what sources you used to evaluate the amounts in the two previous sections. There are several of the most common options to use. For instance, if you referred to the pay stubs or a statement reporting your distribution, you have to mention these documents in field 9.

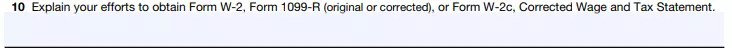

Indicate your way to obtain the W-2, Form 1099-R, etc.

In this section, you need to describe your actions to attempt to get any of these essential Forms from the employer. Mention your communication with the payer, your contacts with IRS customer service, and other relevant information.

To embrace simplicity and accuracy while filling out the aforementioned form or any other legal document, use the form-building software we provide on our web page.