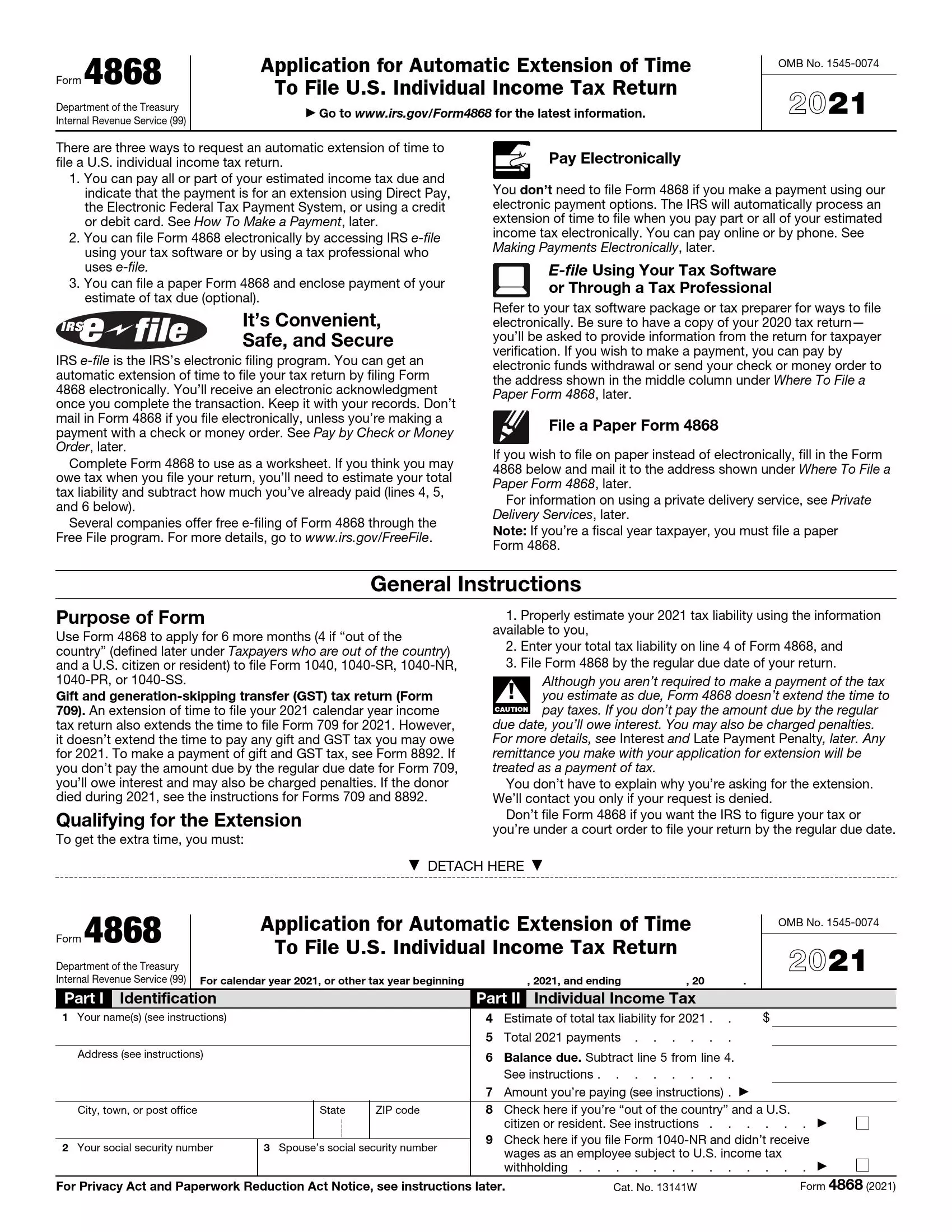

Form 4868 is a tax form provided by the Internal Revenue Service (IRS), allowing taxpayers to request an automatic extension of time to file their individual income tax returns. Taxpayers can use Form 4868 to apply for an additional six months to submit their tax returns, extending the filing deadline from the original due date, usually April 15th, to October 15th. This extension gives individuals more time to gather necessary documentation, organize their finances, and accurately prepare their tax returns without facing penalties for late filing.

To request an extension using Form 4868, taxpayers must estimate their total tax liability for the year and pay any taxes owed by the original due date to avoid penalties and interest. The form requires basic information such as name, address, Social Security number, and estimated tax liability. The extension is automatically granted once submitted to the IRS, giving taxpayers until the extended deadline to file their tax returns.

How to Fill Out the Template

IRS cares about its declarants: the official template itself contains thorough instructions on the form completion and an explanation of every line that you should fill out. You can see all the details below.

- Obtain the Relevant Template

Although you can find the template on the official website of the IRS, you can avoid waste of time, additional links, and internet surfing by using our form-building software. With it, you will obtain the proper file easily.

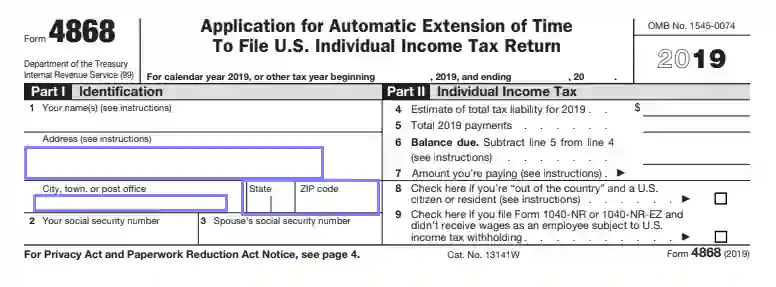

- Define the Taxation Period

You have to choose whether you are requesting an extension for taxes for a calendar year or fiscal year. If you file the form for a fiscal year, insert the dates.

- Introduce Yourself

You should add your name to a designated blank line if you submit the record alone. If you and your wife or husband plan to file together, insert both names.

If your name has changed for some reason since the last declaration filing, you have to notify the Social Security Administration about the change.

- Write Your Address

Below the names, write the address with the city, state (written as two letters), and postal code. If your address is different from the one you stated before, you also should provide Form 8822 to the IRS.

- Insert Your SSN

Next comes your social security number (or SSN). Insert the number in a relevant blank line. If you are filing the document jointly, add your spouse’s SSN nearby as well.

- Estimate Your Tax Liability

You have to approximately count the total amount of taxes to pay this year. You can use the data you inserted in other templates (IRS 1040-PR, IRS 1040-SR, and others).

- Specify How Much You Have Already Paid

If you have covered at least something from your tax liabilities, insert how much you have already paid.

- Indicate the Left Amount

You should subtract the already paid amount from the total liability and write the result here.

- Add the Sum to Pay

If you plan to cover a part of your tax debt when you file the form, write how much you will pay. If you cannot pay anything now, do not worry; you can still ask for an extension.

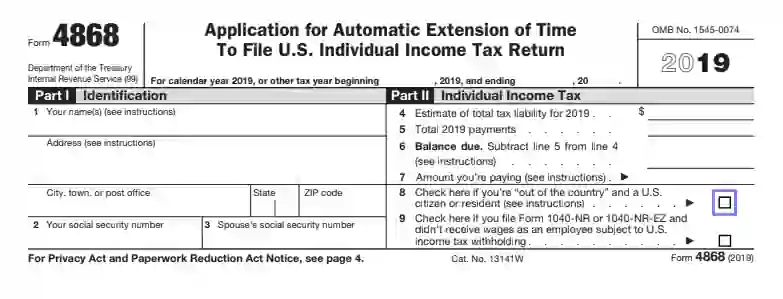

- State If You Are Out of The US

If you are a resident of the United States but currently are not in the country, mark an empty box with a tick.

- Indicate If You File Other Specific Records

Those who filed the 1040-NR or 1040-NR-EZ forms and did not get wages that should be counted in their taxes have to mark a box with a tick here.