IRS Form 8843 is a form used by certain nonresident aliens (including foreign students, teachers, trainees, and researchers) to explain why they should not be counted as present in the United States for the substantial presence test. This test determines if a nonresident alien is considered a resident for tax purposes based on the number of days they spend in the U.S. Form 8843 is not a tax return but rather a statement that helps establish a claim for exempt status regarding U.S. tax residency.

The primary purpose of Form 8843 is to allow eligible nonresident aliens to declare that their presence in the U.S. should not lead to them being classified as tax residents. For students, this can mean that they do not have to count days of presence in the U.S. while on an F, J, M, or Q visa as long as they comply with their visa requirements. For teachers and researchers, the form serves to certify that their presence in the U.S. is tied to teaching or research duties under specific visa categories.

Other IRS Forms for Individuals

The form that you learned on this page is not the only IRS form individual taxpayers prepare for the Internal Revenue Service. Learn what other forms you might need to file.

Filling Out the Form

The template is rather easy compared to other tax forms in the United States. The Service presumes that foreign residents should be able to deal with the template by themselves, so, most likely, you will not require any professional assistance. Additionally, we offer you a handy guide with tips on how to create and send the document.

Besides our guide, you will see the Service’s instructions in the template (Pages 3, 4, and 5). You should read them prior to the filling out process and have them at hand when creating the form. They will probably answer all questions you can have about the document.

Although it may seem simple, some things may raise questions and uncertainties in you. Bear in mind that any time a taxpayer in the US provides wrong details to public authorities, they take the risk of huge fines and even imprisonment. In the case of foreign filers, deportation might also take place.

Start with getting the current template. Most of the forms are updated every year, so you have to check the year written on the top of the first sheet. To ensure that you use the correct version, download the form from trusted sources: either the Service’s site or our site. You can make use of our advanced form-building software to obtain IRS Form 8843 immediately.

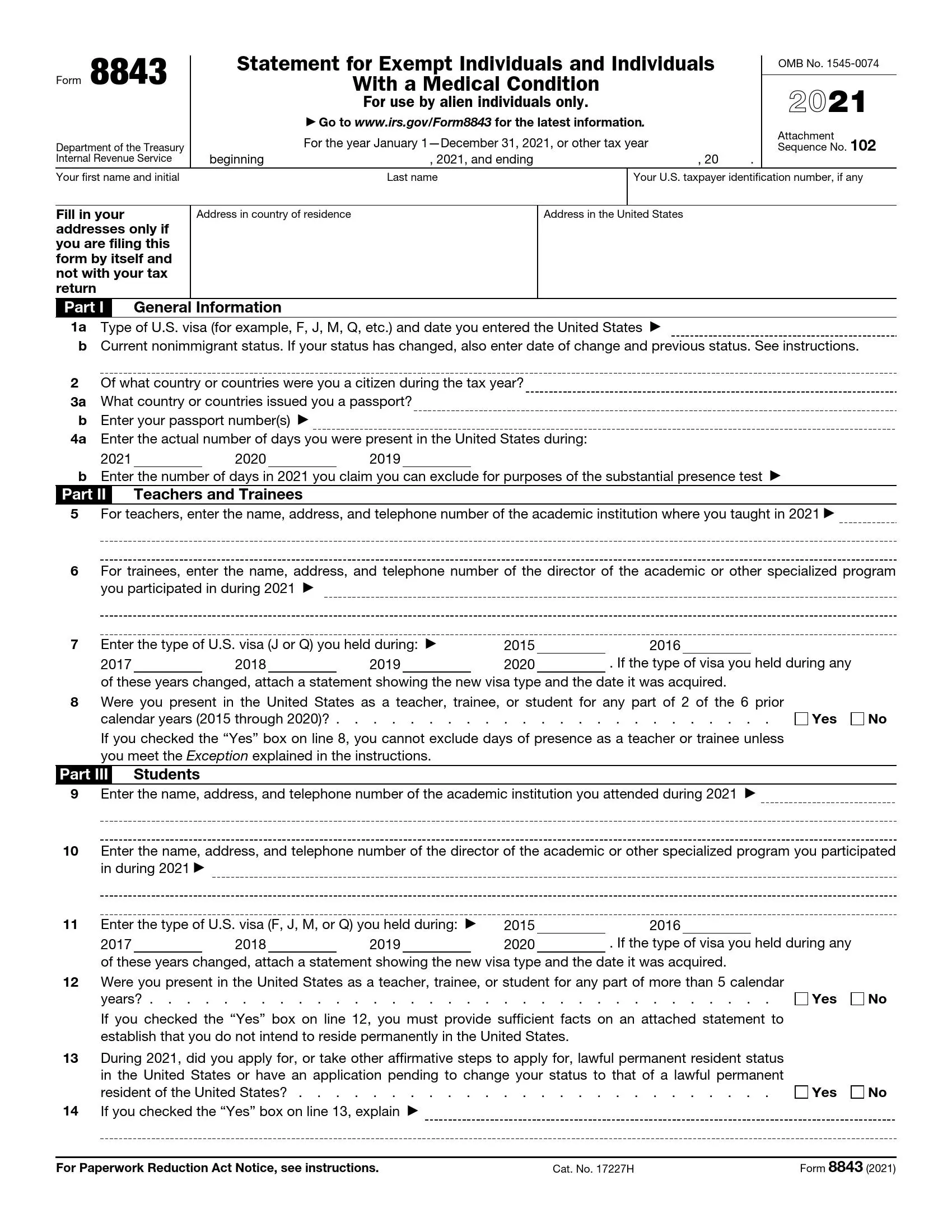

Add the Tax Year

By default, people create the form for a calendar year. However, some people use their own tax year. If this is your case, you have to insert the tax year for which this form is prepared on the top of the first page.

Write Your Name and Tax ID

Below the year, you must indicate your full name (your first name, initial, and last name then). On the right-hand side, provide your U.S. taxpayer ID number if you have such a number. If not, leave this field blank.

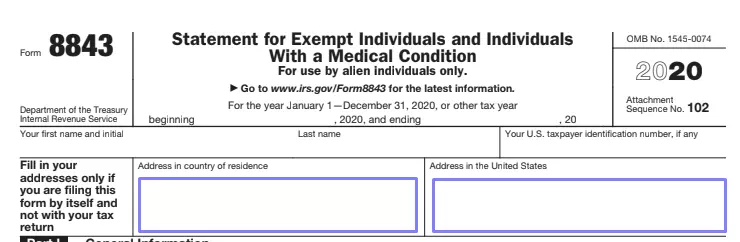

Enter Your Addresses

The form requires you to insert both of your addresses: in the country of permanent residence and in the United States. Fill in the addresses in the designated fields.

Provide General Info

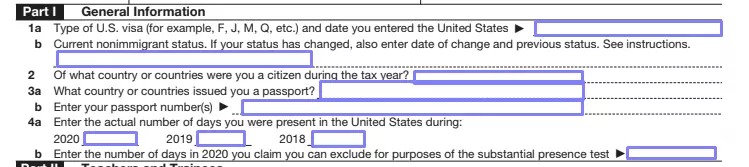

The first part is called “General Information,” and you have to provide some basics about you and your temporary US residence here.

Specify the type of your visa (F, J, and so on) first. Then, enter the date when you arrived in the US. Indicate your current nonimmigrant status below. You might have had another status before this one; if yes, enter the previous status and the date when the changes were made.

You have to answer questions about the country (or countries) in which you were a citizen during the considered year and which country (or countries) gave you a passport (or passports). Insert your passport(s) number(s).

Count the number of days when you stayed inside the US in the last three years. For each year, you will have an empty line where you have to write the relevant number.

The IRS uses special criteria called SPT (Substantial Presence Test) to define whether a person from a foreign country can be considered a resident or non-resident for tax purposes in the United States. In line 4b, answer the question about the number of days you wish to exclude in the current year because they were reserved for the above-mentioned test.

Select a Part to Fill Out

The following form’s parts are used by various categories of filers: teachers and trainees, students, athletes, and people who face medical problems. Pick the part that fits your case and skip other parts.

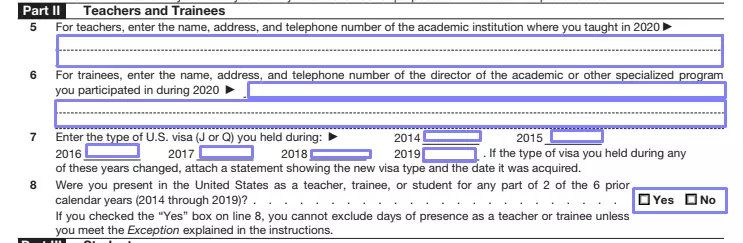

Complete Part II (If It Applies)

You need to fill out this part if you are a trainee or a teacher. Teachers should indicate the place where they taught in the considered year: you need to write its name, address, and phone number. Trainers must answer about their program (academic or any other qualified program) below: state the program director’s name, address, and phone number.

Determine the type of your visa in the next line. You have to insert the type for the last six years. If the type has changed at some point, you must provide details (the new tape and date when the visa was issued) on a separate paper. Answer the following question about your presence in the US to understand if you can or cannot exclude any days for SPT. See the Service’s guidelines to check if you fit in the “Exception” cases.

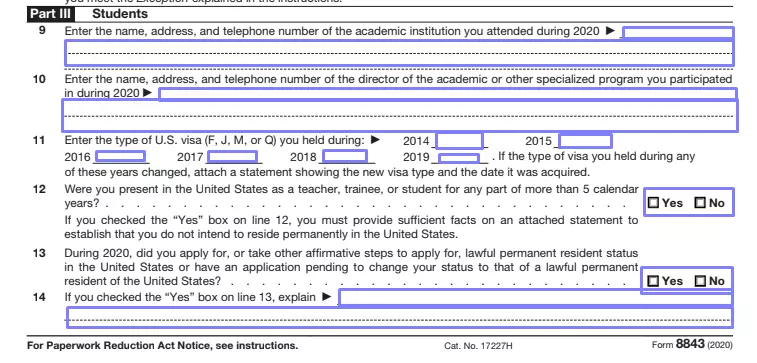

Proceed to Part III (If You Are a Student)

Students need to complete the form’s third part. Add the required data (the name, address, and phone number) of either your educational institution or the program you attended in the considered year.

Add your visa types for the last years as the template demands and provide a statement describing changes, if there were any. Reply to two “yes or no” questions below and provide an explanation if needed.

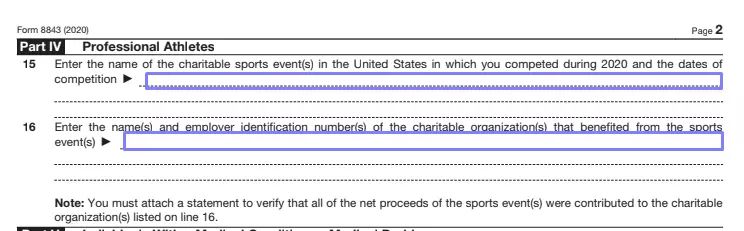

Fill Out Part IV (for Athletes)

If you are a professional athlete, you have to go to the fourth part. Identify the events in which you participated in the mentioned year and insert details about organizations (their names and addresses) that have gained profits from those events. Prepare a statement about the organizations’ net proceeds as written below the questions.

Describe Your Case in Part V (Medical Issues)

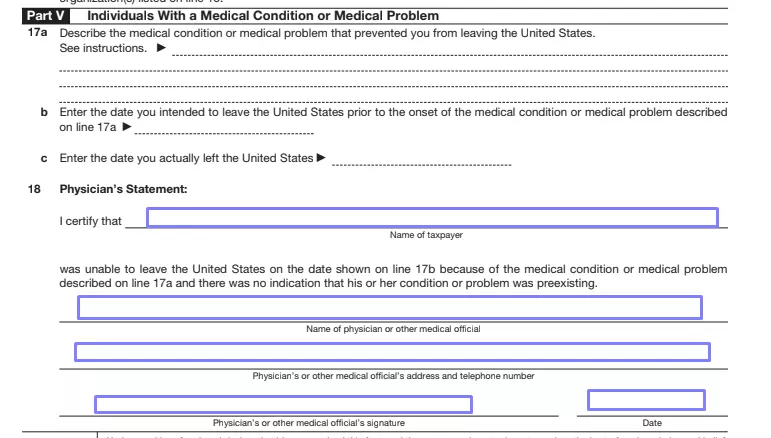

If you faced medical issues that made it impossible to leave the territory of the United States, you should complete the last, fifth part. Start with explaining what exactly happened. Enter the date of your planned leaving of the US (that did not happen because you had had medical problems). Then, write the date of your actual leaving.

Below, your physician must provide their statement about your case, proving that you had unavoidable circumstances that made you stay in the US. It is necessary that your doctor writes your name, their name, address, and phone number. Then, they must sign and date the document.

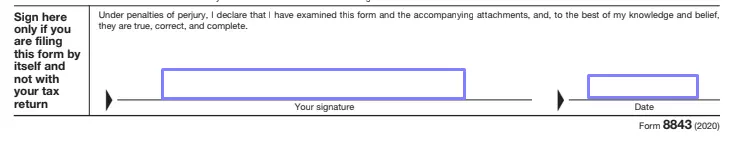

Sign the Form

Now, you must leave your signature in the form and date it. Your signature serves as verification of everything you have written in the document. We recommend double-checking all provided data before you sign the papers.