IRS Form 8857, also known as the Request for Innocent Spouse Relief, is a form taxpayers use to seek relief from tax liabilities if they believe only their spouse or former spouse should be held responsible for all or part of the tax. Filing this form can be crucial for individuals unaware of or had no control over the filing errors made by their spouse on a jointly filed tax return. Individuals may consider submitting Form 8857 under several circumstances, including if they:

- Were unaware of the errors made on the joint tax return,

- Were coerced into signing the return,

- Would face significant financial hardship if held responsible for the tax.

The IRS evaluates these claims carefully, considering the taxpayer’s knowledge of and involvement with the financial activities in question at the time of signing.

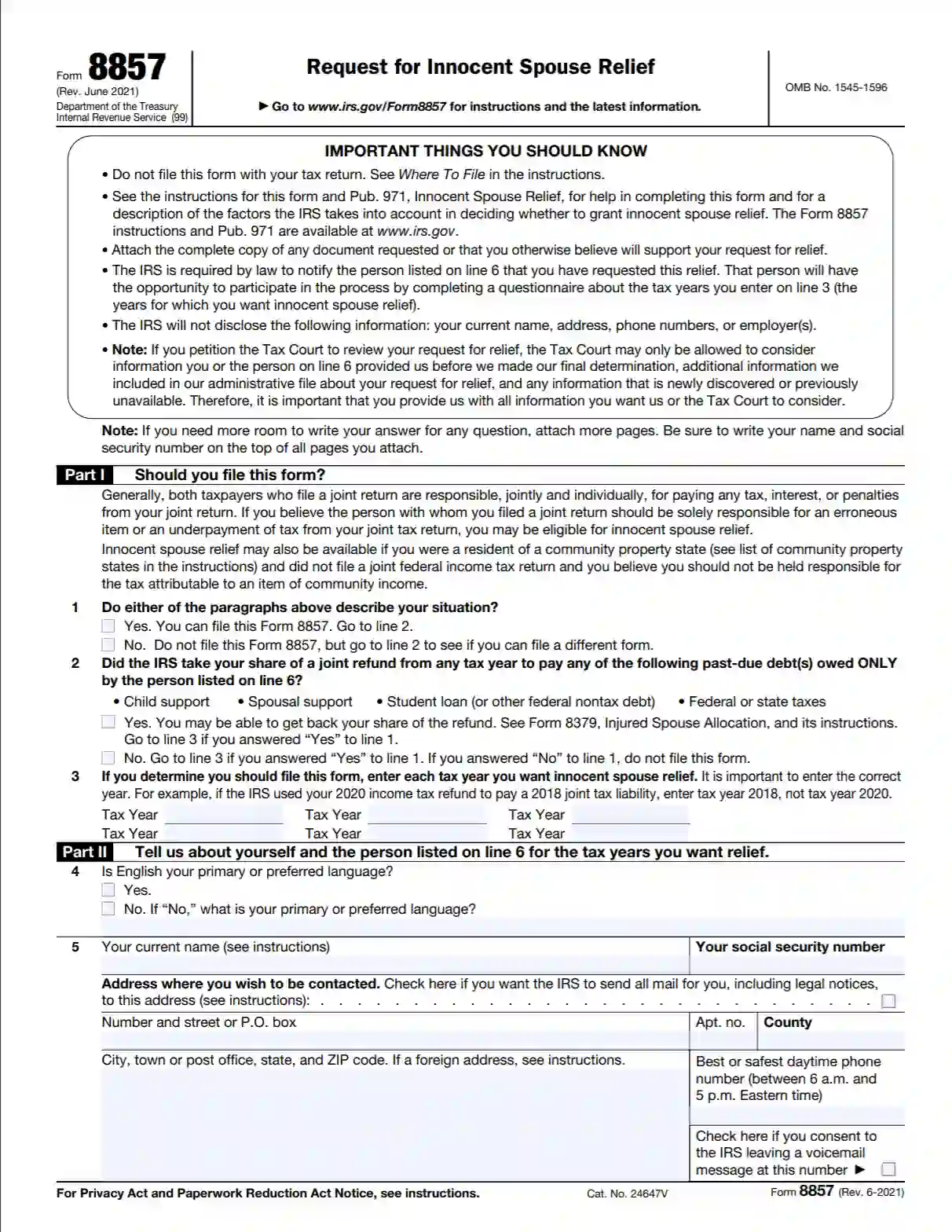

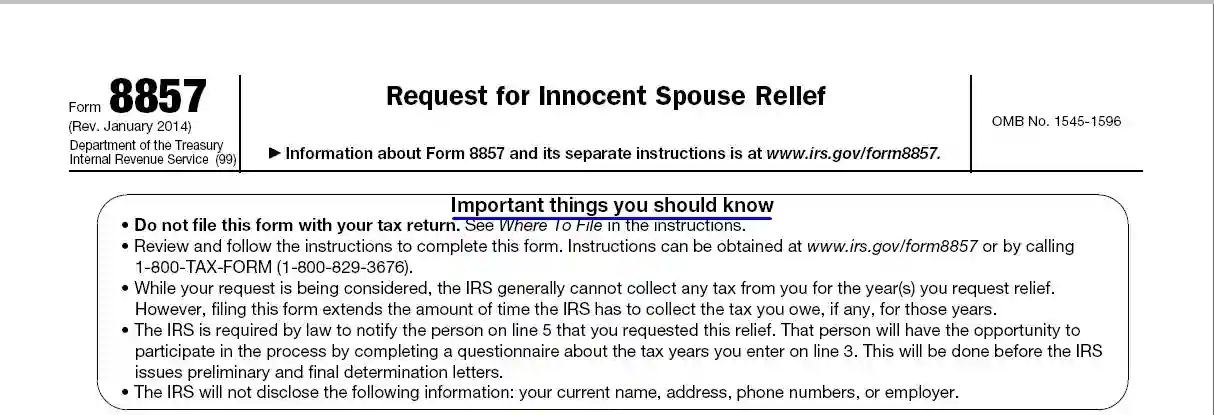

A Reference Guide for Filling out the IRS 8857

The form starts with providing some legal guidance to the applicants, so ensure you get familiar with the designated filling rules and recommendations on the form completion.

Put Your Name and SSN at the Top of All Enclosed Documents

There may not be enough free space for your answers in the form. In this case, enclose more pages. And do not forget to add your name and social security number on any additional list, document, or statement you attach to the request.

Verify Your Situation and Enter the Appropriate Year

Answer “Yes” or “No” in the boxes on line 1. Depending on your answer, go to lines 2 and 3. Be sure that the year you entered on line 3 is correct.

Enter the Information About Yourself

Part II contains questions related to information about you and your spouse (or the former spouse). On line four, you should enter your name, your social security number, and your address, including the city, town, or post office, state, and ZIP code. Also, specify the most convenient phone number to call you, if necessary.

Add the Same Info about Your Spouse

On line five, you would have to enter the name of your spouse, indicated in this request, and all the other information you know about him or her.

Describe Your Marital Status and Education Level

First, specify the current official marital status between you and the person you have indicated above. If your situation changed after the specified tax period, you should add the confirming documents (for example, it may be a death certificate).

Then define your education level at that period; further explanations are possible here.

Report Domestic Violence Cases or Health Problems

Here, you may add any information about the abuse or violence; whether it has happened during the tax period, you want to get relief. Your health condition at present or some years ago is a fundamental reason to be considered too. If you are afraid to write something in this form but feel it essential, point it out, and the revenue service authorities will contact you.

Answer Some Questions on Your Joint Return

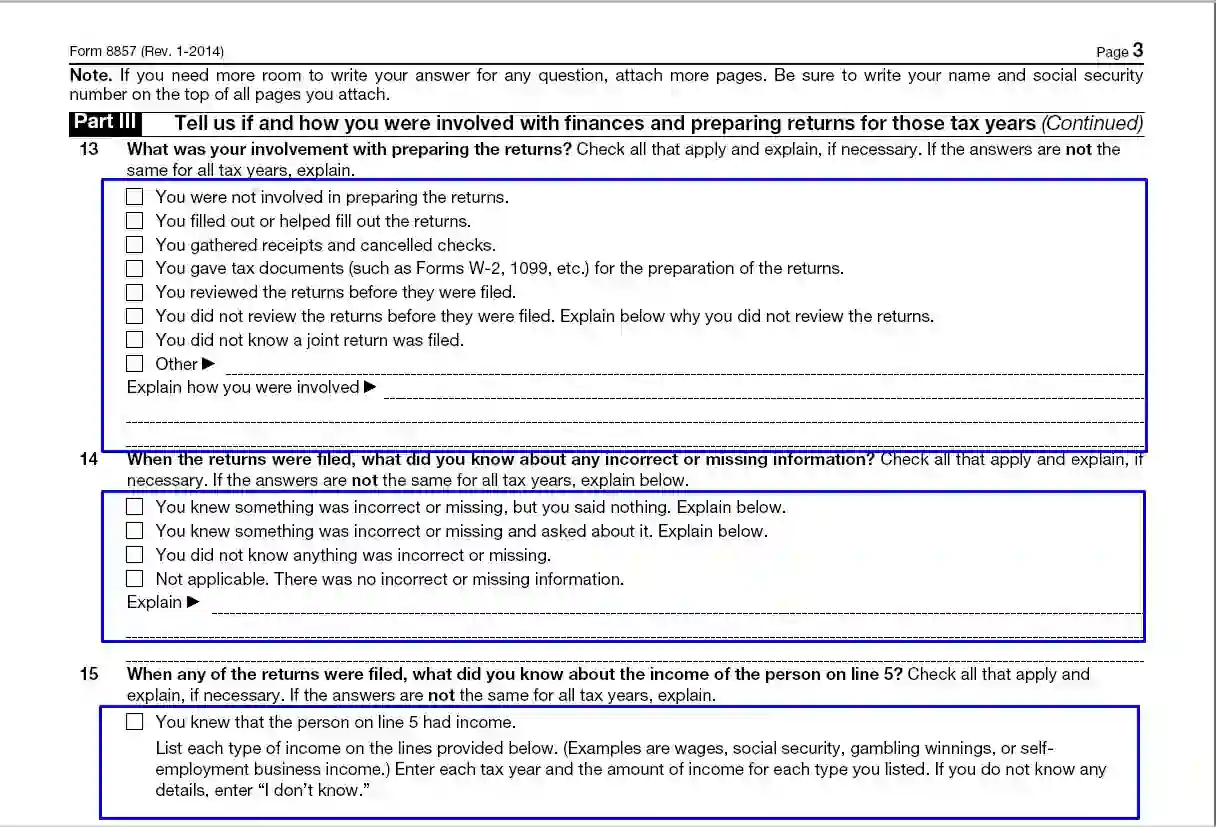

Part III is devoted to your financial activities and the tax returns you prepared and submitted to the service. On lines 11 and 12, you should honestly answer whether you actually signed your joint financial declaration together with your spouse, and especially if it happened on your free consent (explain your answers, if necessary).

Define Your Involvement in the Family’s Financial Issues

Lines 13-15 are to identify your role in the preparation of tax returns and your knowledge about any incorrect information or hidden income of the other part. Fill in the appropriate boxes.

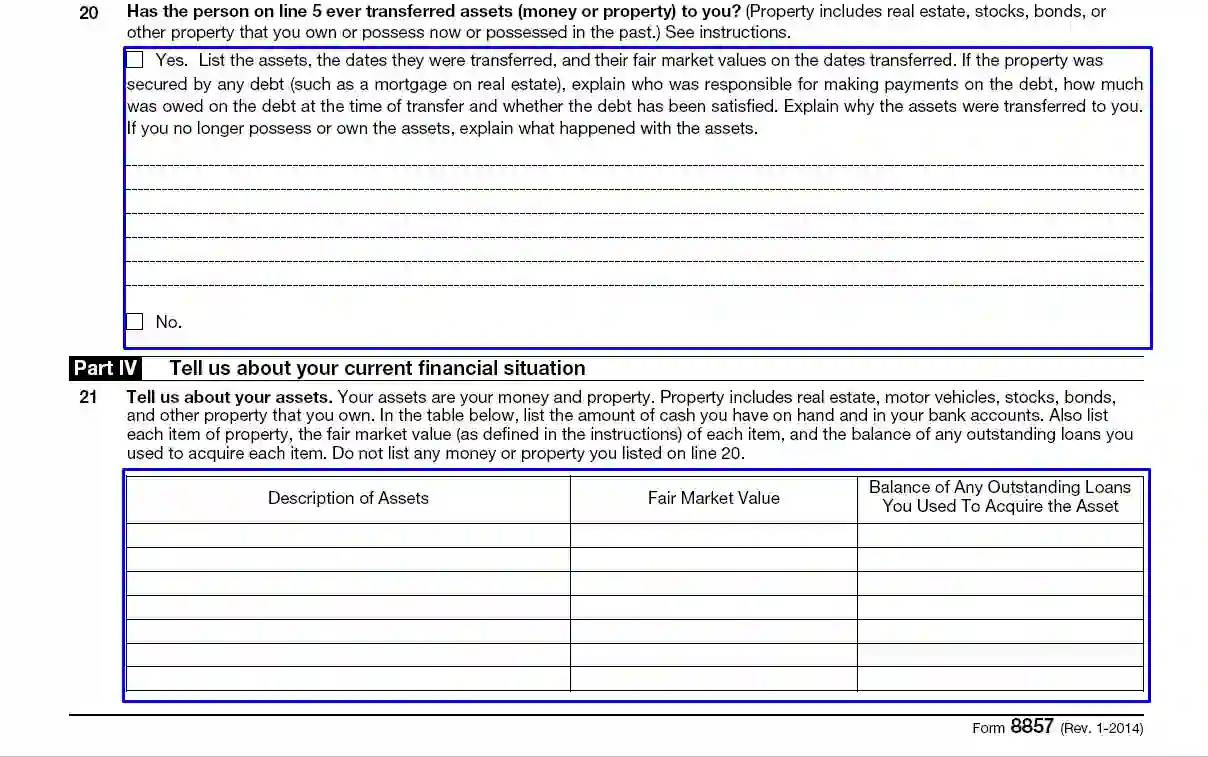

Indicate the Transfers of Property (if any)

In the case, you or your spouse has ever transferred any property or other valuable objects to each other, your relief requirement may be rejected.

On lines 20 and 21, you should describe all your property, including money and various movable and immovable objects you possess at present.

Provide Other Information You Consider Important

In Part IV, you may add any details or additions that may be important for deciding on your liability exemption.

Sign and Date the Form

Hopefully, you have filled the form to the end and checked it with the help of our built-in software. All you have to do is to sign and date it, as well as to leave a completed copy for yourself. If any paid person helped you to prepare this application, he should sign it too.