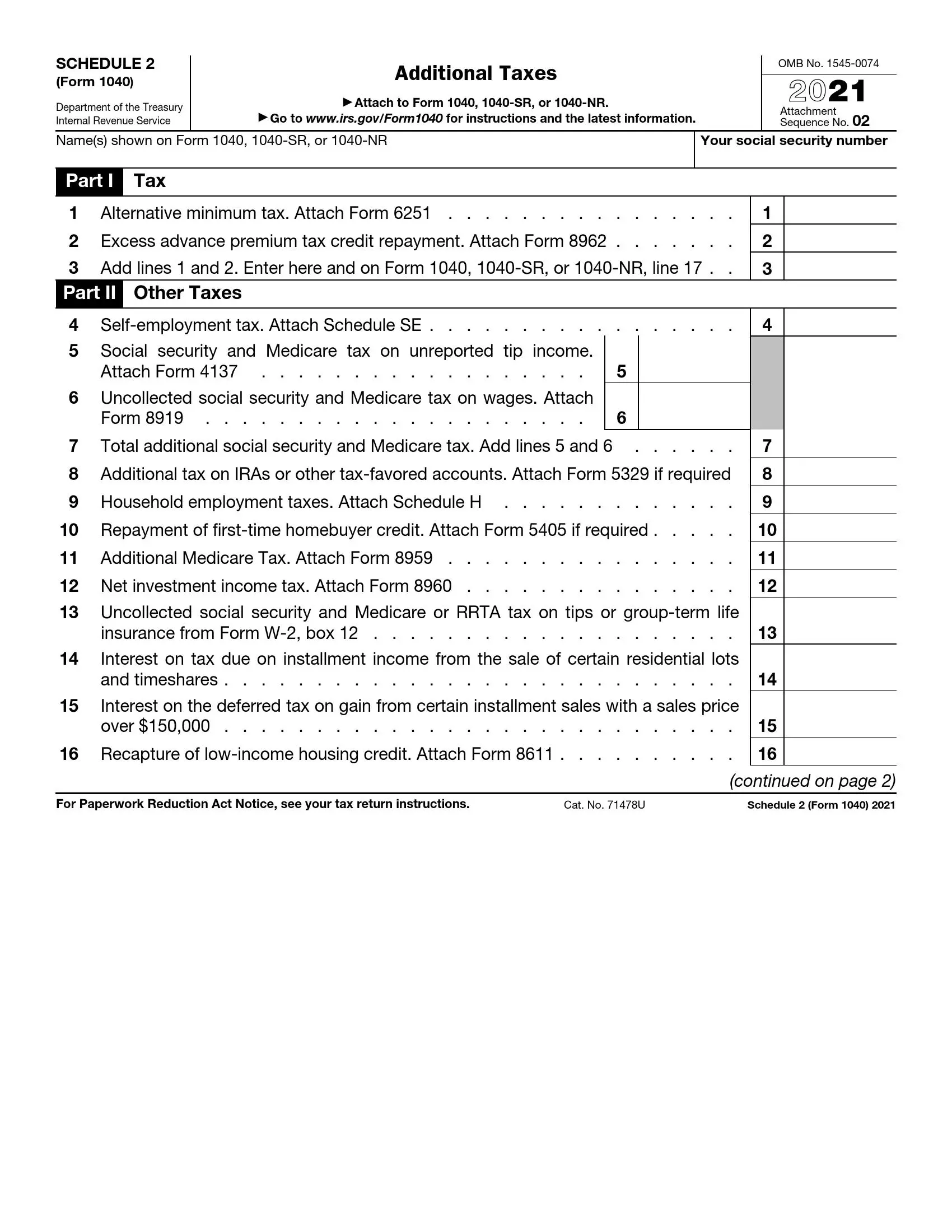

IRS Schedule 2 reports additional taxes not directly entered on the main Form 1040 or 1040-SR. This includes various taxes that may apply to taxpayers beyond the standard income tax calculations. Schedule 2 is divided into Part I for tax and Part II for other taxes.

Part I of Schedule 2 primarily reports alternative minimum tax (AMT) and excess advance premium tax credit repayment. The AMT is a supplemental income tax in addition to baseline income tax for certain individuals, corporations, estates, and trusts, with exemptions allowing for lower standard income tax. Part II covers other taxes, including self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, and the repayment of first-time homebuyer credit. This schedule ensures that all applicable taxes are accounted for and properly reported on the taxpayer’s annual return.

Other IRS Forms for Individuals

One needs IRS schedules to provide more information along with tax returns. Read about other schedules and forms you might need if you are an individual taxpayer.

How to Fill Out IRS Schedule 2

The IRS provides a questionnaire test to define the declarant’s eligibility for filing Additional Taxes Schedule 2 documents. Make use of our template-building software to generate and download the needed form. Also, we offer this step-by-step guidance on completing the Schedule 2 attachment below.

Submit Your Legal Name

Begin filling in the schedule by identifying yourself. Enter your complete legal name as it is reported on the corresponding 1040 or 1040-RS From.

Enter the SSN

Complete the heading part by providing your social security number.

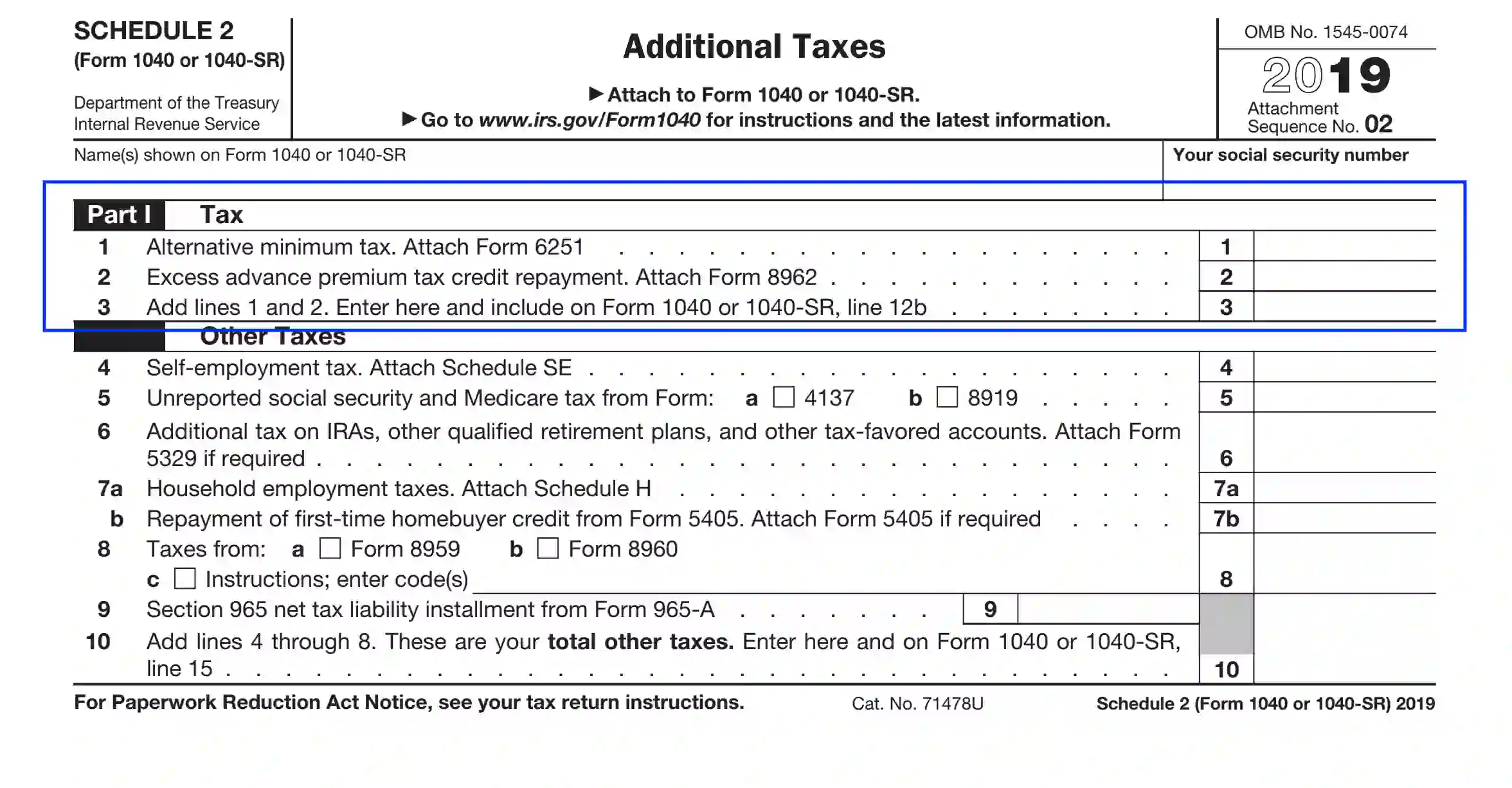

Complete the Tax Part

Here, the declarant should cover three aspects:

- Alternative minimum tax (AMT)

To confirm the amount, include Form 6251.

- Redundant premium tax credit refund

This credit type allows to purchase and compensate healthcare insurance services acquired through Marketplace. If the declarant, their husband (or wife), or their dependents are eligible to use the privilege, the declarant should prepare and provide Form 8962 for verification. Also, you are liable to refund the premium credit payments if some other person has subscribed you to Marketplace services.

- Total amounts in Units 1 and 2. The amount should also be included in Unit 12 (b) of Form 1040 or 1040-RS.

Proceed to the rest of the units and complete the form.

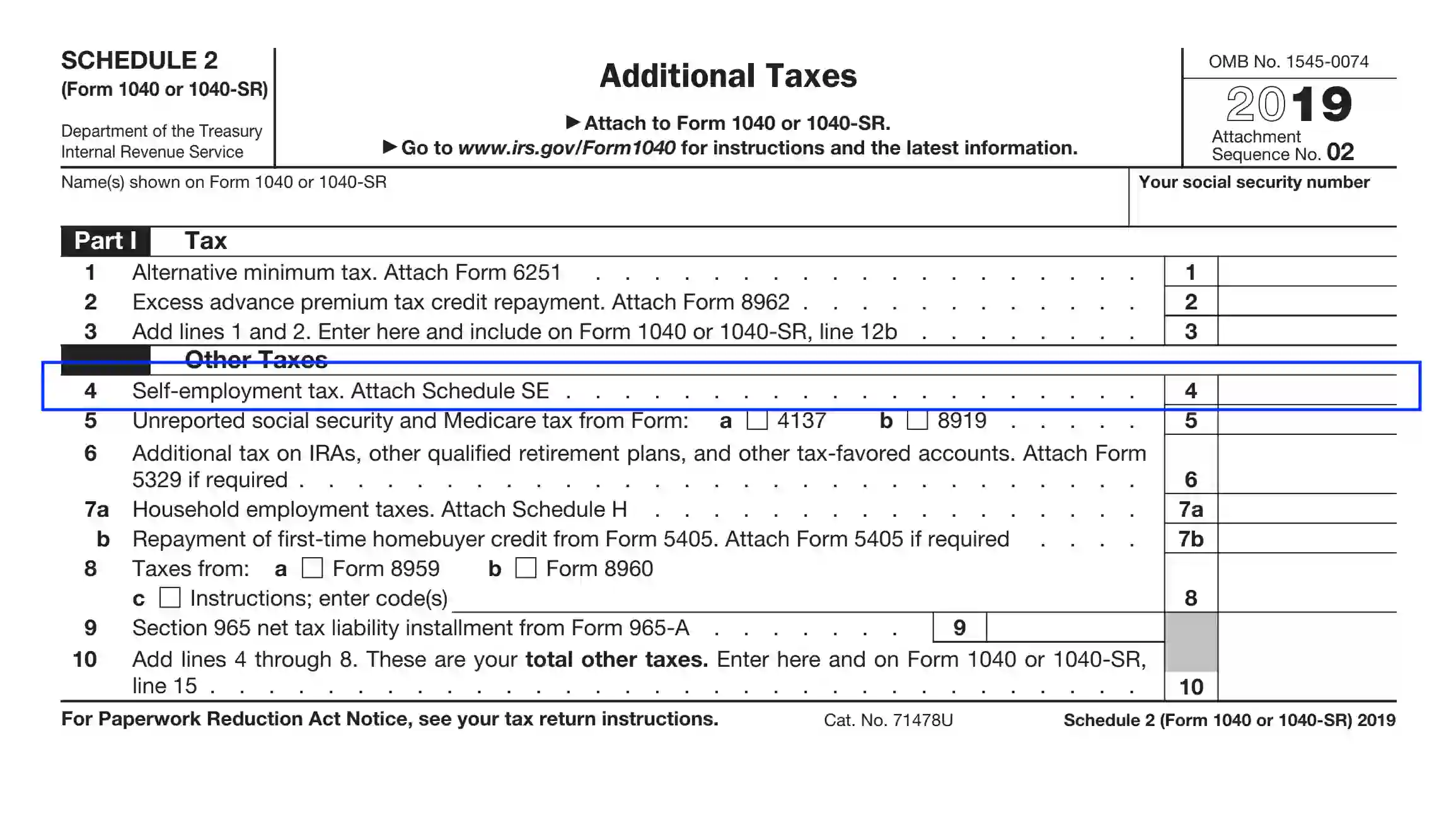

Specify the Self-Employment Withdrawals

Attach the self-employment schedule (if applicable) to clarify Unit 4 of the “Other Taxes” Part.

Clarify the Undisclosed Medicare and Social Security Withdrawals

Here, the declarant needs to specify only undisclosed withdrawals. If you gained tips that exceeded 20 USD and forgot to report these data to your employer, use Form 4137. Do not include any tickets or passes that are not in a cash equivalent.

If your employer hasn’t subtracted the SS and Medicate contributions from your salary due to any reason, use Form 8919 to report the info. Select and mark the corresponding box.

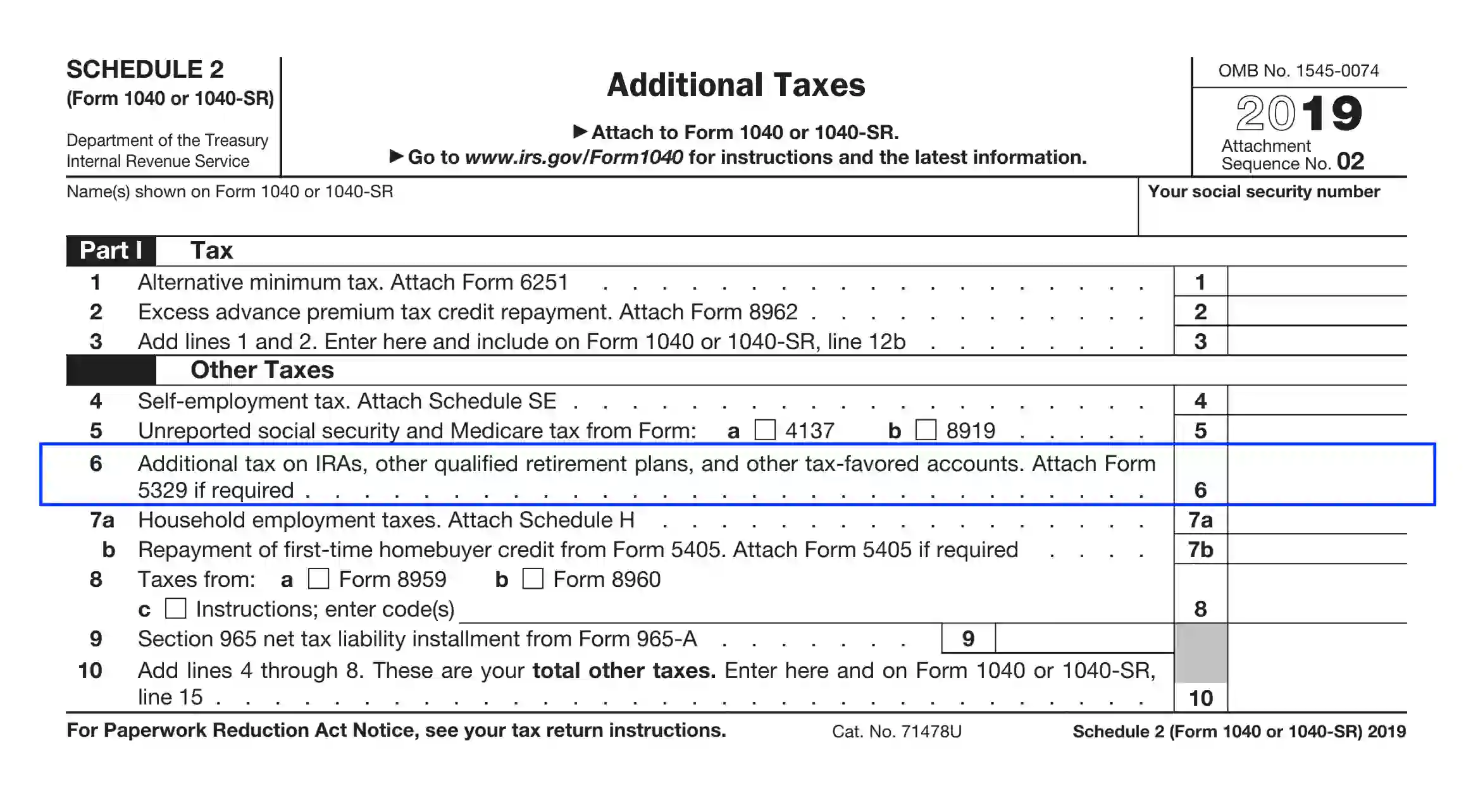

Disclose IRA and Other Related Programs

If you have any tax privileges regarding such beneficial programs as IRA, pensions, and other tax-favored savings, use Form 5329 to disclose the requested info.

Submit the Household Withdrawals

If you have any employed persons in your household, complete Unit 7 (a) and provide an explanation in the Schedule H attachment. Complete Unit 7 (b) if you acquired the home in 2008 and used it as a permanent dwelling throughout the tax period at issue.

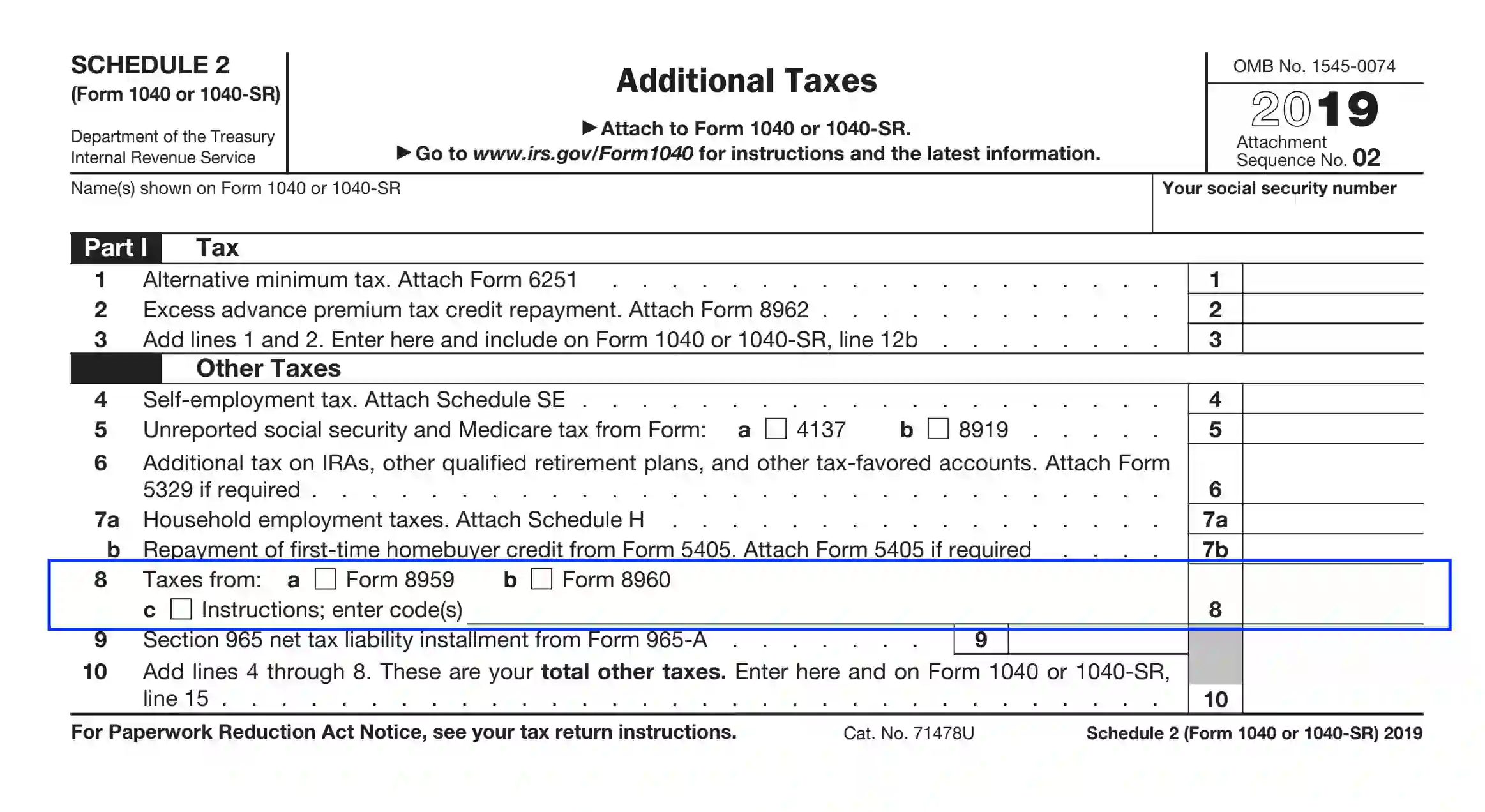

List Other Unreported Taxes

Use Unit 8 to submit other unreported taxation withdrawals that are not reflected on the current return.

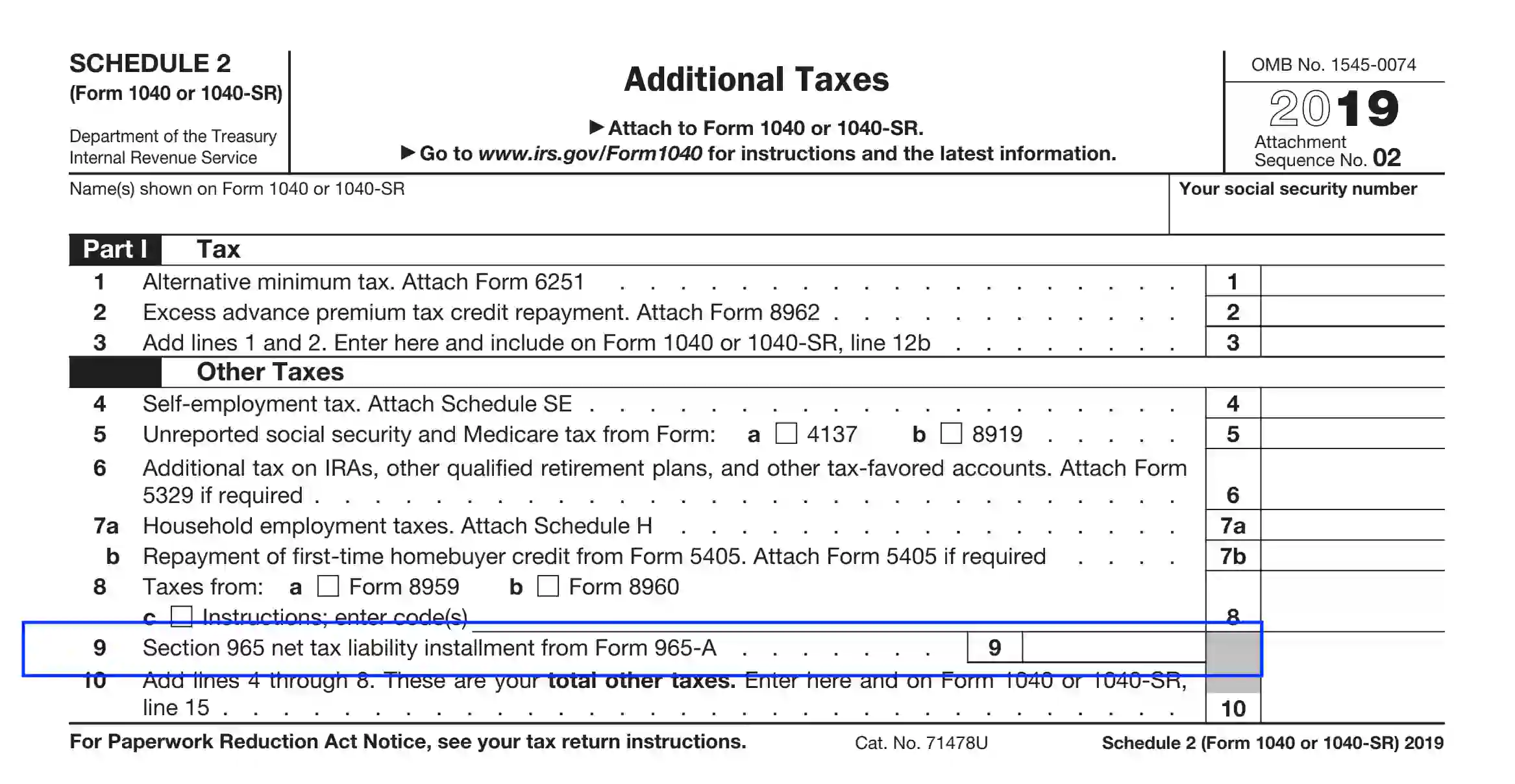

Complete Unit 9 (If appropriate)

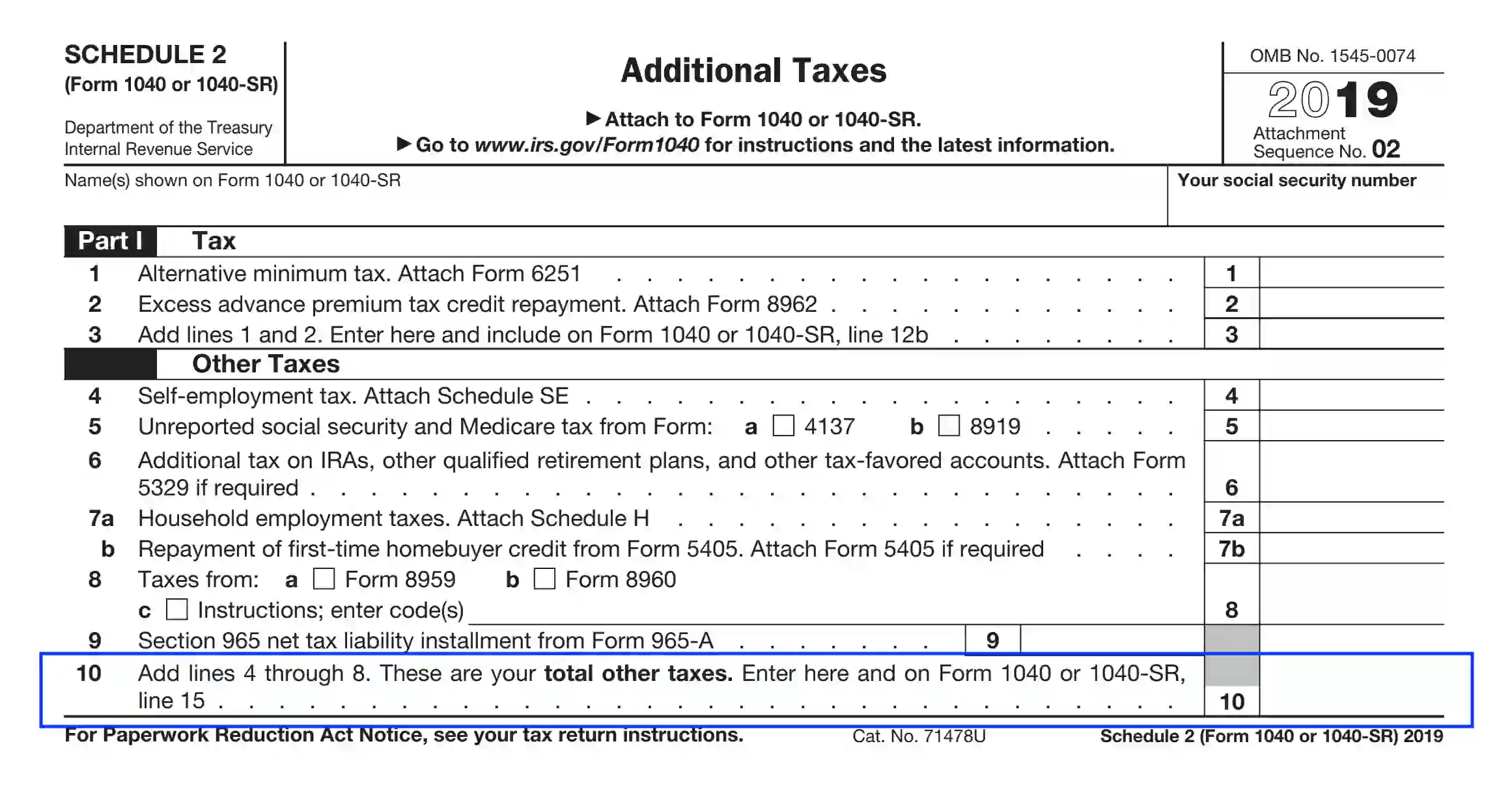

Compute the Total Other Taxes

Total up amounts in Units 4 through 8 to compute the total taxation withdrawals. Insert the total amount in Unit 10 of the respected schedule and Unit 15 of Form 1040 (or 1040-SR).