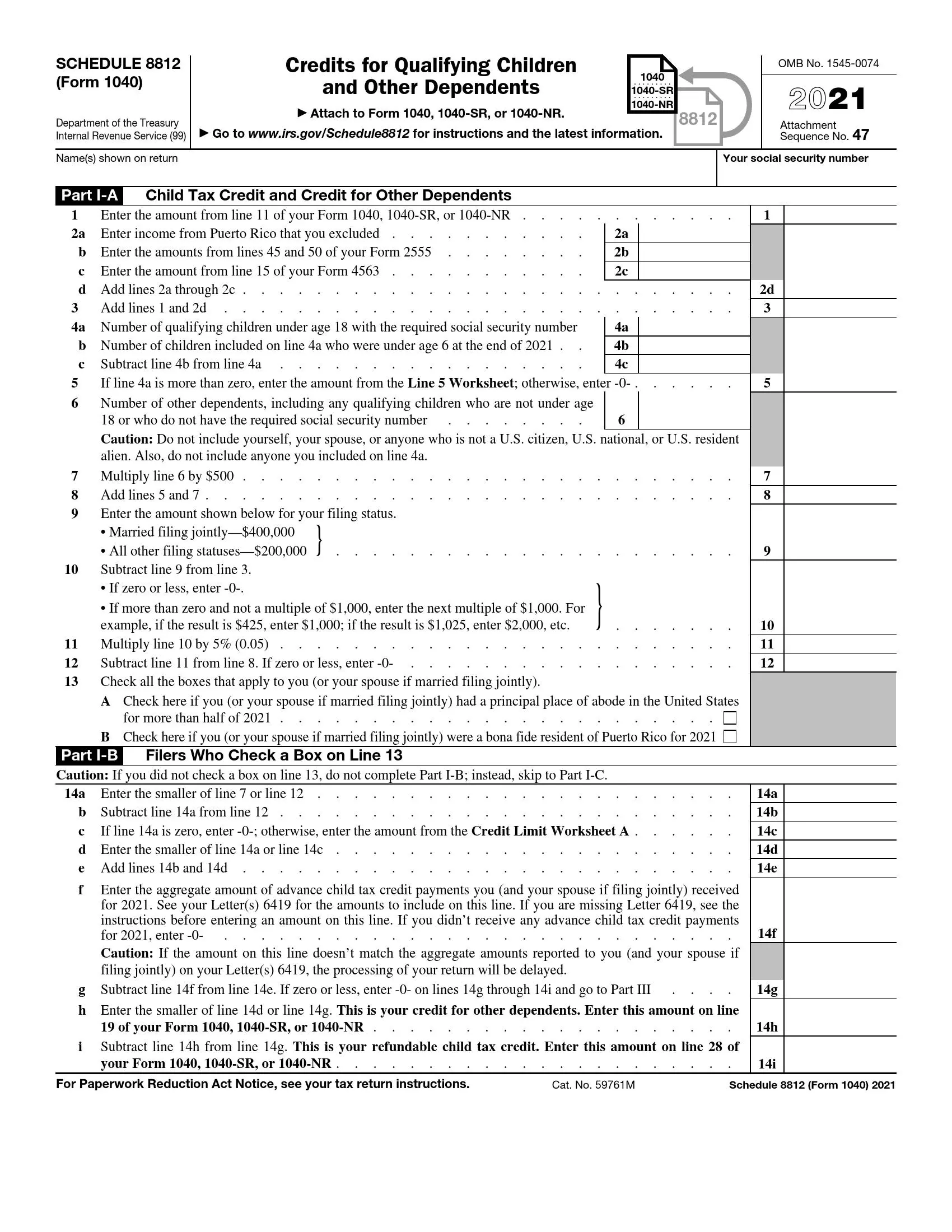

IRS Schedule 8812, which accompanies Form 1040, is specifically designed for taxpayers to calculate and claim the Child Tax Credit (CTC), including the Additional Child Tax Credit (ACTC) and the Credit for Other Dependents (ODC). This form is necessary when taxpayers need to determine their eligibility for these credits and the amount they can claim.

Schedule 8812 is divided into several parts. The first part requires information to determine if the child qualifies for the CTC or ACTC. This includes tests for age, relationship, support, dependent status, citizenship, and residency. The subsequent parts allow taxpayers to calculate the amount of credit they can claim. The ACTC is particularly beneficial for those who receive less than the full amount of the Child Tax Credit because their tax liability is lower than the credit. The ODC provides a smaller credit amount for other dependents who do not qualify for the CTC, such as dependent children over 17 or elderly parents. This schedule helps ensure eligible taxpayers receive appropriate credits to reduce their tax burden.

Other IRS Forms for Individuals

Preparation of IRS schedules is only necessary under certain circumstances. Read about related schedules and IRS forms to make sure you haven’t missed out on anything important.

Steps to Fill Out the Document

The form takes only 1 page and is divided into three parts. The first part of the paper is filled in by everyone who meets the voiced requirements. The second is needed for those who have three or more children who meet the requirements. In the third part, you will receive the credit amount.

We recommend using the special form-building software, which you can easily use on our website. This will save you time.

Identify yourself

Please enter your name as in the tax return and the number of Social Security.

Transfer data from other papers

To fill out the first two points, you will need data from other docs. Insert them as required by the instructions. If in line 3 you get zero, then there is no point in continuing to fill out the document further.

Indicate the number of children

Enter the number of children that fit all requirements. Multiply their number by $ 1400, and write the result in point 4.

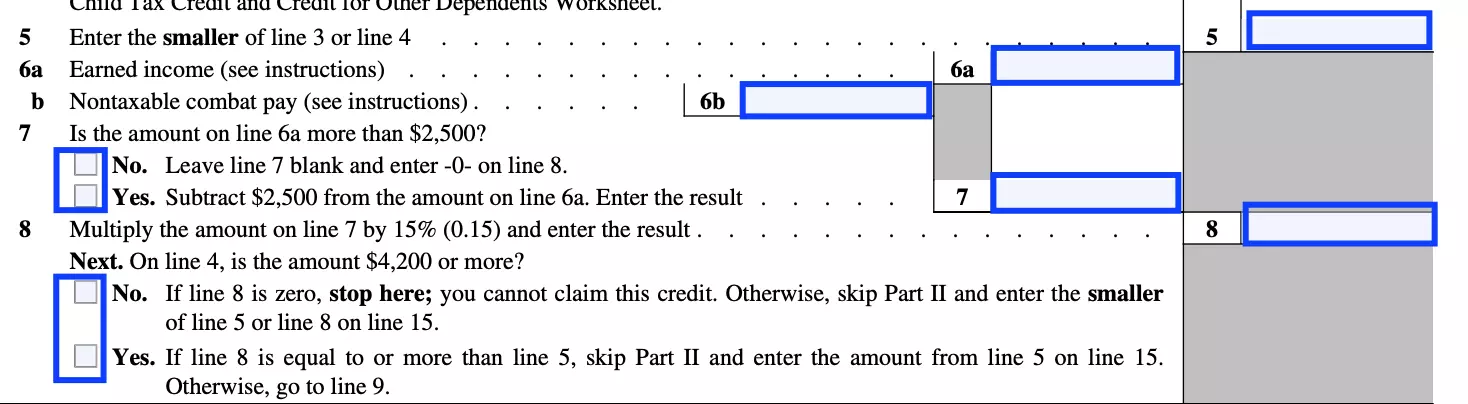

Complete the remaining items in Part 1

Following clear instructions, continue filling out this part of the document from points 5 to 8. Based on your answers, you will either stop filling out the form here and move your answer to Part 3 or continue filling out Part 2.

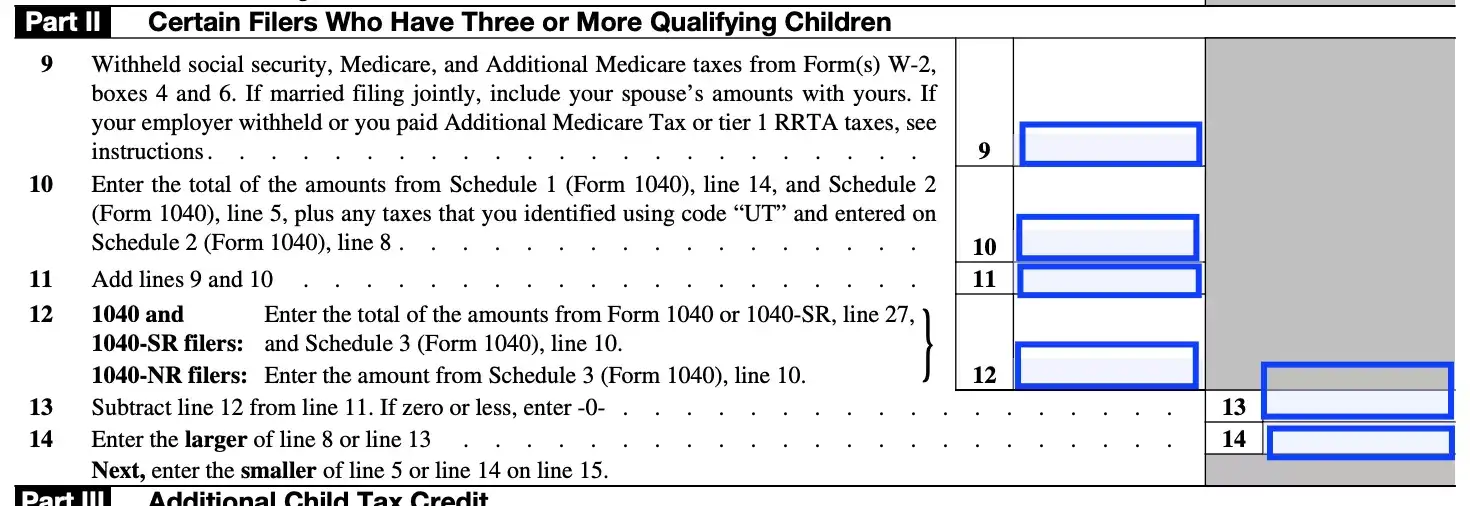

Complete Part 2

Using the previously filled out forms, enter the data in the second part of the document.

Get the total amount

In column 15, you need to insert:

- either the number obtained in paragraph 5 or 8 (whichever is less) and if you did not fill out part 2;

- or the number obtained in points 5 or 14 (whichever is less) if you filled out part 2.

We strongly recommend you consult with a professional before submitting this document. After all, if the Revenue Service recognizes you were not eligible for this ACTC, you may be denied receiving it within the next two years. Therefore, it is better not to risk it but to get extra tax advice if you cannot figure it out yourself. Check the validity of the data several times before submitting it.