IRS Schedule A for Form 990 or 990-EZ is used by tax-exempt organizations, such as charities and other nonprofit entities, to provide additional information about their public charity status and public support. It is an essential form for these organizations to maintain their tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

This schedule requires organizations to classify themselves as a public charity or a private foundation. The form helps determine an organization’s public charity status based on the source of its financial support, including contributions from the general public, governmental agencies, and other public entities. Schedule A contains several parts designed to demonstrate compliance with the public support test, which requires that a significant portion of an organization’s funding come from the public or other sources that further its tax-exempt purposes.

Other IRS Forms for Charities and Nonprofits

Here, we have collected some other IRS forms that might be valuable to your organization. Knowing the peculiarities of these forms will help you prove your legal operation in the eyes of the IRS.

How to Fill Out the Form

The traditional way of obtaining the template is by visiting the IRS official website, where you can find not only the relevant form but also instructions on how to complete it. However, if you are reading this article, there is a quicker way to get Schedule A — by using our highly-developed and automized form-building software. Our PDF editor allows users to find the necessary form and fill it out online or create their own template (the second option is not advisable when dealing with tax forms). While completing the paper, you can check the information for accuracy. Making a mistake no longer leads to re-writing the entire document. You can correct the mistake online in the place where you have made it.

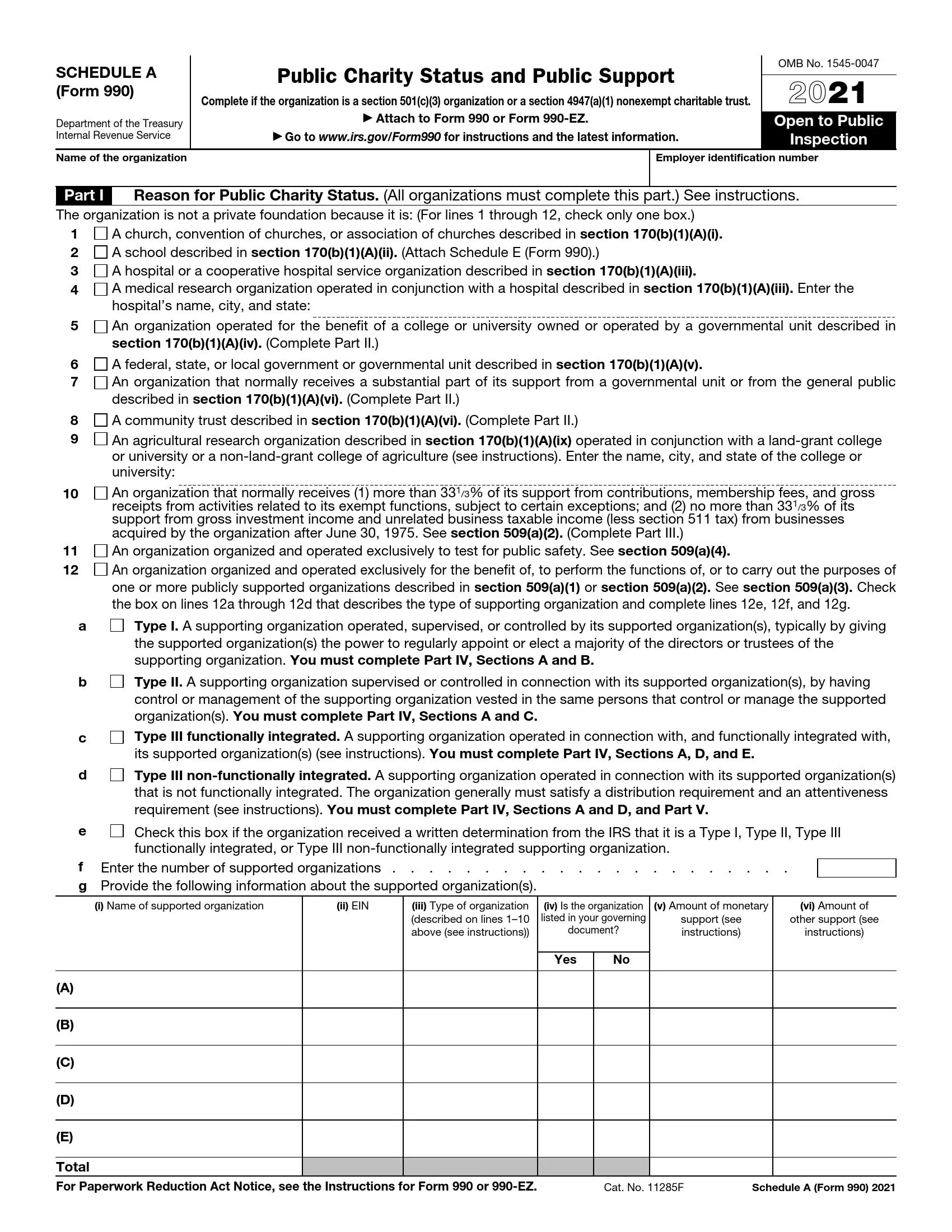

Once you have the form before your eyes, you can notice a well-organized document structure: the form consists of eight pages and is divided into six parts. Each document part (except for Part 6) comprises several sections distinguished by the alphabet letters in their names.

We encourage you to read the guide below to complete the form successfully. However, to make sure that you understand all the instructions in the form and what details you need to provide, we recommend turning to a professional legal adviser who can clarify all the issues.

Identify the Filer

First and foremost, at the top of the document (right below the title), you are required to enter the full legal name of your organization and the ID number of the employer (also referred to as EIN), which typically consists of nine digits. Entering the EIN is a compulsory action. If you still do not have one, you can apply online on the Service’s website or make a request by phone or mail.

Ensure that the legal name is the same as the one that was written in the requested tax return report (Form 990 or 990-EZ). If you enter the name correctly, the tax agents will not have problems with identifying the papers.

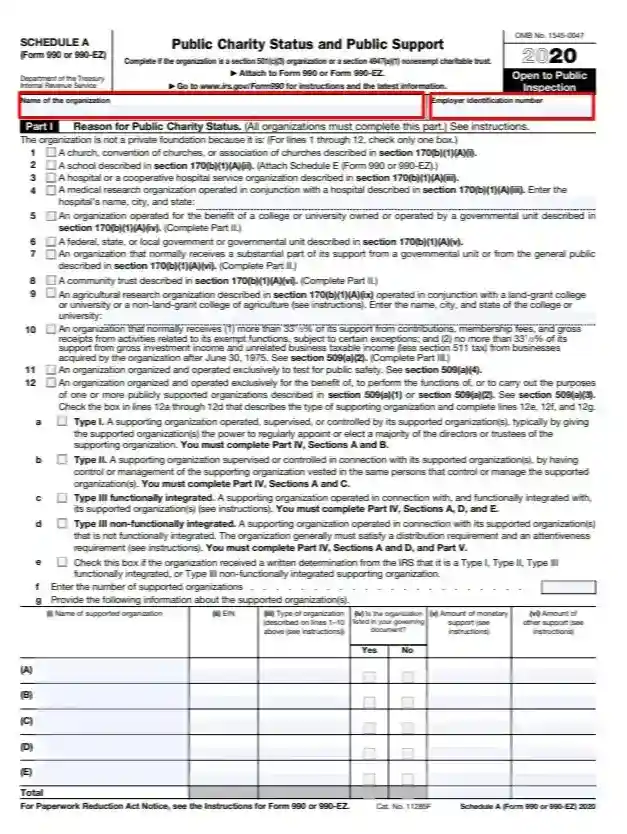

Indicate the Type of Your Organization

Part 1 of the document takes up the entire first page. It contains 12 major points (or lines), each stating one reason your entity belongs to public charity foundations. You are to choose one of these boxes. If there is more than one reason you have this status, you can state them in Part 6, which is a section for additional information. The list of reasons includes but is not limited to churches, schools, hospitals, governmental units, and other foundations operating for public safety or benefit.

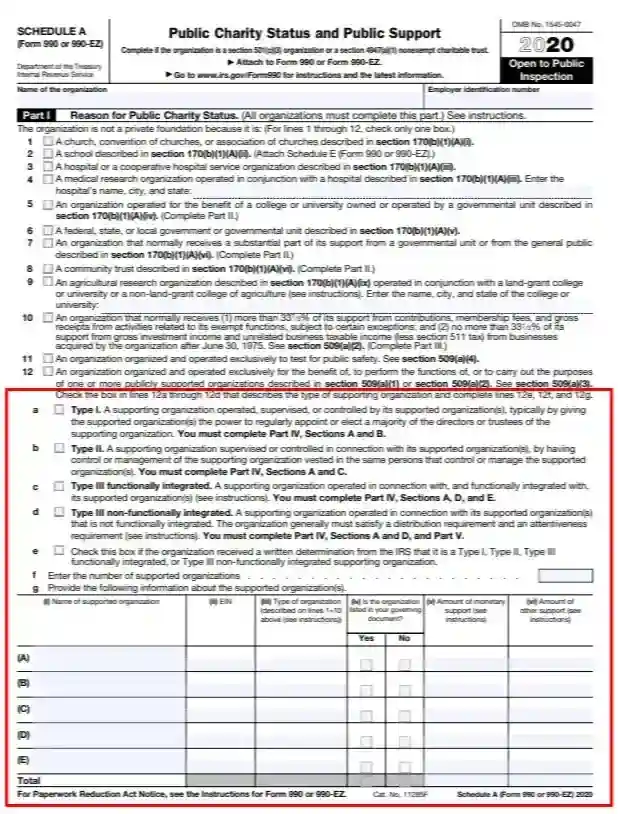

Describe the Type of Your Supporting Organization

If you select line 12 as the reason for your public charity status, you must also complete lines 12a-12g. Points a-d are used to define the exact type of organization that supports other entities. There are four types in total:

- Type I

- Type II

- Type III (functionally integrated)

- Type III (non-functionally integrated)

Each type is described in the form. Besides, you are provided with instructions on your further actions when you choose a certain type.

On line 12f, insert the number of organizations that receive your support. Complete the table below by giving basic details about these organizations (the full legal name, the EIN, the type, the total amount of support, etc.).

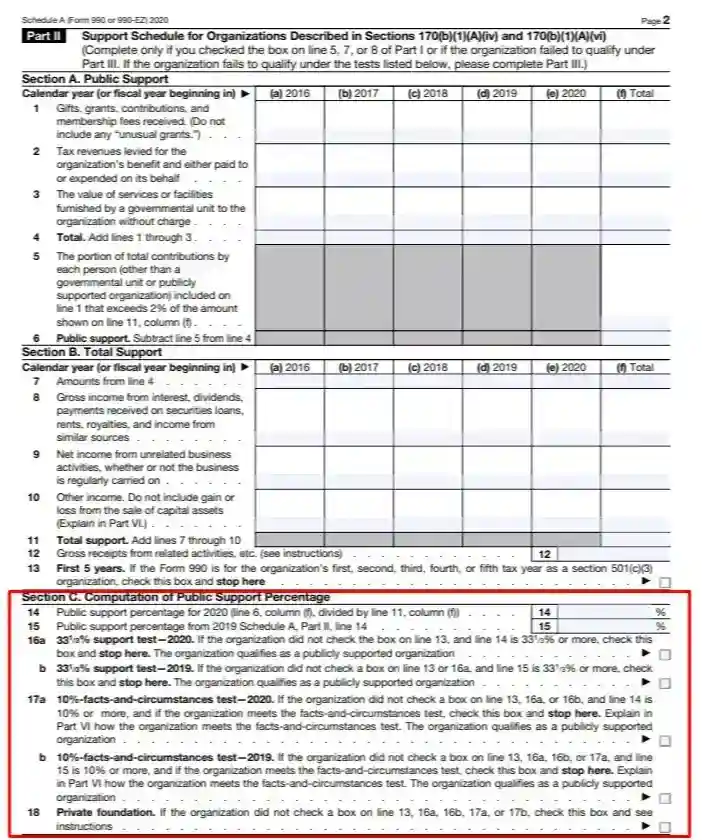

Complete Part II (for specific types of organizations)

Like Parts III-V, this part is mandatory to fill out only if you check certain boxes in the previous part. Thus, proceed to this part if you have selected boxes 5, 7, or 8 (you are either a community trust, a foundation supported by a governmental unit, or an organization operated to benefit non-private colleges and universities.

This part is divided into three sections listed below:

- Section A

Write the amount of public support (grants, gifts, tax revenues, services received from governmental units, etc.) in the given years (from 2016 to 2020) and then enter the total value.

- Section B

Put in information about your gross income or net income, which is not related to business activities. On line 10, include the amount of income from other sources not mentioned in the previous lines. Insert the total amount of support and gross receipts from actives related to business.

- Section C

This section is necessary to fill out only if you tick the box on line 13 of the preceding section.

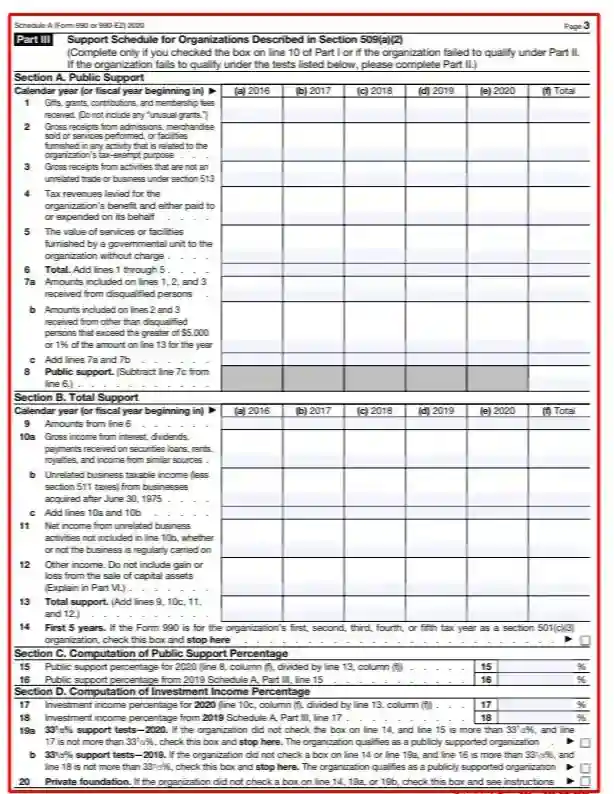

Fill Out Part III (for specific organizations)

The structure of this part is almost identical to the one in Part II. The only difference is that it contains one additional section. Therefore, the part is divided in the following way:

- Section A for public support

- Section B for the total amount of support

- Section C for computation of public support calculated in percents

- Section D for computation of investment income calculated in percents

Like in Part II, in this part, the IRS gives clear instructions on which sections you must fill out and which ones you must leave blank (and under what conditions). Read carefully the information provided in each section.

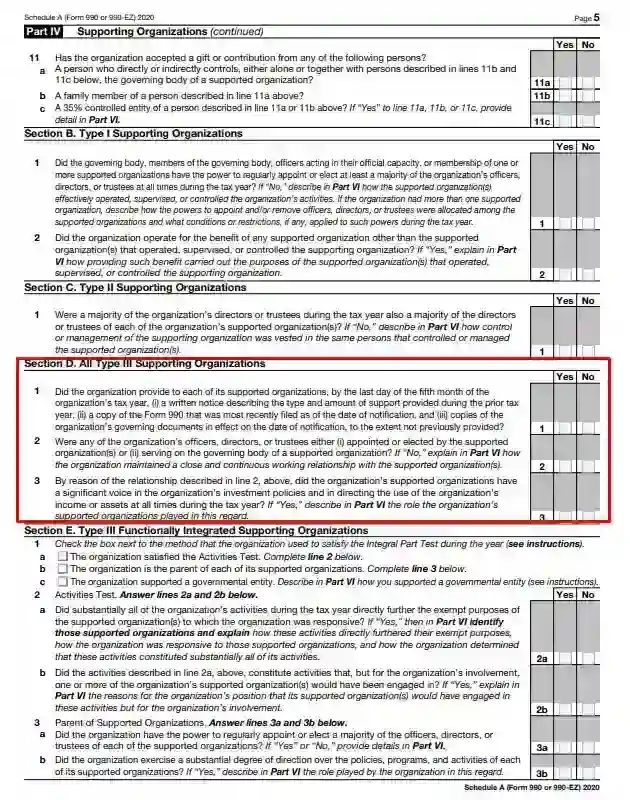

Proceed to Part IV (only for supporting organizations)

As the step suggests, this part is completed only by organizations best described by line 12 on the first page of the document.

Part IV contains five sections meant for different types of supporting organizations. However, lines 1-11 in Section A, containing a short questionnaire, must be filled regardless of the type.

Mind that Section A ends on page 5.

Questions in Section B must be answered by organizations defined as Type I. Like in the other sections, you are allowed to give “Yes” or “No” answers.

The next section consists of only one question and is completed by Type II organizations.

Fill out Section D only if your organization belongs to the Type III group according to an exemption letter.

The last section in this part is required for organizations that are described as Type III non-functionally integrated foundations.

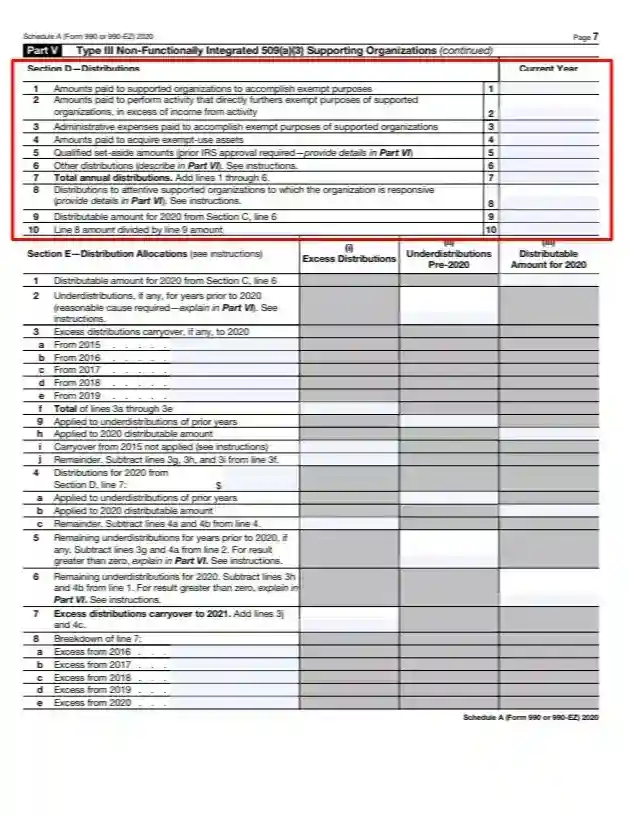

Complete Part V (for organizations defined as Type III non-functionally integrated)

Before you proceed to the part sections, you can indicate whether or not you meet the Integral Part Test. Check the box at the top of the document if the statement is related to you. In other cases, complete the following sections to prove that you satisfy the distribution requirements:

- Section A (for adjusted net income, which is defined as the total taxable income)

- Section B (for minimum asset amount)

- Section C (for indicating distributable amount)

- Section D (for your total amount of distributions)

- Section E (for showing how the distributions are allocated)

Add Information in Part VI (if needed)

Above the blank lines, you can find the list of sections and parts of the documents in which you might need to add more information but do not have enough space. This part is included specifically for such cases. If you need to provide any explanation or details, especially for your answers in Part IV, please do it in the given section.