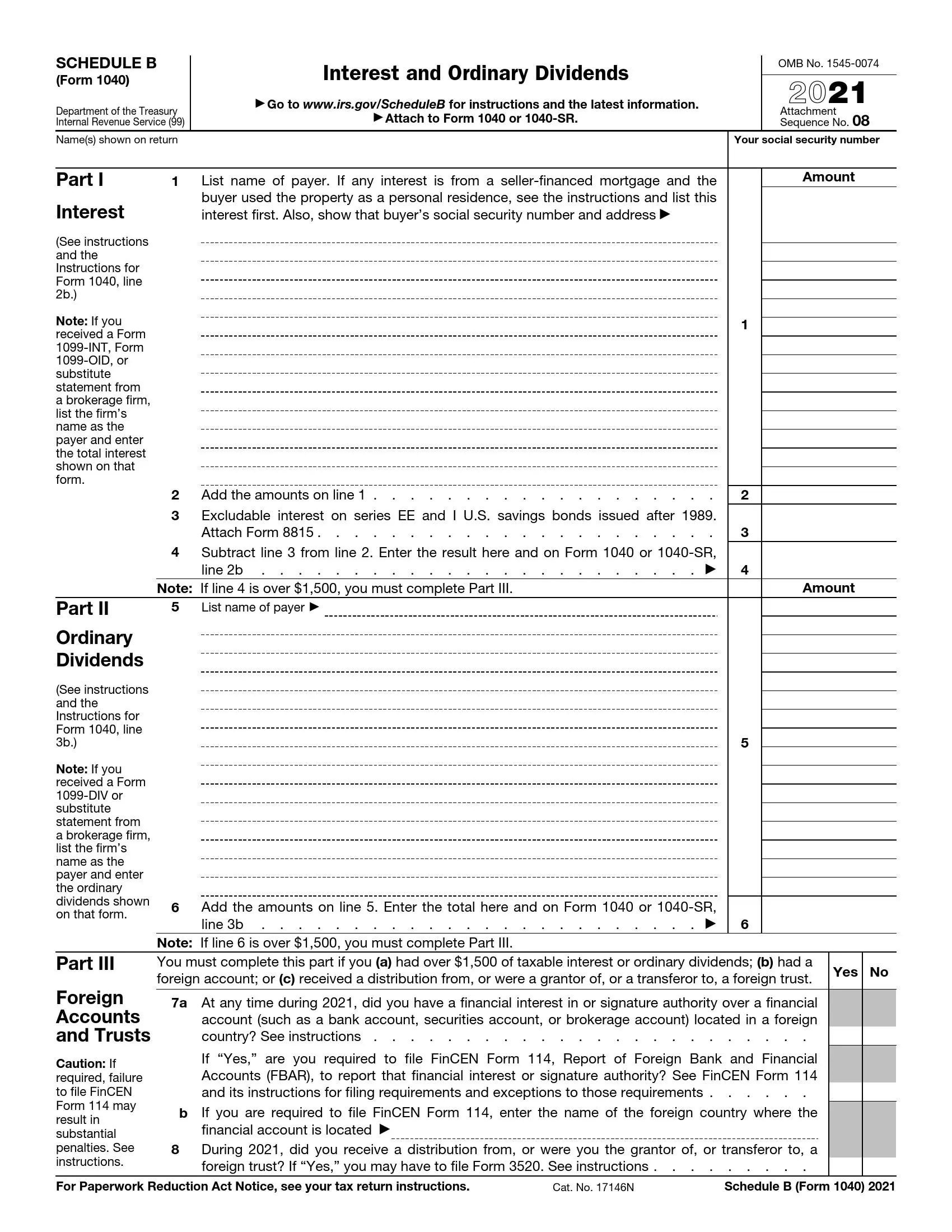

IRS Schedule B, an attachment to Form 1040, is titled “Interest and Ordinary Dividends.” Taxpayers use this form to report the amount of interest and ordinary dividends received during the tax year that exceed certain thresholds. Specifically, Schedule B is required if the total amount of interest and dividends a taxpayer receives exceeds $1,500 or if the taxpayer has received interest or dividends from certain foreign accounts or trusts. Schedule B is organized into three sections where taxpayers must list:

- All sources and amounts of interest income,

- All sources and amounts of dividend income,

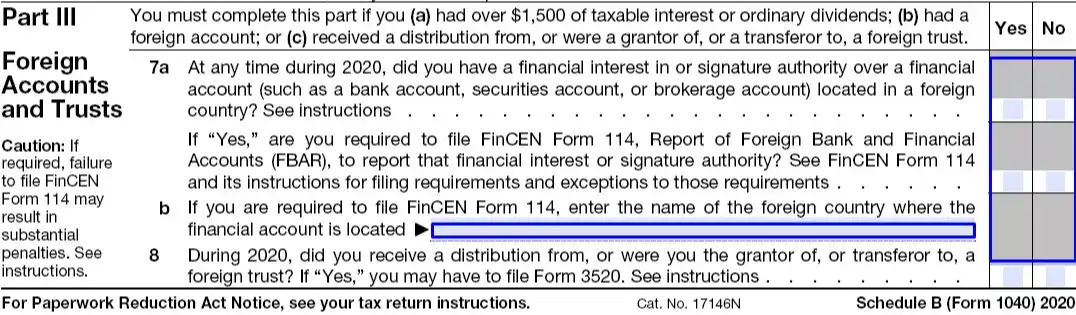

- Information related to foreign accounts and trusts, if applicable.

This form ensures that taxpayers accurately report their income from these sources. Completing Schedule B accurately is essential for compliance with tax laws and correctly calculating taxable income, potentially affecting the taxpayer’s overall tax liability.

Other IRS Forms for Individuals

Whether or not you need to add a certain schedule to an IRS form will depend on specific factors. Learn what schedules there are to make sure you have used the proper one.

How to Complete It Properly?

This supplement to the main duty form consists only of one page divided into three parts. Every part consists of several lines and boxes to be checked. You should complete these lines, as many as necessary, depending on the number of the payment documents you have received from different payers throughout the reported year.

You can make more than one record on one line, but be sure that the information is readable, the sums of money in particular. It is admittable to enclose additional pages if you need more space, but don’t forget to indicate your name (identically to the main duty form) and the SSN. We recommend filling out this document with the help of our form building software to make the task easier, save your time and eliminate all possible mistakes.

1. Start with Pointing Out Your Name

On the first line of this document, you have to write down your name exactly as it stands on your tax return. Don’t forget to indicate your security number too.

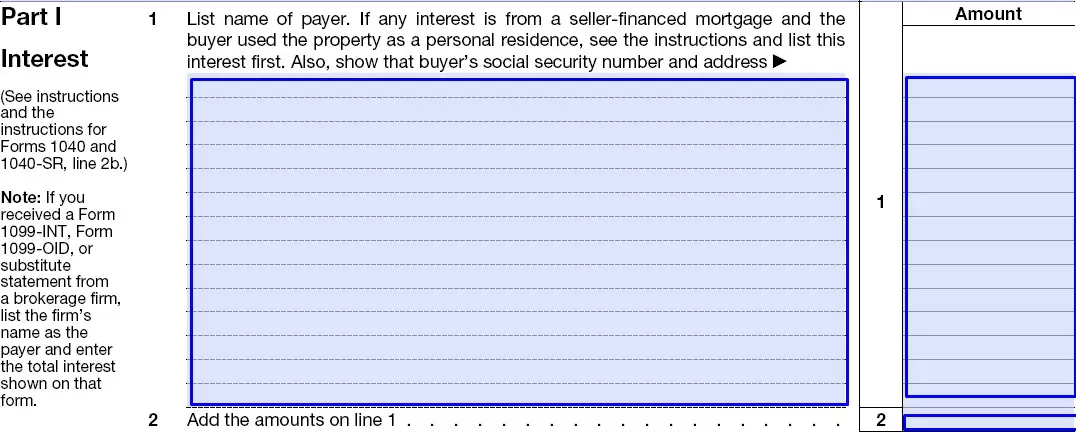

2. List the Amounts of All Your Interests

Part I of enclosure B is dedicated to your interests if you have to show them. Here you should include the names of all payers who have sent you the appropriate documents. Show the sum over against every name. Summarize all the amounts on line two of the form.

3. Deduct Your Savings Bonds’ Gain

In the case you received any interest from the bonds during the tax period, you should take it away from the sum above. Write down the final result for Part I. Remember that you should also indicate it in your Form 1040 on a certain line.

4. Enumerate Your Dividends Here

The second part of this enclosure B is for your regular benefits. Specify them in the same order as your interests above. Totalize them and enter the final sum on line 6 here and line 3b of your duty return. Now go to the last part of the document if you fall under the corresponding requirements.

5. Fill out Part III of the Enclosure

You are not obliged to complete this section of the form every time, but only in certain cases. Please, examine carefully all the related instructions given in this form B, in the form of your duty declaration, as well as on the official Duty Service site. Keep it in view that you will have to pay a significant fine if any mistake occurs. To avoid this event, fill out the form using our multifunctional online PDF editor.