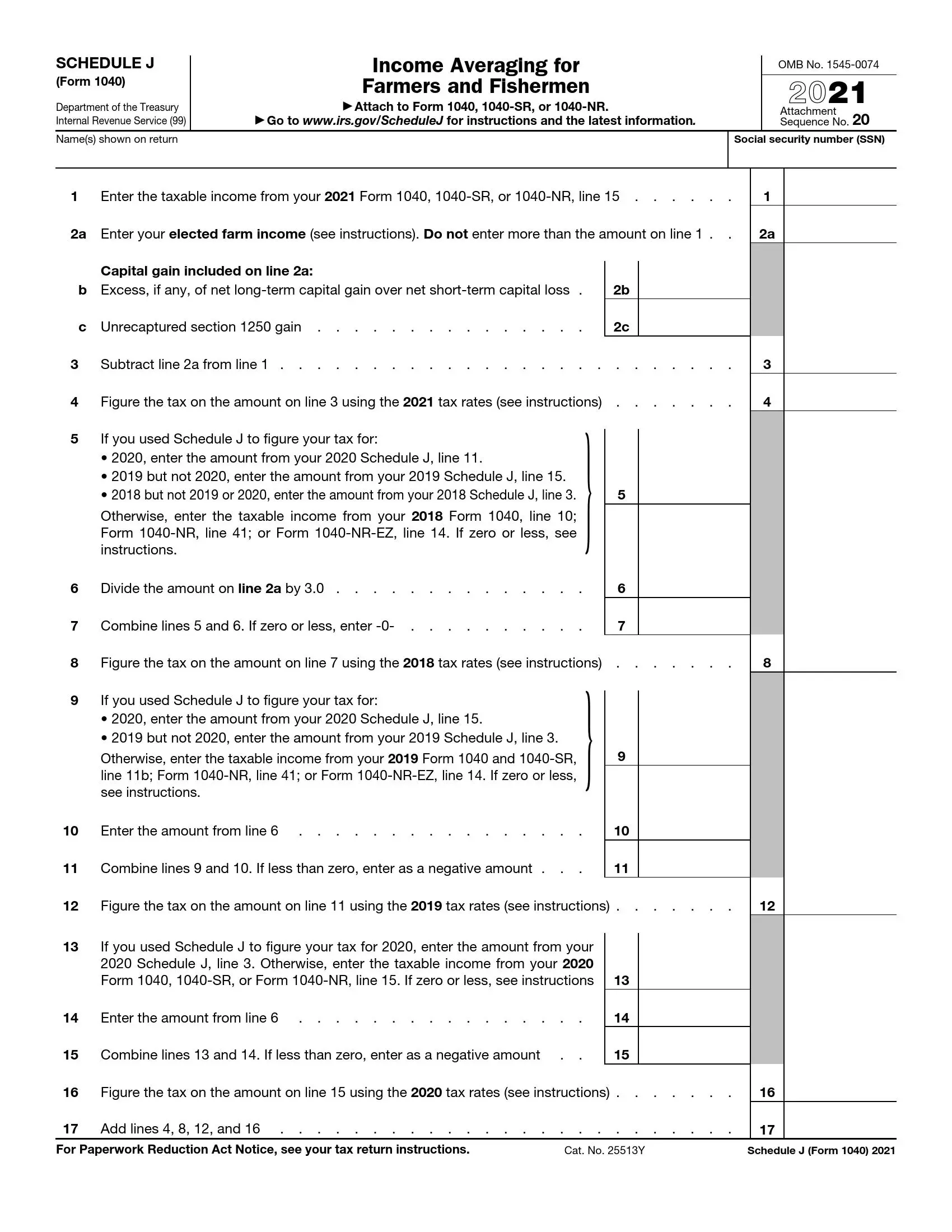

IRS Schedule J, also known as “Income Averaging for Farmers and Fishermen,” is a tax form qualifying farmers and fishermen use to calculate their income tax liability under an income averaging method. This method allows farmers and fishermen to average their income over the past three years, which can result in a lower tax liability by reducing the impact of significant fluctuations in income from year to year. Schedule J is attached to Form 1040 or Form 1040-SR. The basic information provided on Schedule J includes:

- Details about the taxpayer’s farming or fishing activities,

- Income earned from farming or fishing activities over the past three years,

- And the calculation of the taxpayer’s income tax liability using the income averaging method.

By completing Schedule J, qualifying farmers and fishermen can take advantage of the income averaging method to reduce their tax liability and smooth out the impact of income fluctuations. This form helps ensure that farmers and fishermen are taxed fairly and provides them with a tax planning tool to manage their tax obligations more effectively.

Other IRS Forms for Individuals

There might be some other schedules to IRS forms you need to get familiar with before you file your tax return.

How to Fill Out the Form

Filling out the document can seem complicated and confusing to you. This is really not the easiest document, and you cannot complete it without preparing.

First, you need to collect copies of your reports from the past three years, as you will have to transfer information from them.

Identify yourself

As with most documents, you need to start by writing your name and number of Social Security.

Transfer the value

Just put the number from the specified documents in paragraph 1.

Enter the value of your profit

Carefully read the instructions included with this document before filling it out.

If you are involved in several businesses (which are discussed in the document), then you need to add their indicators to get only one number.

This paragraph also says that you should not enter an indicator more than was indicated in paragraph 1.

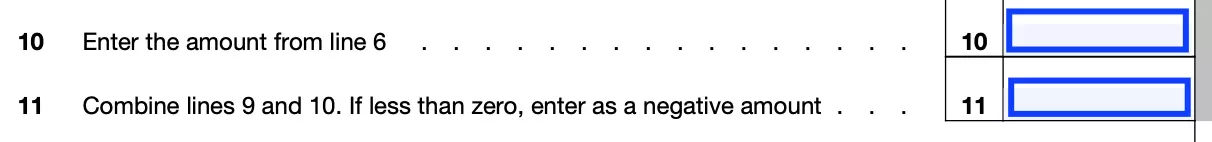

Perform the calculation

Just subtract one metric from the other.

Enter indicators

To complete items 4 and 5, you will have to carefully study the instructions. Their filling depends on what documents you have already submitted and the income tax for which year you are using. If the instructions seem too confusing to you, it is best to ask your tax professional for clarification.

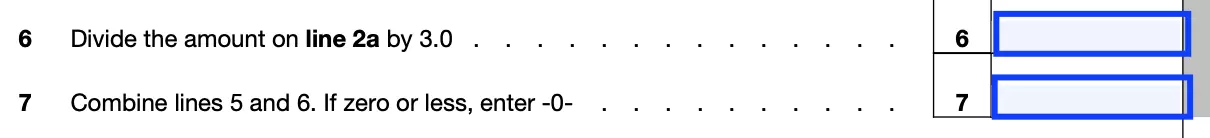

Perform calculations

Use either a calculator or a form-filling program. In the second case, you do not have to count yourself, and the program will perform all the necessary operations.

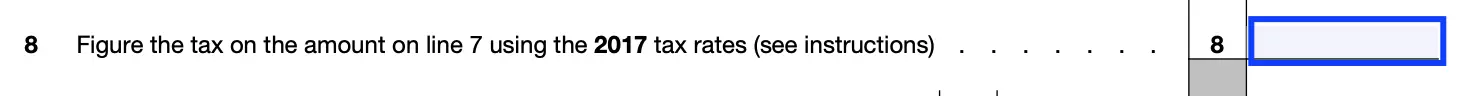

Figure the tax

If you got zero in the previous paragraph, then put the same thing here.

If you indicated a positive number, then use the tables from the documents and indicate the tax rate according to your situation.

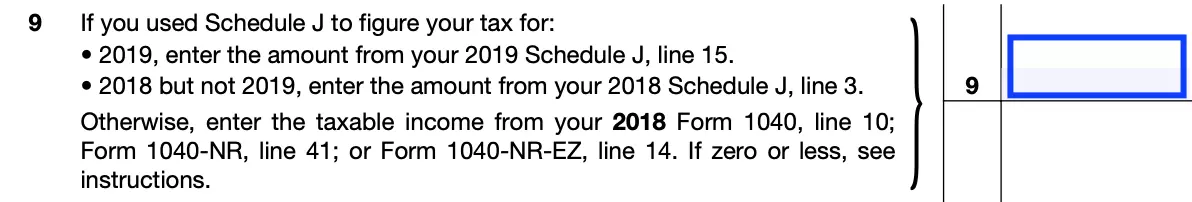

Enter indicators

You will have to study the instructions carefully again to enter the indicators that apply to you and use the additional Taxable income table.

Calculate

This form is a repetition of the same actions. Likewise, in the next two points, you need to perform simple mathematical calculations again.

Do the same with points 12-15

You need to review the instructions again and apply them to your situation. Fill in points 12 and 13, and then do the calculations. Only the year to which the indicators relate changes.

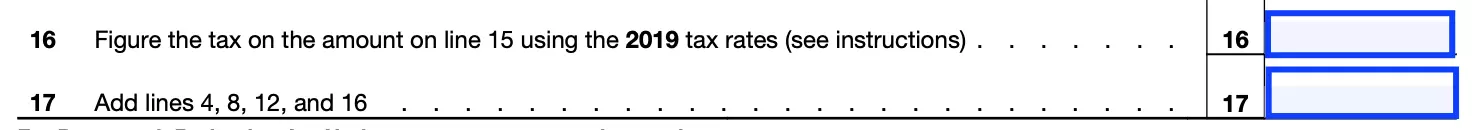

Use 2019 tax rates

If in the previous paragraph you got zero or negative indicator, then put zero here again. If not, use the table from the instructions to enter the required metric.

In step 17, add the named lines.

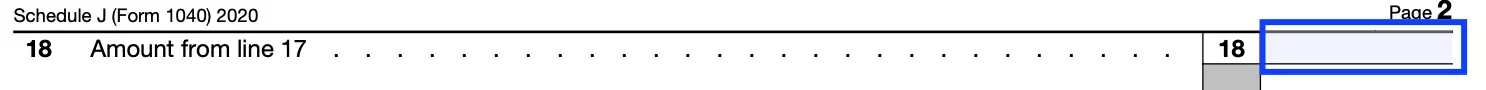

Transfer the indicator

Just write in this paragraph the number that you got in the previous paragraph.

Transfer the numbers

Transfer all indicators according to the instructions in paragraphs 19 to 21. Be careful.

Get the required number

First, add up the numbers from the previous three points, and then subtract the number from point 18.

Do not forget that you will also need to transfer the obtained result to other documents for filing with the tax office.

As you can see, completing this document requires special training and knowledge, and it will be difficult for an unprepared person to cope on their own. But using it correctly, you can save a lot of money. Therefore, we advise you to either pay special attention to studying all the instructions or use the help of professionals.