IRS Schedule M-3 for Form 1120 is a form used by certain corporations to reconcile financial statement net income with taxable income reported on their income tax return. This schedule is specifically required for corporations that report total assets of $10 million or more on their balance sheet and file Form 1120, the U.S. Corporation Income Tax Return.

The purpose of Schedule M-3 is to provide a detailed explanation of the differences between net income as reported to shareholders and other stakeholders in financial statements according to Generally Accepted Accounting Principles (GAAP) and the net income as calculated for tax purposes. The schedule helps the IRS understand how these differences arise, focusing on temporary and permanent differences that affect a corporation’s tax liabilities.

Other IRS Forms for Business

Not all corporations have to file the Schedule M-3. Learn what other IRS forms are required of the same type of corporation as yours.

How to Complete the Form

The most common way to find the official template is to enter the name of the form in the search section on the IRS website. Once you have pressed “Enter” or have clicked the search button, you will get a lot of links related to the form. The links will lead you not only to the form itself but also to the general instructions, which contain the basic information about the form and other attachments and help you complete it.

However, there is another option for you. If you don’t want to leave our website, you can download the form by using our advanced and automated software, specifically designed for storing lots of different legal documents and assisting people in completing them. We provide a PDF editor that allows our clients to find the latest version of the template and fill it out online (we advise you to use official forms rather than to create your own papers when dealing with tax documents). Completing the form online also allows you to check the text you enter for accuracy.

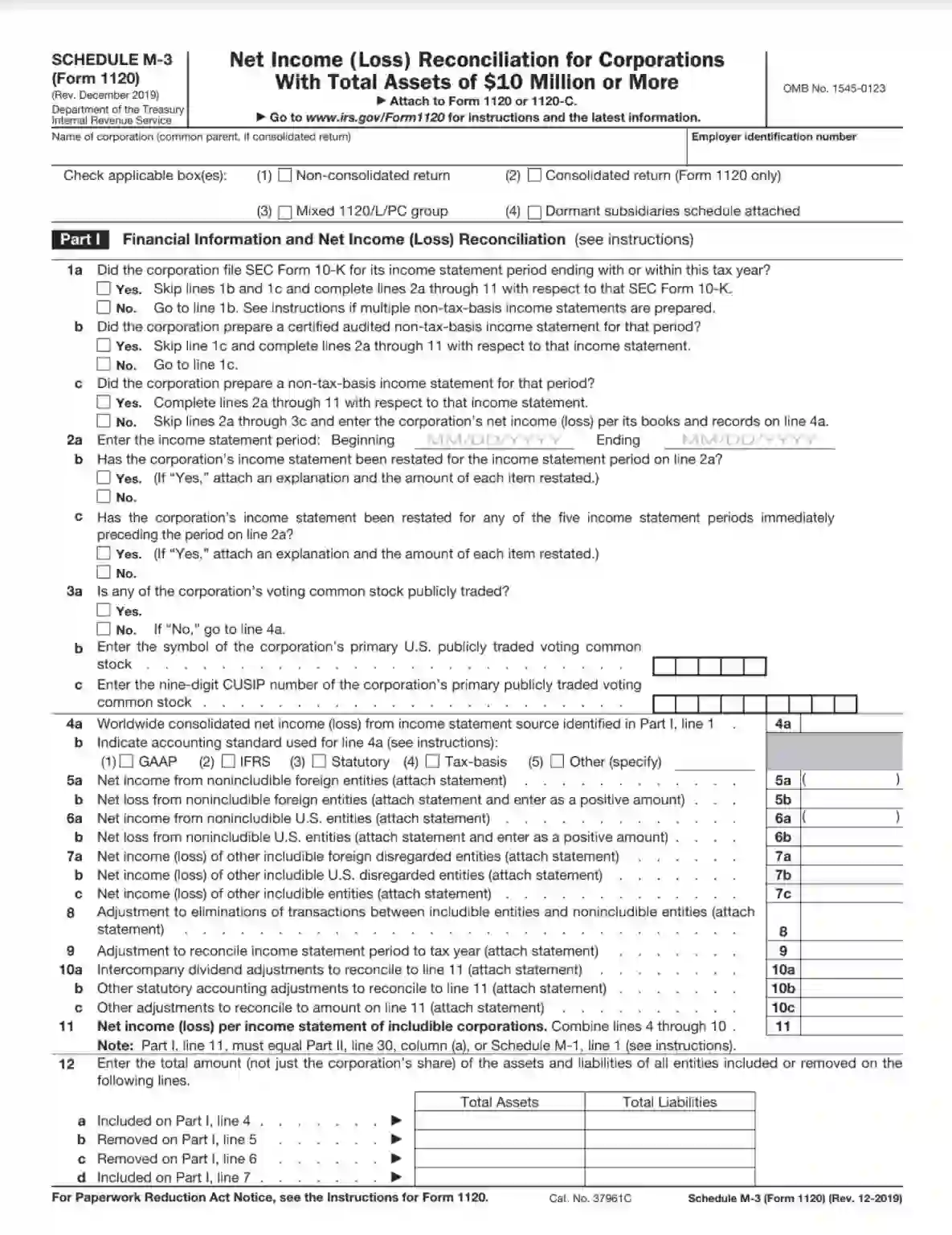

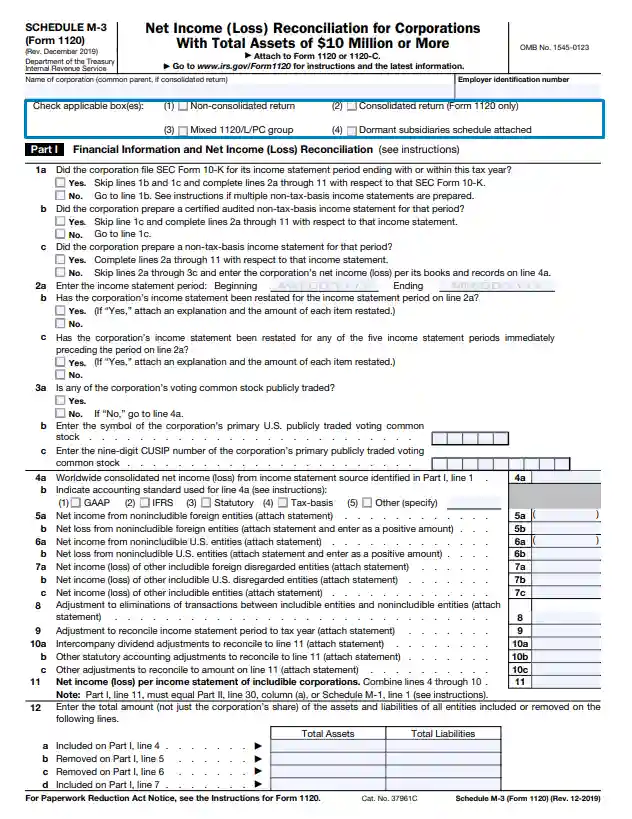

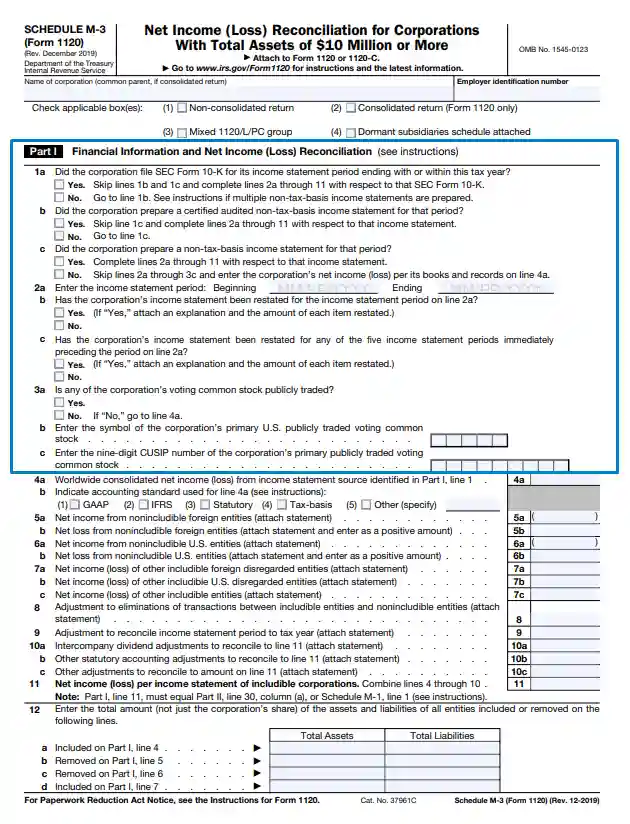

The Schedule M-3 template generated by the IRS consists of three pages. All the sections are divided into three parts. We recommend reading the IRS instructions for the form if you don’t know whether to complete this or that part.

We encourage you to read the guide below if you decide not to turn to a legal specialist to complete the form on your behalf. Legal services are rather expensive, but your mistakes can cost you much more. Thus, if you have any questions and doubts, hire a legal adviser.

Identify the Filer

At the top of the document, enter the full legal name of the corporation. If the form is sent by a consolidated group, write the name of the head company (also known as the common parent).

Besides, input the EIN (or the ID number of the employer), consisting of nine digits. The name of the section is typed in bold. Therefore, it is mandatory to fill it out. In case you don’t have an EIN, we want to remind you that the tax agency allows you to send an application form online.

Specify the Type of Your Return

In this section, select the appropriate box to indicate which type of return you are filing. There are four boxes: for corporate returns of an affiliated group, for non-consolidated returns, for mixed groups. You can also indicate that you attach a dormant subsidiary schedule.

Complete Part I

In the first part of the document, which contains three subsections, you are to provide financial information and to report the net income (loss) amount. You will find instructions on which lines you need to skip and which ones you are to fill out.

The first subsection has a small questionnaire (six questions in total) which requires that you give either the“Yes” or “No” answer. Depending on the answer you give, you are to complete or skip different lines.

In the second subsection, you must indicate the consolidated net income (or loss), which accounting standard is used, net income of different subsidiary entities, and other details. Read the instructions carefully to avoid mistakes.

The third subsection starts and ends on line 12. Here, you are required to enter the total amount of the assets and liabilities. Follow the instructions which help you understand which parts and lines you are to include or remove.

Introduce the Corporation and Subsidiary (if needed)

If you are required to complete Part II, provide basic information about the common parent and the subsidiary, which includes the full legal name and the ID of the employer. In the middle of the section, choose the relevant box.

Fill out Part II (if needed)

As we have already mentioned, it is mandatory to fill out Parts II and III if the total value of your assets is more than 50 US dollars.

In Part II, you are to write the amount of each income (or loss) item, indicate the temporary or permanent difference, reconciliation totals, and many other financial details.

Proceed to Page 3

Before you begin to complete Part III, you are to fill in the same information as was mentioned in Step 4: At the top of Page 3, write the full legal name of the corporation, check the necessary box, and enter the name of the subsidiary.

Complete Part III

Unlike Part II, the last past is devoted to expenses and deductions. However, it is similar to the previous part in its structure: it has the same columns (although some of them are named differently) and sections for each item.