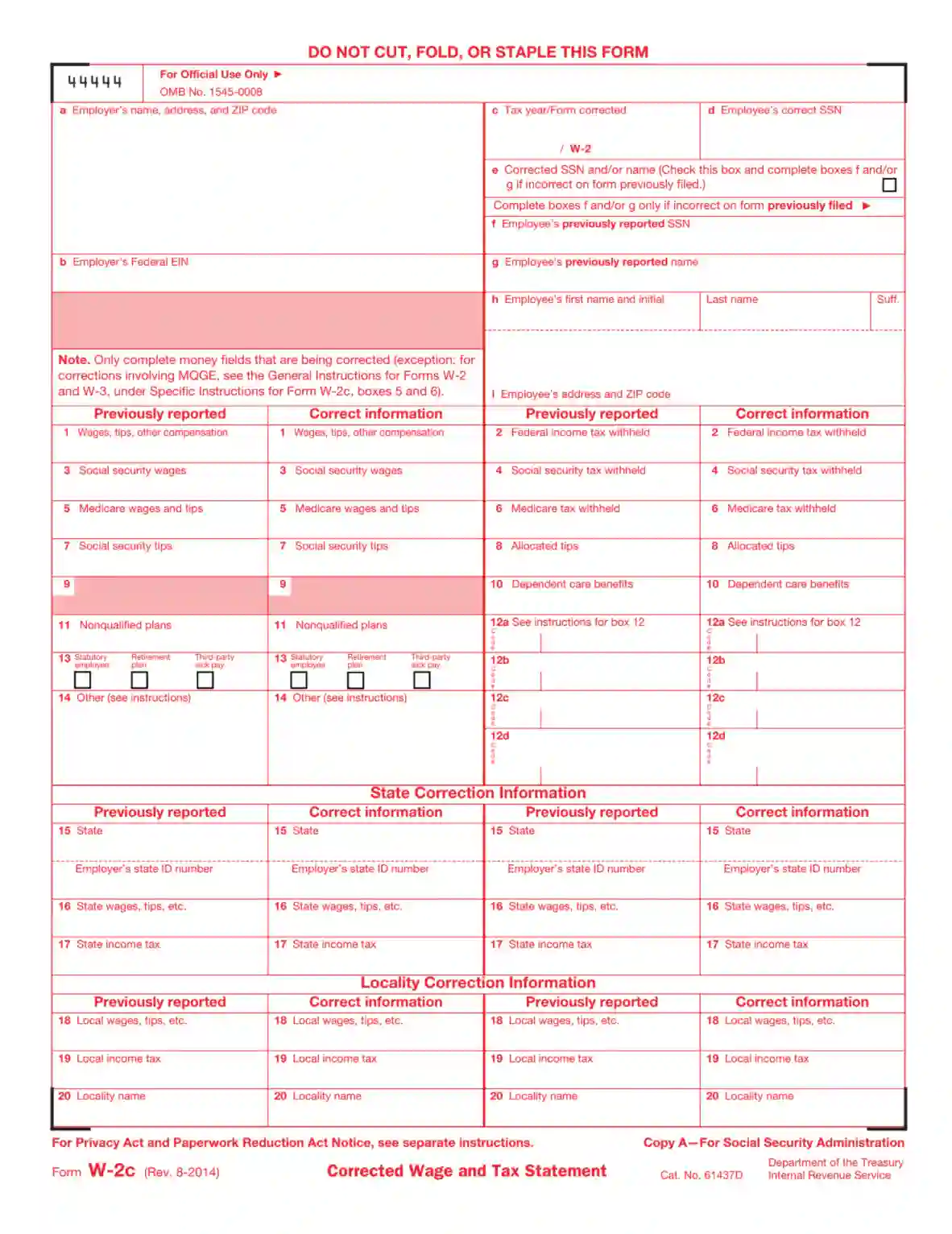

IRS Form W-2c, titled “Corrected Wage and Tax Statements,” is used to correct errors on the original IRS Form W-2. This form is necessary when there are mistakes in the data reported on a W-2 form, such as incorrect employee name, Social Security number, wages, or tax withholdings. It is the responsibility of the employer to issue Form W-2c to correct any errors and provide the corrected information to both the employee and the Social Security Administration (SSA).

Employers may need to file this form whenever an error is found in the previously filed W-2 forms, even if the errors are found years later. For employees, receiving a W-2c is crucial for ensuring that their tax records are accurate and that they report the correct information when filing their tax returns. This form helps maintain accurate tax records and ensures proper reporting of earnings and taxes to the government, essential for compliance and accurate Social Security benefits calculation.

Other IRS Forms for Business

Changing mistakes in IRS forms should be done very accurately to avoid any sort of penalties from the IRS. For the same purpose, you have to file all the mandatory forms required by the Service. Learn more about them on our other pages.

How to Fill out Form W-2C

You need to obtain the relevant form template to be able to fill it out. The IRS only provides the electronic version of the form for informational purposes. That is why the original copy (Copy A) is presented in red ink.

You can either buy the template from the IRS or a licensed seller. We suggest you use our form-building software to create and customize the legal form you need.

In addition, we have created a comprehensive filing guide to help you get through the process effortlessly. Read the recommendations below to fill out the form successfully.

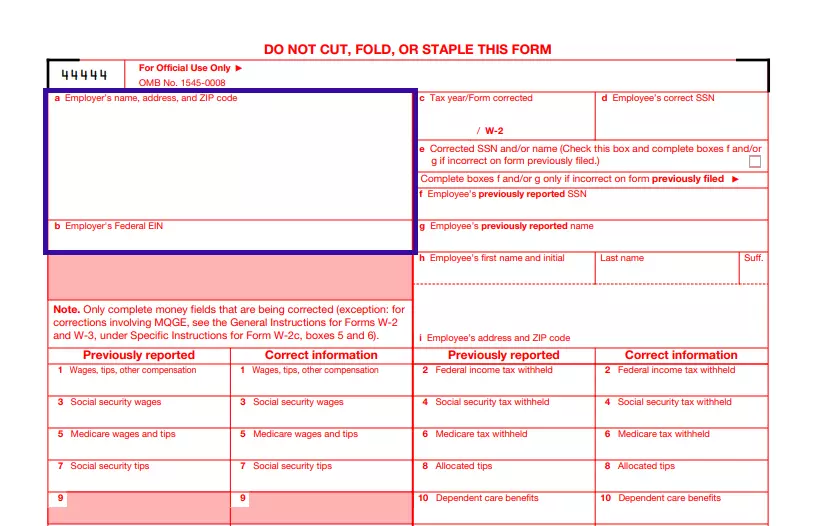

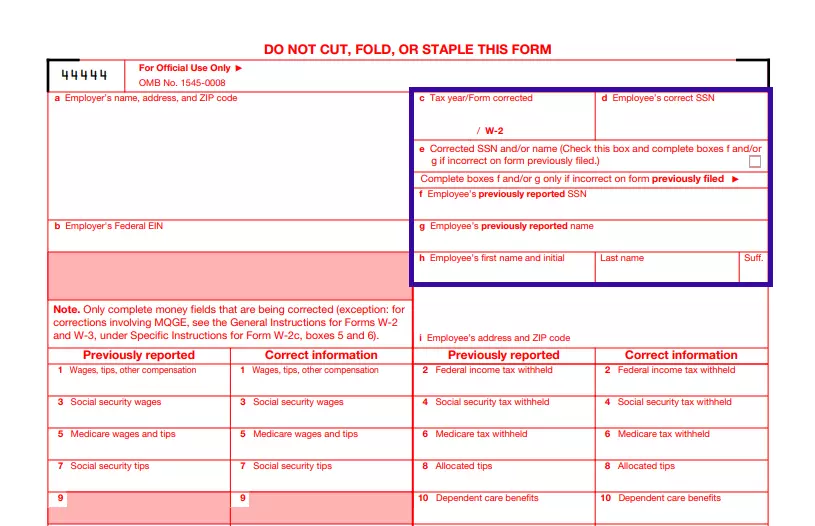

Identify the Employer

In the first blank box, you need to enter the employer’s business name, physical address, and ZIP code (or PO, if applicable). Below, you shall enter the Federal Employer’s Identification Number.

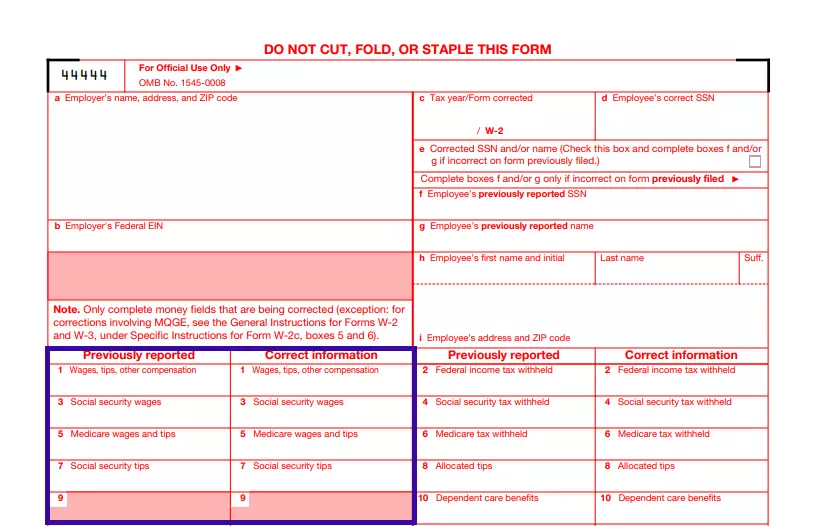

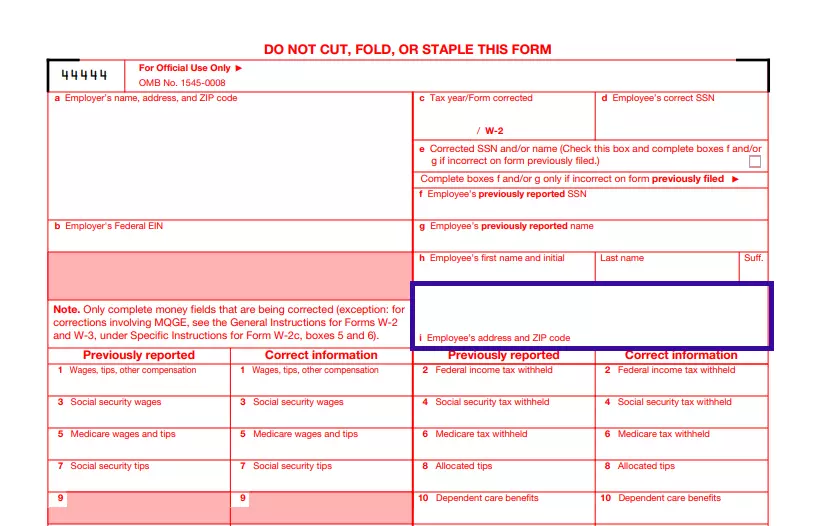

Insert the Corrected Monetary Amounts

Starting from the following part, you can insert the necessary correction to your Wage and Tax Statement. There will be two columns and two sets of data that you will need to fill in. Enter the previously stated data and then the corrected version in the columns, respectively. The first set of amendments concerns wages, including those for social security, medicare, tips, and compensations.

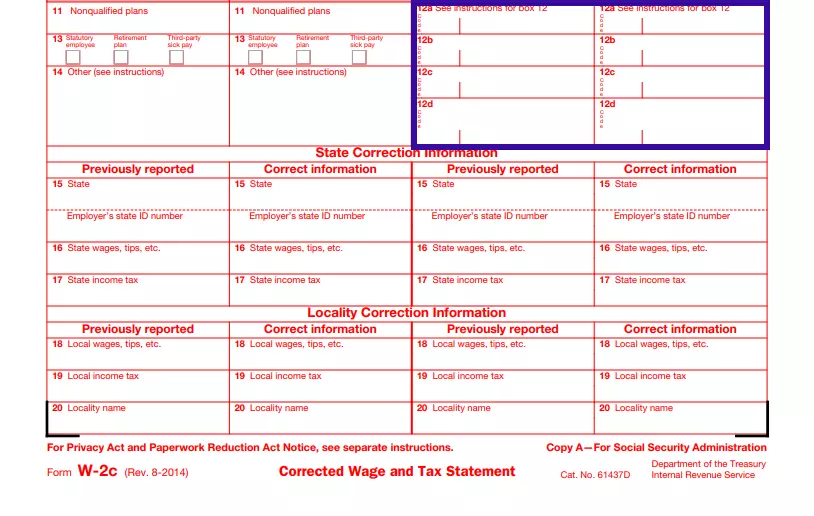

Choose and Amend the Payment Plan

In the next section, you need to indicate the corrections related to nonqualified plans (statutory, retirement, sick leave, and so on). Only fill out this section if mistakes were made in the original form. Otherwise, leave the fields empty.

Make the Name and SSN Corrections

You can use the following set of amendments to make corrections to the employee’s name and SSN. If the full legal name of the subject employee was spelled wrong, a digit from the SSN was missing, or the employee’s name had changed at the moment of the original Statement submission, you shall insert the corrected info here. Do not forget to indicate the accounting year you are making the corrections for.

Insert the Employee’s Correct Address

For example, let us imagine a situation when the employee’s physical and mailing address had changed, and the employer did not know about it. The employer inserted the old address, and the Statement thus became invalid. Now, the applicant shall insert the accurate address in the corresponding lines.

Provide the Correct Amount of Tax Withheld

If you have noticed that your employer had reported incorrect info about your federal, state, or local taxes withheld in the accounting year, you shall insert the corrected information in this set of sections. Do not forget to indicate the initially submitted info so that the SSA and the IRS knew where to make the corrections.

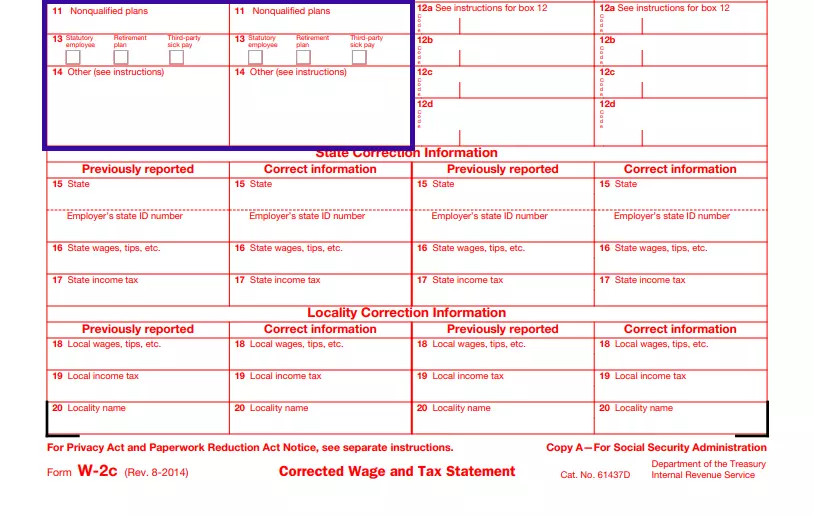

Complete Section 12 (if applicable)

Line 12 (and all its sections) can only be filled in and amended by a tax professional. There are specific codes applied to calculate the deductible income amounts in this section. Most of them relate to any extraordinary taxable or tax-exempt income, like uncontrolled social and life insurance, tips, various salary reductions, and compensation that do not fall in line with any other taxable income categories. If you need to make corrections in this section, better leave it to the tax professional or the company’s responsible officer.

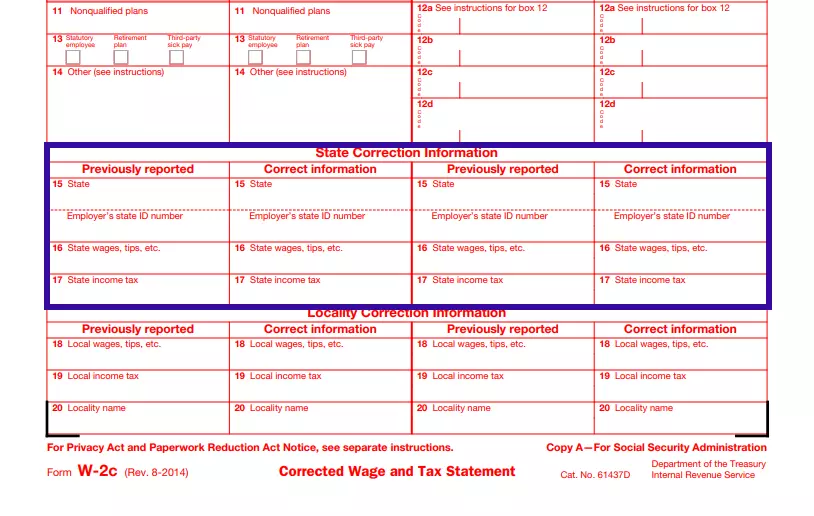

Make Amends to the Submitted State Info

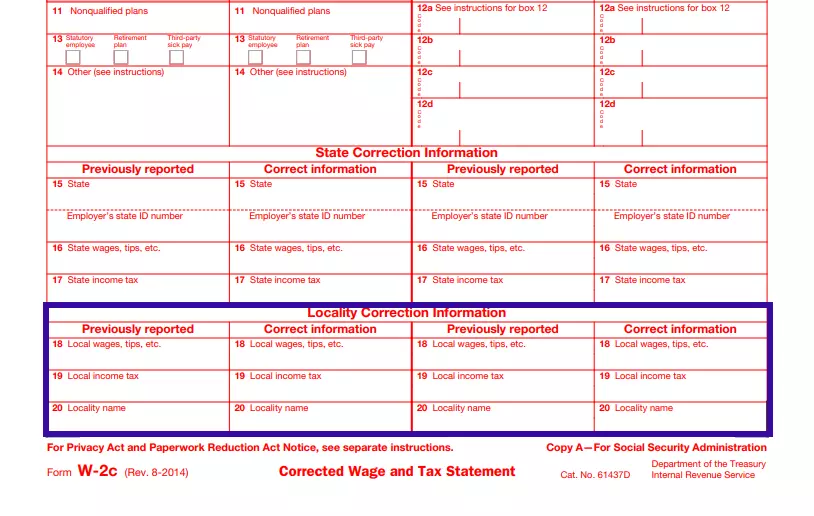

If you need to correct any personal info related to state taxation, please use this section to do so. You may amend the state’s name, EIN, wages, tips, other earnings, and the state tax amount withheld in the accounting year.

Correct the Submitted Locality Info

The same rule applies to the locality taxation data. If any of the above-mentioned data was initially inserted incorrectly, you should provide the correct and accurate options and amounts in this section. Do not forget to fill out both columns suggested.

Check with the Submission Process

Once you have made the corrections, ensure to double-check the information you have inserted. Please note that you have to refresh the information in the other tax-related forms, too. Thus, you will need to correct and file Form 1040X to amend your submitted tax returns if you have made any corrections in this section. Attach Copy B of your completed Form W-2c to confirm that the corrections are now accurate. You can do that after you file the original W-2c form.

Please note that the IRS accepts electronic filings now. If you, as the employer, need to file over 250 corrected forms, you can only submit them electronically. This measure is performed to make the submission procedure more convenient for both the filers and the IRS staff.