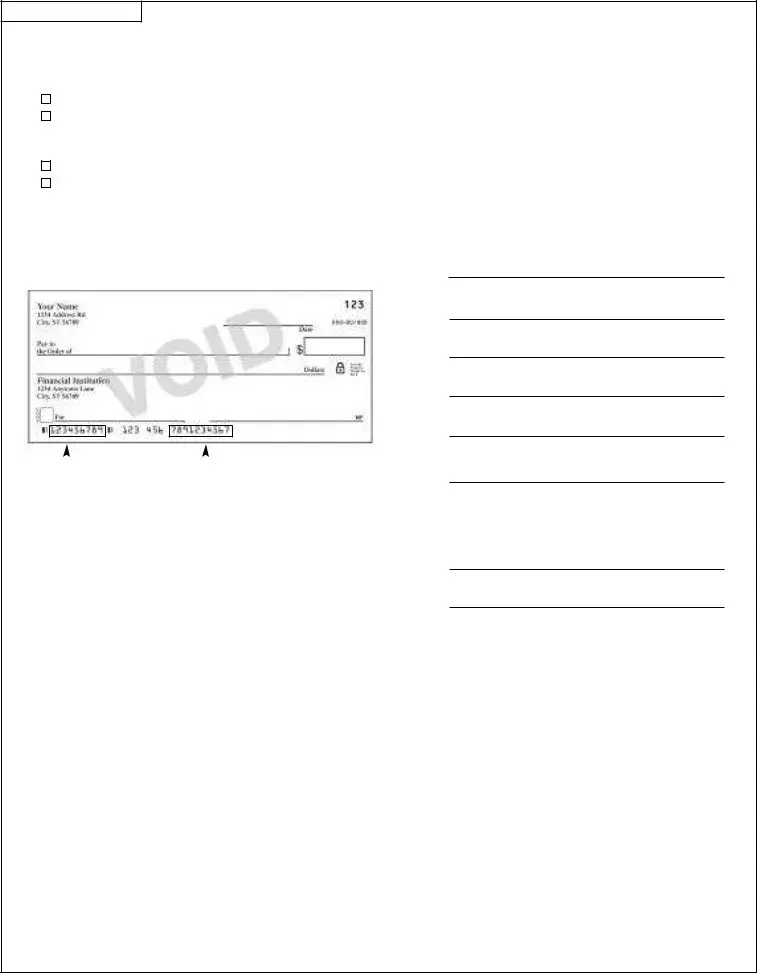

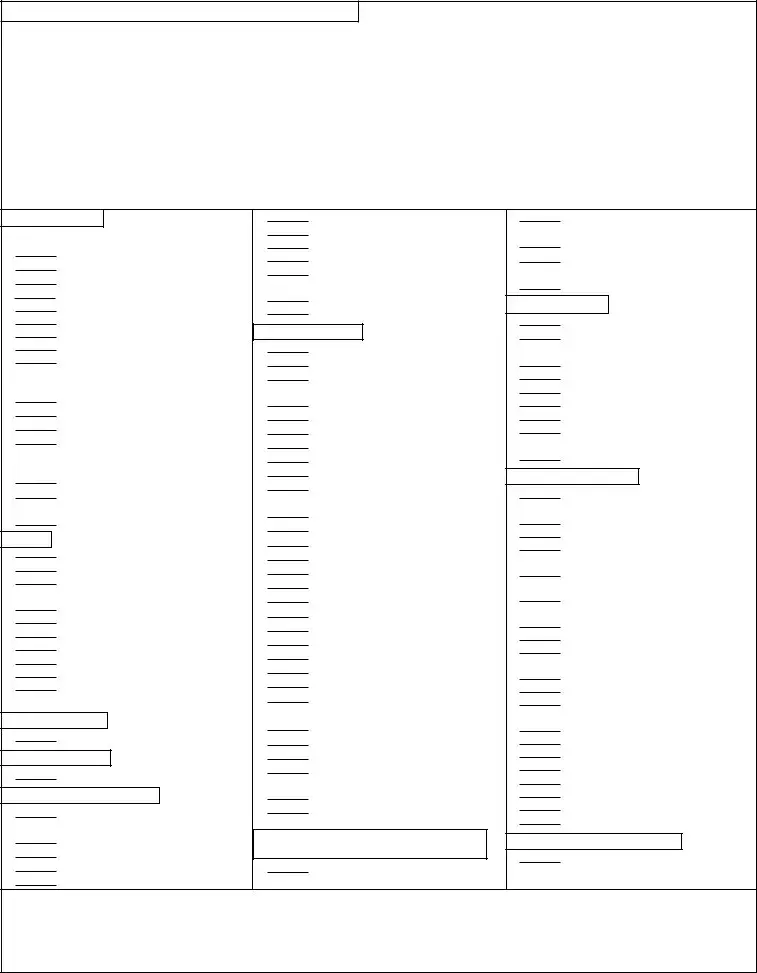

5. Withdrawal Instructions from the Investment Options

How you want your hardship withdrawal taken:

•For withdrawals only from the Guaranteed Interest Option (GIO) and/or the Variable Investment Options (excluding the Fixed Maturity Options (FMOs)), complete section 5A.

•For withdrawals only from the Fixed Maturity Option(s), complete section 5B.

•For withdrawals from both the GIO and/or the Variable Investment Options, and FMOs, complete Sections 5A and 5B.

A.Withdrawals from the GIO and/or Variable Investment Options only:

Please withdraw the total amount needed proportionately from the GIO and/or Variable Investment Options.

Please withdraw the total amount needed proportionately from the GIO and/or Variable Investment Options.

Please withdraw the specific dollar amount as designated below from the GIO and/or Variable Investment Options.

Please withdraw the specific dollar amount as designated below from the GIO and/or Variable Investment Options.

Specific dollar amounts should be taken from the GIO and/or Variable Investment Options. If you wish to withdraw the entire amount from your GIO or from a specific Variable Investment Option, you may enter ‘‘all’’ next to that option. The amount withdrawn will be the withdrawal amount plus any applicable withdrawal charges.

Asset Allocation

AXA Allocation

$AXA Aggressive Allocation (18*)

$AXA Balanced Strategy (8Q*)

$AXA Conservative Allocation (15*)

$AXA Conservative Growth Strategy (8R*)

$AXA Conservative-Plus Allocation (16*)

$AXA Conservative Strategy (8S*)

$AXA Moderate Allocation (T4*)

$AXA Moderate Growth Strategy (8O*)

$AXA Moderate-Plus Allocation (17*)

Target Allocation

$Target 2015 Allocation (6G*)

$Target 2025 Allocation (6H*)

$Target 2035 Allocation (6I*)

$Target 2045 Allocation (6J*)

Other Asset Allocation

$All Asset Growth – Alt 20 (7H*)

$EQ/AllianceBernstein Dynamic Wealth Strategies (8P*)

$EQ/Franklin Templeton Allocation (6P*)

Bonds

$EQ/Core Bond Index (96*)

$EQ/Global Bond PLUS (47*)

$EQ/Intermediate Government Bond (TI*)1

$EQ/PIMCO Ultra Short Bond (28*)

$EQ/Quality Bond PLUS (TQ*)

$Invesco V.I. High Yield (8L*)5

$Ivy Funds VIP High Income (8G*)5

$Multimanager Core Bond (69*)

$Multimanager Multi-Sector Bond (TH*)

$Templeton Global Bond Securities (8F*)2,5

Cash Equivalents

$EQ/Money Market (T3*)

Guaranteed-Fixed

$Guaranteed Interest Option (A1*)

International Stocks/Global

$AXA Tactical Manager International

(7N*)

$EQ/Global Multi-Sector Equity (78*)

$EQ/International Core PLUS (88*)

$EQ/International Equity Index (TN*)1

$EQ/International Value PLUS (73*)

$EQ/MFS International Growth (26*)

$EQ/Oppenheimer Global (6A*)

$EQ/Templeton Global Equity (6D*)

$Invesco V.I. International Growth (7Z*)5

$Lazard Retirement Emerging Markets Equity (8H*)5

$MFS® International Value (8A*)5

$Multimanager International Equity (65*)1

Large Cap Stocks

$AXA Tactical Manager 500 (7M*)

$EQ/BlackRock Basic Value Equity (81*)

$EQ/Boston Advisors Equity Income (33*)

$EQ/Calvert Socially Responsible (92*)

$EQ/Capital Guardian Research (86*)3

$EQ/Common Stock Index (T1*)

$EQ/Davis New York Venture (6Q*)

$EQ/Equity 500 Index (TE*)

$EQ/Equity Growth PLUS (94*)

$EQ/JPMorgan Value Opportunities (72*)

$EQ/Large Cap Core PLUS (85*)

$EQ/Large Cap Growth Index (82*)

$EQ/Large Cap Growth PLUS (77*)

$EQ/Large Cap Value Index (49*)

$EQ/Large Cap Value PLUS (89*)1

$EQ/Lord Abbett Large Cap Core (05*)

$EQ/Montag & Caldwell Growth (34*)1

$EQ/Mutual Large Cap Equity (6F*)

$EQ/T. Rowe Price Growth Stock (32*)

$EQ/UBS Growth and Income (35*)3

$EQ/Van Kampen Comstock (07*)1

$EQ/Wells Fargo Omega Growth (83*)3

$Fidelity® VIP Contrafund® (7R*)5

$Invesco V.I. Diversified Dividend (8B*)2,5

$MFS® Investors Growth Stock (8I*)5

$MFS® Investors Trust (7P*)5

$Multimanager Aggressive Equity (T2*)

$Multimanager Large Cap Core Equity (57*)3

$Multimanager Large Cap Value (58*)

$Oppenheimer Main Street Fund/VA (7Q*)2,5

Personal Income Benefit (PIB) Variable Investment Options

$PIB AXA Moderate Growth Strategy (Q1*)4

$PIB EQ/AllianceBernstein Dynamic Wealth Strategies (Q2*)4

$PIB AXA Balanced Strategy (Q3*)4

$PIB AXA Conservative Growth Strategy (Q4*)4

$PIB AXA Conservative Strategy (Q5*)4

Sector/Specialty

$EQ/Franklin Core Balanced (6C*)

$EQ/GAMCO Mergers and Acquisitions (25*)3

$Invesco V.I. Global Real Estate (8C*)5

$Ivy Funds VIP Energy (8D*)5

$MFS® Technology (8J*)5

$MFS® Utilities (8K*)5

$Multimanager Technology (67*)

$PIMCO VIT CommodityRealReturn® Strategy (8E*)2,5

$Van Eck VIP Global Hard Assets (8N*)5

Small/Mid Cap Stocks

$American Century VIP Mid Cap Value (7V*)2,5

$AXA Tactical Manager 400 (7L*)

$AXA Tactical Manager 2000 (7K*)

$EQ/AllianceBernstein Small Cap Growth (TP*)

$EQ/AXA Franklin Small Cap Value Core (6E*)

$EQ/GAMCO Small Company Value (37*)

$EQ/Mid Cap Index (55*)

$EQ/Mid Cap Value PLUS (79*)

$EQ/Morgan Stanley Mid Cap Growth (08*)

$EQ/Small Company Index (97*)

$Fidelity VIP Mid Cap (7U*)2,5

$Goldman Sachs VIT Mid Cap Value (7W*)5

$Invesco V.I. Mid Cap Core Equity (7T*)5

$Invesco V.I. Small Cap Equity (7X*)5

$Ivy Funds VIP Mid Cap Growth (8M*)5

$Ivy Funds VIP Small Cap Growth (7Y*)5

$Multimanager Mid Cap Growth (59*)1

$Multimanager Mid Cap Value (61*)1

$Multimanager Small Cap Growth (36*)1

$Multimanager Small Cap Value (91*)1

Structured Investment Option

$Segment Holding Account for S&P 500 1yr -10% Buffer (V1)4

Please withdraw the total amount needed

Please withdraw the total amount needed

Please withdraw the specific

Please withdraw the specific

Withdrawals from

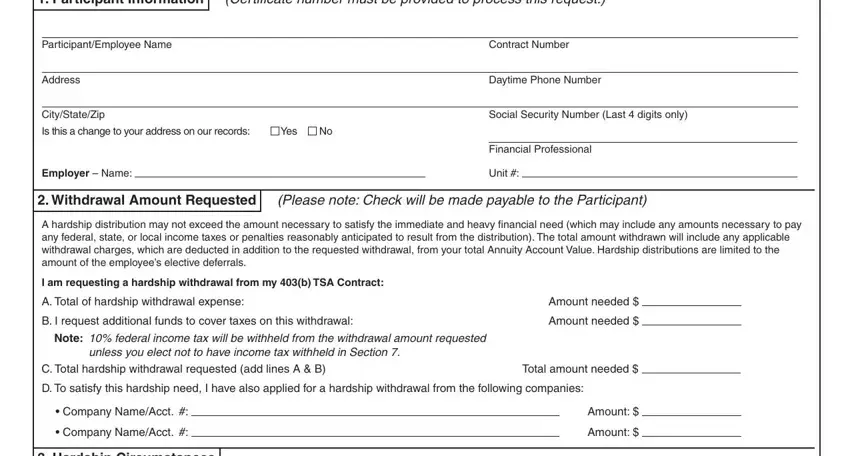

Withdrawals from  I do not want federal income taxes (and state, if applicable) withheld from my hardship withdrawal. I have provided my U.S. residence address and Social Security number in Section 1 of this form. I understand that I am responsible for the payment of any estimated taxes, and that I may incur penalties if my payments are not enough.

I do not want federal income taxes (and state, if applicable) withheld from my hardship withdrawal. I have provided my U.S. residence address and Social Security number in Section 1 of this form. I understand that I am responsible for the payment of any estimated taxes, and that I may incur penalties if my payments are not enough.