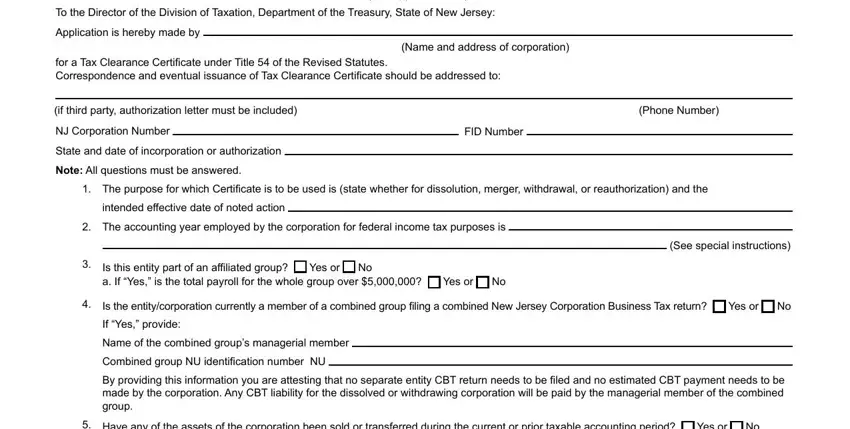

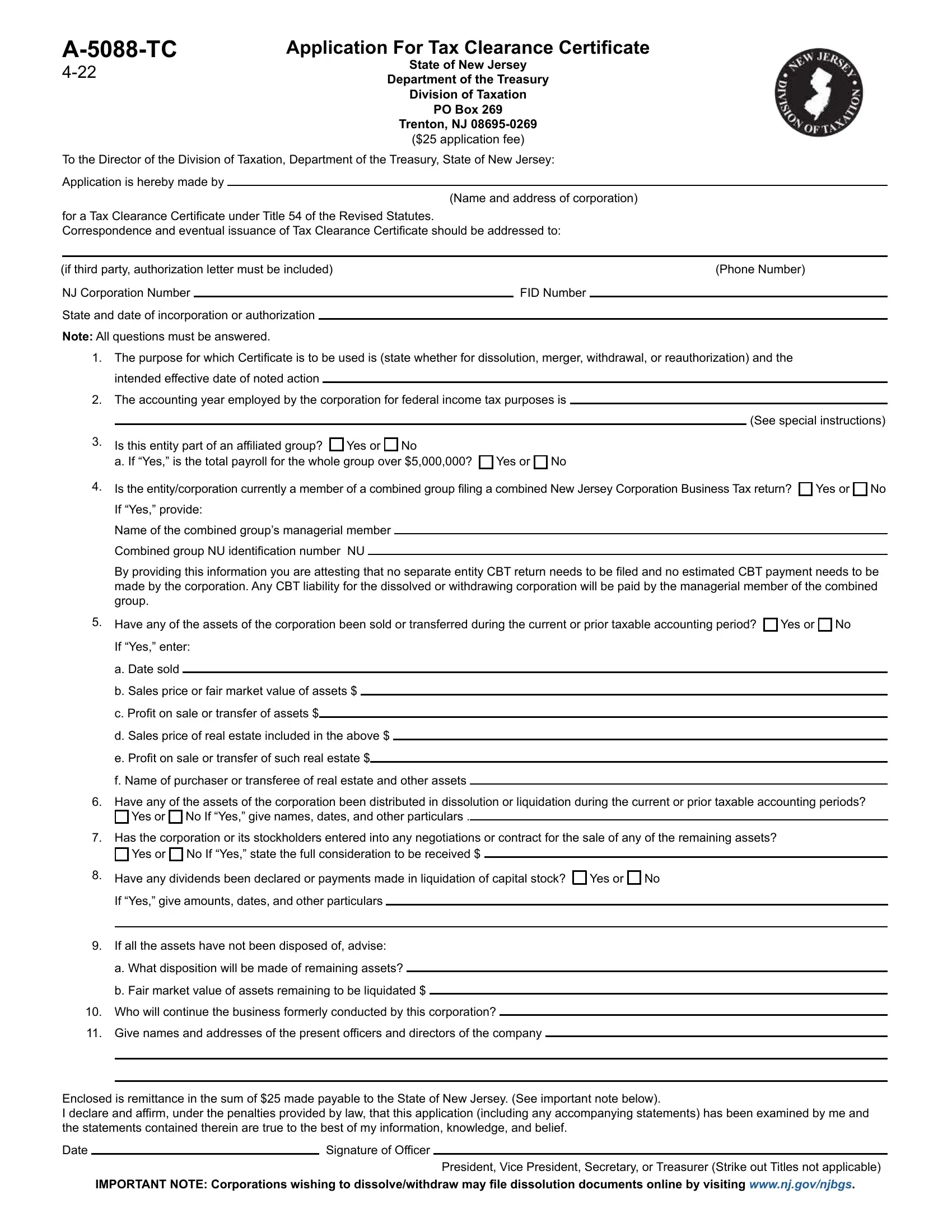

A-5088-TC |

State of New Jersey |

4-11, R-11 |

Department of the Treasury |

|

DIVISION OF TAXATION |

|

PO Box 269 |

|

TRENTON, NJ 08695-0269 |

|

APPLICATION FOR TAX CLEARANCE CERTIFICATE |

|

(See Important Note below for application fee) |

To the Director of the Division of Taxation, Department of the Treasury, State of New Jersey:

Application is hereby made by ___________________________________________________________________________________________________

(Name and address of corporation)

for a Tax Clearance Certificate under Title 54 of the Revised Statutes.

Correspondence and eventual issuance of Tax Clearance Certificate should be addressed to:

____________________________________________________________________________________________________________________________

(if third party, authorization letter must be included) |

(Phone Number) |

NJ Corporation Number __________________ FID Number __________________ |

State & date of incorporation or authorization ___________________ |

NOTE: All questions must be answered. |

|

1.The purpose for which Certificate is to be used is (state whether for dissolution, merger, withdrawal, or reauthorization) and the

intended effective date of noted action ______________________________________________________________________________________

2.The accounting year employed by the corporation for Federal Income Tax purposes is ________________________________________________

|

____________________________________ (See special instruction on reverse side.) |

3. |

Is this entity a part of an affiliated group? Yes or No |

|

|

a. If “Yes”, is the total payroll for the whole group over $5,000,000? |

Yes or No |

4. |

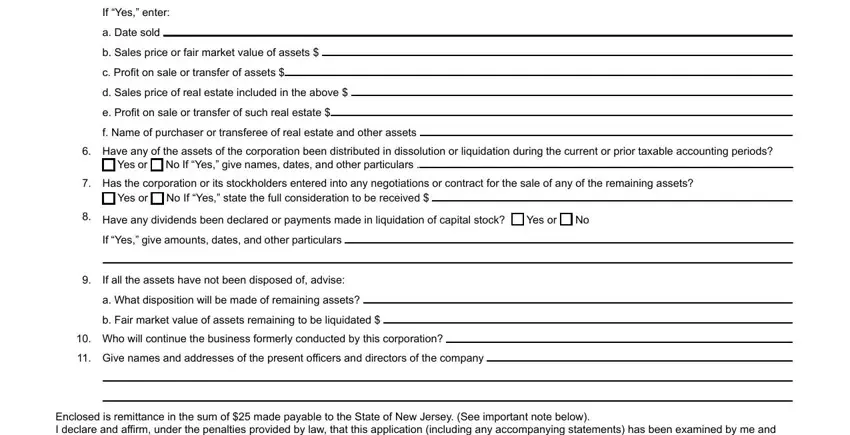

Have any of the assets of the corporation been sold or transferred during the current or prior taxable accounting period? Yes or No |

a.If “Yes”, enter date sold ________________________________________________________

b.Sales price or fair market value of assets $ ________________________________________

c.Profit on sale or transfer of assets $______________________________________________

d.Sales price of real estate included in the above $ ___________________________________

e.Profit on sale or transfer of such real estate $_______________________________________

f.Name of purchaser or transferee of real estate and other assets ______________________________________________________________

5.Have any of the assets of the corporation been distributed in dissolution or liquidation during the current or prior taxable accounting periods?

Yes or No If “Yes”, give names, dates and other particulars. _____________________________________________________________

____________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________

6.Has the corporation or its stockholders entered into any negotiations or contract for the sale of any of the remaining assets?

Yes or No If “Yes”, state the full consideration to be received $__________________________________________________________

7. Have any dividends been declared or payments made in liquidation of capital stock? Yes or No

If “Yes”, give amounts, dates and other particulars ____________________________________________________________________________

____________________________________________________________________________________________________________________

8.If all the assets have not been disposed of, advise:

a.What disposition will be made of remaining assets? ________________________________________________________________________

b.Fair market value of assets remaining to be liquidated $_____________________________________________________________________

9.Who will continue the business formerly conducted by this corporation?___________________________________________________________

10.Give names and addresses of the present officers and directors of the company _______________________________

____________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________

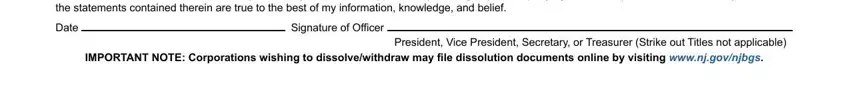

Enclosed is remittance in the sum of $25.00 made payable to the State of New Jersey. (See Important Note Below).

I declare and affirm, under the penalties provided by law, that this application (including any accompanying statements) has been examined by me and the statements contained therein are true to the best of my information, knowledge and belief.

Date_______________________ Signature of Officer __________________________________________________________________

President, Vice President, Secretary or Treasurer (Strike out Titles not applicable)

IMPORTANT NOTE: Corporations wishing to dissolve/withdraw may file dissolution documents online by visiting www.nj.gov/njbgs.