The PDF editor works to make completing forms really easy. It is extremely convenient to modify the [FORMNAME] document. Consider these actions if you want to achieve this:

Step 1: Hit the orange "Get Form Now" button on the website page.

Step 2: Now you are on the document editing page. You may edit, add content, highlight particular words or phrases, put crosses or checks, and put images.

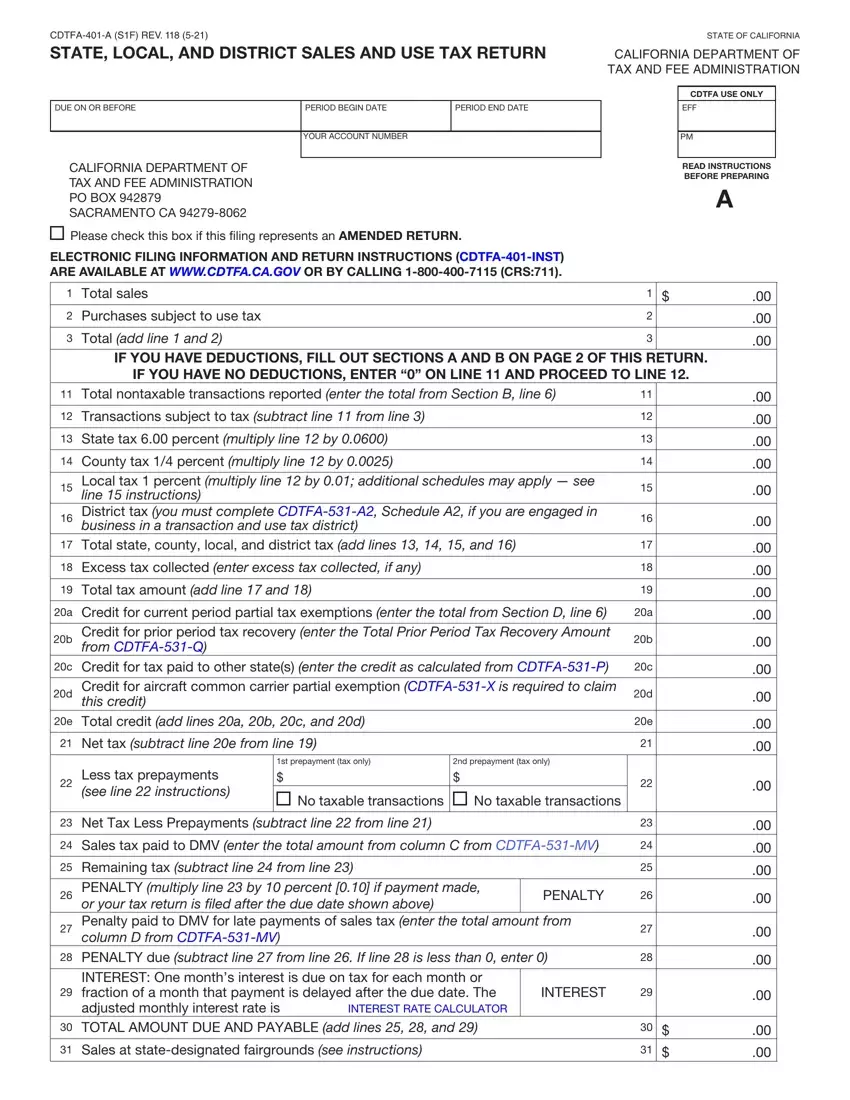

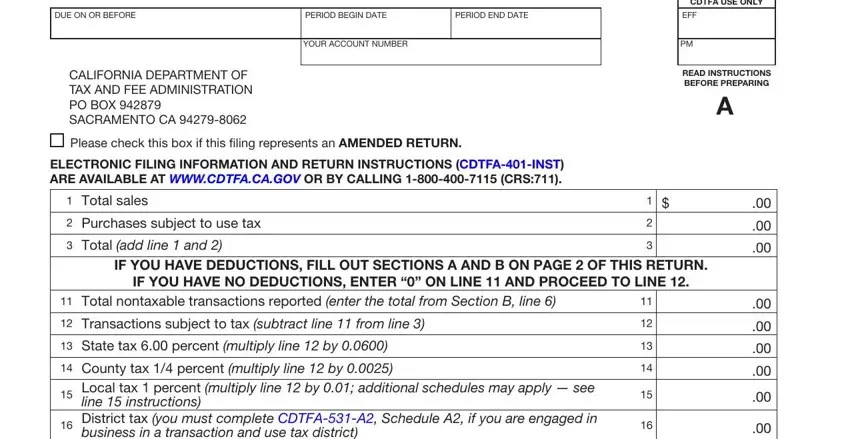

Complete the following sections to fill in the form:

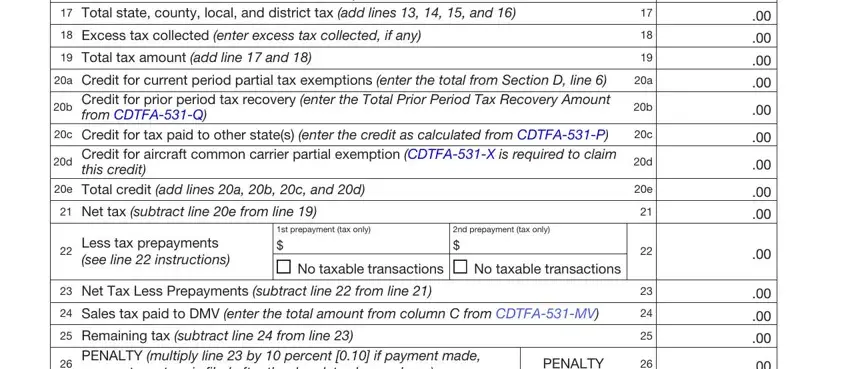

Enter the demanded details in business in a transaction and use, Total state county local and, Excess tax collected enter excess, Total tax amount add line and, a Credit for current period, Credit for prior period tax, c Credit for tax paid to other, Credit for aircraft common carrier, e Total credit add lines a b c and, Net tax subtract line e from line, Less tax prepayments see line, st prepayment tax only, nd prepayment tax only, No taxable transactions No taxable, and Net Tax Less Prepayments subtract box.

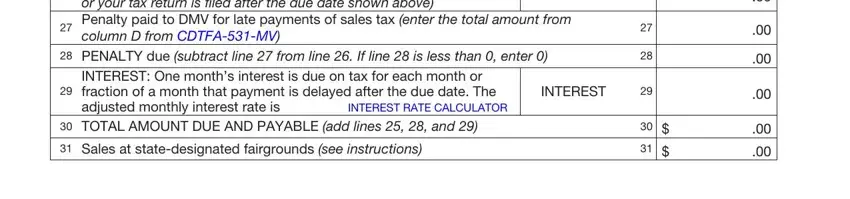

You're going to be expected to note the information to let the platform complete the section PENALTY multiply line by percent, PENALTY, PENALTY due subtract line from, INTEREST One months interest is, INTEREST RATE CALCULATOR, TOTAL AMOUNT DUE AND PAYABLE add, Sales at statedesignated, and INTEREST.

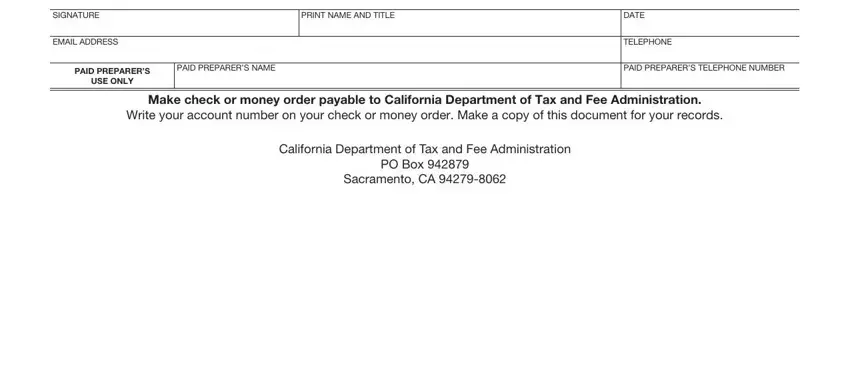

Identify the rights and responsibilities of the parties inside the paragraph SIGNATURE, EMAIL ADDRESS, PRINT NAME AND TITLE, PAID PREPARERS USE ONLY, PAID PREPARERS NAME, DATE, TELEPHONE, PAID PREPARERS TELEPHONE NUMBER, Make check or money order payable, and California Department of Tax and.

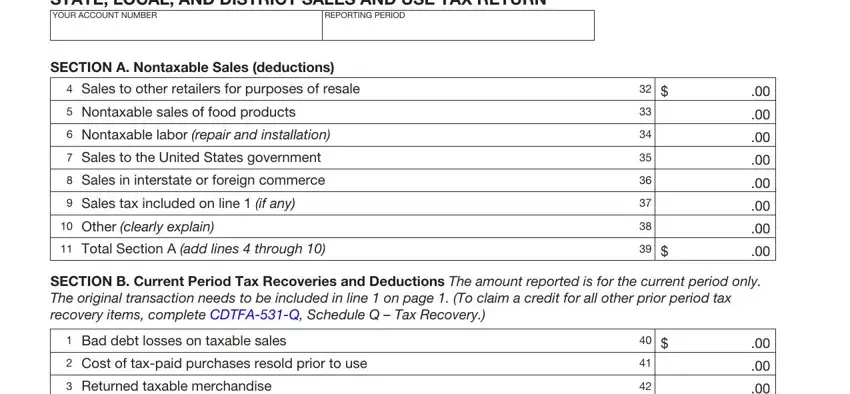

Finalize by reviewing these areas and completing the required details: STATE LOCAL AND DISTRICT SALES AND, REPORTING PERIOD, SECTION A Nontaxable Sales, Sales to other retailers for, Nontaxable sales of food products, Nontaxable labor repair and, Sales to the United States, Sales in interstate or foreign, Sales tax included on line if any, Other clearly explain, Total Section A add lines, SECTION B Current Period Tax, Bad debt losses on taxable sales, Cost of taxpaid purchases resold, and Returned taxable merchandise.

Step 3: After you press the Done button, your ready form can be simply transferred to any of your gadgets or to email specified by you.

Step 4: You can generate copies of the file tostay clear of any type of potential problems. You need not worry, we don't distribute or check your data.