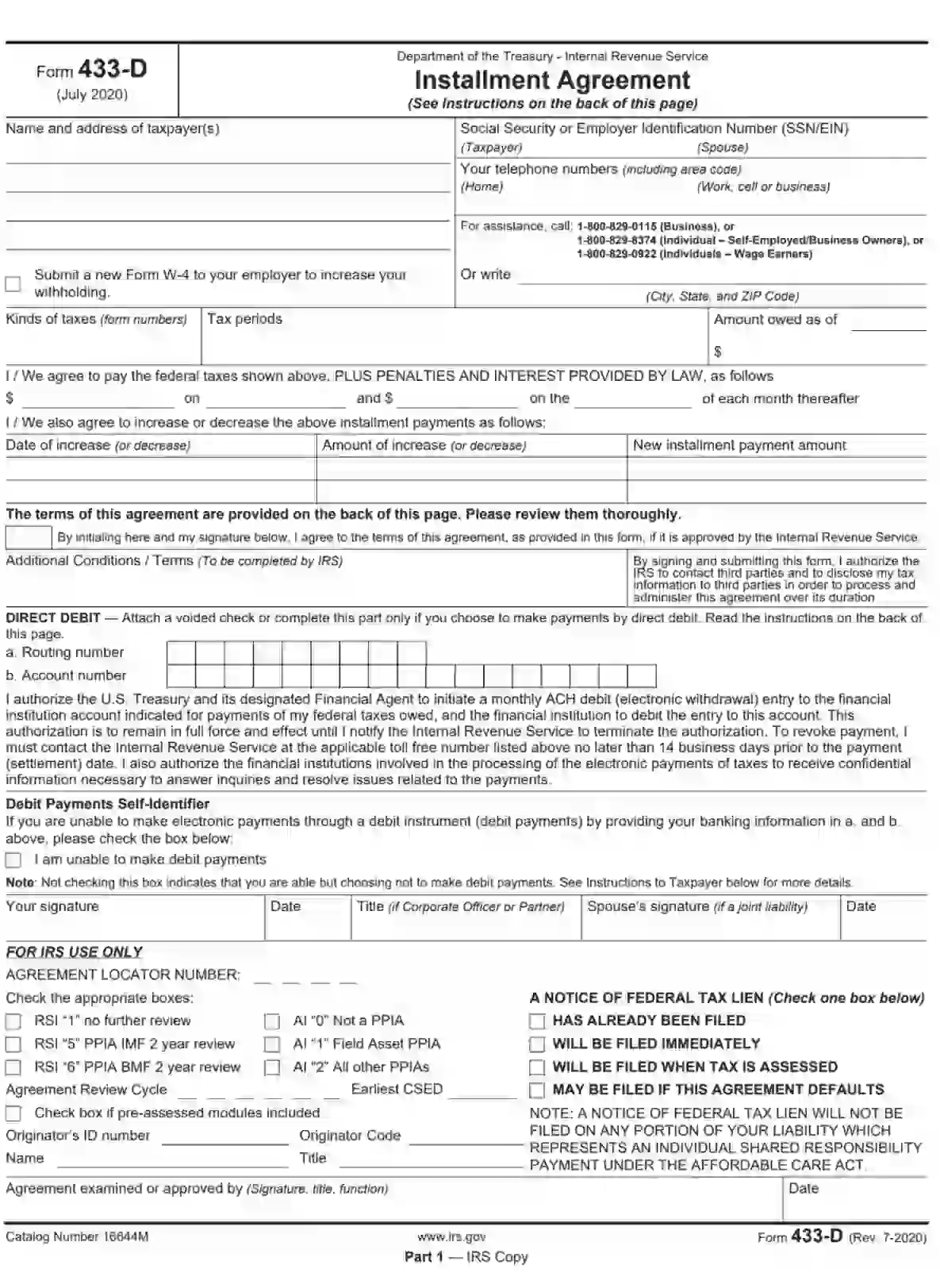

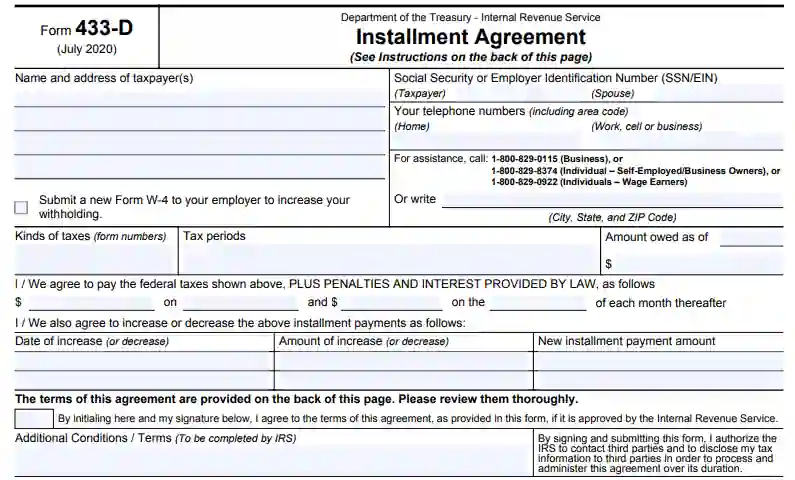

Form 433-D is a financial statement taxpayers use to request a direct debit installment agreement with the Internal Revenue Service (IRS) to pay their tax liabilities. The “Installment Agreement” form allows taxpayers to propose a structured payment plan to pay off their outstanding tax debt over time through automatic monthly withdrawals from their bank account. It requires taxpayers to provide detailed information about their income, expenses, assets, and liabilities to assess their ability to make the proposed installment payments.

The purpose of Form 433-D is to streamline the process of setting up installment agreements for taxpayers who cannot pay their tax liabilities in full. By completing this form and proposing a direct debit installment plan, taxpayers can demonstrate their commitment to fulfilling their tax obligations and avoid more aggressive collection actions by the IRS, such as liens or levies. Form 433-D serves as a tool for taxpayers to negotiate manageable payment terms with the IRS, helping to alleviate financial strain and resolve tax issues.

Other IRS Forms for Individuals

Individual taxpayers might need to file various IRS forms, based on the complexity of their finances. Check some other IRS you will want to be familiar with.

Instructions For Compiling the Form

Please read the instructions carefully before filling out the document. If necessary, use our form-building software to save time and effort.

Basic Information

Like any official document, this form includes information about the taxpayer. Provide your first and last name, current address, and social security or taxpayer-identification number. As a rule, when submitting documents together with your spouse, specify information about this. Don’t forget to write down all available phone numbers and mailing addresses. By the way, if you are submitting the application, but you are not a business owner, provide information about your employer. What else is required? For the Tax Service, it is vital to have a bank account, bank details, and route numbers. You also specify the amount of the first payment and the subsequent ones. It is a mandatory condition of the form. If for some reason your amounts will change and you know about it in advance, provide this information.

All confidential information also passes through banking institutions and tax authorities, so write the account numbers. Be sure to sign the document.

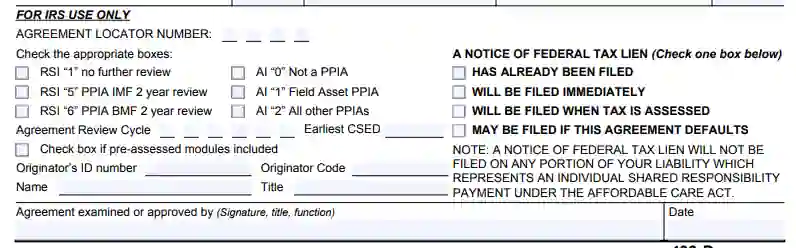

Further Conditions

Besides, you may fill in the information about the federal tax lien. Select the appropriate checkbox and enter the numbers and codes. Choose a suitable address and send documents. In case of emergency circumstances that affect the non-performance of the agreement, contact the service. Attach the explanatory sheet to the following form. If you systematically fail to pay taxes, the IRS may seize your property, homes, cars, and bank accounts.