With the goal of allowing it to be as quick to apply as it can be, we developed our PDF editor. The whole process of preparing the insolvency worksheet excel will be quick should you try out the following steps.

Step 1: The first thing should be to pick the orange "Get Form Now" button.

Step 2: Now, you are on the file editing page. You can add information, edit present information, highlight certain words or phrases, insert crosses or checks, add images, sign the form, erase unrequired fields, etc.

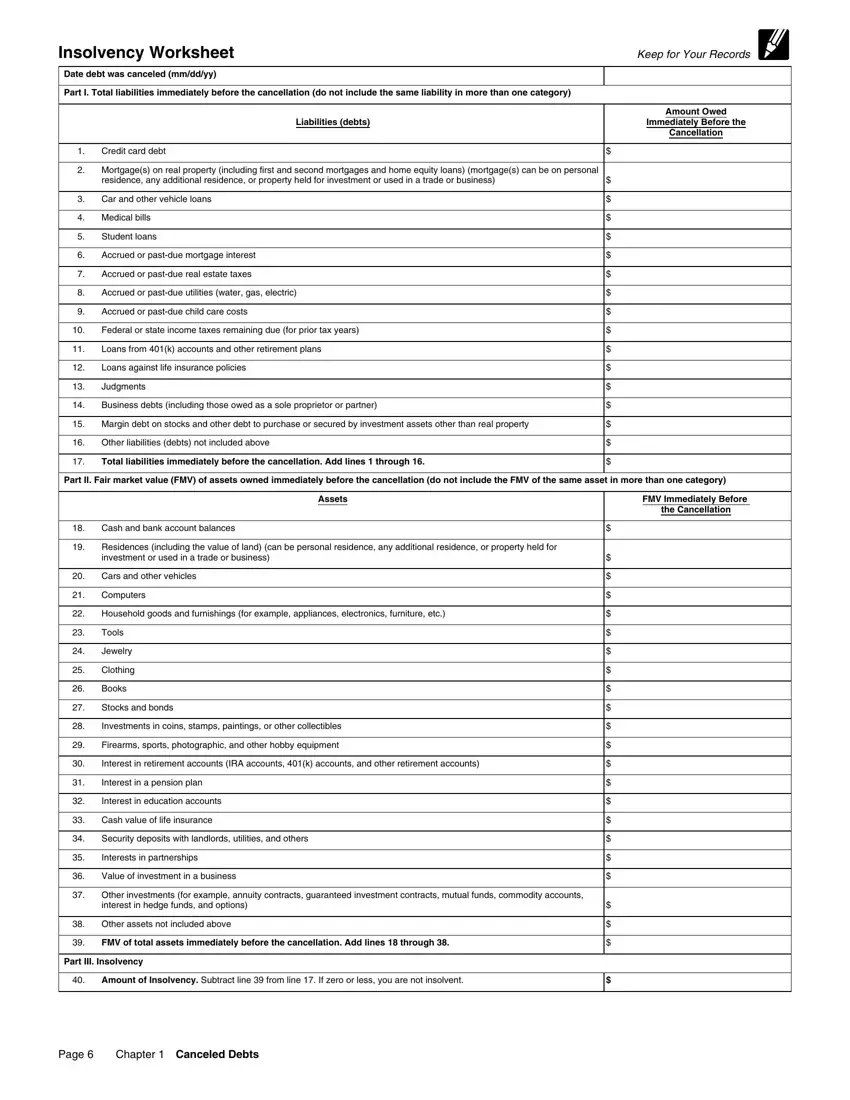

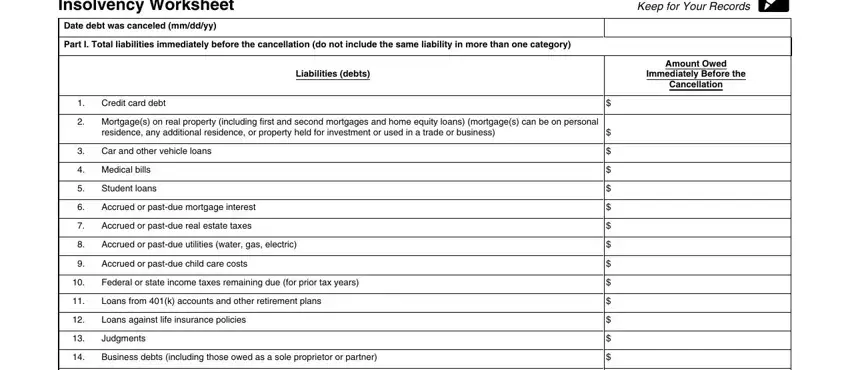

Feel free to provide the following details to complete the insolvency worksheet excel PDF:

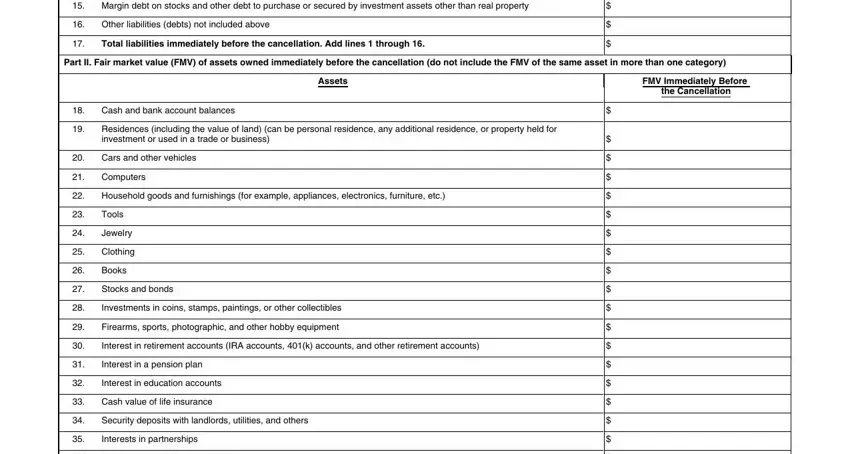

The program will need you to prepare the Margin debt on stocks and other, Other liabilities debts not, Total liabilities immediately, Part II Fair market value FMV of, Assets, FMV Immediately Before the, Cash and bank account balances, Residences including the value of, Cars and other vehicles, Computers, Household goods and furnishings, Tools, Jewelry, Clothing, and Books part.

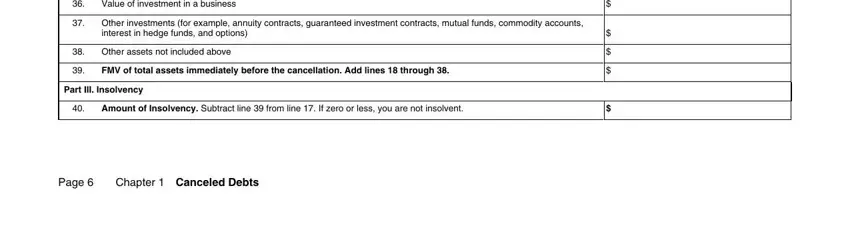

In the Value of investment in a business, Other investments for example, Other assets not included above, FMV of total assets immediately, Part III Insolvency, Amount of Insolvency Subtract line, Page, and Chapter Canceled Debts area, point out the crucial data.

Step 3: As soon as you've selected the Done button, your document will be accessible for transfer to any type of gadget or email you specify.

Step 4: You can make copies of the document tokeep away from any kind of future concerns. You need not worry, we don't distribute or watch your information.