In navigating the complex landscape of agricultural management and conservation efforts, the AD-1026D form emerges as a pivotal tool for producers facing undue economic hardship. Released by the Farm Service Agency under the U.S. Department of Agriculture, this form stands as a testament to the government's acknowledgment of the various challenges that can impede a producer's ability to comply with conservation requirements. It operates within a legal framework that is both specific and protective, drawing authority from the Commodity Credit Corporation Charter Act and the Food, Conservation, and Energy Act of 2008, as well as the Privacy Act of 1974. These laws ensure that the information provided by producers is used solely to assess the economic feasibility of implementing conservation systems as defined by the Natural Resources Conservation Service (NRCS). The form facilitates a structured process where producers can detail the reasons why adhering to specified conservation practices would inflict financial strain. Such claims are thoroughly evaluated by the NRCS and the county committee, which together determine the viability of requested relief measures. The completion and submission of the AD-1026D form are critical steps for producers seeking assistance, framing a dialogue between the agricultural community and federal agencies aimed at fostering sustainable farming practices while recognizing the economic realities faced by individual producers.

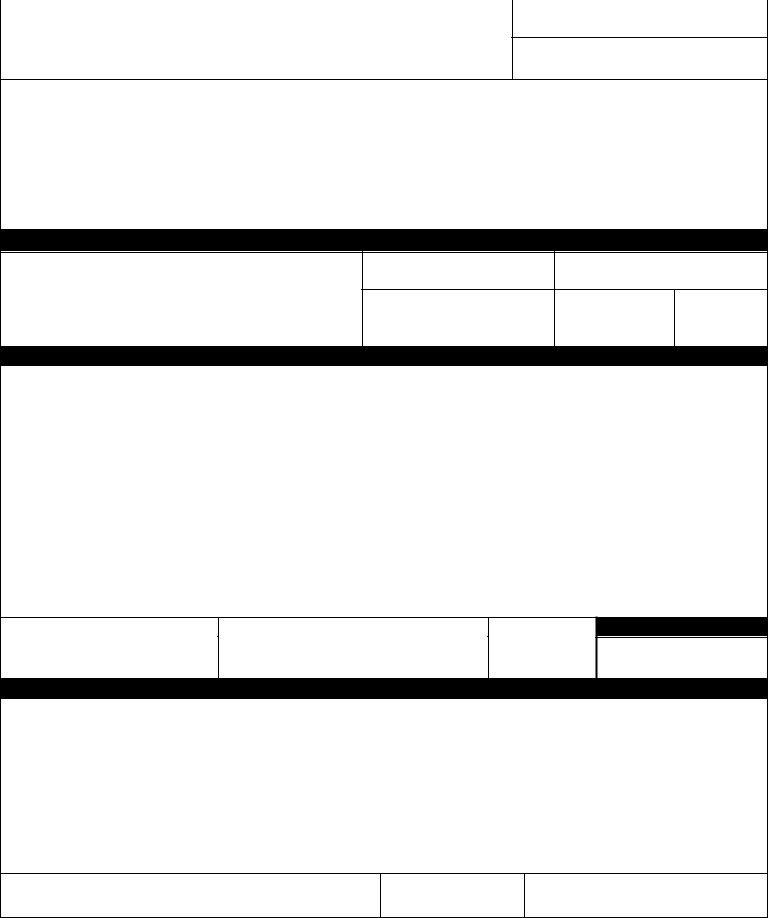

| Question | Answer |

|---|---|

| Form Name | Form Ad 1026D |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | TDD, electronic ad 1026, FSA, 19A |

This form is available electronically. |

Form Approved – OMB No. |

|

U.S. DEPARTMENT OF AGRICULTURE |

1A. STATE NAME |

|

Farm Service Agency |

|

|

RELIEF FOR UNDUE ECONOMIC HARDSHIP REQUEST HIGHLY |

1B. COUNTY NAME |

ERODIBLE LAND CONSERVATION |

|

NOTE: |

The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this |

|

form is 7 CFR Part 12, the Commodity Credit Corporation Charter Act (15 U.S.C. 714 et seq.), and the Food, Conservation, and Energy Act of 2008 (Pub. L. |

|

The information will be used to make a determination as to whether application of the conservation system according to the specifications determined by NRCS would |

|

impose an undue economic hardship on the producer. The information collected on the form may be disclosed to other Federal, State, Local government agencies, Tribal |

|

agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses |

|

identified in the System of Records Notice for |

|

the requested information will result in an inability to make a determination as to whether application of the conservation system according to the specifications |

|

determined by NRCS would impose an undue economic hardship on the producer. |

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

PART A – PRODUCER INFORMATION

2A. NAME AND ADDRESS OF PRODUCER (Including Zip Code)

3.TAX IDENTIFICATION NUMBER

(Last 4 Digits)

4. FARM NUMBER

5A. TRACT NUMBER

5B. FIELD NUMBER

6. CROP YEAR

2B. TELEPHONE NO. (Including Area Code):

PART B - PRODUCER REQUEST FOR UNDUE ECONOMIC HARDSHIP DETERMINATION

7.State the reasons that application of a conservation system according to the specifications determined by NRCS would impose an undue economic hardship. Include all pertinent information to be considered, such as the cost of installation of the required conservation practices, efforts to obtain

Note: The relief determination shall apply only for the crop year and fields identified in Part A. Application for relief shall be requested annually.

8A. SIGNATURE OF PRODUCER (By)

8B. TITLE/RELATIONSHIP OF THE INDIVIDUAL IF SIGNING IN A REPRESENTATIVE CAPACITY

8C. DATE

FOR FSA USE ONLY

9.DATE REFERRED TO NRCS

PART C – TO BE COMPLETED BY NRCS

10.Describe in detail the practices required, estimated cost, suggested alternatives, cost share assistance available for the practices, and any other information that NRCS or the Conservation District may have to assist the Committee in making a recommendation or determination. The information may be provided on a separate sheet, signed and dated, and attached to this application:

11A. SIGNATURE OF NRCS EMPLOYEE

11B. DATE

12. DATE REFERRED TO FSA

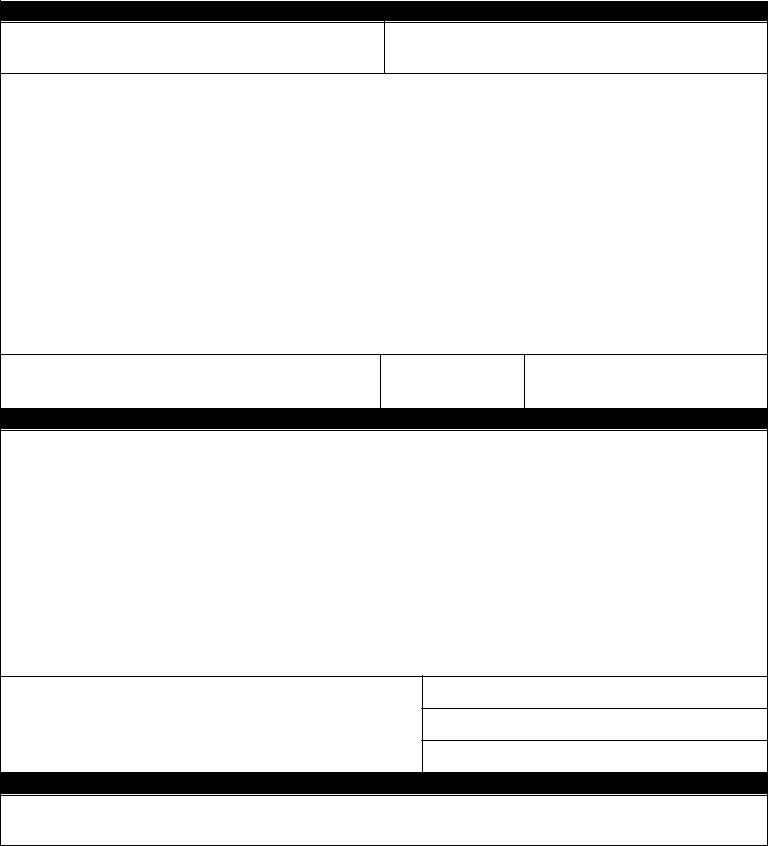

Page 2 of 2 |

PART D - TO BE COMPLETED BY THE COUNTY COMMITTEE

13. Estimated cost of the practices that the producer affirms would cause

undue economic hardship.

$

14.Approximate amount of USDA benefits the producer expects to earn if compliance requirements are met.

$

15.Based on information provided by the producer, information provided by NRCS, and the County Committee's knowledge of the producer's operation, describe in detail the County Committee's recommendation and extent of relief to avoid the hardship, if any, and reasons for the recommendation to the State Committee:

16A. SIGNATURE OF COUNTY COMMITTEE REPRESENTATIVE

16B. DATE

17.DATE REFERRED TO STATE COMMITTEE

PART E - TO BE COMPLETED BY STATE COMMITTEE

18.Based on information provided, and any other information deemed necessary to make a determination, describe in detail the State Committee's determination, extent of relief, if any, and the reasons for the determination:

19A. SIGNATURE OF COUNTY COMMITTEE REPRESENTATIVE

19B. DATE

20.DATE PRODUCER WAS NOTIFIED

21.DATE REFERRED TO COUNTY COMMITTEE

PART F- TO BE COMPLETED BY FSA COUNTY OFFICE

22. Date NRCS was provided a copy of

The U.S. Department of Agriculture (USDA) prohibits discrimination in all of its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, political beliefs, genetic information, reprisal, or because all or part of an individual’s income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at (202)