It is possible to complete the https secure mtrustcompany document with our PDF editor. These actions will enable you to easily get your document ready.

Step 1: The first thing should be to press the orange "Get Form Now" button.

Step 2: The document editing page is now available. You can add text or manage existing data.

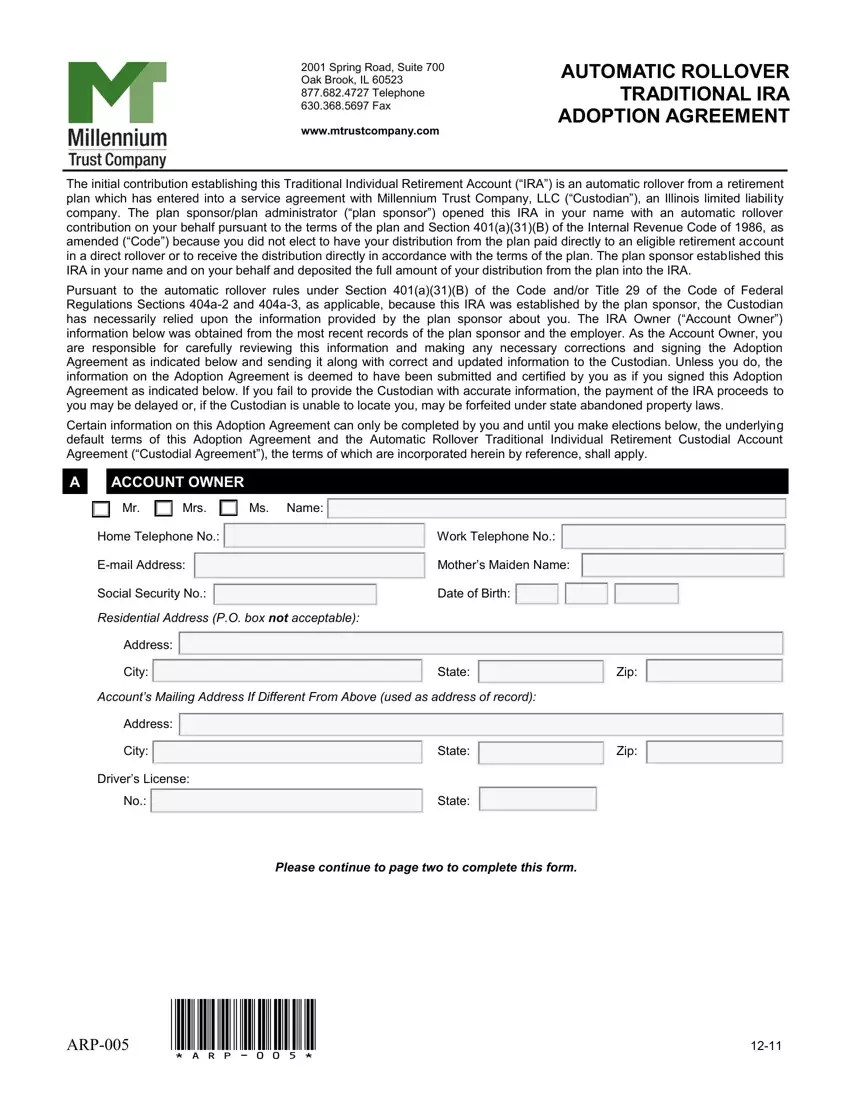

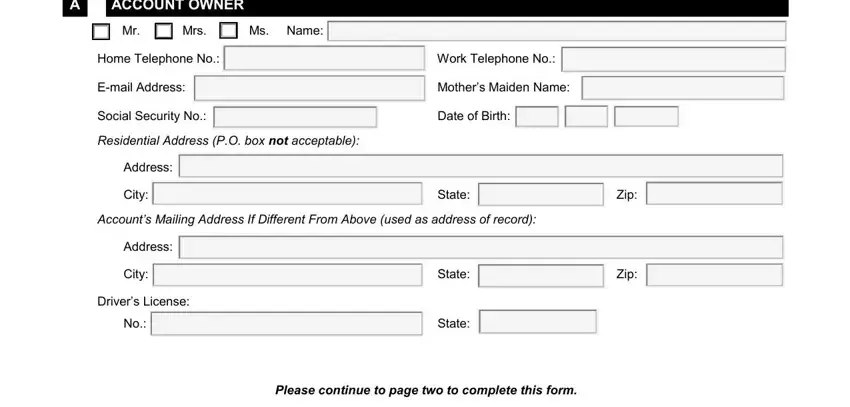

Enter the information required by the platform to prepare the file.

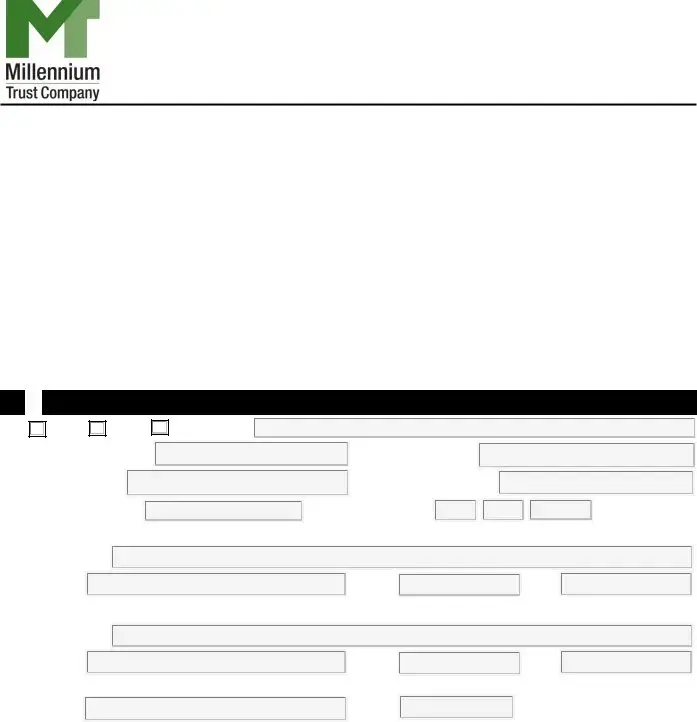

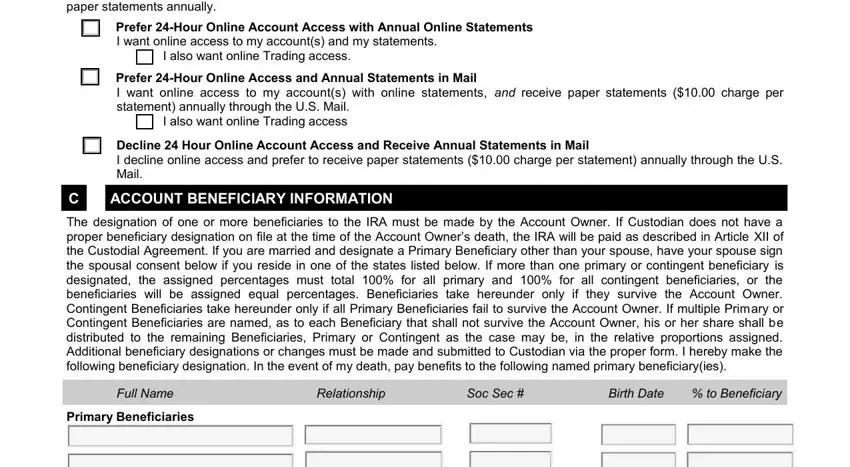

You have to submit the B Please indicate your preferences, Prefer Hour Online Account Access, I want online access to my, I also want online Trading access, Prefer Hour Online Access and, I want online access to my, I also want online Trading access, Decline Hour Online Account, I decline online access and prefer, ACCOUNT BENEFICIARY INFORMATION, The designation of one or more, Full Name, Relationship, Soc Sec, and Birth Date to Beneficiary space with the necessary details.

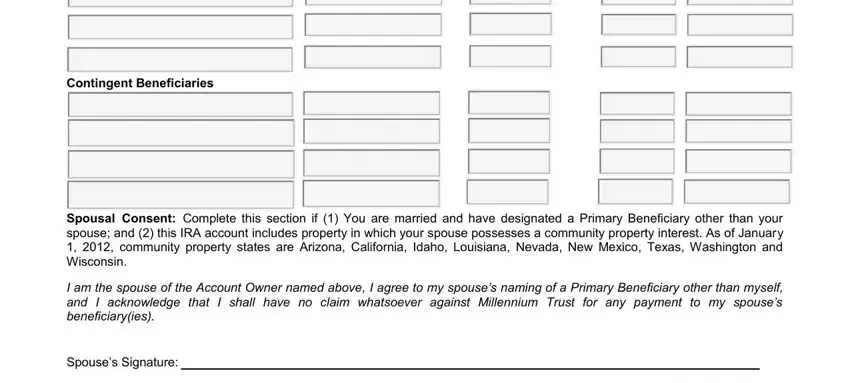

Write the vital particulars while you're on the Contingent Beneficiaries, Spousal Consent Complete this, I am the spouse of the Account, and Spouses Signature box.

The Spouses Name, ARP, Please continue to page three to, and Date section may be used to indicate the rights and responsibilities of each party.

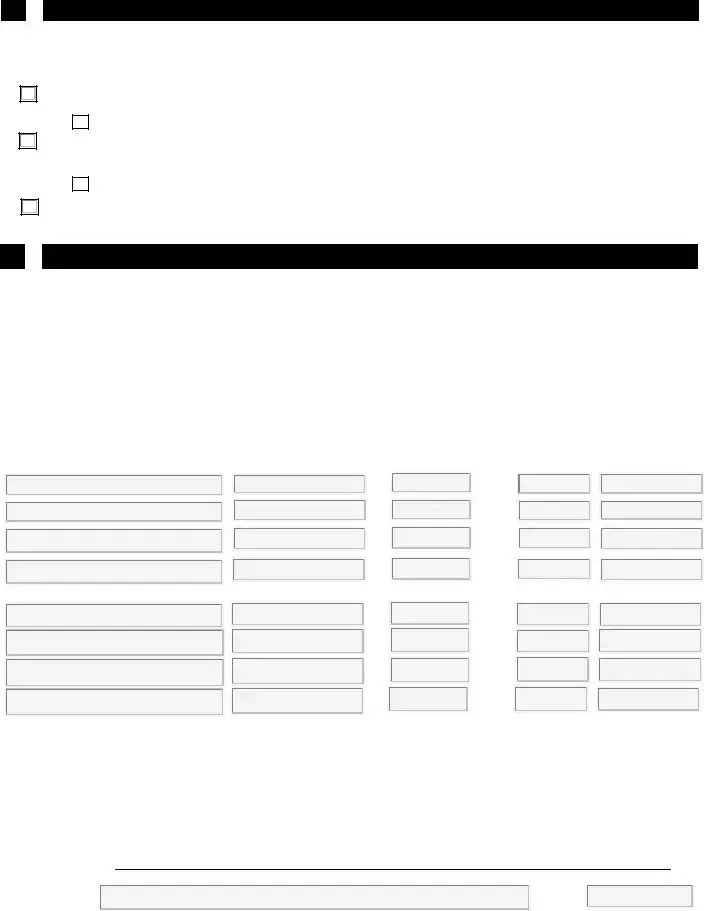

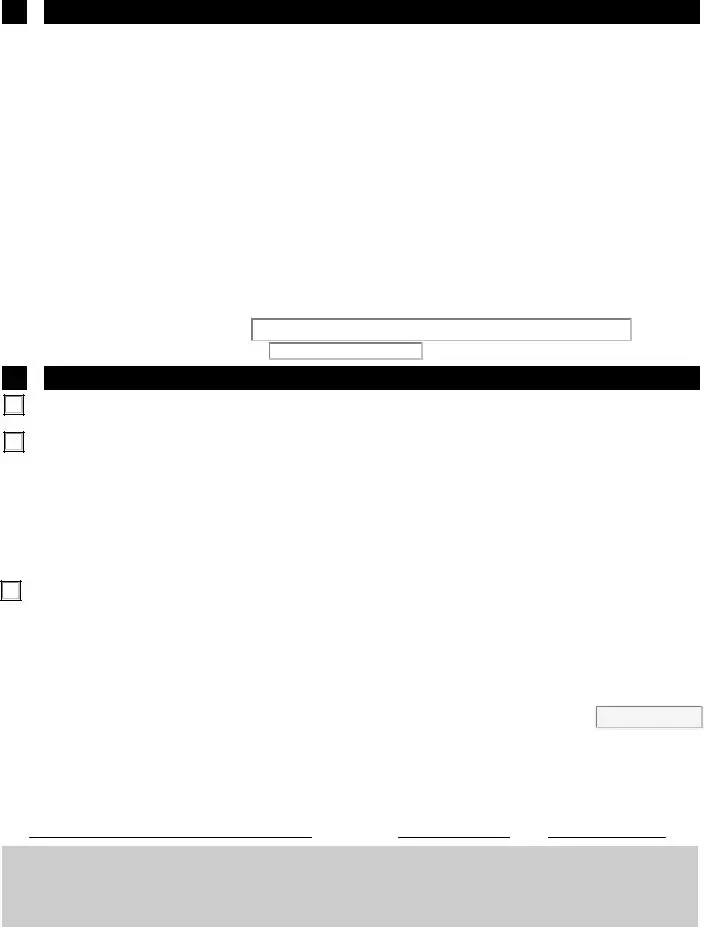

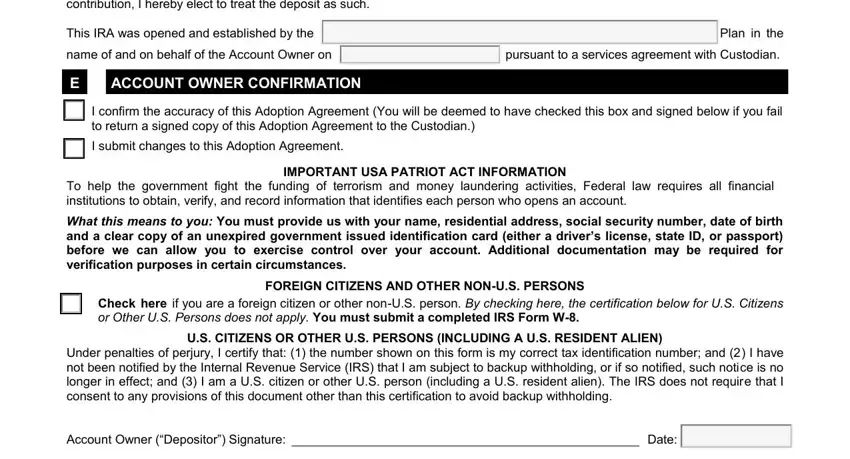

Check the areas The IRA was opened and established, This IRA was opened and, Plan in the, name of and on behalf of the, pursuant to a services agreement, ACCOUNT OWNER CONFIRMATION, I confirm the accuracy of this, to return a signed copy of this, I submit changes to this Adoption, IMPORTANT USA PATRIOT ACT, To help the government fight the, What this means to you You must, FOREIGN CITIZENS AND OTHER NONUS, or Other US Persons does not apply, and US CITIZENS OR OTHER US PERSONS and next fill them out.

Step 3: When you are done, hit the "Done" button to transfer the PDF form.

Step 4: It can be easier to prepare copies of your document. You can be sure that we won't disclose or see your information.