When working in the online PDF tool by FormsPal, you're able to complete or edit imrf or gregister here. Our team is devoted to giving you the absolute best experience with our editor by regularly adding new capabilities and improvements. Our tool has become even more user-friendly as the result of the most recent updates! Currently, working with PDF forms is a lot easier and faster than ever before. To get the ball rolling, go through these simple steps:

Step 1: Hit the orange "Get Form" button above. It will open our editor so that you could start filling out your form.

Step 2: With the help of this state-of-the-art PDF tool, you can do more than merely fill out forms. Try each of the features and make your docs appear great with customized text incorporated, or adjust the file's original input to excellence - all supported by an ability to incorporate almost any graphics and sign it off.

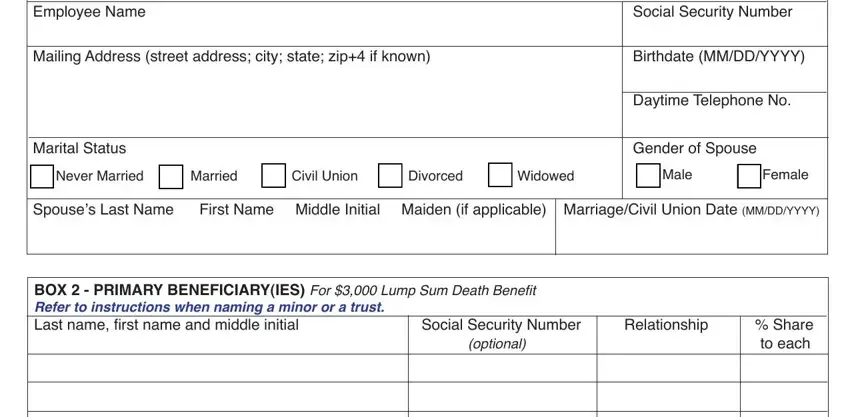

As a way to complete this PDF form, make sure that you provide the right details in every area:

1. Begin filling out your imrf or gregister with a group of essential blanks. Collect all the important information and be sure there's nothing neglected!

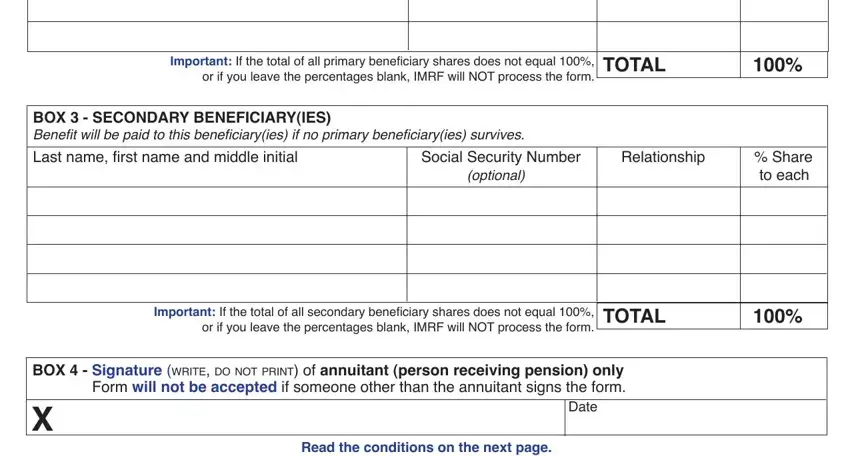

2. Once the last section is filled out, go to enter the relevant details in these - Important If the total of all, TOTAL, BOX SECONDARY BENEFICIARYIES, optional, Social Security Number Relationship, Share to each, Important If the total of all, TOTAL, BOX Signature write do not print, Date, Completed form may be mailed to, and Read the conditions on the next.

Be really attentive while filling in TOTAL and Important If the total of all, since this is where many people make mistakes.

Step 3: Make sure your details are correct and click on "Done" to continue further. Make a free trial plan with us and acquire immediate access to imrf or gregister - download, email, or edit from your FormsPal account. FormsPal is dedicated to the privacy of our users; we make sure that all information going through our tool stays secure.