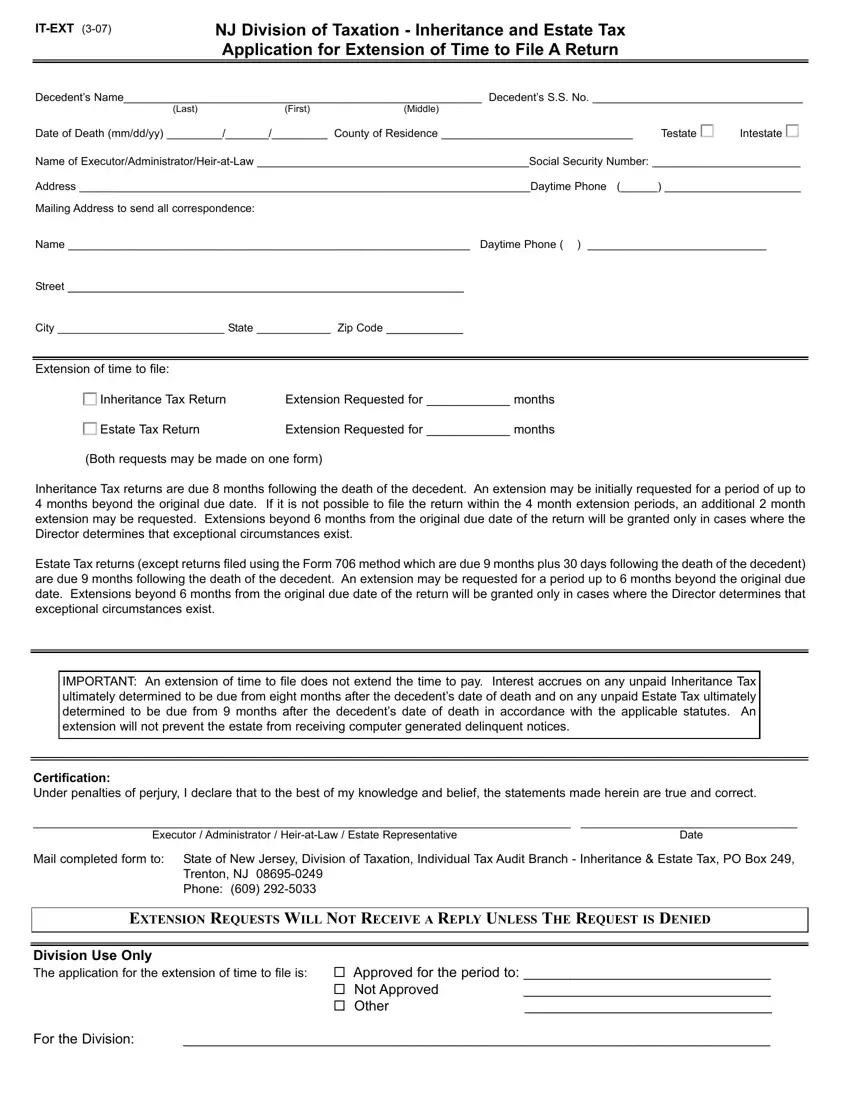

It won't be hard to create nj form estate working with our PDF editor. This is the way you may successfully prepare your form.

Step 1: On the following page, hit the orange "Get form now" button.

Step 2: Once you have accessed the editing page nj form estate, you'll be able to discover every one of the functions available for the form inside the upper menu.

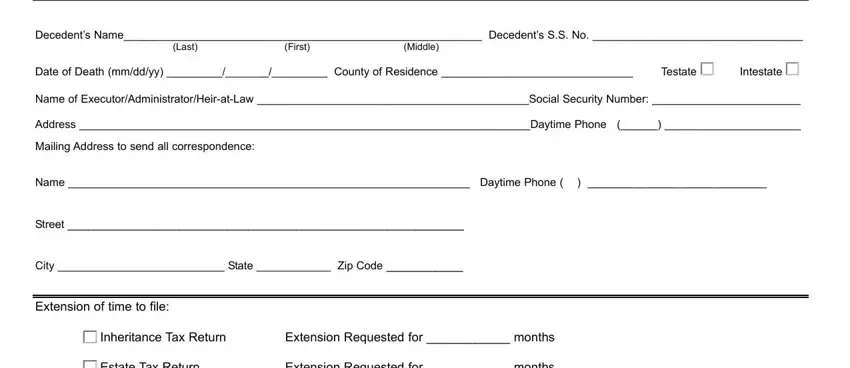

For every single section, add the content demanded by the application.

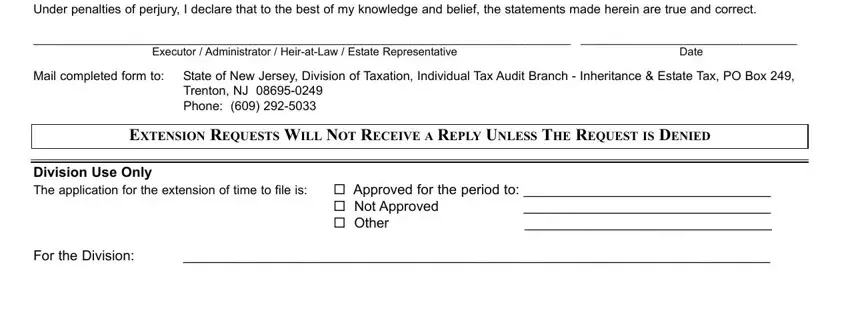

Fill in the Certification Under penalties of, Executor Administrator HeiratLaw, Date, Mail completed form to, State of New Jersey Division of, EXTENSION REQUESTS WILL NOT, Division Use Only The application, cid Approved for the period to, and For the Division fields with any particulars that is demanded by the application.

Step 3: When you are done, choose the "Done" button to transfer the PDF document.

Step 4: Create at least several copies of the document to keep away from any sort of potential difficulties.